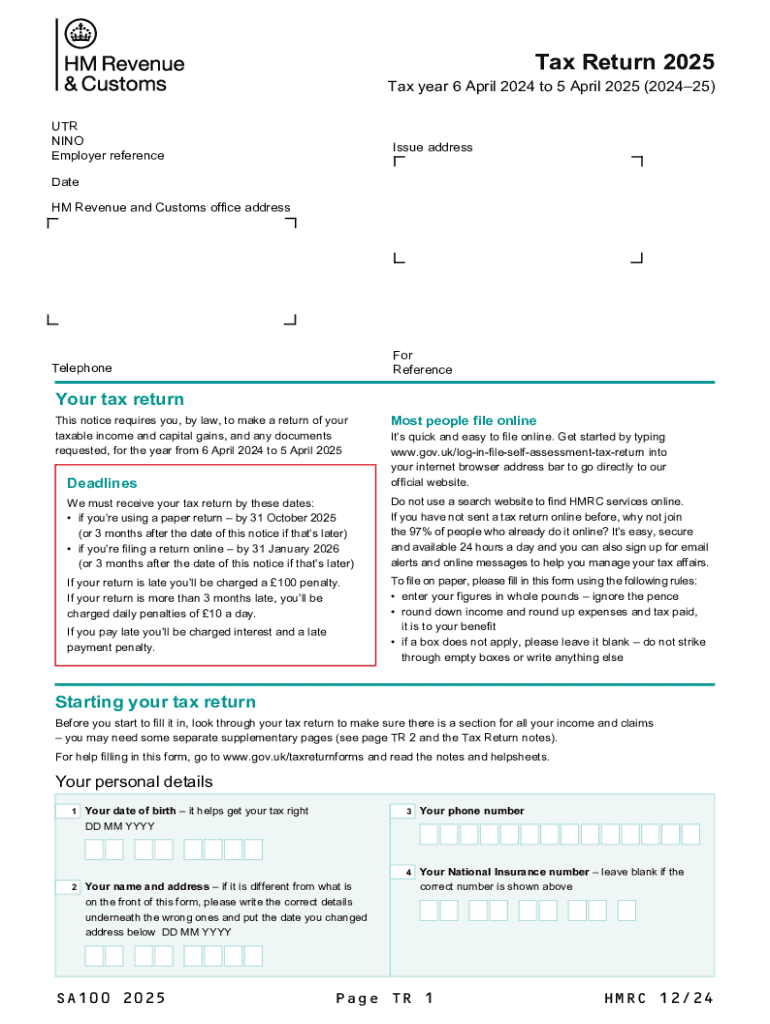

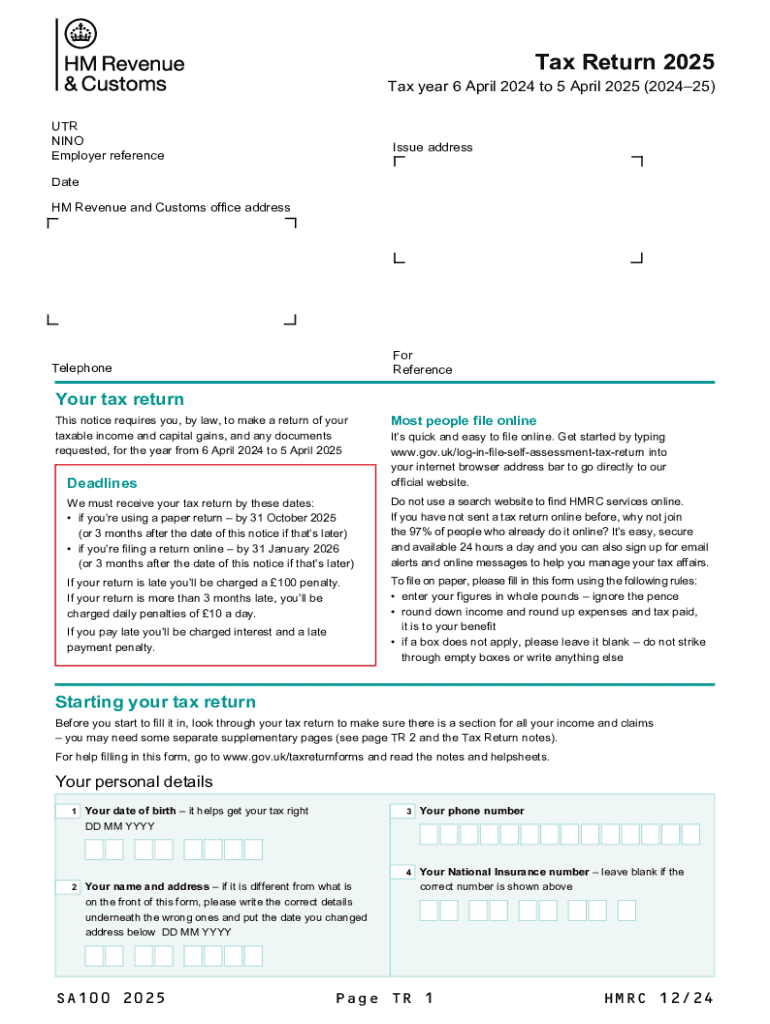

UK Form SA100 2025-2026 free printable template

Show details

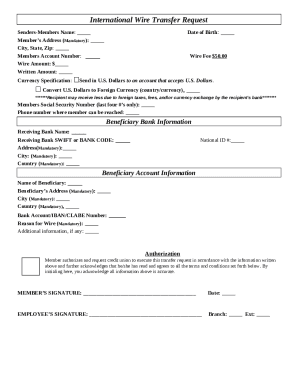

This document is intended for individuals to report their taxable income and capital gains to HM Revenue and Customs for the tax year from 6 April 2024 to 5 April 2025. It includes guidelines on how

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Form SA100

Edit your UK Form SA100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Form SA100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK Form SA100 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK Form SA100. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Form SA100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Form SA100

How to fill out sa100 2025

01

Gather all necessary documents, including previous tax returns, income statements, and any other relevant financial information.

02

Obtain the SA100 form for the tax year 2025 from the HMRC website or through your accountant.

03

Fill out your personal details in the relevant sections such as your name, address, and National Insurance number.

04

Report your income from all sources including employment, self-employment, dividends, and any other income.

05

Complete the additional sections depending on your financial situation, such as expenses for self-employment or property income.

06

Claim any allowable deductions, reliefs, or tax credits that you are eligible for.

07

Review all entries for accuracy and completeness.

08

Submit the form by the deadline, either online through the HMRC portal or by sending a paper form.

Who needs sa100 2025?

01

Individuals who are self-employed and need to report their income and pay tax on it.

02

People earning rental income from properties.

03

Those with income that is not automatically taxed through PAYE (Pay As You Earn) and need to declare it.

04

Individuals who have certain types of income, such as dividends or savings interest, that exceed the tax-free allowance.

Fill

form

: Try Risk Free

People Also Ask about

What is self employment form called?

More In Forms and Instructions Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

How do I know which tax form to use?

Key Takeaways. Form 1040 is the standard tax return form that most individual taxpayers use every year. The IRS no longer accepts Forms 1040-EZ or Form 1040-A for tax years 2018 and beyond, which means most taxpayers must use Form 1040 to complete their tax returns.

Which tax form do I use?

Form 1040 is the standard tax return form that most individual taxpayers use every year.

How do I get a copy of my full tax return?

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Should I use 1040 or 1040EZ?

You can use the 1040 to report all types of income, deductions, and credits. You may have received a Form 1040A or 1040EZ in the mail because of the return you filed last year. If your situation has changed this year, it may be to your advantage to file a Form 1040 instead.

What is the SA100?

The SA100 is the main tax return for individuals. Use it to file your tax return for: student loan repayments. interest and dividends. UK pensions and annuities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in UK Form SA100 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing UK Form SA100 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit UK Form SA100 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing UK Form SA100 right away.

How do I fill out the UK Form SA100 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign UK Form SA100 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is sa100?

SA100 is the annual Self Assessment tax return form used by individuals in the UK to report their income, gains, and tax liabilities to HM Revenue and Customs (HMRC).

Who is required to file sa100?

Individuals who are self-employed, have income from rental properties, investments, or need to report other income not taxed at source are required to file SA100.

How to fill out sa100?

To fill out SA100, individuals must complete their personal details, report income, claim any allowances or deductions, and calculate tax owed. It's recommended to use the online service or consult guidance provided by HMRC.

What is the purpose of sa100?

The purpose of SA100 is to provide HMRC with a comprehensive overview of an individual's income and expenses, allowing for the correct determination of tax liability.

What information must be reported on sa100?

SA100 requires individuals to report information such as total income from all sources, taxable income, allowable expenses, capital gains, and any tax reliefs claimed.

Fill out your UK Form SA100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Form sa100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.