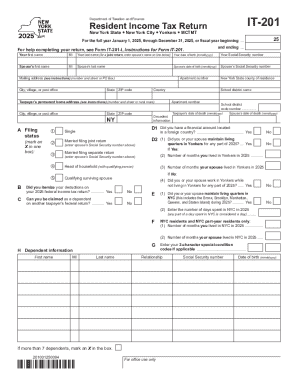

NY DTF IT-201 2024 free printable template

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

How to fill out NY DTF IT-201

Latest updates to NY DTF IT-201

About NY DTF IT previous version

What is NY DTF IT-201?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about NY DTF IT-201

What should I do if I need to correct mistakes on my NY DTF IT-201 after filing?

If you need to amend your NY DTF IT-201, you should submit Form IT-201-X, which is the amended return form. It's crucial to correct any errors as soon as you notice them to avoid penalties or interest. Additionally, ensure that you clearly indicate that the document is a correction when submitting it.

How can I verify if my NY DTF IT-201 has been received and is being processed?

To check the status of your NY DTF IT-201, you can use the New York State Department of Taxation and Finance's online services. Enter your details to verify receipt and processing status. If you filed electronically, you should receive a confirmation email; if you have not, you may want to follow up directly with their office.

What legal nuances should I be aware of when e-filing the NY DTF IT-201?

When e-filing your NY DTF IT-201, it's important to understand the acceptability of electronic signatures. New York allows e-signatures on many forms, including tax returns, but they must meet specific requirements. Additionally, familiarize yourself with the record retention period for your documents and ensure your personal data is securely handled.

What are common errors to avoid when submitting the NY DTF IT-201?

Common errors include mismatched personal information, incorrect Social Security numbers, and not using the latest version of the form. Always double-check your math and ensure that all necessary documentation is attached to minimize processing delays or rejections.

What should I do if I receive a notice or letter from the tax department regarding my NY DTF IT-201?

If you receive a notice regarding your NY DTF IT-201, carefully review the content for specific instructions. It's essential to respond promptly and prepare any necessary documentation to clarify your position. If you're unsure about how to proceed, consider consulting a tax professional to assist you.

See what our users say