Get the free California Schedule P (100w)

Get, Create, Make and Sign california schedule p 100w

Editing california schedule p 100w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california schedule p 100w

How to fill out california schedule p 100w

Who needs california schedule p 100w?

A Comprehensive Guide to California Schedule P (100W) Form

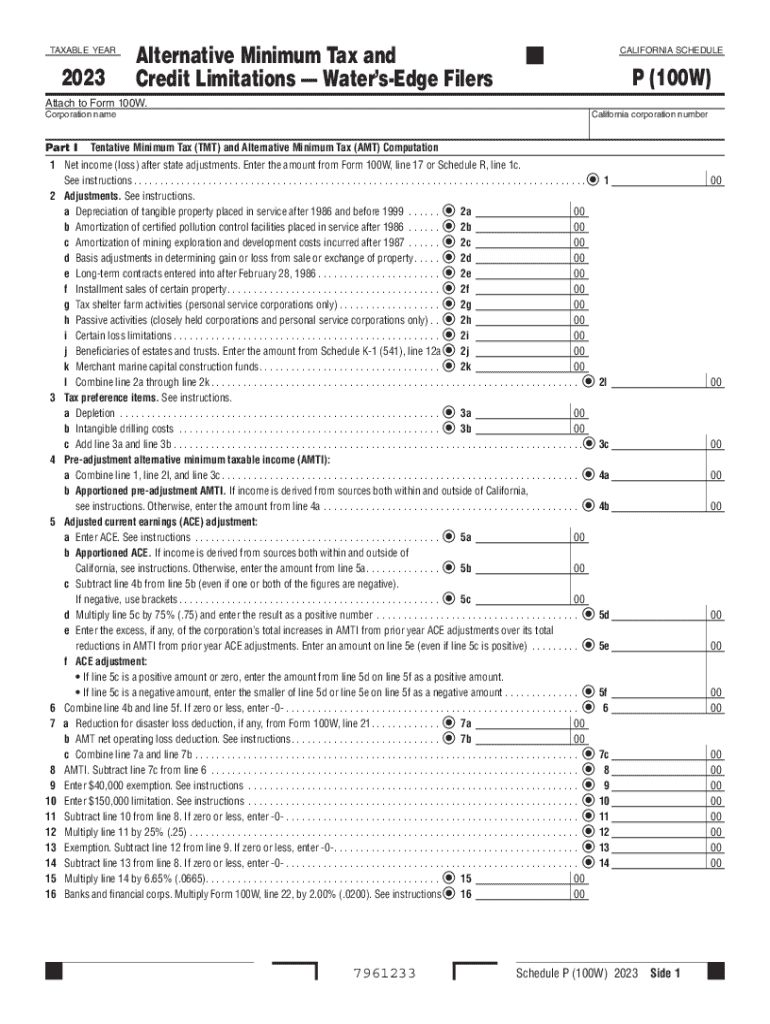

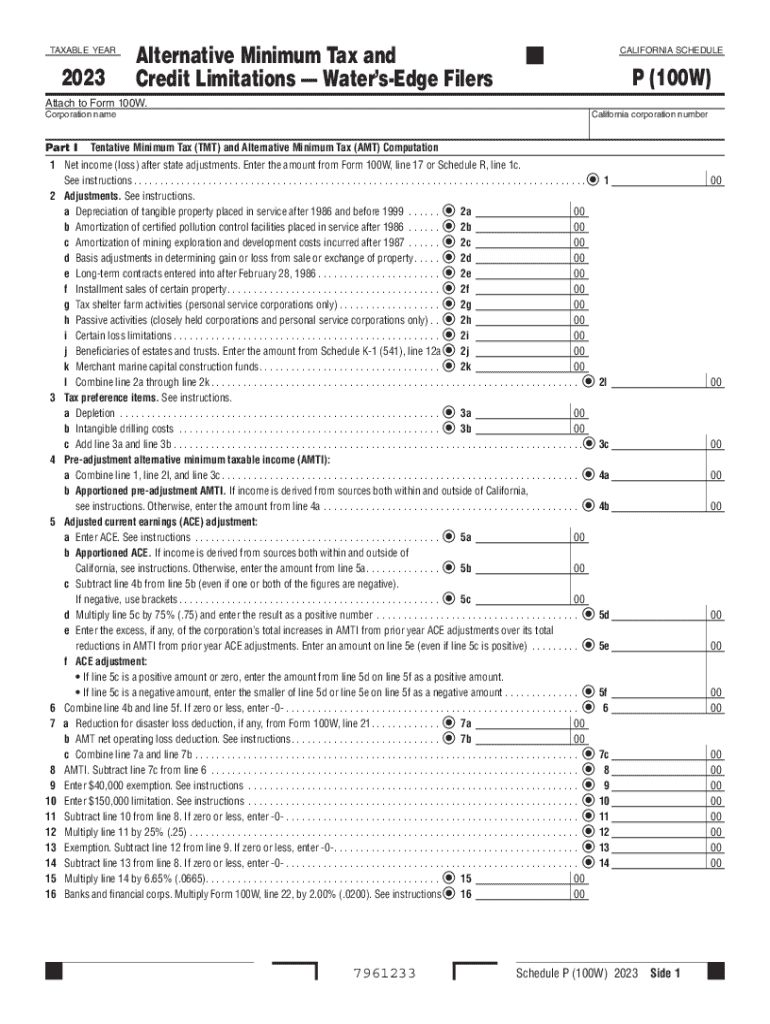

Overview of California Schedule P (100W)

The California Schedule P (100W) form is a crucial document used by corporations that are Water's-Edge filers in California. This form allows taxpayers to report their Alternative Minimum Tax (AMT) and determine the tax credits applicable to their situation. Understanding the purpose of Schedule P (100W) is important for compliance with state tax laws and to minimize tax liabilities.

The significance of this form extends beyond mere compliance; it offers California taxpayers an opportunity to utilize potential credits that could significantly lower their tax burdens. Key features such as the data needed to compute the Tentative Minimum Tax (TMT) and limitations on credits help taxpayers navigate the complexities of alternative minimum taxation efficiently.

Who must file Schedule P (100W)?

Not every taxpayer needs to file the California Schedule P (100W). The eligibility criteria primarily include corporations that are classified as Water’s-Edge filers, which refers to those corporations that are doing business in California but have non-California sourced income as well. Understanding the specific circumstances under which Schedule P needs to be filed is essential to avoid unnecessary penalties.

Filing Schedule P correctly hinges on distinct situations, including mergers, acquisitions, or specific tax situations that involve both affiliated and non-affiliated entities. Companies must understand these classifications as they relate to filing requirements to ensure compliance and accuracy.

Understanding the structure of Schedule P (100W)

The structure of Schedule P (100W) is divided into three main parts, each designed to provide clarity in filing and compliance. Part I focuses on the Tentative Minimum Tax (TMT) and the computation of AMT, while Parts II and III deal with various credits that can potentially reduce tax liability.

Detailed line instructions for completing Schedule P (100W)

Each line on the Schedule P (100W) requires precise information to ensure correct tax filing. Starting from Line 1, where net income or loss after state adjustments must be reported, to Line 19, which concludes with the calculation of the AMT, every line has specific instructions.

Walker through the remaining lines includes more complex items, where accuracy is paramount. Common mistakes often arise in areas like depreciation calculations and adjustment entries, signifying the importance of cross-referencing with supporting documentation.

Calculating adjusted current earnings (ACE)

Adjusted Current Earnings (ACE) play a pivotal role in the process of calculating AMT liability. An accurate ACE calculation influences the tentative minimum tax equation directly. Corporations should assess all relevant income and adjustments that could alter the ACE figure.

Examples of situations affecting ACE can include modifications for accelerated depreciation or adjustments for foreign income. Thus, it's essential to monitor these changes closely to ensure an accurate reporting process.

Credits that impact Schedule P (100W)

Many credits within the California tax system directly impact the Schedule P (100W). These credits can not only reduce excess regular tax but also reduce AMTs. Familiarizing oneself with the specific credits and their applications can lead to significant tax savings.

Common mistakes to avoid

When filing California Schedule P (100W), common errors can lead to delays, underreporting, or facing penalties. Accurate entry of figures, especially in the computation of AMT and credits, is crucial. Reviewing the entire form for consistency and accuracy is an essential step in the process.

Establishing a checklist to confirm completeness and correctness of the filing helps in mitigating these risks, thereby ensuring compliance and optimizing potential tax benefits.

Frequently asked questions (FAQs)

Many concerns arise surrounding the California Schedule P (100W), often regarding specific circumstances that may require tailored strategies. Common queries include how to amend a previous filing, handle extensions, or navigate unique tax situations. Understanding these frequently asked questions can provide clarity and ensure compliance.

Contextual resources

Several resources are available to aid taxpayers in understanding the Schedule P (100W). California’s tax agency provides official forms and guidance. Moreover, various online platforms, including pdfFiller, can assist in document creation and management to streamline the filing process. Engaging with these resources ensures taxpayers are well-equipped to handle their tax obligations.

Interactive tools

pdfFiller offers interactive tools to assist users in completing the California Schedule P (100W). These tools provide straightforward editting, signing, and filing options from anywhere, ensuring ease of access and management of documents. With user-friendly interfaces, taxpayers can navigate the complexities associated with tax forms efficiently.

Conclusion of key points

The California Schedule P (100W) form serves as an essential tool in managing corporate tax liabilities effectively. A thorough understanding of its structure, vital line instructions, and applicable credits is crucial for compliance and optimizing tax outcomes. Utilizing platforms like pdfFiller not only enhances the ease of document management but also supports taxpayers in navigating the complexities of the tax system seamlessly.

Therefore, organizations and individuals alike are encouraged to leverage the insights and tools available, making the filing process as straightforward as possible. Achieving compliance and maximizing potential benefits from the California Schedule P (100W) is achievable with the right resources and knowledge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find california schedule p 100w?

Can I create an eSignature for the california schedule p 100w in Gmail?

How do I fill out california schedule p 100w on an Android device?

What is california schedule p 100w?

Who is required to file california schedule p 100w?

How to fill out california schedule p 100w?

What is the purpose of california schedule p 100w?

What information must be reported on california schedule p 100w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.