FL Tangible Personal Property Tax Return - Miami-Dade County 2012 free printable template

Show details

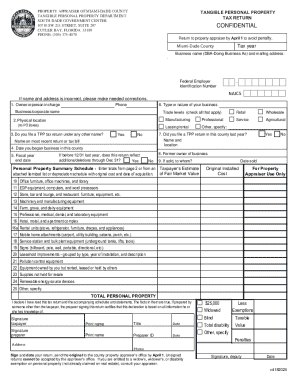

TANGIBLE PERSONAL PROPERTY

TAX RETURNMIAMIDADE COUNTY PROPERTY APPRAISER

TANGIBLE PERSONAL PROPERTY DIVISION

SOUTH MADE GOVERNMENT CENTER

10710 SW 211 STREET, SUITE 207

CUTLER BAY, FLORIDA 33189

PHONE:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Tangible Personal Property Tax Return

Edit your FL Tangible Personal Property Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Tangible Personal Property Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL Tangible Personal Property Tax Return online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL Tangible Personal Property Tax Return. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Tangible Personal Property Tax Return - Miami-Dade County Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

How do I contact Miami Dade property appraiser?

For questions or to review your property assessment, property owners can visit our offices or send us an email. Appointments can also be scheduled online or by calling our office directly at 305-375-4712.

What are the qualifications for homestead exemption in Florida?

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

What documents do I need for homestead exemption in Florida?

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

What documents do you need for homestead in Florida?

A valid Florida driver's license or state ID card. However, Florida has extensive identification requirements including (1) primary identification (e.g. a certified copy of a birth certificate or a valid passport), (2) proof of a Social Security Number, and (3) proof of the residential address.

At what age do seniors stop paying property taxes in Florida?

The Senior Exemption is an additional property tax benefit available to home owners who meet the following criteria: The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1.

How do you qualify for homestead exemption in Miami Dade?

To qualify for a Homestead Exemption, you must own the property and it must be your permanent residence "to the exclusion of all others" as of January 1st of the year you are seeking the homestead exemption. Once you receive the Homestead Exemption, you do not have to re-apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my FL Tangible Personal Property Tax Return in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign FL Tangible Personal Property Tax Return and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete FL Tangible Personal Property Tax Return online?

With pdfFiller, you may easily complete and sign FL Tangible Personal Property Tax Return online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit FL Tangible Personal Property Tax Return on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing FL Tangible Personal Property Tax Return, you can start right away.

What is dade property appraiser?

The Dade Property Appraiser is the government official responsible for determining the value of properties for tax purposes in Dade County.

Who is required to file dade property appraiser?

Property owners in Dade County are required to file the property appraiser.

How to fill out dade property appraiser?

The Dade Property Appraiser form can typically be filled out online or submitted in person at the county office. Property owners must provide information about the property's value and ownership.

What is the purpose of dade property appraiser?

The purpose of the Dade Property Appraiser is to assess the value of properties accurately for tax purposes, so that property taxes can be calculated fairly.

What information must be reported on dade property appraiser?

Property owners must report information such as property value, ownership details, and any improvements made to the property.

Fill out your FL Tangible Personal Property Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Tangible Personal Property Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.