KEYSTONE CLGS-32-1 2024-2025 free printable template

Show details

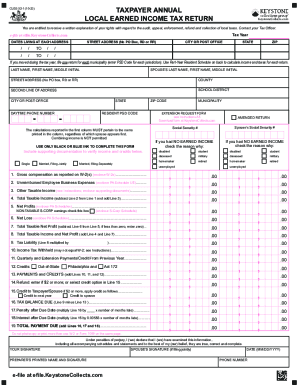

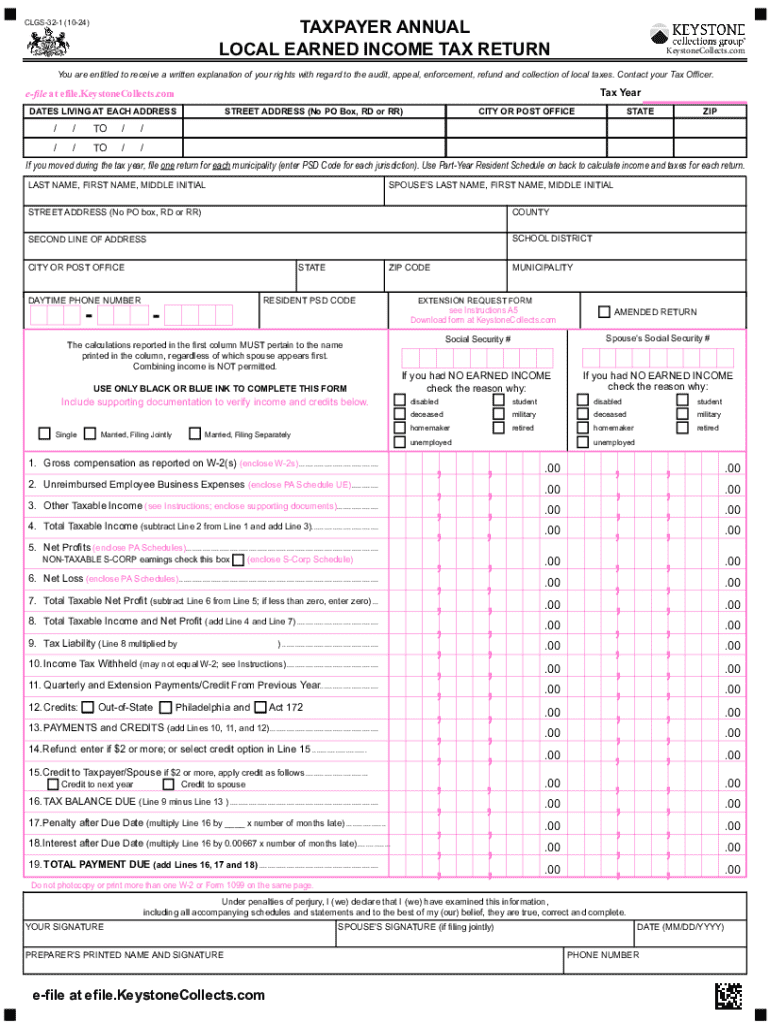

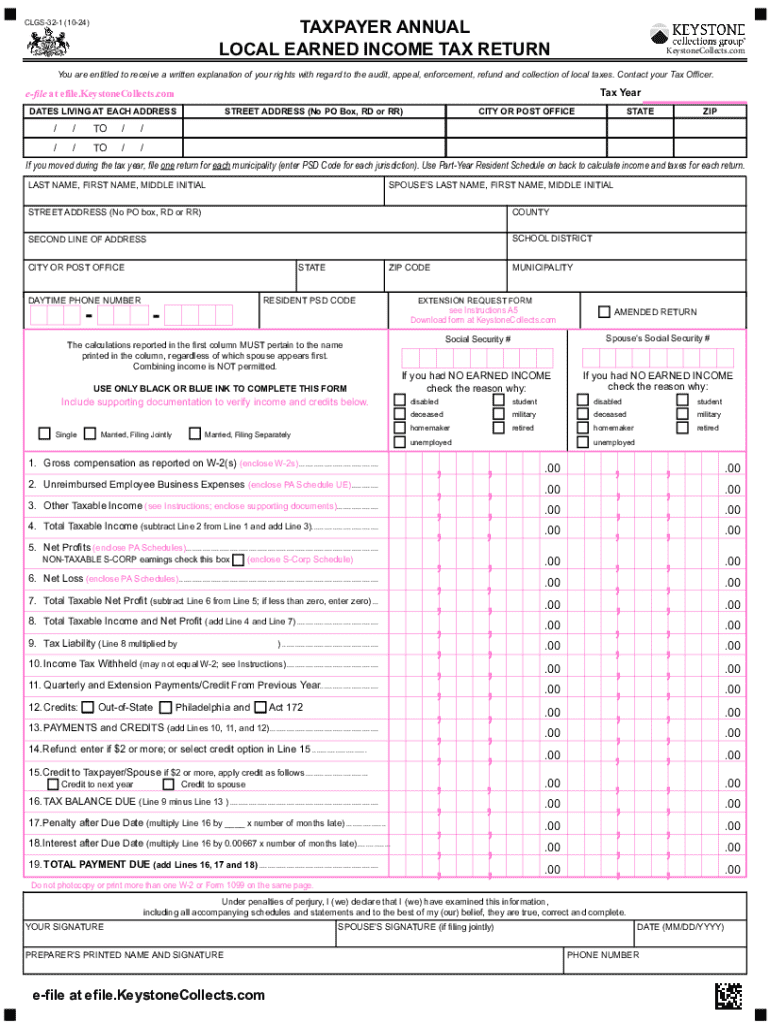

TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURN CLGS-32-1 (10-24) KeystoneCollects.com You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign clgs321 keystone tax return form

Edit your clgs321 annual local return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your clgs321 keystone local tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit clgs321 annual local return form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit clgs321 local income form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KEYSTONE CLGS-32-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out clgs321 taxpayer annual earned form

How to fill out KEYSTONE CLGS-32-1

01

Gather all necessary personal and business information, including your legal name, contact details, and any relevant identification numbers.

02

Access the KEYSTONE CLGS-32-1 form from the official website or authorized source.

03

Begin filling out the form by entering your name and address in the designated fields.

04

Provide details regarding your business structure, such as whether you are a sole proprietor or part of a corporation.

05

Include any relevant financial information required, such as revenue and expenses, as indicated on the form.

06

Review the completed sections to ensure all information is accurate and up-to-date.

07

Sign and date the form at the bottom as required.

08

Submit the form according to the provided instructions, whether online or via mail.

Who needs KEYSTONE CLGS-32-1?

01

Individuals who are starting a new business in the Keystone region.

02

Existing business owners who need to update their records.

03

Participants in state programs that require documentation of business structure.

04

Entrepreneurs seeking funding or permits that necessitate filing this form.

Fill

clgs321 local return form

: Try Risk Free

People Also Ask about clgs321 keystone local tax print

What disqualifies you from earned income credit?

Eligibility is limited to low-to-moderate income earners If you do not have a qualifying child, you must also be at least 25 or older but under 65, not qualify as a dependent of another person and lived in the United States for more than half of the year.

How much is the EITC for 2023?

The maximum amount of credit: No qualifying children: $600. 1 qualifying child: $3,995. 2 qualifying children: $6,604.Tax Year 2023. Children or Relatives ClaimedFiling as Single, Head of Household, or WidowedFiling as Married Filing JointlyZero$17,640$24,210One$46,560$53,1202 more rows • Jan 26, 2023

What form do I use for PA local income tax withholding?

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situa- tion changes. Photocopies of this form are acceptable.

Do I have to pay local earned income tax?

You are required to pay local earned income tax on the income earned for the period of time you resided in the municipality. For example, if you lived and worked in the municipality for only 4 months then you only pay on the income earned during those 4 months.

How to download T1 General from CRA?

If you have a CRA My Account, you can find your T1 for the current year, as well as the past 11 years that you filed, by looking under the \u201ctax returns view\u201d section. If you look for anything older, you will need to contact the CRA directly at 1-800-959-8281 to request a copy.

Where do I get my T1 General?

You will have a copy of your T1 Generals in your tax package provided to you by your tax preparer. If you prepare and submit your taxes yourself then you will have a copy of your T1 Generals in your tax software. If you cannot find your T1 Generals please contact your tax preparer and they will provide you with a copy.

What is a CLGS 32 1?

CLGS-32-1 (10-22) You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes. Contact your Tax Officer.

Who is exempt from PA local earned income tax?

Are there income exemptions to the local services tax (LST)? Yes. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits are exempt from the tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send clgs321 keystone taxpayer form to be eSigned by others?

Once your clgs321 annual local income form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit clgs321 local income tax form on an iOS device?

Create, edit, and share clgs321 keystone local return form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete clgs321 keystone local tax online on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your clgs321 keystone local tax get. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is KEYSTONE CLGS-32-1?

KEYSTONE CLGS-32-1 is a form used for reporting local government statistics in Pennsylvania, specifically related to the collection and remittance of local income taxes.

Who is required to file KEYSTONE CLGS-32-1?

Entities or individuals responsible for collecting local income taxes in Pennsylvania, such as employers and tax collectors, are required to file KEYSTONE CLGS-32-1.

How to fill out KEYSTONE CLGS-32-1?

To fill out KEYSTONE CLGS-32-1, one must provide relevant information including the collector's name, tax year, and details of taxable income and tax collected, following the instructions provided on the form.

What is the purpose of KEYSTONE CLGS-32-1?

The purpose of KEYSTONE CLGS-32-1 is to ensure accurate reporting and distribution of local income taxes to the appropriate municipalities in Pennsylvania.

What information must be reported on KEYSTONE CLGS-32-1?

KEYSTONE CLGS-32-1 requires reporting of the total taxable income, local tax rates, amounts collected, and any other pertinent details related to local income tax for the specified period.

Fill out your taxpayer annual local earned online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

clgs321 Earned Income Return Form is not the form you're looking for?Search for another form here.

Keywords relevant to clgs321 keystone earned form download

Related to clgs321 local income tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.