IRS Instruction 4797 2024 free printable template

Show details

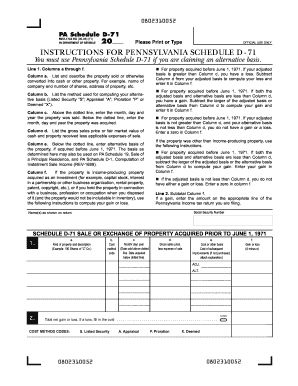

Other Forms You May Have To File Use Form 4684 to report involuntary conversions from casualties and thefts. See Where To Report Amounts From Worksheet below. 5. Worksheet Instructions Caution For a disposition due to casualty or theft skip lines 1 and 5 and enter the amount from line 4 on Form 4684 line 20 and complete the rest of Form 4684. Keep adequate records to distinguish section 1244 stock from any other stock owned in the same You must complete this line if there is a gain on Form...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 4797

Edit your IRS Instruction 4797 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 4797 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instruction 4797 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Instruction 4797. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 4797 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction 4797

How to fill out IRS Instruction 4797

01

Gather all necessary documentation related to your business property sales, including purchase and sale dates, costs, and any improvements made.

02

Obtain your IRS Form 4797 and instructions from the IRS website or your tax preparer.

03

Fill out Part I for the sale of business property, entering the property descriptions and sales details.

04

Complete Part II if you're reporting the gain or loss from like-kind exchanges.

05

Provide details in Part III if you have sales of Section 1231 assets, and summarize gains and losses.

06

Calculate total gains or losses to enter on your tax return.

07

Double-check all entries for accuracy and completeness.

08

Submit the completed Form 4797 with your tax return.

Who needs IRS Instruction 4797?

01

Taxpayers who have sold, exchanged, or otherwise disposed of business property.

02

Individuals reporting gains or losses from Section 1231 assets.

03

Business owners dealing with like-kind exchanges.

04

Taxpayers needing to report dispositions of certain assets held for business purposes.

Fill

form

: Try Risk Free

People Also Ask about

What should I report on form 4797?

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets. The disposition of capital assets not reported on Schedule D.

What is form 4797 used for when selling a business?

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets.

How do I fill out a 4797 for sale of rental property?

When filling out Form 4797, entities must provide the following information: Description of the property. Purchase date. Sale or transfer date. Cost of purchase. Gross sales price. Depreciation amount (which is added to the sales price1 1

Who must file form 4797?

Anyone who has realized gains from the sale or transfer of a property used for business purposes is required to file Form 4797 along with their regular tax return with the IRS for the year the gains were realized.

What is the difference between form 4797 and Schedule D?

Whereas Schedule D forms are used to report personal gains, IRS Form 4797 is used to report profits from real estate transactions centered on business use. IRS Form 4797 has much more specific utilization, while Schedule D is a required form for anyone reporting personal gains in general.

Do I need form 4797?

If you sold property that was your home and you also used it for business, you may need to use Form 4797 to report the sale of the part used for business (or the sale of the entire property if used entirely for business). Gain or loss on the sale of the home may be a capital gain or loss or an ordinary gain or loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS Instruction 4797?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the IRS Instruction 4797. Open it immediately and start altering it with sophisticated capabilities.

How do I edit IRS Instruction 4797 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your IRS Instruction 4797 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit IRS Instruction 4797 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IRS Instruction 4797 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS Instruction 4797?

IRS Instruction 4797 is a tax form that is used to report the sale of business property, including real estate and personal property, and the related gains or losses from those sales.

Who is required to file IRS Instruction 4797?

Individuals, businesses, and entities that have sold or exchanged depreciable property or other business assets during the tax year are required to file IRS Instruction 4797.

How to fill out IRS Instruction 4797?

To fill out IRS Instruction 4797, taxpayers need to report details about the sale or exchange, including the description of the property, date of acquisition and sale, cost basis, and the selling price. It is advisable to follow the specific instructions provided for each part of the form.

What is the purpose of IRS Instruction 4797?

The purpose of IRS Instruction 4797 is to facilitate the reporting of gains and losses from the sale of business property in order to ensure proper taxation and compliance with IRS regulations.

What information must be reported on IRS Instruction 4797?

The information that must be reported on IRS Instruction 4797 includes the property description, acquisition date, sale date, adjusted basis, selling price, and the amount of any depreciation recapture.

Fill out your IRS Instruction 4797 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 4797 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.