Get the free California Schedule R

Get, Create, Make and Sign california schedule r

Editing california schedule r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california schedule r

How to fill out california schedule r

Who needs california schedule r?

California Schedule R Form: A Comprehensive Guide

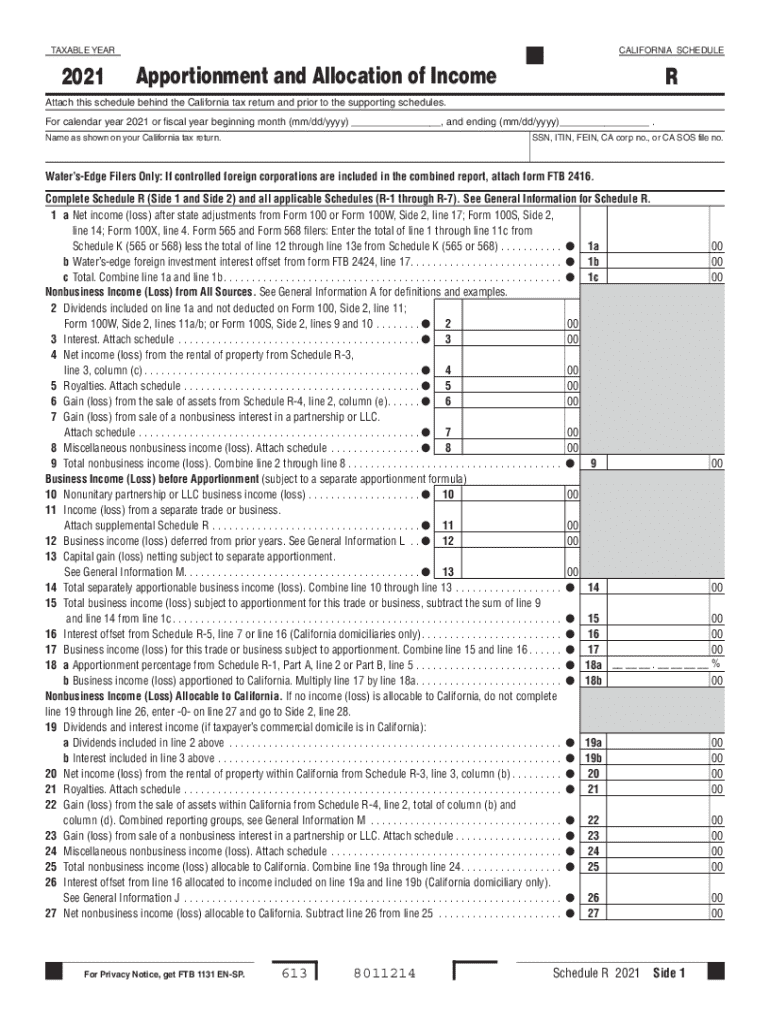

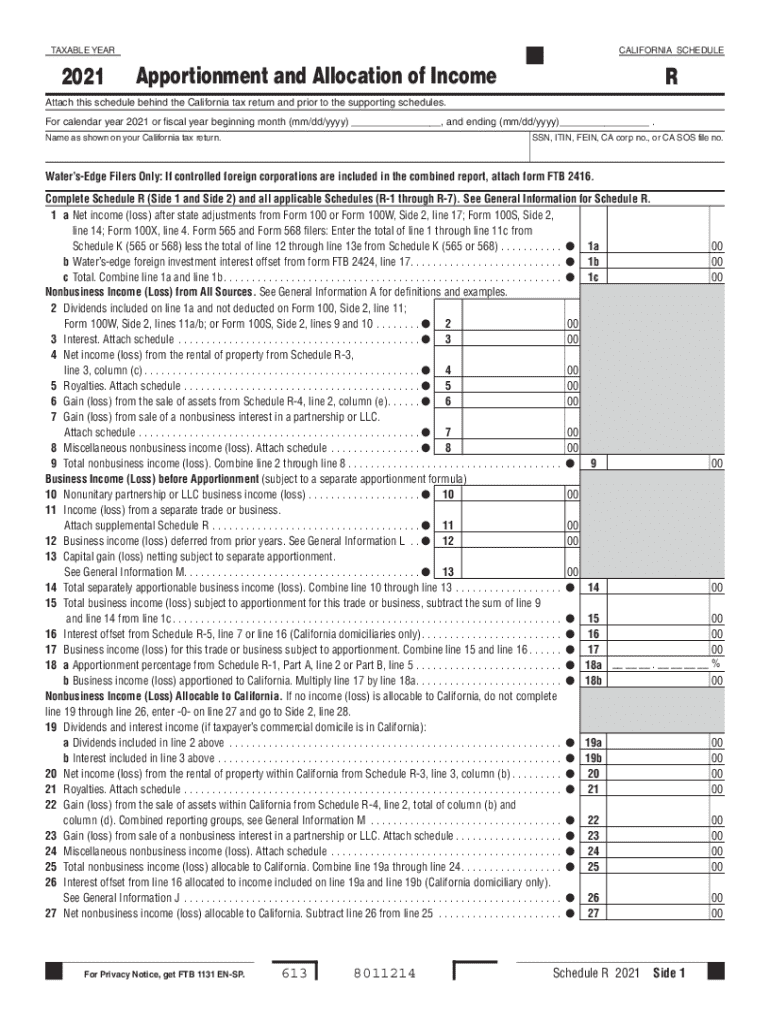

Overview of California Schedule R Form

The California Schedule R form is an essential document used for the apportionment and allocation of income for business entities operating both inside and outside California. This form ensures that profits are appropriately divided among states based on specific factors. Understanding the importance and purpose of the Schedule R is crucial for any taxpayer engaged in multiple jurisdiction business operations.

Understanding apportionment and allocation of income

Apportionment and allocation are fundamental concepts in understanding how businesses report income generated across different states. Apportionment refers to the division of total taxable income among the states in which a business operates, while allocation focuses on the determination of income from specific sources for tax reporting. Practically, this can have significant tax implications depending on how these are handled.

Detailed sections of the Schedule R form

The Schedule R form comprises several sections that require careful consideration. Properly understanding these sections is vital to ensure accurate filing. The form includes general information, specific instructions based on the entity type, and additional considerations for water’s-edge filers.

Factors influencing apportionment

Various factors collectively influence the final apportionment percentage, which directly impacts how much tax is paid in California. Businesses often focus on three primary factors: property, payroll, and sales. Each of these elements contributes to determining the share of taxable income for a business operating in California.

Calculating the apportionment percentage

Calculating the apportionment percentage can be straightforward or complex, depending on the chosen method adopted by the business. There are generally two primary methodologies: the Single-Sales Factor Method and the Traditional Three-Factor Formula. Understanding how to apply these methods correctly is crucial for accurate income tax reporting.

Special considerations in reporting income and loss

When reporting income, businesses must navigate various complexities, especially regarding income or loss from different trades and investments. Distinguishing between ordinary business income and capital gains or losses is vital, as this influences how apportionment is calculated. Recognizing these distinctions can streamline the filing process.

Completing specific line instructions for California Schedule R

Completing the Schedule R may seem overwhelming, but following specific line instructions ensures accuracy. Each line in the form has distinct meanings and requirements that the taxpayer must follow meticulously to guarantee optimal compliance.

Compliance and privacy notices

Maintaining compliance is essential when filing California Schedule R. Taxpayers must be mindful of the Privacy Notice regarding data collection by the Franchise Tax Board. Understanding these notices can help mitigate the risks associated with non-compliance.

Utilizing interactive tools for effective document management

Utilizing efficient document management systems simplifies the prep and filing of California Schedule R. Tools such as pdfFiller offer users seamless solutions for filling out the form, enhancing collaboration while ensuring compliance.

Frequently asked questions (FAQs) about California Schedule R

Understanding common questions regarding the California Schedule R can clarify any confusion before filing. Issues may arise concerning apportionment methods, specific income types, and any changes in state regulations that affect partnerships and corporations.

Resources for further assistance

Accessing reliable resources can further enhance understanding of the California Schedule R form. The Franchise Tax Board is a credible source for updated guidelines, while professional tax assistance can solve specific queries related to income apportionment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my california schedule r directly from Gmail?

Where do I find california schedule r?

How do I execute california schedule r online?

What is california schedule r?

Who is required to file california schedule r?

How to fill out california schedule r?

What is the purpose of california schedule r?

What information must be reported on california schedule r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.