MS DoR 89-350 2024 free printable template

Show details

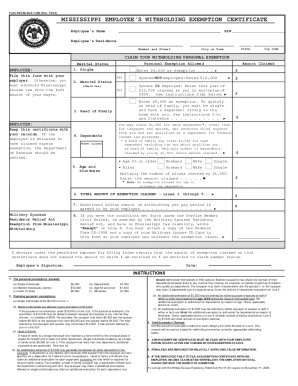

Print Form Reset Form Form 89-350-24-8-1-000 (Rev. 08/24) MISSISSIPPI EMPLOYEE\'S WITHHOLDING EXEMPTION CERTIFICATE Employee\'s Name SSN Employee\'s Residence Number and Street EMPLOYEE: File this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MS DoR 89-350

Edit your MS DoR 89-350 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MS DoR 89-350 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MS DoR 89-350 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MS DoR 89-350. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 89-350 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MS DoR 89-350

How to fill out MS DoR 89-350

01

Obtain the MS DoR 89-350 form from the appropriate state department website or office.

02

Fill in the date at the top of the form.

03

Provide the full name and address of the individual or organization submitting the form.

04

Include the relevant identification numbers, such as social security number or tax ID number, if applicable.

05

Clearly state the purpose for submitting the form in the designated section.

06

Provide any required supporting documentation as specified in the instructions.

07

Review the form for accuracy and completeness before submission.

08

Sign and date the form where indicated.

09

Submit the form to the appropriate office either by mail or in person, as directed.

Who needs MS DoR 89-350?

01

Individuals or organizations who need to report activities related to the specific regulations that MS DoR 89-350 addresses.

02

Taxpayers who are required to report certain financial information to the state.

03

Businesses that need to document compliance with state laws or regulations.

Fill

form

: Try Risk Free

People Also Ask about

Does Mississippi tax retirement income?

For 2022, the first $5,000 of taxable income is exempt, but the first $10,000 is exempt beginning in 2023. Plus, the tax rate on taxable income above $10,000 is gradually reduced starting in 2024. Seniors will also like the fact that most retirement income is exempt from Mississippi tax.

Does Mississippi have state withholding tax?

All employers who have employees working in Mississippi are required to withhold state income tax from their paychecks. The amount withheld will be based on the employee's Form W-4 and the state's withholding tables.

What is a form 80-105?

If you need to change or amend an accepted Mississippi State Income Tax Return for the current or previous Tax Year, you need to complete Form 80-105 (residents) or Form 80-205 (nonresidents and part-year residents). Forms 80-105 and 80-205 are Forms used for the Tax Amendment.

Does Mississippi have a state tax form?

These 2021 forms and more are available: Mississippi Form 80-105 – Resident Return. Mississippi Form 80-205 – Nonresident and Part-Year Resident Return. Mississippi Form 80-108 – Adjustments and Contributions.

Does MS have a state tax form?

Mississippi Form 80-105 – Resident Return. Mississippi Form 80-205 – Nonresident and Part-Year Resident Return. Mississippi Form 80-108 – Adjustments and Contributions. Mississippi Form 80-160 – Other State Tax Credit.

Who must file a Mississippi state tax return?

Who has to file Mississippi state taxes? If you lived in Mississippi or worked for a company based there, you must file a tax return if your income exceeds the deductions and exemptions. For single taxpayers, your gross income must be more than $8,300, plus $1,500 for each dependent.

What is a form 80 108?

Itemized Deductions. Individual taxpayers may elect to either itemize their individual nonbusiness deductions or claim a standard deduction.

Do you have to file a state tax return in Mississippi?

Who has to file Mississippi state taxes? If you lived in Mississippi or worked for a company based there, you must file a tax return if your income exceeds the deductions and exemptions. For single taxpayers, your gross income must be more than $8,300, plus $1,500 for each dependent.

Does Mississippi have a state income tax form?

These 2021 forms and more are available: Mississippi Form 80-105 – Resident Return. Mississippi Form 80-205 – Nonresident and Part-Year Resident Return. Mississippi Form 80-108 – Adjustments and Contributions.

What is IRS form 80 107?

More about the Mississippi Form 80-107 We last updated Mississippi Form 80-107 in January 2022 from the Mississippi Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.

What income is taxable in Mississippi?

If you are claiming a single tax filing status and have a gross income of $8,300 plus $1,500 for each dependent, you need to file taxes in the state. If you are filing jointly as a married resident and you and your spouse have gross income in excess of $16,600 plus $1,500 for each dependent or more.

Who has to file a Mississippi tax return?

Who has to file Mississippi state taxes? If you lived in Mississippi or worked for a company based there, you must file a tax return if your income exceeds the deductions and exemptions. For single taxpayers, your gross income must be more than $8,300, plus $1,500 for each dependent.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MS DoR 89-350?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the MS DoR 89-350. Open it immediately and start altering it with sophisticated capabilities.

How do I execute MS DoR 89-350 online?

With pdfFiller, you may easily complete and sign MS DoR 89-350 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out MS DoR 89-350 on an Android device?

Use the pdfFiller mobile app and complete your MS DoR 89-350 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MS DoR 89-350?

MS DoR 89-350 is a form used for reporting specific financial and operational data to the Mississippi Department of Revenue.

Who is required to file MS DoR 89-350?

Entities that engage in certain business activities in Mississippi and are subject to the state's tax regulations are required to file MS DoR 89-350.

How to fill out MS DoR 89-350?

To fill out MS DoR 89-350, follow the instructions provided on the form, ensuring that all required information is accurately entered, and submit it to the Mississippi Department of Revenue by the specified deadline.

What is the purpose of MS DoR 89-350?

The purpose of MS DoR 89-350 is to collect necessary data that helps the Mississippi Department of Revenue assess tax liabilities and ensure compliance with state tax laws.

What information must be reported on MS DoR 89-350?

The information that must be reported on MS DoR 89-350 typically includes financial statements, income details, and operational metrics relevant to the business's activities within Mississippi.

Fill out your MS DoR 89-350 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MS DoR 89-350 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.