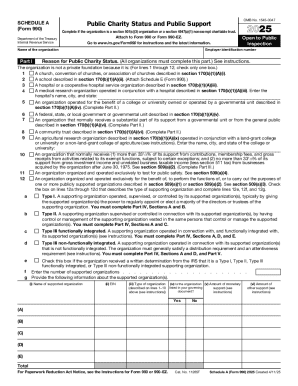

IRS 990 - Schedule A 2024 free printable template

Instructions and Help about schedule a 990 ez

How to edit schedule a 990 ez

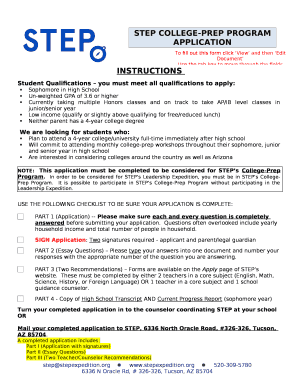

How to fill out schedule a 990 ez

Latest updates to schedule a 990 ez

All You Need to Know About schedule a 990 ez

What is schedule a 990 ez?

Who needs the form?

Due date

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

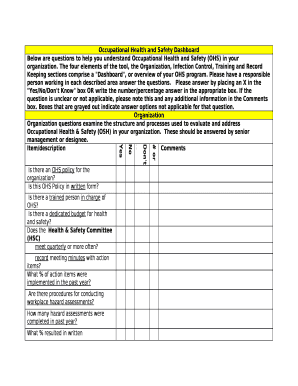

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule A

What should I do if I realize I've made a mistake after submitting my schedule a 990 ez?

If you discover an error in your submitted schedule a 990 ez, you can correct it by filing an amended return. It's essential to follow the IRS guidelines for amendments to ensure compliance. Keep in mind that if the amendment impacts previously reported errors, you may also want to include explanatory documentation to clarify the changes.

How can I verify the status of my submitted schedule a 990 ez?

To verify the status of your submitted schedule a 990 ez, you can utilize the IRS online tracking tools, which often provide updates on receipt and processing times. In case of e-file rejection, pay attention to common rejection codes, which can guide you on the necessary actions to rectify the issues.

What are some common errors to avoid when submitting a schedule a 990 ez?

Common errors when submitting a schedule a 990 ez include incorrect taxpayer identification numbers, mismatches in reported amounts, and omitted signatures. Double-check all fields and documentation before submission to minimize these issues and ensure a smoother filing process.

What should I know about the e-signature requirements for schedule a 990 ez?

When filing a schedule a 990 ez electronically, ensure that your e-signature complies with IRS requirements. This includes having proper authentication mechanisms and preserving the digital integrity of the signature, ensuring that it meets necessary security measures.

Are there service fees associated with e-filing a schedule a 990 ez?

Yes, some third-party services charge fees for e-filing a schedule a 990 ez. It's advisable to compare various e-filing options to determine which service offers the best value while meeting your filing needs. Be sure to check if any fees apply if a submission is rejected, as prospective refunds may also vary.

See what our users say