Get the free CORPORATE ACCOUNTING - I

Show details

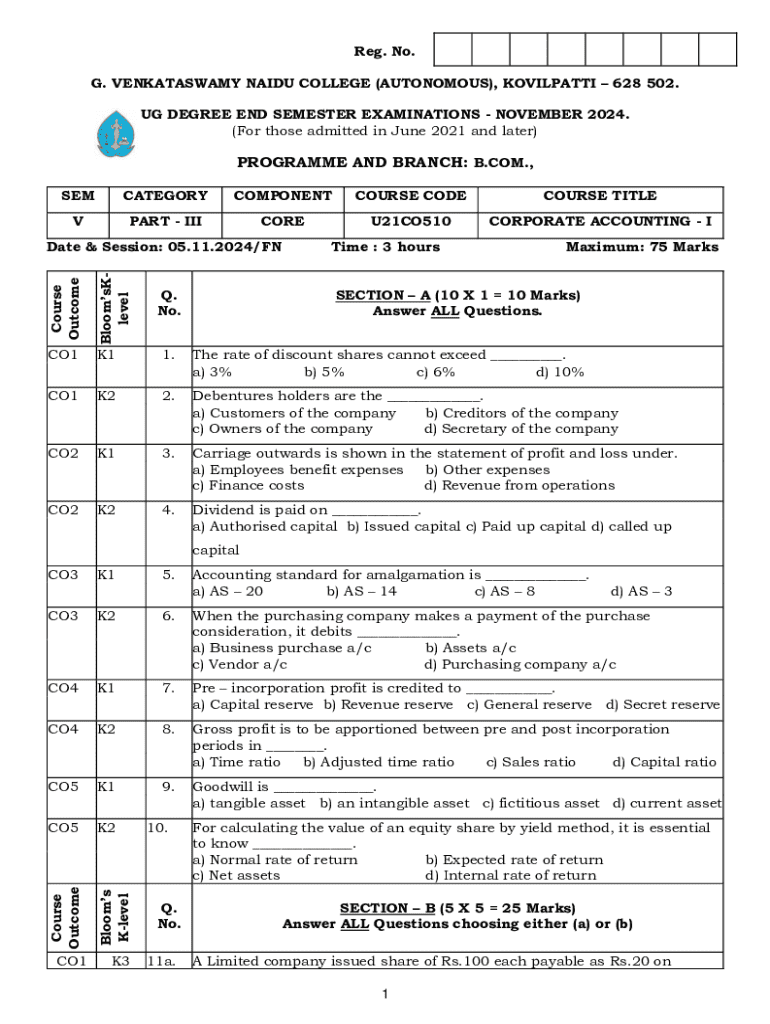

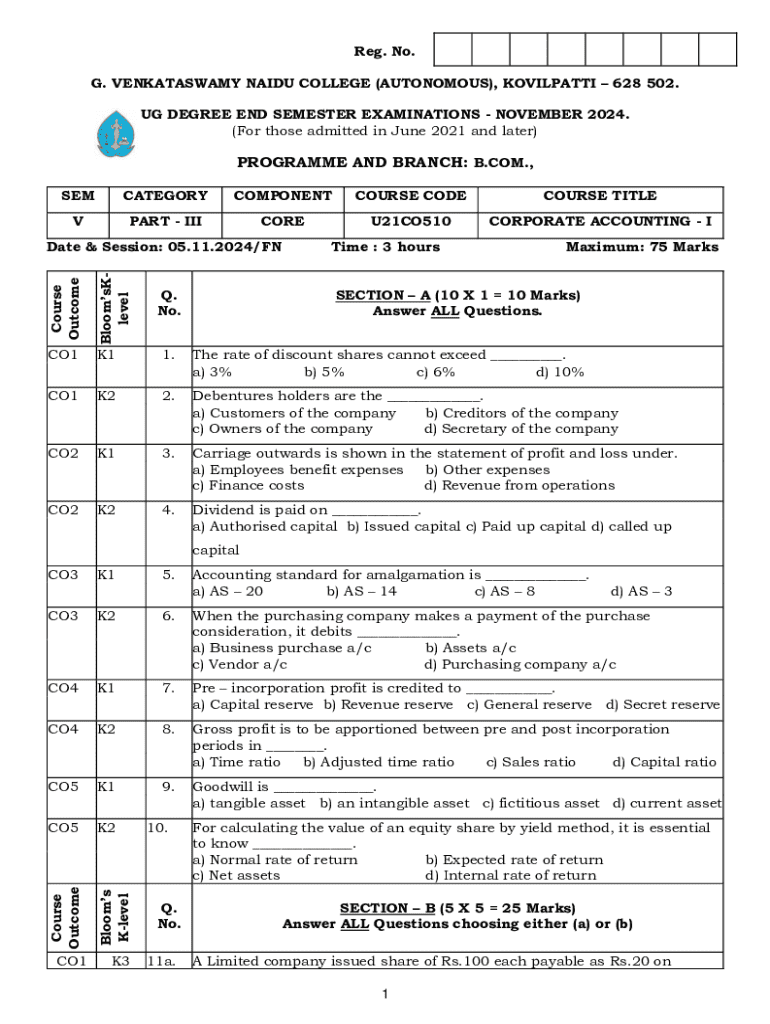

Reg. No. G. VENKATASWAMY NAIDU COLLEGE (AUTONOMOUS), KOVILPATTI 628 502. UG DEGREE END SEMESTER EXAMINATIONS NOVEMBER 2024. (For those admitted in June 2021 and later)PROGRAMME AND BRANCH: B.COM.,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate accounting - i

Edit your corporate accounting - i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate accounting - i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate accounting - i online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate accounting - i. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate accounting - i

How to fill out corporate accounting - i

01

Gather all financial documents such as invoices, receipts, and bank statements.

02

Organize the documents by category (e.g., revenue, expenses, assets, liabilities).

03

Choose an accounting method (cash or accrual) that suits your business needs.

04

Set up a chart of accounts to categorize financial transactions.

05

Record all transactions in the accounting software or ledger regularly.

06

Reconcile bank statements with your records to ensure accuracy.

07

Prepare financial statements such as income statements, balance sheets, and cash flow statements.

08

Review and analyze financial data for decision making and compliance.

09

Ensure compliance with accounting standards and tax regulations.

Who needs corporate accounting - i?

01

Businesses of all sizes to manage finances effectively.

02

Corporations to ensure accurate reporting and compliance.

03

Investors seeking insights into a company's financial health.

04

Lenders assessing the creditworthiness of a business.

05

Regulatory bodies requiring financial transparency.

06

Accountants and financial professionals for operational and strategic planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate accounting - i to be eSigned by others?

Once your corporate accounting - i is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit corporate accounting - i in Chrome?

corporate accounting - i can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit corporate accounting - i straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit corporate accounting - i.

What is corporate accounting - i?

Corporate accounting is the process of recording, summarizing, and reporting the financial transactions of a corporation. It involves preparing financial statements, managing accounts, and ensuring compliance with regulatory requirements.

Who is required to file corporate accounting - i?

Corporations, including publicly traded companies and private businesses, are required to file corporate accounting. This includes entities that have legal recognition as corporations and must adhere to specific accounting standards.

How to fill out corporate accounting - i?

To fill out corporate accounting, gather all financial documents, record transactions in journals, post to ledgers, prepare financial statements (such as balance sheets, income statements), and ensure all entries comply with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

What is the purpose of corporate accounting - i?

The purpose of corporate accounting is to provide a clear and accurate picture of a corporation's financial health. It aids in decision-making, ensures regulatory compliance, and facilitates financial reporting to shareholders and stakeholders.

What information must be reported on corporate accounting - i?

Corporate accounting must report information such as revenues, expenses, assets, liabilities, equity, cash flows, and any other relevant financial data that reflects the corporation's financial condition and performance.

Fill out your corporate accounting - i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Accounting - I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.