FL DR-501 2021 free printable template

Show details

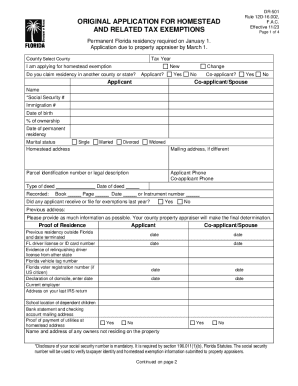

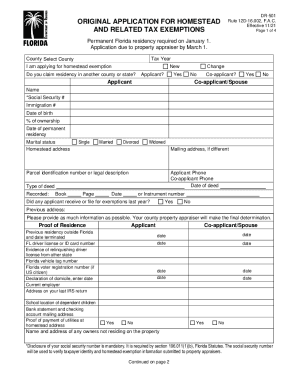

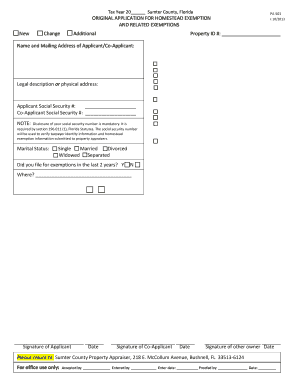

All taxes Proof of age DR-501SC household income 196. 075 Death certificate of spouse 196. 202 Florida physician DVA or SSA Disabled Quadriplegic 196. DR-501 R* 06/17 12DER17-02 Eff* 06/17 ORIGINAL APPLICATION FOR HOMESTEAD AND RELATED TAX EXEMPTIONS Permanent Florida residency required on January 1. Application due to property appraiser by March 1. FOR THE 2017 TAX YEAR the application for first responders injured in the line of duty or a surviving spouse is DUE BY AUGUST 1 2017. County Tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your homestead related tax exemptions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homestead related tax exemptions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homestead related tax exemptions online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit homestead application florida form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

FL DR-501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out homestead related tax exemptions

How to fill out homestead related tax exemptions:

01

Gather all necessary documents, such as proof of ownership of the property, proof of residency, and any income or financial information required.

02

Determine the specific homestead related tax exemptions that you may be eligible for, such as exemptions for senior citizens, disabled individuals, or veterans.

03

Obtain the appropriate tax exemption application form from your local tax authority or download it from their website.

04

Fill out the application form accurately and completely, providing all requested information and supporting documentation.

05

Double-check and review the completed application form to ensure accuracy and ensure that all required information and documentation are included.

06

Submit the completed application form and any supporting documents to the appropriate tax authority by the specified deadline.

07

Follow up with the tax authority to ensure that your application has been received and processed, and to address any additional requirements or inquiries they may have.

Who needs homestead related tax exemptions:

01

Homeowners who meet specific criteria, such as being senior citizens, disabled individuals, or veterans, may be eligible for homestead related tax exemptions.

02

Individuals who own and reside in the property they are seeking tax exemptions for may also qualify for homestead related tax exemptions.

03

The requirements and eligibility criteria for homestead related tax exemptions may vary depending on the jurisdiction, so it is essential to consult with your local tax authority or review the relevant tax laws and regulations for accurate information.

Fill fl application homestead form : Try Risk Free

People Also Ask about homestead related tax exemptions

How do you qualify for Florida homestead exemption?

Who qualifies for Florida homestead exemption?

What do I need to homestead my house in Florida?

Where can I find the form to homestead your house in Florida?

What are the requirements for Florida homestead?

Can I apply for the Florida homestead exemption online?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is homestead related tax exemptions?

Homestead-related tax exemptions refer to tax benefits provided to homeowners who use their property as their primary residence or "homestead." These exemptions aim to reduce property tax burdens on homeowners, primarily by providing a reduction in the assessed value of the property for tax purposes.

The specific benefits of homestead-related tax exemptions vary depending on the jurisdiction. However, some common types of exemptions include:

1. Homestead exemption: This exemption often provides a fixed dollar amount deduction or percentage reduction in the assessed value of the home. It can help lower the property tax liability for homeowners.

2. Age-related exemptions: Some jurisdictions offer additional exemptions to elderly homeowners, typically 65 years or older. These exemptions may provide additional property tax reductions or freeze the assessed value of the home to prevent increases.

3. Disability-related exemptions: Homeowners with disabilities may be eligible for additional exemptions or reductions in property taxes. The type and amount of exemption offered may vary based on the jurisdiction.

4. Veteran-related exemptions: Military veterans may be eligible for specific exemptions based on their service or disability status. These exemptions can vary widely depending on the jurisdiction and veteran's circumstances.

It's important to note that the availability and specific details of homestead-related tax exemptions differ among states, counties, and municipalities. Homeowners are advised to consult their local tax authority or assessors' office to understand the eligibility criteria and specific benefits applicable in their area.

Who is required to file homestead related tax exemptions?

The requirements for filing homestead-related tax exemptions vary by jurisdiction. In general, individuals who may be required to file homestead tax exemptions include:

1. Homeowners: Homeowners who own and occupy a property as their primary residence may be eligible for a homestead exemption.

2. Senior citizens or disabled individuals: Some jurisdictions provide additional homestead exemptions for senior citizens or disabled individuals, usually with age or disability-related criteria.

3. Veterans: In certain areas, veterans may be eligible for additional homestead exemptions.

4. Low-income individuals or families: Some jurisdictions offer homestead exemptions based on income levels, providing relief for low-income homeowners.

It is essential to check with the local tax authority, such as the county assessor's office or the municipality, to determine the specific requirements and eligibility criteria for homestead-related tax exemptions in your area.

How to fill out homestead related tax exemptions?

To fill out homestead-related tax exemptions, follow these steps:

1. Determine your eligibility: Familiarize yourself with the specific qualifications for homestead exemptions in your state or local jurisdiction. Generally, these exemptions are available to homeowners who use their property as their primary residence.

2. Obtain the necessary forms: Contact your local tax assessor's office or visit their website to retrieve the appropriate homestead exemption application form. Forms may vary by jurisdiction, so ensure you have the most up-to-date version.

3. Gather required documentation: Collect the necessary documents to support your application, which may include:

- Proof of ownership: Provide a copy of the deed or title to your property.

- Proof of residency: Gather documents that demonstrate your residency, such as driver's license, utility bills, or voter registration.

- Proof of income: Some jurisdictions require proof of income eligibility for certain homestead exemptions. Prepare documents, like tax returns or pay stubs, to support your income status if applicable.

4. Complete the application form: Fill out the application form completely and accurately. Ensure you provide all requested information, including property details and personal information.

5. Attach supporting documentation: Gather the necessary supporting documents and attach them to your application. Make sure to include copies, as original documents may not be returned.

6. Submit the application: Submit your completed application and supporting documentation to the appropriate tax assessor's office. Check their guidelines for submission methods, such as in-person submission, mail, or online submission.

7. Follow up and verification: After submission, follow up with the tax assessor's office to confirm the receipt of your application. They may require additional information or documentation for verification purposes.

8. Review assessment and exemptions: Once your application is processed, review your property tax assessment to ensure the homestead exemption has been applied correctly. If any issues or discrepancies arise, contact the tax assessor's office promptly for clarification.

It's important to note that the specific process may vary depending on your location. Consult with your local tax assessor's office or a tax professional for precise instructions tailored to your jurisdiction.

What is the purpose of homestead related tax exemptions?

The purpose of homestead-related tax exemptions is to provide financial relief to homeowners by lowering their property tax obligations. These exemptions aim to protect and support individuals and families who own and occupy their primary residences, often referred to as "homesteads." The exemptions usually work by reducing the taxable value of the property, allowing homeowners to pay less in property taxes.

Homestead exemptions are designed to help alleviate the financial burden on homeowners, especially those with limited incomes or facing economic hardship. These tax breaks can make housing more affordable and incentivize homeownership, particularly for low-income or elderly individuals who may have difficulty paying property taxes. Additionally, they can promote stability and encourage long-term residency by reducing the overall housing costs for homeowners.

Furthermore, homestead exemptions also contribute to the idea of providing a stable and secure environment for families. By reducing property taxes for homeowners, these exemptions ensure families can better allocate their resources to cover other essential expenses such as education, healthcare, or savings.

It is important to note that specific rules and eligibility criteria for homestead-related tax exemptions may vary across jurisdictions.

What information must be reported on homestead related tax exemptions?

The specific information that must be reported on homestead-related tax exemptions can vary depending on the jurisdiction. However, some common information that may be required includes:

1. Property owner's name and contact information: This includes the name, address, and phone number of the individual or entity claiming the homestead exemption.

2. Property address: The address of the property for which the exemption is being claimed.

3. Declaration of primary residence: The property owner may need to declare that the specific property is their primary residence and that they meet the requirements for a homestead exemption.

4. Ownership information: Details about the property's ownership, such as whether it is owned solely by the applicant or jointly with others.

5. Income and financial information: Some jurisdictions may require the property owner to provide information about their income or financial status to determine eligibility for certain homestead exemptions.

6. Supporting documents: Various supporting documents may be required, such as proof of residency (e.g., utility bills, driver's license), proof of ownership (e.g., deed or title), and other documentation as specified by the relevant tax authority.

It is important to note that the specific requirements and forms for homestead-related tax exemptions can differ significantly between jurisdictions. It is recommended to consult with the local tax authority or seek professional advice to understand the specific reporting requirements in a particular area.

What is the penalty for the late filing of homestead related tax exemptions?

The penalty for late filing of homestead related tax exemptions varies depending on the jurisdiction and the specific circumstances. In general, late filing can result in the denial of the exemption or a reduction in the amount of the exemption. Additionally, there may be late fees or interest charges imposed on the overdue taxes. It is important to consult with a local tax authority or a tax professional for accurate and specific information regarding the penalties for late filing of homestead related tax exemptions in a particular area.

Where do I find homestead related tax exemptions?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the homestead application florida form. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my application homestead exemptions online in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your florida application homestead exemptions form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit application homestead exemptions on an Android device?

The pdfFiller app for Android allows you to edit PDF files like florida application homestead tax exemptions form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your homestead related tax exemptions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Homestead Exemptions Online is not the form you're looking for?Search for another form here.

Keywords relevant to fl application homestead exemptions form

Related to florida homestead application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.