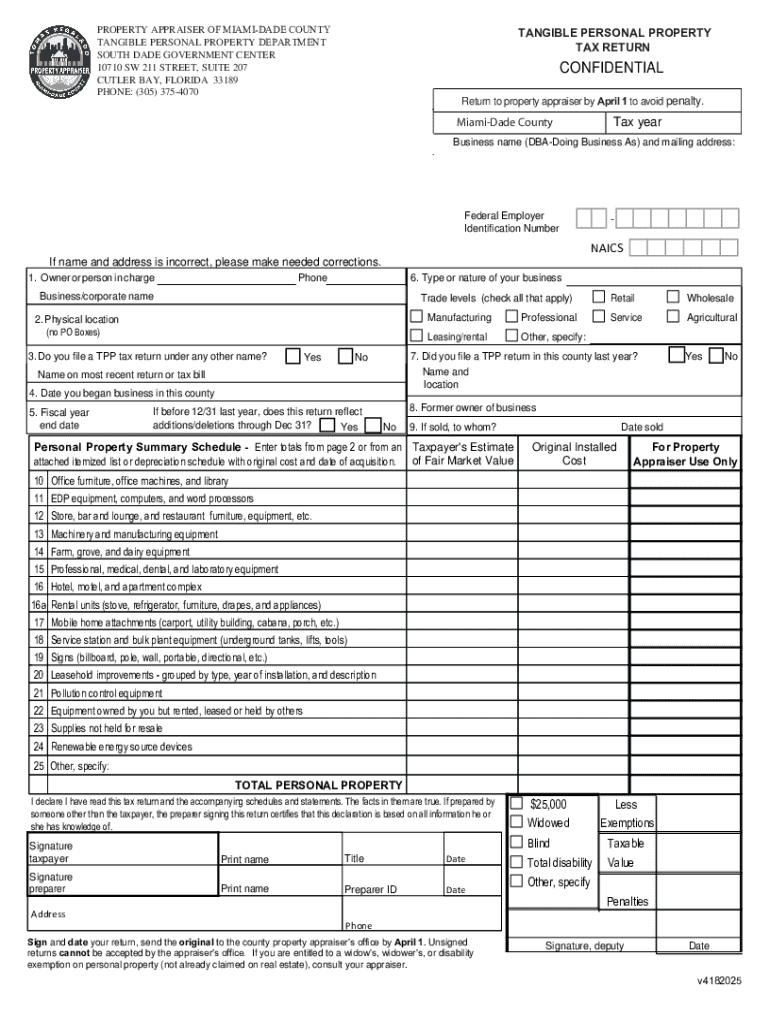

FL Tangible Personal Property Tax Return - Miami-Dade County 2025 free printable template

Get, Create, Make and Sign FL Tangible Personal Property Tax Return

Editing FL Tangible Personal Property Tax Return online

Uncompromising security for your PDF editing and eSignature needs

FL Tangible Personal Property Tax Return - Miami-Dade County Form Versions

How to Fill Out Forms with pdfFiller: A Comprehensive Guide

Understanding different types of forms

Forms play a crucial role across various sectors, serving as the backbone of communication and information sharing. Understanding the distinction between personal and professional forms is essential. Personal forms may range from tax submissions to medical consent forms, while professional forms can include contracts, invoices, and reports. Each type holds weighted implications, from legal accountability to administrative efficiencies.

Moreover, the digital revolution has introduced flexibility in using forms, leading to a clear divergence between digital and physical forms. Digital forms offer instant completion and submission, alongside automatic validation checks, which can significantly reduce errors. In contrast, physical forms are often used in environments where signatures or original documents are required, such as legal settings. Understanding these types aids you in choosing what best fits your needs.

Preparing to fill out your form

Preparation is key before you dive into filling out your form. Start by gathering your necessary information. Typical details may include names, addresses, contact numbers, and financial information. Missing any critical data can lead to delays or additional questions, resulting in inefficiencies.

Next, selecting the right form template can streamline the filling process. pdfFiller offers an extensive range of templates tailored for various purposes, from simple consent forms to complex contracts. Take a moment to explore these templates to find one that best suits your requirements.

Using pdfFiller to fill out forms

Navigating the pdfFiller interface is intuitive and user-friendly. Begin by locating the desired form template using the built-in search function. Once you've selected a template, the platform provides various editing tools to personalize it according to your specifications.

Editing your form is straightforward, thanks to pdfFiller’s powerful tools that allow you to adjust text, alter layout, and even add images or logos using a drag-and-drop feature. To enhance user interaction, you can incorporate elements such as checkboxes, radio buttons, and dropdown lists, ensuring a clear and organized formatting for the end-user.

Signing and collaborating on forms

Digital signatures, or eSignatures, are a modern solution that has gained acceptance due to their legal validity. Using pdfFiller, creating a digital signature is seamless — simply draw or upload your signature, and apply it directly to the document. This eliminates the need for printing and scanning, making the process faster.

Collaboration is also simplified within pdfFiller. Team members can be invited for review, allowing for real-time editing and commentary. This feature ensures that all feedback is centralized and accessible, enhancing teamwork and transparency.

Managing your forms

After your form is filled out and submitted, effective management is essential. With pdfFiller, you can save your forms directly on the platform or store them in the cloud. This offers significant advantages, including easy retrieval from any device and protection against data loss.

Tracking changes and versions is vital for maintaining version control. pdfFiller’s version history feature allows you to see edit timelines and restore previous versions when necessary, enabling seamless management of your documents.

Ensuring compliance and security

When working with forms, legal compliance remains a top priority. Certain requirements must be met depending on the form's purpose, and non-compliance can lead to significant issues. pdfFiller adheres to stringent security protocols, ensuring user privacy and document protection across the board.

Keeping your documents organized is equally important. By implementing a tagging system within pdfFiller, you can easily categorize your forms for quick retrieval and ensure that your documentation remains systematic and efficient.

Troubleshooting common issues

As with any technology, users may encounter errors while filling out forms. Common mistakes include overlooking required fields or entering incorrect information. To avoid these, double-check your data before submission.

For technical issues, pdfFiller provides robust customer support. You can reach out for assistance, and the FAQs section addresses many common user concerns, helping you resolve issues efficiently.

Best practices for effective form management

To enhance the efficiency of filling out forms, adopt a few best practices. Regularly review your process and ensure that your information is consistent and up-to-date. Maintaining clarity by using straightforward language and clearly defining sections will reduce confusion.

Continuous learning about document management tools is vital. Explore online tutorials or the pdfFiller blog for new tips and techniques to improve your skill set in managing forms effectively.

Advanced features of pdfFiller

pdfFiller not only facilitates form filling but also offers integration with various software systems. This enables you to streamline workflows across platforms, increasing productivity.

Customizing your solution with pdfFiller allows you to tailor features to fit your specific needs. Real-life case studies demonstrate how businesses have leveraged pdfFiller for their form management, yielding remarkable efficiency gains.

Utilizing analytics and insights

To gain a competitive edge, it’s essential to track form usage and engagement. pdfFiller allows you to monitor how users interact with your forms, providing insightful data that can be leveraged to enhance service delivery.

Using these insights, you can fine-tune your form creation process by identifying areas that require clarification or detail, thus improving overall efficiency.

Final notes

Maintaining workflow efficiency with pdfFiller is achievable by adopting organized practices and embracing its collaborative features. Whether working individually or within a team, taking full advantage of what pdfFiller offers will significantly enhance your document management experience.

People Also Ask about

How do I contact Miami Dade property appraiser?

What are the qualifications for homestead exemption in Florida?

What documents do I need for homestead exemption in Florida?

What documents do you need for homestead in Florida?

At what age do seniors stop paying property taxes in Florida?

How do you qualify for homestead exemption in Miami Dade?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my FL Tangible Personal Property Tax Return directly from Gmail?

How do I edit FL Tangible Personal Property Tax Return on an iOS device?

How do I complete FL Tangible Personal Property Tax Return on an Android device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.