Get the free Calhfa Conventional Program

Get, Create, Make and Sign calhfa conventional program

How to edit calhfa conventional program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calhfa conventional program

How to fill out calhfa conventional program

Who needs calhfa conventional program?

A comprehensive guide to the CalHFA Conventional Program form

Overview of the CalHFA Conventional Program

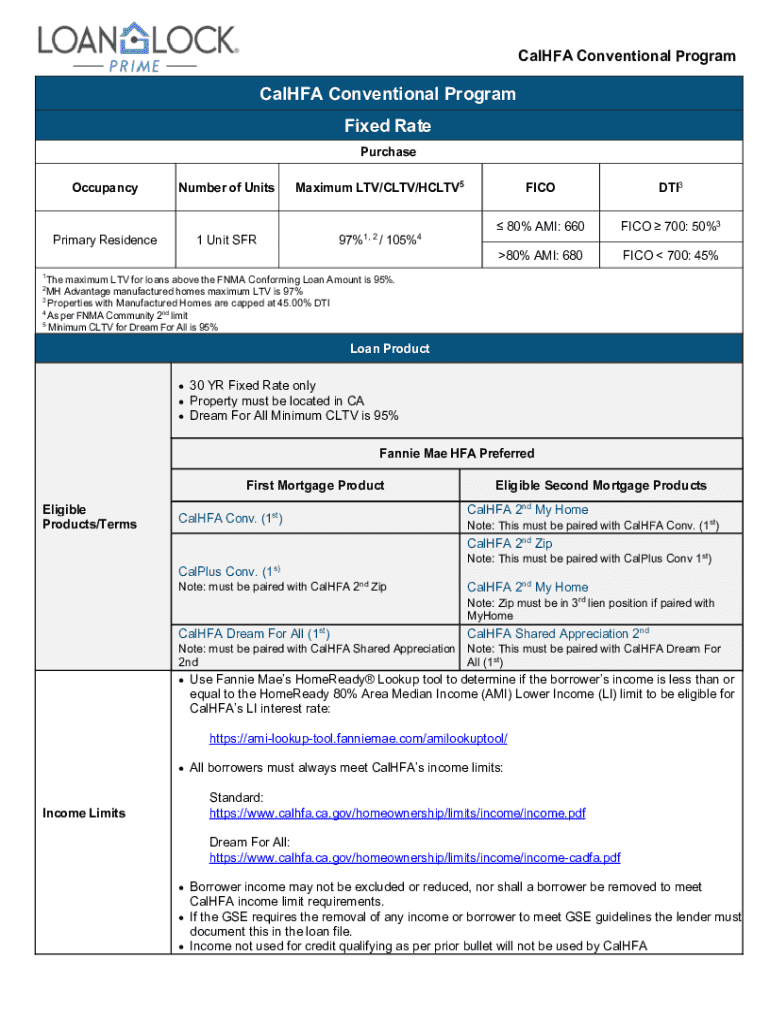

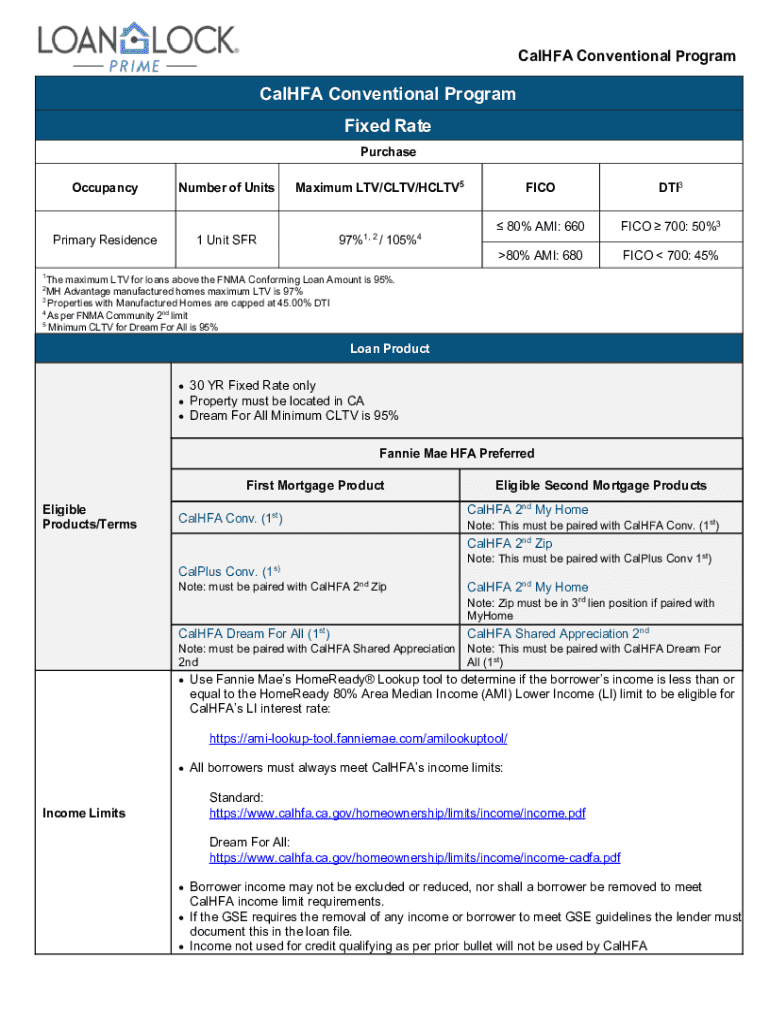

The CalHFA Conventional Program offers an innovative pathway for homebuyers seeking to purchase their first home in California. Focused on empowerment and accessibility, this program provides crucial financial assistance, making homeownership achievable for many individuals and families. The program specifically targets low to moderate-income homebuyers, ultimately fostering community development and support across California.

By offering a competitive solution to traditional lending practices, the CalHFA Conventional Program enables first-time buyers to access funds that may otherwise be out of reach. This initiative plays a crucial role in expanding homeownership opportunities and enriching the lives of those who participate. Ultimately, it is about giving individuals a chance to invest in their futures and build equity in their homes.

Understanding the CalHFA Conventional Program form

The CalHFA Conventional Program form is an essential document that serves as the application basis for interested applicants. It plays a pivotal role by formally capturing the information required for assessment and approval. Understanding this form is crucial for potential applicants as it encompasses key details necessary for eligibility determination and financial assessment.

Completing this form requires careful attention and consideration since it demands various required documents including proof of income, asset declarations, and details regarding the property intended for purchase. By being well-prepared, applicants can streamline the application process, leading to a less stressful experience.

Step-by-step guide to completing the CalHFA Conventional Program form

Filling out the CalHFA Conventional Program form can seem daunting, but with adequate preparation, the process can be straightforward. Before starting, it is essential to gather all necessary documents. This includes your recent tax returns, pay stubs, bank statements, and identification. Having these on hand will facilitate a smoother and quicker completion of the form.

Understanding the various sections of the form is crucial. The primary sections include Personal Information, Employment Details, Financial Information, and Property Information. Each section is significant in assessing your eligibility for the program, so it's vital to provide clear and accurate information.

Accuracy is crucial when completing the form. Ensure that all information is up-to-date and consistent with the documents you gathered. Double-checking your entries can prevent unnecessary delays or rejections in the application process.

Editing and managing your form with pdfFiller

Once you have your CalHFA Conventional Program form, utilizing tools like pdfFiller can make the editing process efficient and effective. This platform offers an array of editing tools that help users navigate through their forms easily, ensuring that corrections and modifications can be made seamlessly.

Whether you need to correct a mistake, add comments, or clarify certain entries, pdfFiller’s features enable hassle-free adjustments. Additionally, collaboration tools allow users to share the form for input from team members or advisors, enhancing the overall accuracy and quality of the submission.

eSigning the CalHFA Conventional Program form

With an increasing reliance on digital solutions, understanding the eSigning process for the CalHFA Conventional Program form is essential. eSigning not only speeds up the submission process but also retains the legal validity that traditional signing methods offer, ensuring compliance with the regulatory standards.

When using pdfFiller, the eSigning process is straightforward. Users can sign the document electronically using various methods including drawing, typing, or uploading a signature image. This way, applicants can finalize their forms without the need for printing or scanning, further simplifying the application process.

Common questions and troubleshooting

As with any process, potential applicants may find themselves with questions or facing challenges while completing the CalHFA Conventional Program form. It's important to have access to a resource that provides clarity on the most frequently asked questions and common issues encountered.

Eligibility questions regarding income limits, credit requirements, and specific details about the home purchase often arise among applicants. Additionally, individuals can experience confusion over certain sections of the form that require further explanation. To clarify these points, it's recommended to consult available resources or contact support when needed.

Finalizing and submitting your form

After completing the CalHFA Conventional Program form, a thorough review is imperative to ensure all your information is accurate and all necessary attachments are included. A checklist can be particularly useful at this stage, confirming that everything aligns with the requirements set forth by the program.

The submission process can be executed via pdfFiller, which provides a streamlined method for sending in your application. Alternatively, applicants may choose to submit through other specified channels by CalHFA. Being aware of submission guidelines will help in preventing any setbacks in your application timeline.

Tracking your application progress

Understanding the timeline associated with the CalHFA Conventional Program application process can alleviate some anxiety during this period. Typically, processing times can vary based on several factors including the volume of applications and completeness of submissions. Awareness of these timelines can guide applicants in planning their next steps.

Using tools provided by pdfFiller can make tracking your application progress easier. The platform offers features that enable users to monitor the status of their submitted forms, providing real-time updates that help keep applicants informed.

Additional support and resources

Access to support and resources can significantly enhance the application experience when submitting your CalHFA Conventional Program form. Should applicants require assistance, there are channels available for reaching out directly to CalHFA representatives.

Moreover, exploring online tools and financial calculators on the pdfFiller website can provide further insights and support in making informed decisions regarding home purchase options.

User testimonials and success stories

Hearing from those who have successfully utilized the CalHFA Conventional Program can offer motivation and insight to new applicants. Many previous beneficiaries of the program have expressed their satisfaction with the assistance received and the ease of the application process facilitated by platforms such as pdfFiller.

These real-life experiences not only highlight the program's impact but also illustrate how user-friendly digital tools like pdfFiller can enhance the overall experience, making the journey toward homeownership more achievable and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send calhfa conventional program for eSignature?

Can I create an eSignature for the calhfa conventional program in Gmail?

How do I edit calhfa conventional program straight from my smartphone?

What is calhfa conventional program?

Who is required to file calhfa conventional program?

How to fill out calhfa conventional program?

What is the purpose of calhfa conventional program?

What information must be reported on calhfa conventional program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.