Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form: A comprehensive guide for nonprofits

Understanding the Form 990: An essential overview

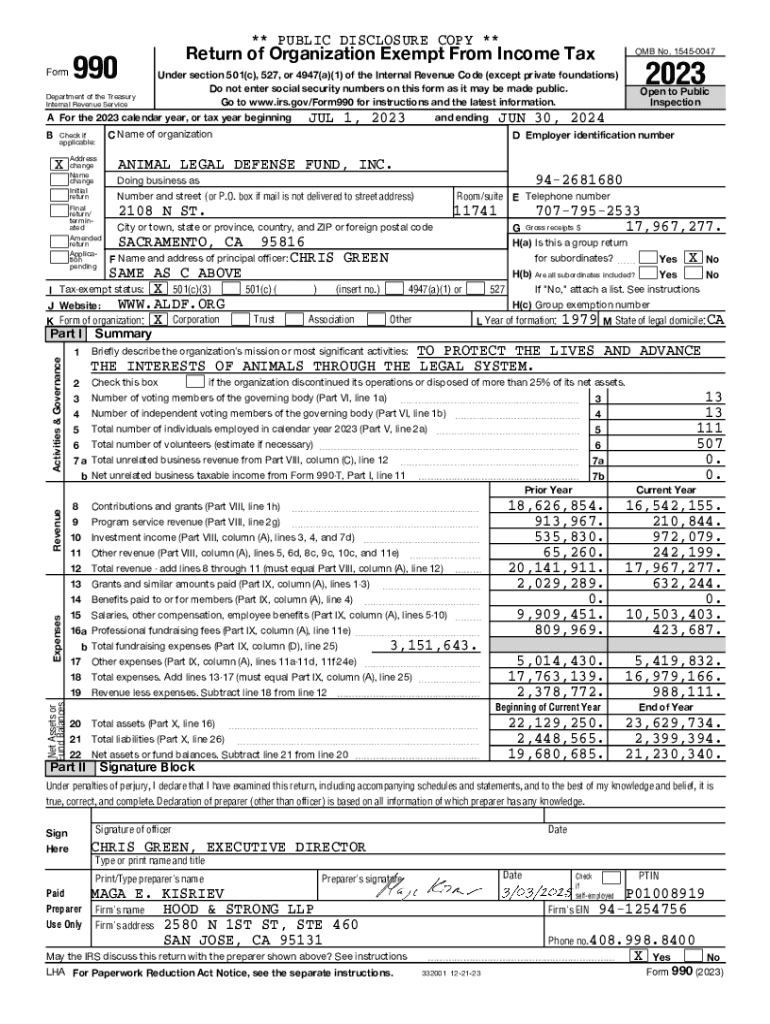

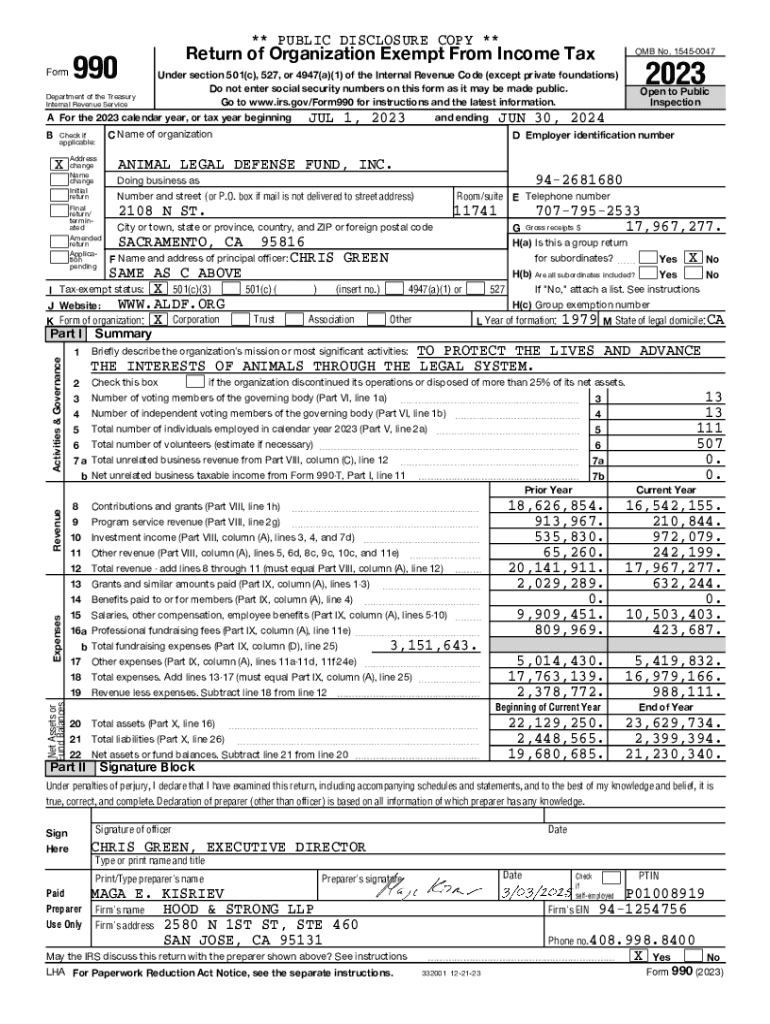

Form 990 is a critical document that nonprofits in the United States must file annually with the Internal Revenue Service (IRS). This form serves multiple purposes, including transparency in financial reporting, compliance with federal tax laws, and providing essential information to the public about the nonprofit's financial health, governance, and operational activities.

The importance of Form 990 cannot be overstated; it enables nonprofit organizations to demonstrate their adherence to regulations while informing stakeholders, such as donors, volunteers, and regulators, about their financial status and contributions to the community.

Understanding the components of Form 990 is essential. Key parts include an overview of the organization, financial statements, detailed information on revenues and expenses, and a balance sheet. It’s crucial to note the distinctions between Form 990, Form 990-EZ (a simplified version for smaller organizations), and Form 990-N (the e-postcard for the smallest nonprofits), determining which form is appropriate based on the nonprofit’s size and revenue.

The primary target audience for Form 990 filing includes nonprofit organizations with gross receipts of $200,000 or more, or total assets of $500,000 or more, as well as certain types of tax-exempt organizations. Understanding these parameters is vital for compliance.

Navigating the Form 990 landscape

To access Form 990, organizations can conveniently download it directly from the IRS website. Furthermore, using pdfFiller's platform allows users to download, edit, and collaborate on the form effortlessly.

Key sections of Form 990 include:

Notable schedules and attachments are also crucial. For instance, Schedule A outlines public charity status and public support, while Schedule B reports significant donations.

Filling out Form 990: A step-by-step guide

Before filing Form 990, significant preparations are essential. Start by gathering all necessary financial data, including audits, income statements, and receipts for contributions and expenses. Defining your accounting methods can also streamline the process.

Here’s a detailed approach to completing each section of Form 990:

Attention to detail is critical throughout the process to avoid common pitfalls, ensuring accuracy and compliance.

Common challenges and solutions

When filling out Form 990, many organizations face challenges that can lead to mistakes. Common pitfalls include misreporting revenue, underestimating expenses, or failing to complete required schedules. Each of these errors can create potential compliance issues.

For organizations unsure about interpreting complex financial terms, consider seeking guidance through resources or professional advisors. Moreover, utilizing tools like pdfFiller can enhance the experience by providing insights and support as nonprofits work through the filing process.

Troubleshooting tips for common issues include:

Filing requirements and deadlines

Understanding who must file Form 990 is essential for compliance. Generally, organizations with gross receipts over $200,000 or total assets exceeding $500,000 must file Form 990. However, several other factors may influence this requirement, including type of organization and entity structure.

Filing deadlines for Form 990 are typically the 15th day of the 5th month following the end of the organization's fiscal year. Nonprofits can apply for a 6-month extension if necessary. However, it is crucial to file any applicable forms on or before the original deadline to avoid penalties.

Penalties for noncompliance

Failing to comply with Form 990 filing requirements can result in substantial penalties. Late filings can incur daily fines, while inaccuracies in the form can lead to further scrutiny by the IRS or even revocation of tax-exempt status.

Moreover, non-filing can impact the organization's reputation with donors, resulting in decreased funding opportunities. Nonprofits should view timely and accurate filings as both a compliance necessity and a fundamental component of maintaining credibility and trust.

Public inspection regulations

Form 990 is a public document, meaning it can be accessed by anyone interested in the financials of a nonprofit organization. This transparency is key for fostering trust between nonprofits and the communities they serve.

To find publicly available Form 990 filings, individuals can visit the IRS website or utilize databases such as Guidestar or ProPublica, which compile these forms for easier access.

Using Form 990 for charitable evaluation research

Researchers, policymakers, and the public rely on Form 990 as a vital resource for evaluating the operations and impacts of charitable organizations. The data within these forms provide insights into how funds are utilized, allowing for informed decision-making and fostering accountability within the nonprofit sector.

Understanding and interpreting Form 990 information is crucial for accurate assessments. Best practices for using this data include cross-referencing with other financial resources, being aware of the nonprofit’s mission alignment with reported financial activities, and contextualizing numbers within broader sector trends.

Interactive tools for Form 990 management

pdfFiller provides an array of tools designed for nonprofits looking to manage Form 990 effectively. With capabilities for editing, signing, and collaborating on the document, organizations can streamline their filing processes significantly.

Features that enhance collaboration and document management include the ability to invite team members for joint edits, track changes in real-time, and securely store files in the cloud. This ensures that all relevant stakeholders have access to the most updated data, boosting overall productivity and compliance.

Looking ahead: Trends and changes in Form 990 regulation

The IRS often updates its regulations and instructions for Form 990. Staying informed about these changes is essential for nonprofits to ensure compliance and avoid potential pitfalls. Recent updates have included shifts in reporting requirements, focusing on transparency and accountability.

Nonprofits should actively monitor developments through the IRS website and relevant sector publications. Engaging in continuous education can prepare organizations for upcoming regulatory changes, ensuring they adapt effectively to maintain their operations and integrity.

Additional resources for nonprofits

For those seeking further guidance on Form 990, several official IRS resources and detailed instructions can provide clarity while navigating filing requirements. Additionally, nonprofit management books and articles can serve as valuable tools for understanding the broader landscape.

Connecting with community forums and support networks allows nonprofits to share insights and experiences, further enhancing their ability to navigate Form 990 successfully. Engaging with a spectrum of resources strengthens an organization's grasp of financial reporting and enhances its operational effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

How do I edit form 990 in Chrome?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.