Get the free Corporate Disclosure Statement - law osu

Get, Create, Make and Sign corporate disclosure statement

How to edit corporate disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate disclosure statement

How to fill out corporate disclosure statement

Who needs corporate disclosure statement?

Corporate Disclosure Statement Form: How-to Guide

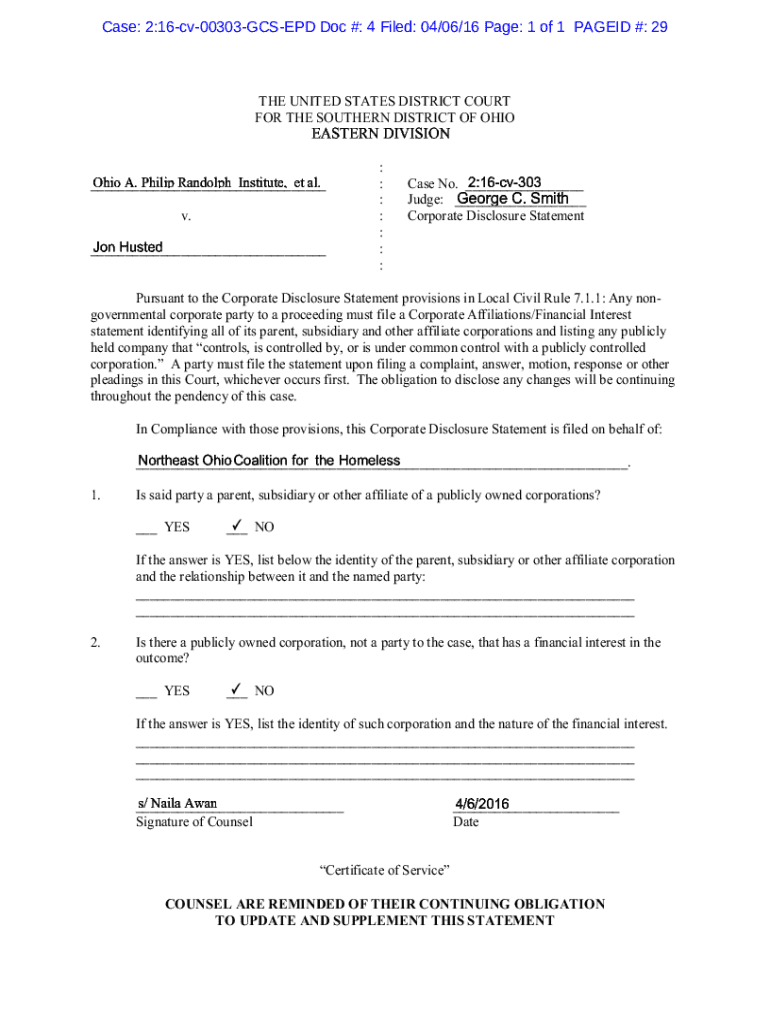

Understanding the corporate disclosure statement

A corporate disclosure statement is a formal document that outlines critical information about a corporation's financial status, management structure, and operational practices. This statement serves as a transparent communication tool, ensuring that stakeholders, including investors, regulators, and the public, have access to relevant data necessary for making informed decisions.

The importance of corporate disclosure statements in corporate governance cannot be overstated. They play a pivotal role in promoting accountability and transparency within companies. By disclosing information, corporations help build trust with their stakeholders, which is essential for maintaining a positive corporate reputation.

Key components of the corporate disclosure statement often include company information, financial data, and management and ownership details. Each section provides insight into the operational integrity and financial health of the organization.

Legal requirements for disclosure statements

Navigating the legal landscape of disclosure statements requires an understanding of various regulations that govern corporate reporting. Organizations listed on stock exchanges, for example, must adhere to the Securities and Exchange Commission (SEC) rules, which mandate comprehensive and accurate disclosure of relevant information.

Typically, publicly traded companies and certain private entities are required to submit a disclosure statement. The information required often extends to financial performance, governance practices, potential conflicts of interest, and other material data that may affect shareholder decisions.

In essence, the types of information typically required include financial statements, details on executive compensation, risk factors, and governance practices. Compliance with these requirements is crucial to avoid penalties and maintain organizational integrity.

Timing of disclosure: when and how often to file

Corporations must adhere to strict timelines when it comes to filing their corporate disclosure statements. Generally, companies are required to submit these documents quarterly or annually, depending on their size, public status, and regulatory obligations. Each jurisdiction may have specific requirements regarding the frequency and timing of these filings.

Key deadlines should be highlighted, such as the end of the fiscal year for annual disclosures and the dates for quarterly filing. Understanding these timelines can help companies avoid missed deadlines that could lead to compliance issues.

Preparing to fill out the corporate disclosure statement form

Before diving into the completion of the corporate disclosure statement form, it's essential to prepare adequately. Gathering necessary documents and information is the first step. Companies should collect their financial statements, records of corporate governance, and any previous disclosures relevant to the current filing.

Identifying roles within the organization is equally crucial. Collaborating with key stakeholders, such as finance teams, legal advisors, and managerial staff, ensures that the information provided is accurate and comprehensive. When roles are clearly defined, the preparation process becomes more streamlined.

Utilizing tools like pdfFiller can enhance this preparation phase, providing templates and interactive features that simplify document creation and editing. This cloud-based platform allows multiple team members to work on disclosures without the logistical constraints of traditional methods.

Step-by-step instructions for completing the corporate disclosure statement form

Completing the corporate disclosure statement form can be simplified by breaking it down into manageable sections. Starting with the company information, businesses should provide their legal name and structure, as well as their business address and contact information. This sets the foundation for the rest of the document.

Next, financial information must be detailed, including income statements and balance sheets. Corporations are required to disclose their assets and liabilities transparently, facilitating stakeholder evaluations of financial health.

Finally, the management and ownership section should include details of key executives and board members along with a clear distribution of ownership. This transparency is crucial for stakeholders who are interested in the governance structure of the company.

As companies fill out these sections, accuracy in data entry is paramount. Common mistakes to avoid include overlooking essential disclosures and submitting incomplete data. Meticulous review processes can help mitigate these issues.

Editing and enhancing your disclosure statement

Once the corporate disclosure statement form is drafted, utilizing tools like pdfFiller can help enhance the document's presentation and accuracy. The ability to make changes easily allows organizations to maintain competitive and compliant disclosures.

Adding comments and annotations can provide clarity and context to specific entries within the statement, especially for stakeholders who may need additional information for interpretation. Furthermore, the collaboration features enable teams to work together in real-time, making adjustments as needed before the final submission.

Signing and finalizing the form

The finalization of the corporate disclosure statement requires careful attention to compliance with signature regulations. Many jurisdictions allow for electronic signatures, and tools like pdfFiller make this process straightforward. By following a step-by-step procedure for eSigning, teams can finalize documents promptly.

Handling multiple signatures may arise, especially in large organizations. Ensuring each necessary signatory reviews and approves the document before submission is vital to uphold the integrity of the disclosure.

Submitting your corporate disclosure statement

With the corporate disclosure statement finalized, the next step is submission. Organizations should be aware of their options—whether submitting digitally or physically—to regulatory bodies governing their disclosures. Digital submissions can be processed faster, while physical documents may also be facilitated depending on jurisdictional requirements.

Guidelines and best practices for filing should be reviewed carefully. Confirming the successful submission and tracking the status of the document ensures compliance and helps organizations prepare for future filings.

Practical implications of corporate disclosure statements

The implications of corporate disclosure statements extend beyond mere compliance. Non-compliance can lead to severe consequences such as fines, legal issues, and reputational damage. Therefore, maintaining an accurate and timely disclosure process is essential for protecting a company's standing in the market.

Transparency through well-prepared disclosures ensures that stakeholders, including investors and analysts, can trust the information provided. An honest disclosure reflects positively on the company’s governance practices, boosting company reputation and credibility in a competitive landscape.

FAQs about corporate disclosure statements

As companies engage with the corporate disclosure statement process, questions are bound to arise. Common inquiries from new filers include clarification on who exactly is required to file and what specific forms must be used. Troubleshooting any submission issues also remains a frequent concern, so it’s wise to understand the filing procedures to minimize complications.

Resources for further guidance should be readily available, whether from regulatory bodies, legal advisors, or platforms like pdfFiller, which offers comprehensive support and templates tailored for corporate disclosures. Exploring these resources can help navigate the complexities associated with disclosure regulations.

Updates and future considerations for corporate disclosure

The landscape of corporate disclosure regulations is dynamic, with ongoing trends influencing the amount and type of information that must be disclosed. Keeping informed on these changes is crucial for maintaining compliance and ensuring that disclosures remain relevant and comprehensive.

As new regulations emerge, understanding how tools like pdfFiller adapt to these changes will be invaluable. The platform consistently updates its resources to align with current disclosure requirements, enabling users to manage their documents seamlessly.

Leveraging pdfFiller for ongoing document management

Managing the corporate disclosure statement history within pdfFiller allows organizations to keep track of their submissions efficiently. Users can set reminders for upcoming filings, ensuring they remain compliant with regulatory deadlines without the risk of overlooking important dates.

Furthermore, utilizing analytics features can improve future statements. By reviewing past disclosures and evaluating areas for enhancement, companies can bolster their reporting practices and ensure that their disclosures are not only compliant but also advantageous for their corporate image.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete corporate disclosure statement online?

How do I edit corporate disclosure statement online?

How can I edit corporate disclosure statement on a smartphone?

What is corporate disclosure statement?

Who is required to file corporate disclosure statement?

How to fill out corporate disclosure statement?

What is the purpose of corporate disclosure statement?

What information must be reported on corporate disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.