KEYSTONE CLGS-32-1 2021 free printable template

Show details

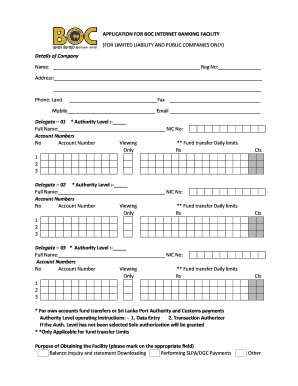

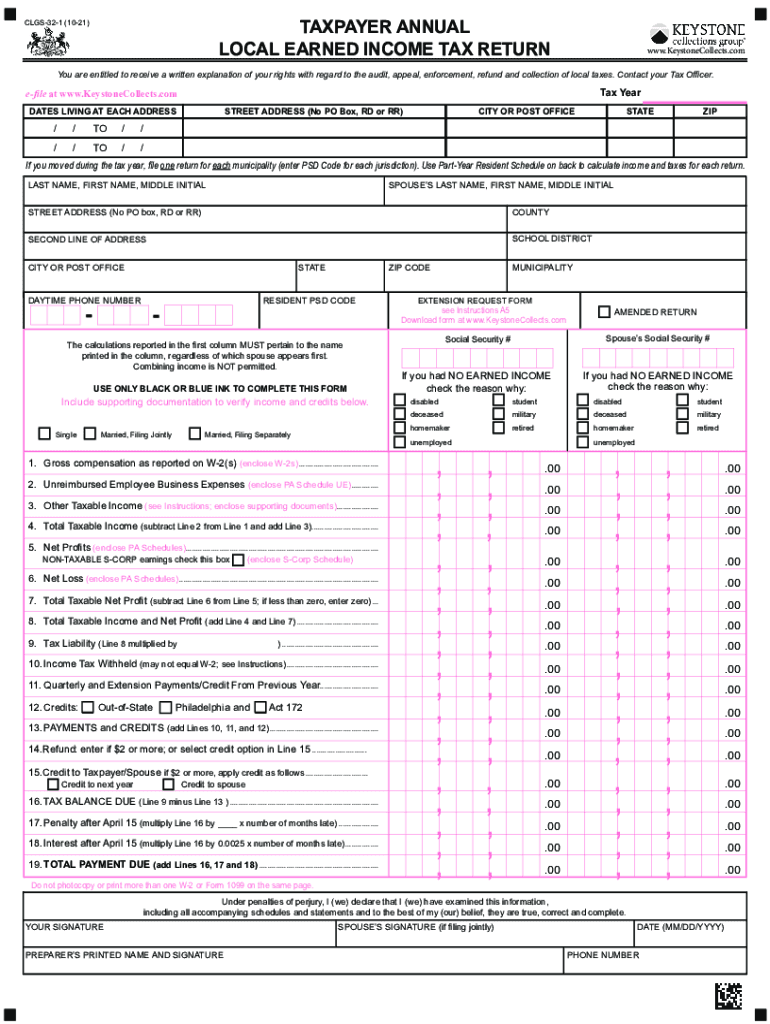

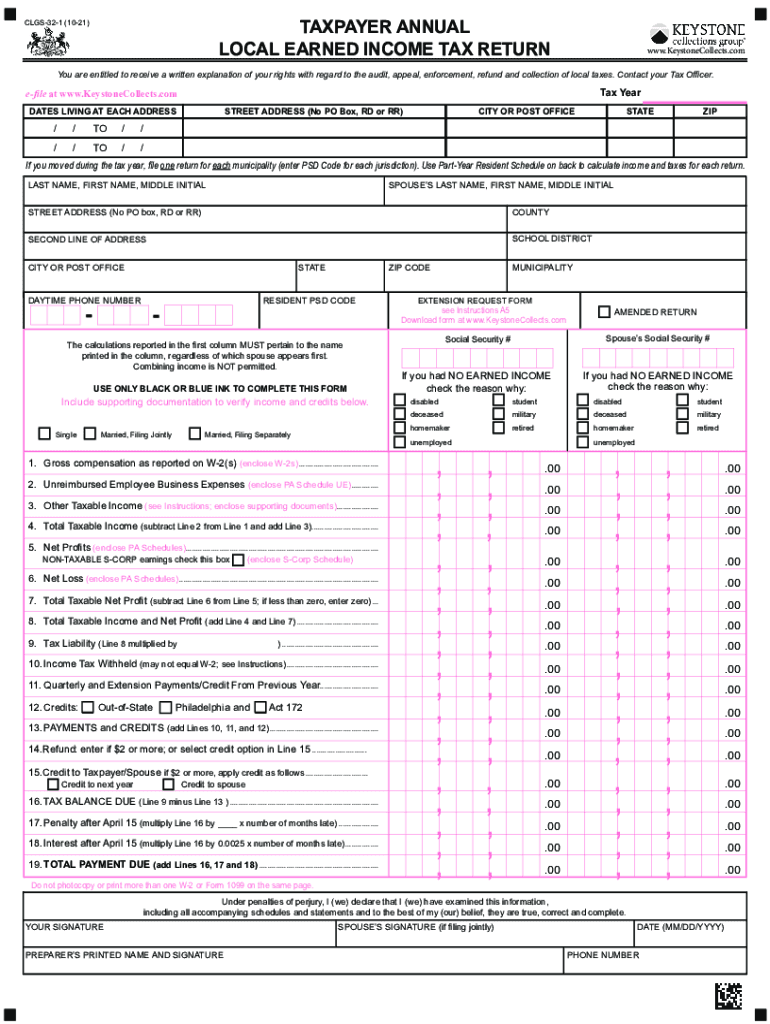

TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURNCLGS321 (1020×www.KeystoneCollects.comYou are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KEYSTONE CLGS-32-1

Edit your KEYSTONE CLGS-32-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KEYSTONE CLGS-32-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KEYSTONE CLGS-32-1 online

Follow the steps below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit KEYSTONE CLGS-32-1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KEYSTONE CLGS-32-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KEYSTONE CLGS-32-1

How to fill out KEYSTONE CLGS-32-1

01

Gather necessary information such as personal details and relevant documentation.

02

Locate the section for personal information on the form.

03

Carefully fill in your name, address, and contact information in the appropriate fields.

04

Provide any required identification numbers or account details as prompted.

05

Review the instructions for any additional sections or requirements specific to your situation.

06

Complete all necessary signatures and dates where indicated.

07

Double-check all information for accuracy and completeness before submission.

08

Submit the completed form to the appropriate authority or email it as instructed.

Who needs KEYSTONE CLGS-32-1?

01

Individuals or entities who are applying for certain licenses or permits in Keystone jurisdiction.

02

Applicants needing to report specific information to comply with regulatory requirements.

03

Businesses needing to update or verify their registered status.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from PA local earned income tax?

Are there income exemptions to the local services tax (LST)? Yes. If the annual tax rate is higher than $10, employees earning less than $12,000 annually from wages, earned income and/or net profits are exempt from the tax.

Do I have to file local earned income tax?

Yes. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question, a local earned income return must be filed annually by April 15, (unless the 15th falls on a Saturday or Sunday then the due date becomes the next business day) for the preceding calendar year.

What is a local earned income tax return?

What is the Earned Income Tax? The local Earned Income Tax (EIT) was enacted in 1965 under Act 511, the state law that gives municipalities and school districts the legal authority to levy a tax on individual gross earned income/compensation and net profits.

Who must file a PA local tax return?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Where can I get a PA local tax form?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is the 15112 form?

Complete the EIC Eligibility Form 15112, Earned Income Credit Worksheet (CP27)PDF. If you are eligible for the credit, Sign and date the Form 15112.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KEYSTONE CLGS-32-1 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like KEYSTONE CLGS-32-1, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in KEYSTONE CLGS-32-1?

The editing procedure is simple with pdfFiller. Open your KEYSTONE CLGS-32-1 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit KEYSTONE CLGS-32-1 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing KEYSTONE CLGS-32-1 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is KEYSTONE CLGS-32-1?

KEYSTONE CLGS-32-1 is a specific form used for reporting certain financial or operational information as required by regulatory authorities.

Who is required to file KEYSTONE CLGS-32-1?

Entities or organizations that fall under the jurisdiction of the filing requirements outlined by the regulatory authority are required to file KEYSTONE CLGS-32-1.

How to fill out KEYSTONE CLGS-32-1?

To fill out KEYSTONE CLGS-32-1, one should carefully follow the instructions provided on the form, ensuring all necessary fields are completed accurately based on the reported information.

What is the purpose of KEYSTONE CLGS-32-1?

The purpose of KEYSTONE CLGS-32-1 is to collect and report specific financial or operational data to aid in compliance with regulatory standards.

What information must be reported on KEYSTONE CLGS-32-1?

The information that must be reported on KEYSTONE CLGS-32-1 typically includes financial figures, operational metrics, and any other specifics as required by the regulatory guidelines.

Fill out your KEYSTONE CLGS-32-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KEYSTONE CLGS-32-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.