Get the free Real Estate Joint Venture Agreement template

Show details

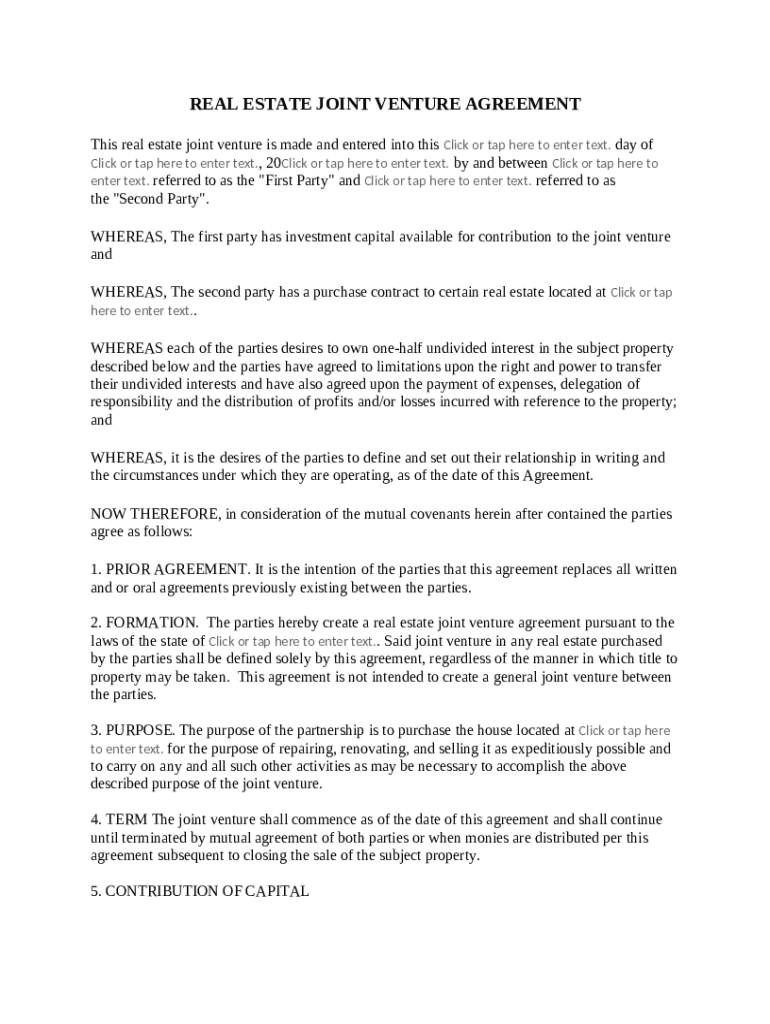

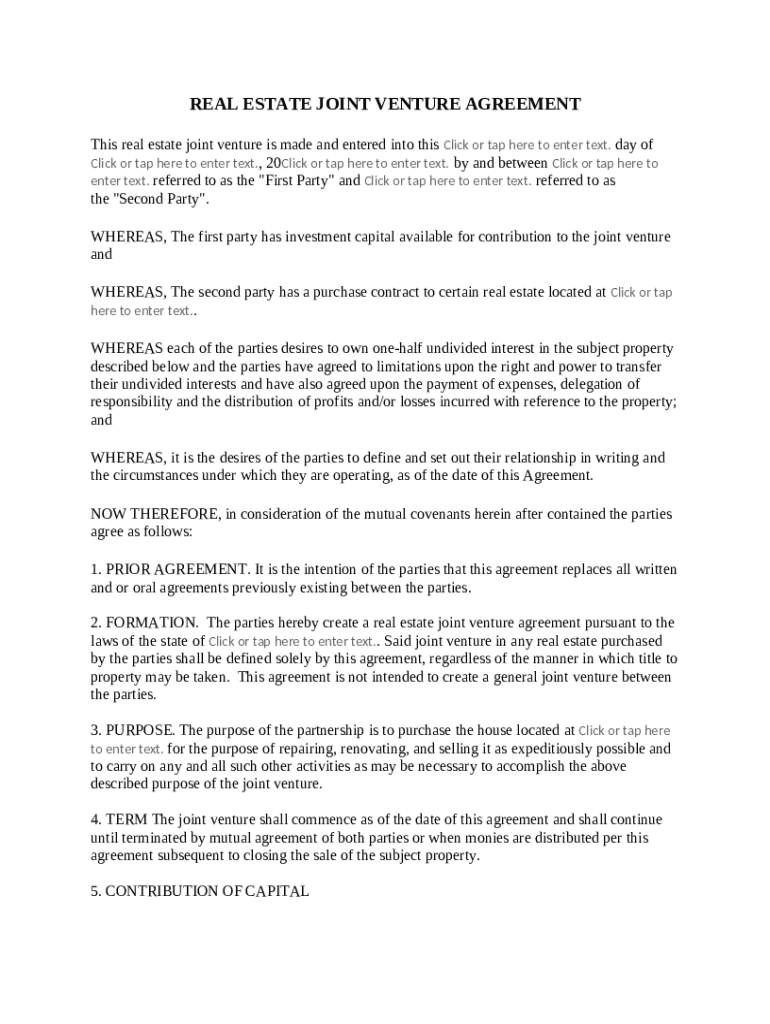

This is a sample Real Estate Joint Venture Agreement. A real estate joint venture (JV) is a deal between multiple parties to work together and combine resources to develop a real estate project. The

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is real estate joint venture

A real estate joint venture is a partnership between two or more parties to invest in, develop, or manage real estate properties.

pdfFiller scores top ratings on review platforms

Haven't been able to add a blank page to the 3 page form I was working. The instructional video indicated I should see a "Pages" icon on the Edit line. I didn't.

Has been a very good experience. Easy to use.

Simple, easy to use, easy to manipulate,

even for a novice.

It was my first time uploading forms. It was pretty easy. I think the more I use it the better.

I have tried many different PDF fillable forms... this one, BY FAR, is the easiest to use and I LOVE IT!

Very user friendly and looks like a very good lease form

Who needs real estate joint venture?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Real Estate Joint Venture Form on pdfFiller

How does understanding real estate joint ventures help?

Real estate joint ventures are crucial for pooling resources, expertise, and risk management among multiple parties. By understanding their definition and importance, stakeholders can make informed decisions about collaboration in property investments.

-

Real estate joint ventures involve two or more parties joining together to invest in property. This collaboration can lead to larger and more ambitious projects than any individual could undertake alone.

-

The benefits include shared risks, access to diverse resources, and enhanced market positioning. This helps partners leverage each other’s strengths for optimal project outcomes.

-

Common types of joint ventures in real estate include development partnerships, equity partnerships, and long-term rental agreements, each serving unique purposes within investment strategies.

What are the key components of a real estate joint venture agreement?

A real estate joint venture agreement outlines the responsibilities, contributions, and expectations of each party involved. Clarity on these components is vital for preventing disputes during the project.

-

It's crucial to specify each partner in the agreement using First Party and Second Party fields to avoid confusion regarding responsibilities.

-

Each party's contributions, including capital investment and property contracts, must be detailed to ensure transparency and accountability in the partnership.

-

The agreement should define each partner's undivided interests and any limitations on transfer rights, which helps protect partners and their investments.

What essential clauses should be included in the agreement?

Incorporating certain clauses in the joint venture agreement ensures that all parties are aligned with the project's goals and processes. These clauses help manage future conflicts and operational efficiency.

-

This clause outlines how the new agreement supersedes any prior agreements, clarifying the current expectations among partners.

-

Defining the joint venture under state law ensures that the entity complies with local regulations, protecting all parties involved.

-

Clearly laying out each partner's payment obligations and profit distribution systems is crucial for a smooth running of the partnership.

How to fill out the real estate joint venture form?

Filling out the real estate joint venture form on pdfFiller is an easy process, guided by clear steps and interactive tools. Leveraging these features can significantly streamline your document management.

-

Follow the sequential steps provided on pdfFiller to fill out your form accurately, ensuring all necessary information is included.

-

Make use of pdfFiller's editing and signing tools to customize your joint venture form according to your partnership’s needs.

-

Utilize collaborative functionalities to enable multiple stakeholders to contribute to and approve the joint venture document, thereby enhancing engagement.

What are the common assumptions for partnerships?

Partnering in a real estate joint venture often comes with assumptions that can impact the partnership's direction and finance. Understanding these aspects can lead to better strategic alignment.

-

Partners often assume they will share expenses equally, which is not always the case. It’s vital to outline how funding will be secured and managed.

-

Understanding potential capital calls—requests for additional funds to cover unforeseen expenses—can mitigate misunderstandings among partners.

-

Partners may also have different approaches to financing decisions, leading to conflicts if not clearly defined from the outset.

What legal considerations and compliance factors should you keep in mind?

Each region has specific laws governing real estate partnerships, which can impact the joint venture's setup and operation. Awareness of these regulations aids in maintaining compliance and avoiding legal pitfalls.

-

Each region may have unique laws affecting real estate partnerships, making it essential to consult legal counsel.

-

Compliance with state-specific regulations for joint ventures protects all parties and ensures the legitimacy of the partnership.

-

Understanding potential legal pitfalls and how to mitigate them is crucial for safeguarding your investments and interests.

How to manage your real estate joint venture post-formation?

Effective management post-formation ensures the success of a real estate joint venture. Implementing best practices for communication and performance evaluation fosters a healthy partnership.

-

Regular updates and communications among parties enhance transparency and help in addressing issues swiftly.

-

Establishing solid strategies for managing financial outcomes and distributions prevents conflicts and promotes satisfaction.

-

Regular evaluating of the joint venture's performance enables partners to make informed adjustments and optimize outcomes.

How to fill out the real estate joint venture

-

1.1. Begin by gathering all necessary information about the parties involved, including names, addresses, and roles in the joint venture.

-

2.2. Open the real estate joint venture form on pdfFiller and select the option to fill out the document.

-

3.3. Start with section one, which typically requires the details of the property being developed or invested in, including address, parcel number, and current ownership status.

-

4.4. Proceed to enter the contributions of each party. Specify the type and amount of capital, property, or other resources each partner is bringing to the venture.

-

5.5. Review the profit-sharing agreements, detailing how profits and losses will be distributed among the partners.

-

6.6. Fill out sections regarding management responsibilities, decision-making processes, and any exit strategies that have been agreed upon.

-

7.7. Once all information is entered, review the completed document for accuracy and completeness.

-

8.8. Save the document to your account and print it for signatures.

-

9.9. Ensure that all parties sign the venture agreement to make it legally binding before proceeding with operations.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.