FL DR-501 2025 free printable template

Show details

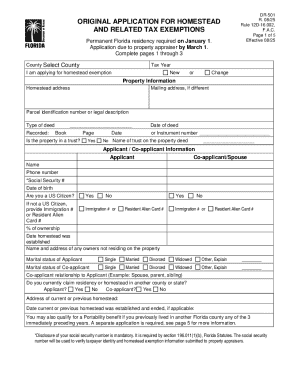

DR-501 R. 01/25 Rule12D-16.002, F.A.C. Page 1 of 4 Provisional ORIGINAL APPLICATION FOR HOMESTEAD AND RELATED TAX EXEMPTIONS Permanent Florida residency required on January 1. Application due to property

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-501

Edit your FL DR-501 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-501 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DR-501 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DR-501. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-501

How to fill out FL DR-501

01

Obtain a copy of FL DR-501 form from the Florida Department of Revenue website or your local property appraiser's office.

02

Fill in your name, address, and contact information at the top of the form.

03

Provide the property information, including the address and the property identification (Parcel Number).

04

Select the appropriate exemption type you are applying for, such as homestead exemption or other types of exemptions.

05

Complete the eligibility section by answering questions regarding your ownership and residency.

06

Include any required supporting documentation, such as proof of residency or income documents.

07

Review the completed form for accuracy and completeness.

08

Sign and date the application at the bottom of the form.

09

Submit the completed form along with any necessary attachments to your local Property Appraiser's office either in person or by mail before the deadline.

Who needs FL DR-501?

01

Homeowners in Florida who wish to apply for property tax exemptions such as homestead exemption.

02

Individuals who qualify for additional exemptions, like widow/widower exemptions, disability exemptions, or veterans exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do you qualify for Florida homestead exemption?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

Who qualifies for Florida homestead exemption?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

What do I need to homestead my house in Florida?

You should confirm what is acceptable with the county property appraiser's office, but a few examples of documents that might need include the following: A Florida driver's license or state ID. A Florida vehicle registration number. A Florida voter's ID. Immigration documents, if you're not a U.S. citizen.

Where can I find the form to homestead your house in Florida?

The application for homestead exemption (Form DR- 501) and other exemption forms are on the Department's forms page and on most property appraisers' websites. Submit your homestead application to your county property apprsaiser.

What are the requirements for Florida homestead?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

Can I apply for the Florida homestead exemption online?

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit FL DR-501 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including FL DR-501, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find FL DR-501?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the FL DR-501 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit FL DR-501 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share FL DR-501 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is FL DR-501?

FL DR-501 is a form used in Florida for reporting the assessment of tangible personal property for tax purposes. It is primarily used by businesses and individuals to report their personal property to the county property appraiser.

Who is required to file FL DR-501?

All businesses and individuals who own tangible personal property in Florida and are subject to property tax are required to file FL DR-501 with their local property appraiser.

How to fill out FL DR-501?

To fill out FL DR-501, you need to provide information regarding the type of tangible personal property owned, its estimated value, and other pertinent details about the property. The form should be completed accurately and submitted to the property appraiser's office by the specified deadline.

What is the purpose of FL DR-501?

The purpose of FL DR-501 is to accurately report the ownership and value of tangible personal property for taxation purposes, ensuring compliance with Florida’s property tax laws.

What information must be reported on FL DR-501?

FL DR-501 requires reporting of details such as the property owner's name and address, a description of the tangible personal property, its location, and its estimated value as of January 1st of the assessment year.

Fill out your FL DR-501 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-501 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.