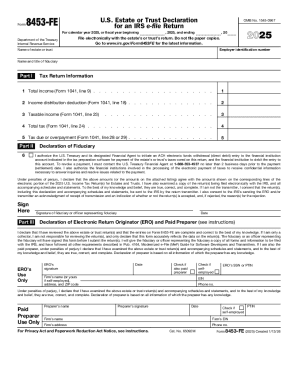

IRS 8453-FE 2024 free printable template

Instructions and Help about IRS 8453-FE

How to edit IRS 8453-FE

How to fill out IRS 8453-FE

Latest updates to IRS 8453-FE

About IRS 8453-FE 2024 previous version

What is IRS 8453-FE?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8453-FE

What should I do if I need to correct a mistake on my IRS 8453-FE after submission?

If you find an error on your IRS 8453-FE after filing, you will need to submit an amended form. The IRS allows corrections, but make sure to clearly indicate changes made to avoid confusion. It's also recommended to check the IRS website for guidance on this process.

How can I track the status of my IRS 8453-FE submission?

To verify the status of your IRS 8453-FE, you can use the IRS's e-file tracking services. This typically involves entering your details and following prompts to get updates. Keep in mind that common e-file rejection codes are available on the IRS site, helping you understand potential issues.

What privacy and data security measures should I be aware of when submitting the IRS 8453-FE?

When filing the IRS 8453-FE, ensure that your personal data is protected. Use secure internet connections and reputable e-filing software that complies with IRS security standards. The IRS recommends keeping records privately stored, retaining them for a minimum of three years.

Are there any special considerations for nonresident payees when filing IRS 8453-FE?

Nonresidents must adhere to specific guidelines when filing the IRS 8453-FE. This includes confirming tax treaty benefits and ensuring proper documentation is submitted. It's crucial for nonresidents to consult IRS resources or a tax professional for tailored advice based on their unique situation.

What common errors should I avoid when submitting the IRS 8453-FE electronically?

To minimize errors when submitting your IRS 8453-FE, double-check all entry fields for accuracy and completeness. Pay close attention to required fields and ensure that any necessary documentation is accurately attached, as omissions can lead to processing delays or rejections.