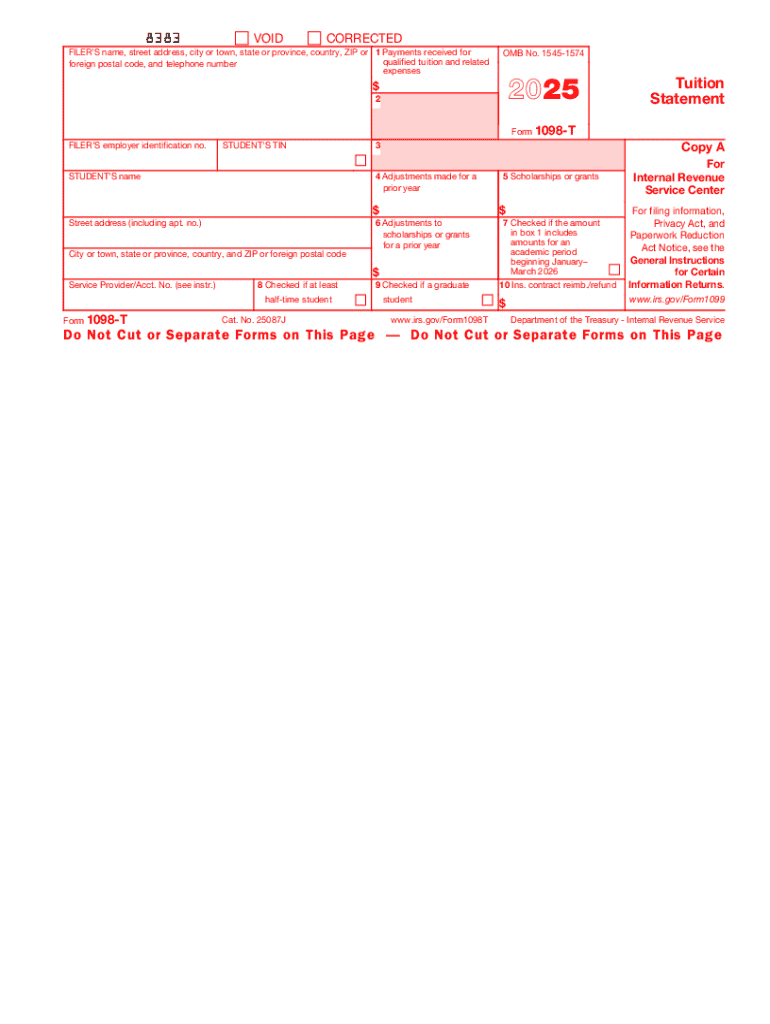

IRS 1098-T 2025-2026 free printable template

Instructions and Help about IRS 1098-T

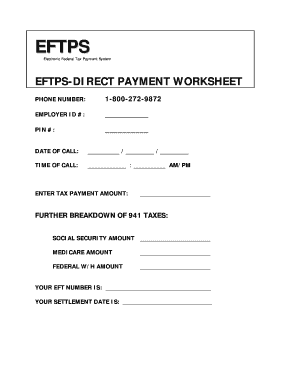

How to edit IRS 1098-T

How to fill out IRS 1098-T

Latest updates to IRS 1098-T

All You Need to Know About IRS 1098-T

What is IRS 1098-T?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1098-T

What should I do if I need to amend an IRS 1098-T after filing?

To amend your IRS 1098-T, you must file a corrected form indicating the changes. It's essential to ensure that you highlight the adjustments clearly. Additionally, keep records of any documentation that supports the corrections for your tax records.

How can I verify if my IRS 1098-T has been received by the IRS?

You can verify the status of your IRS 1098-T by using the IRS online tools or contacting their customer service. Ensure you have your details handy to confirm the receipt of your submission, especially if you filed electronically.

What privacy measures should I consider when filing IRS 1098-T?

When filing IRS 1098-T, ensure that you are using secure methods, such as encrypted software, to protect sensitive data. It's also advisable to limit access to your filing records to safeguard against unauthorized use of your personal information.

What common errors should I avoid when submitting my IRS 1098-T?

Common errors include mismatched social security numbers, incorrect amounts, and missing signatures. Double-check all entries for accuracy before submission to minimize the risk of rejection or the need for amendments.

How do I ensure my IRS 1098-T e-filing is compatible with my software?

Check your e-filing software for compatibility with IRS guidelines and requirements for the IRS 1098-T. Keeping your software updated will help prevent issues and ensure you can file smoothly without technical difficulties.

See what our users say