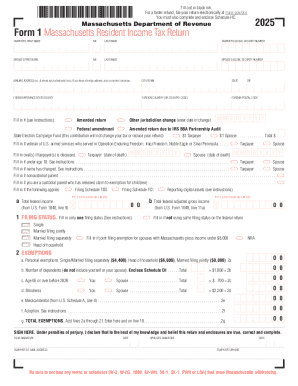

MA Form 1 2024 free printable template

Instructions and Help about MA Form 1

How to edit MA Form 1

How to fill out MA Form 1

Latest updates to MA Form 1

About MA Form 1 2024 previous version

What is MA Form 1?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about MA Form 1

What should I do if I realize I've made a mistake after filing my MA Form 1?

If you discover an error after submitting your MA Form 1, you can file an amended version of the form to correct the mistake. Ensure you follow the guidelines for submitting corrections, which may include providing an explanation of the error. It's crucial to address mistakes promptly to avoid potential penalties or complications with the processing of your form.

How can I verify the status of my submitted MA Form 1?

To check the status of your MA Form 1, you can use the online tracking system provided by the revenue department. This system allows you to monitor the processing status, and if you encounter any issues, it may display common rejection codes that you can address. Keeping track of your submission ensures timely resolution of any problems.

Are e-signatures acceptable when filing the MA Form 1?

Yes, e-signatures are generally acceptable when submitting the MA Form 1 electronically. However, it is important to verify the specific requirements in the filing guidelines to ensure compliance. Utilizing e-signatures can streamline the filing process and enhance the security of your submission.

What steps should I take if my electronic submission of the MA Form 1 is rejected?

If your electronic submission of the MA Form 1 is rejected, carefully review the rejection notice for specific reasons. Address the identified issues and resubmit the form as necessary. Depending on the situation, you may be eligible for a refund of service fees associated with the e-filing if you follow the designated procedures.

How long should I retain records related to my MA Form 1 filing?

It is advisable to retain records related to your MA Form 1 filing for a minimum of three to six years. This retention period is essential in case of audits or inquiries from tax authorities. Keeping detailed records will aid in resolving any future discrepancies or questions regarding your filed form.

See what our users say