Get the free Acquisition of S Corporation (Stock Purchase Agreement) -- Seller is Sole Owner of a...

Show details

An S corporation combines the limited liability of a corporation and the "pass-through" tax-treatment of a partnership. It is a business structure suited to small business owners who want the continuity

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is acquisition of s corporation

The acquisition of an S Corporation involves the process of purchasing or gaining control over a business entity that has elected S Corporation status under the IRS.

pdfFiller scores top ratings on review platforms

Best docs tool ever

Best customer service ever, very prompt response with 24hrs manned online support, this tool is the best and very convenient to use. Had an issue with my account so they did refund money i paid for the premium subscription in less than an hour.

This program is great for me filling…

This program is great for me filling out my paperwork on a weekly basis. It's easy to use and quick to learn how everything works. Will be continuing use for a LONG time!

I love the discount

It's so easy to use.

Good editing capabilities (particularly…

Good editing capabilities (particularly with additional features like signing).Customer support were very prompt with their response and actions.

short but quick learning curve for…

short but quick learning curve for site navigation, but got the hang of it , thanks, leon

Who needs acquisition of s corporation?

Explore how professionals across industries use pdfFiller.

Acquisition of S Corporation Form Guide

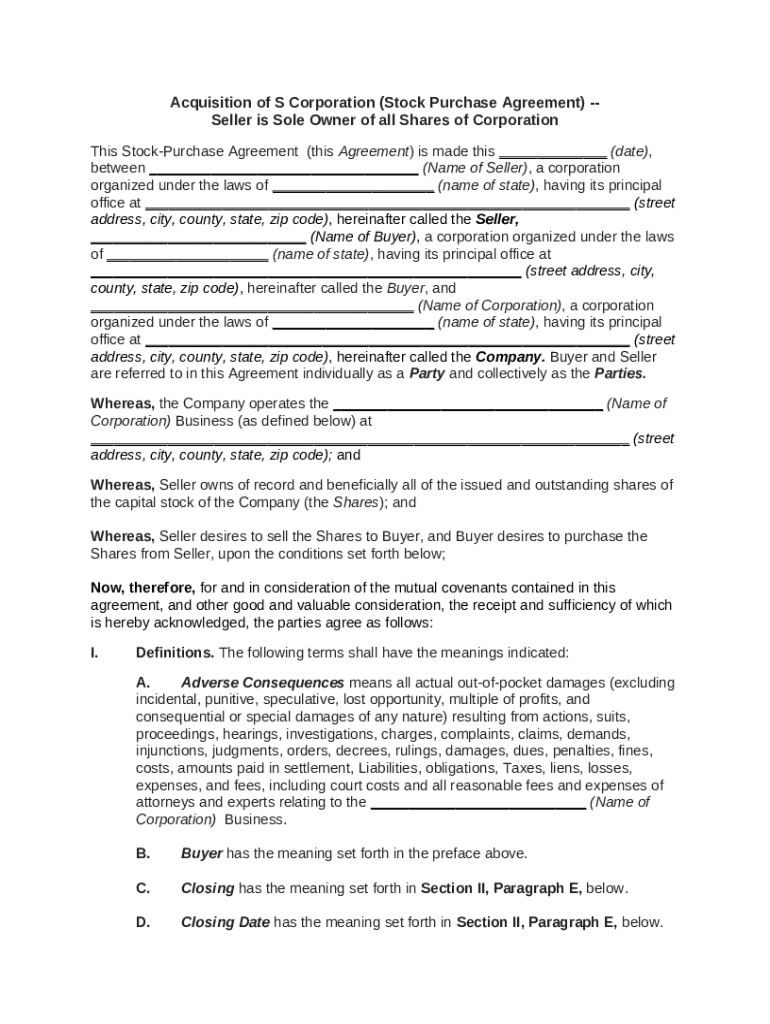

How do you define the acquisition of an S corporation?

An S Corporation is a special type of corporation that meets specific Internal Revenue Code requirements, enabling its income to be passed through to shareholders to avoid double taxation. When acquiring an S Corporation, buyers must understand the unique attributes that differentiate such a corporation from regular C Corporations.

-

Acquiring an S Corporation offers tax benefits, as it allows profits to be taxed at the shareholder level rather than at the corporate level.

-

It’s essential to analyze the target corporation's existing tax status, liabilities, and compliance with IRS regulations to avoid future complications.

What is the overview of the acquisition process?

The acquisition process of an S Corporation encompasses several critical steps designed to ensure a successful transaction. It starts from identifying the target to the final transfer of ownership.

-

Begin with thorough market research, followed by due diligence to assess the financial and operational health of the company.

-

Key documents include the Stock Purchase Agreement, financial statements, and relevant tax documents.

-

Typically, the process spans several months, varying with the complexity of negotiations and regulatory approvals.

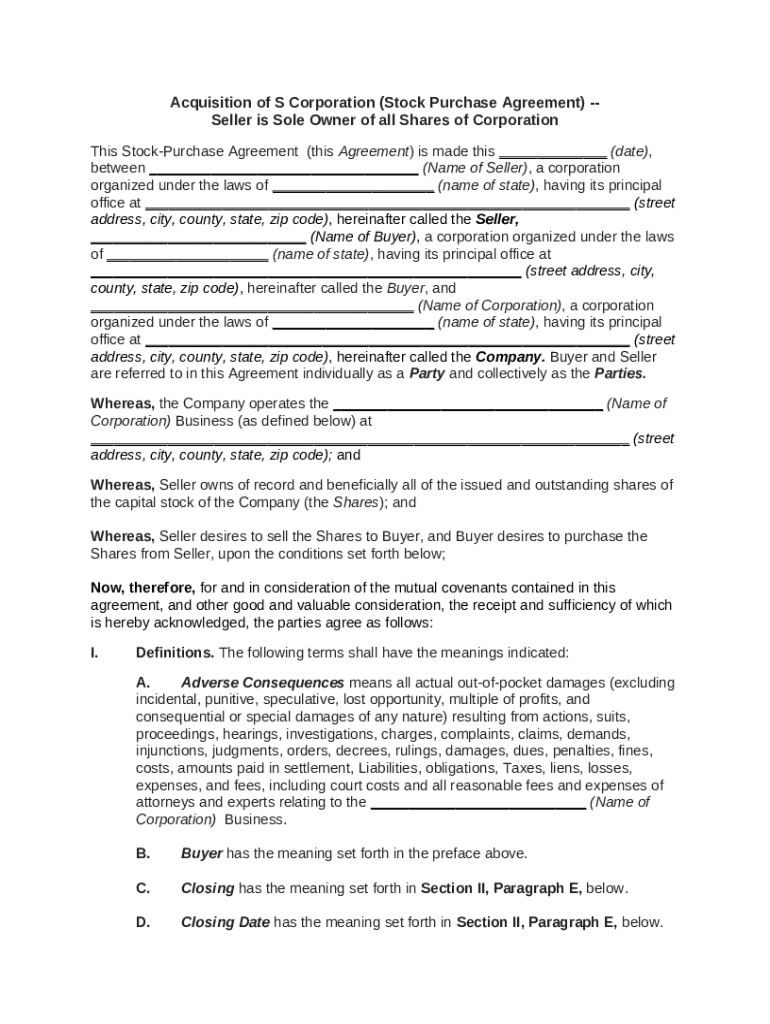

What are the key terms of the Stock Purchase Agreement?

In any acquisition, particularly for S Corporations, the Stock Purchase Agreement (SPA) is crucial. It outlines the terms and conditions under which the purchase will occur.

-

Essential elements include purchase price, payment method, liabilities assumed, and representations by the seller.

-

Typical sections might include 'Purchase Price,' 'Closing Conditions,' and 'Indemnification' clauses.

-

Customize your SPA to reflect the unique aspects of your specific transaction, ensuring clarity and mutual agreement.

-

Both parties must clearly understand their rights, duties, and what happens in the event of a dispute.

How can interactive tools aid in form preparation?

Utilizing interactive tools for document preparation can streamline the process, especially for complex forms like the acquisition of S corporation form.

-

pdfFiller allows for seamless editing, signing, and sharing of documents, enhancing collaboration and reducing errors.

-

Templates can be pre-filled with relevant information, making it easier to create customized agreements quickly.

-

A cloud-based system ensures that all documents are easily accessible, secure, and can be shared with stakeholders in real time.

What are the compliance and legal considerations?

Compliance with legal requirements is crucial for any acquisition, particularly for S Corporations, which are subject to specific IRS regulations.

-

Ensure all documentation adheres to IRS standards to maintain the S Corporation status post-acquisition.

-

Variances in local laws may impose additional checks and registrations to finalize the acquisition.

-

Keep up with the necessary IRS updates and state filings to remain compliant with all legal requirements.

How to mitigate risks during acquisition?

Risk mitigation is a fundamental component of acquiring an S Corporation as potential pitfalls can seriously impact your investment.

-

Common risks include undisclosed liabilities, non-compliance issues, and changes in shareholder agreements.

-

Conduct a comprehensive financial review, including cash flow statements, to ensure accurate valuation.

-

Engaging in thorough due diligence ensures you uncover all pertinent information regarding the target S Corporation.

What are the steps for post-acquisition management?

Post-acquisition management is equally essential as it ensures that all transactions and integrations proceed smoothly.

-

Establish a clear system for managing documentation to comply with new corporate and IRS regulations.

-

Utilizing platforms like pdfFiller enables teams to collaborate securely on sensitive post-acquisition documents.

-

Implement workflows that streamline document management as the corporation transitions post-acquisition.

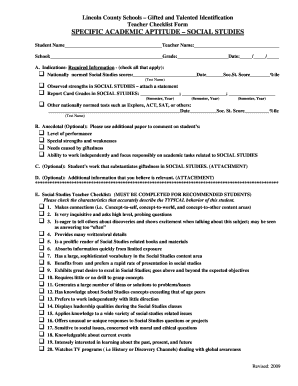

How to fill out the acquisition of s corporation

-

1.Open pdfFiller and upload the acquisition of S Corporation form.

-

2.Review the form for any pre-filled information relevant to your acquisition.

-

3.Begin by entering the name and address of the S Corporation being acquired in the designated fields.

-

4.Fill out the acquisition details, including the purchase price and terms of the agreement.

-

5.Provide information about the acquiring entity, including its name and structure.

-

6.Include any necessary attachments or supporting documents required for the acquisition process.

-

7.Double-check all entered information for accuracy and completeness before submission.

-

8.Finally, save the completed form and submit it as directed, either electronically or by mail.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.