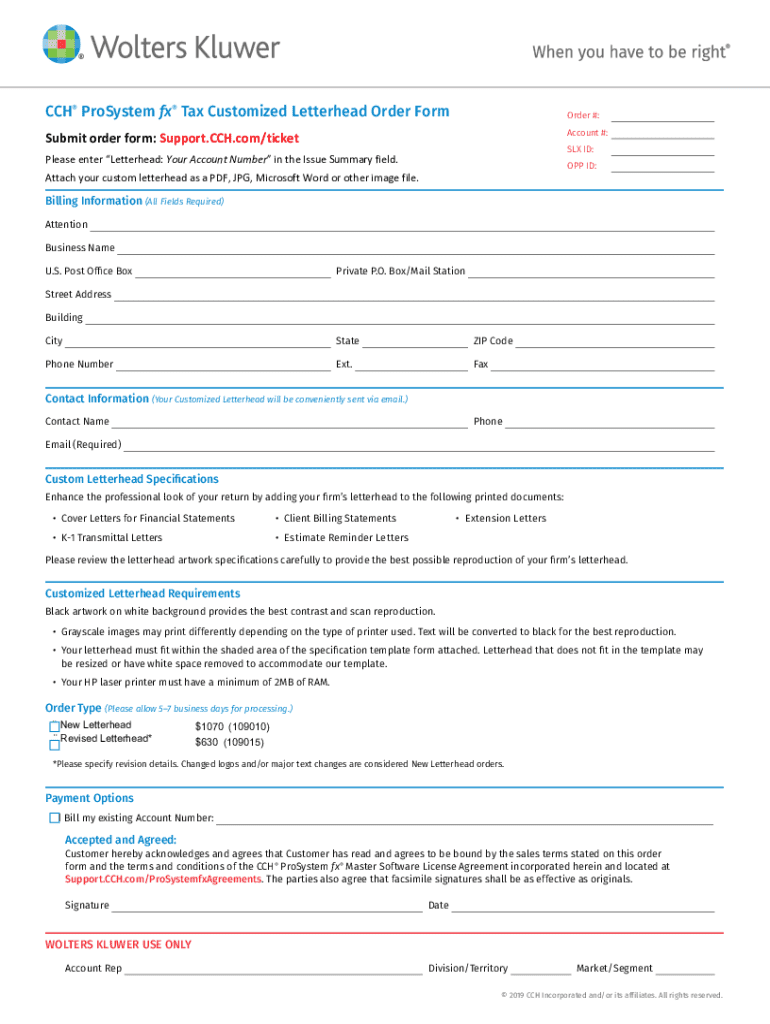

Get the free Cch® Prosystem Fx® Tax Customized Letterhead Order Form

Get, Create, Make and Sign cch prosystem fx tax

How to edit cch prosystem fx tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cch prosystem fx tax

How to fill out cch prosystem fx tax

Who needs cch prosystem fx tax?

Comprehensive Guide to cch ProSystem fx Tax Form

Understanding cch ProSystem fx Tax Form

The cch ProSystem fx tax form represents a streamlined approach to tax preparation and filing for both individuals and business entities. Known for its comprehensive features, this tool allows tax professionals to create accurate tax returns efficiently. As tax laws become more complex and digital filing becomes the standard, utilizing a robust tax form like cch ProSystem is crucial for compliance and accuracy.

Accurate tax forms are essential in the digital age due to the increasing scrutiny of tax filings by the IRS and the competitive nature of tax preparation services. Utilizing software designed for optimal accuracy reduces the risk of errors, audits, and penalties, making this form an invaluable asset.

Key features of cch ProSystem fx Tax Form

One of the most significant advantages of the cch ProSystem fx tax form is its comprehensive capabilities in tax preparation. The form encompasses various aspects of tax filing, including personal and corporate taxes, ensuring a one-stop solution for users. Users appreciate that the software integrates a variety of calculations for deductions, credits, and required schedules, streamlining the process significantly.

Moreover, the user-friendly interface enhances navigation, allowing both seasoned tax professionals and newcomers to access the tool with ease. Clients often commend its intuitive design that simplifies complex tax data entry. Seamless integration with other CCH software products, such as document management and accounting tools, amplifies the cch ProSystem, making it a comprehensive solution for managing tax and financial data.

Accessing the cch ProSystem fx Tax Form

To find the cch ProSystem fx tax form, users can easily navigate within the pdfFiller platform. The form is readily available under a dedicated section for tax forms, ensuring quick access to necessary documents. This ease of access is enhanced even further by the cloud-based nature of pdfFiller, allowing users to retrieve their forms from any location with internet connectivity.

Compatibility remains a vital characteristic of the cch ProSystem fx tax form. The form can be accessed and filled out on various devices, including desktops, tablets, and mobile phones, allowing tax professionals and individuals to work flexibly and efficiently across devices.

Step-by-step instructions for filling out the cch ProSystem fx Tax Form

Preparation guidelines

Before diving into filling out the cch ProSystem fx tax form, it's essential to gather all required documents and information. Typical documents include W-2s, 1099 forms, receipts for deductions, and any previous tax returns. Having these documents ready facilitates a smoother filling process and ensures that all relevant financial information is included.

Common mistakes users make when preparing this form include overlooking important deductions, misentering financial data, and failing to use the most recent tax guidelines. Double-checking each section and ensuring that all required documents are referenced can mitigate these issues.

Filling out the form

When filling out the cch ProSystem fx tax form, pay special attention to the following sections:

To ensure accuracy and compliance, consider cross-referencing your entries with tax guidelines or consult with a tax professional if uncertain about any figures.

Editing the cch ProSystem fx Tax Form with pdfFiller

Utilizing pdfFiller's editing tools allows users to modify any necessary information on the cch ProSystem fx tax form without hassle. These tools make it simple to add notes, comments, or corrections directly within the PDF, enhancing your ability to manage changes efficiently.

Users can easily add or remove information, ensuring that the form is accurately filled before final submission. The editing options also allow for compliance checks by integrating features that highlight areas requiring attention, ensuring that your document conforms to current IRS guidelines.

eSigning the cch ProSystem fx Tax Form

Incorporating electronic signatures into tax documents like the cch ProSystem fx tax form has become increasingly important to simplify the signing process and enhance document security. eSigning helps avoid delays typically associated with physical signatures and ensures that the document is legally binding.

To eSign using pdfFiller, users only need to follow these steps: select the 'eSign' option, drag and drop the signature field onto the document, and complete the signing process through your preferred authentication method. The platform's security features, such as encryption and authentication, safeguard sensitive information, providing peace of mind during the tax filing process.

Collaborating with teams on cch ProSystem fx Tax Forms

When working in teams, collaboration on cch ProSystem fx tax forms can lead to more efficient and accurate tax filings. pdfFiller provides features that enable teams to share access to the same document, facilitating real-time updates and comments among team members.

Version control features help track changes made by team members, allowing for a transparent work environment where all contributions are recognized. Best practices for teamwork in document management include setting clear roles for each team member and establishing timelines for when tasks should be completed, improving workflow efficiency.

Managing documents and forms with pdfFiller

Effective organization of tax forms is crucial for both personal and business accounting. pdfFiller offers tools to manage your cch ProSystem fx tax forms effectively. Users can categorize documents systematically and create a storage system that allows for easy retrieval when needed.

Utilizing cloud storage enhances safety and accessibility. In addition to secure storage, pdfFiller lets you track changes and maintain document history. This aspect proves beneficial during audits or reviews, providing a clear record of all modifications made to your tax documents.

Compliance and best practices for using cch ProSystem fx Tax Form

Ensuring compliance with IRS regulations is paramount when using the cch ProSystem fx tax form. Staying updated on tax law changes and requirements relevant to each tax year can help you avoid costly mistakes or penalties. The IRS website is a valuable resource, providing detailed information on federal tax regulations.

Regularly reviewing the cch ProSystem fx tax form and comparing it against updated tax guidelines ensures that you're utilizing the most accurate information. Engaging with resources and tools for compliance checks can further enhance your readiness for filing taxes.

Troubleshooting common issues

While using the cch ProSystem fx tax form, users might encounter common challenges, including issues with document formatting, error messages during filing, or confusion regarding specific tax entries. Addressing these problems starts with reviewing the user manual or support documentation provided by pdfFiller.

Proactively addressing these common problems can significantly streamline your experience when working with the cch ProSystem fx tax form, allowing you to focus on completing your tax return efficiently.

Enhancing productivity with pdfFiller features

pdfFiller not only facilitates the creation and signing of cch ProSystem fx tax forms but also enhances productivity with advanced features. The tool streamlines the tax form management process, allowing users to quickly fill out, edit, and submit documents throughout a cohesive platform.

Enhanced integration capabilities with accounting tools also amplify workflow, ensuring that your tax preparation aligns seamlessly with your broader financial management practices. This collaborative environment reduces redundancy and promotes a more efficient approach to tax filing.

Customer support and help resources

When navigating the complexities of the cch ProSystem fx tax form, support is crucial. pdfFiller offers robust customer support options, allowing users to contact their team for assistance quickly. Comprehensive user guides and support documentation are available on their website, providing step-by-step instructions for various functionalities.

Additionally, community forums and knowledge bases empower users by sharing common challenges and solutions, creating a supportive environment for leveraging the features of pdfFiller effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cch prosystem fx tax without leaving Google Drive?

How can I send cch prosystem fx tax to be eSigned by others?

How do I edit cch prosystem fx tax in Chrome?

What is cch prosystem fx tax?

Who is required to file cch prosystem fx tax?

How to fill out cch prosystem fx tax?

What is the purpose of cch prosystem fx tax?

What information must be reported on cch prosystem fx tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.