Get the free Indemnification Agreement

Get, Create, Make and Sign indemnification agreement

Editing indemnification agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indemnification agreement

How to fill out indemnification agreement

Who needs indemnification agreement?

Indemnification Agreement Form: A Comprehensive Guide

Understanding indemnification agreements

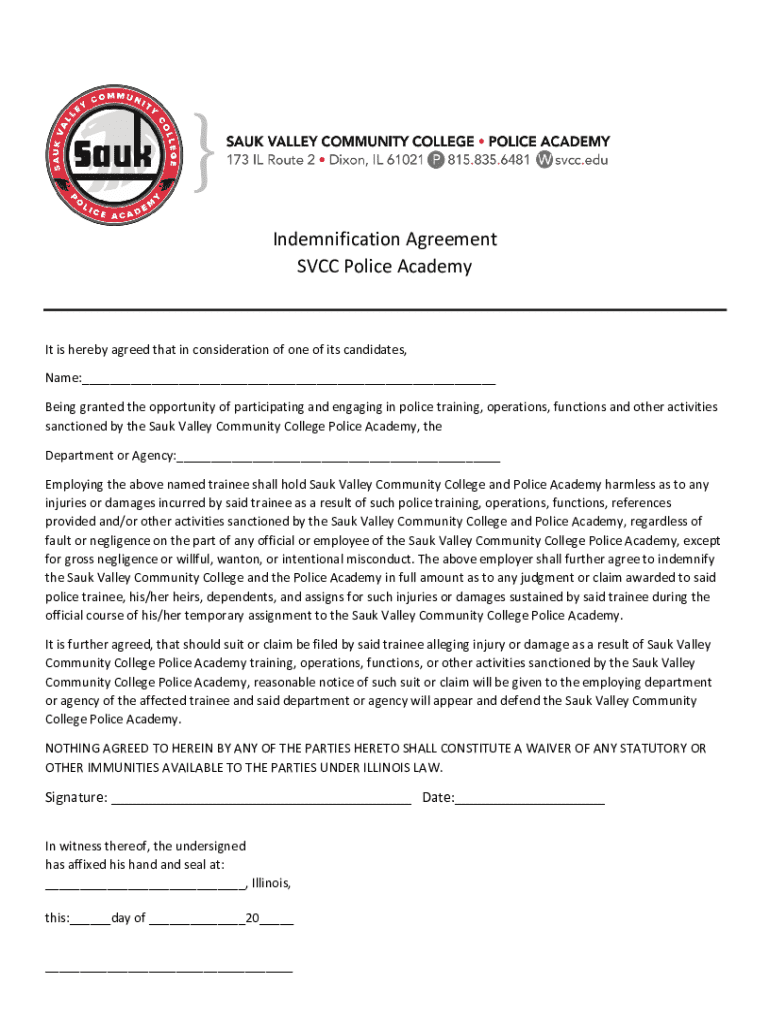

An indemnification agreement is a legal contract between parties wherein one party agrees to compensate the other for certain damages or losses. This agreement is crucial in various business and personal transactions, as it protects parties from the financial repercussions of claims brought by third parties.

The importance of indemnification in contracts cannot be overstated, especially in fields like construction, real estate, and service agreements where liability risks are prevalent. Indemnification serves as a risk transfer mechanism, decreasing potential financial burdens and promoting smoother transactions.

Purpose of an indemnification agreement

The primary purpose of an indemnification agreement is to offer protection against potential liabilities arising from specified events or actions. Such agreements are designed to bolster the confidence of parties engaging in transactions by clearly laying out responsibilities and liabilities.

Indemnification is often required in various situations, including, but not limited to, real estate transactions, service agreements, and joint ventures. Specific scenarios that commonly necessitate indemnification agreements include: construction contracts, where one party may be liable for injuries incurred on a job site, and rental agreements, where landlords may require tenants to indemnify them against damages.

Key elements of an indemnification agreement form

When drafting an indemnification agreement form, several essential elements should be included. These components define the contract and ensure that both parties have a clear understanding of their roles and obligations.

Firstly, general details about the agreement should include the title, date, and effective date to establish the timeline of the contract. Additionally, the identities of the indemnitor and indemnitee must be clearly stated, outlining all relevant contact information to avoid ambiguity.

Drafting your indemnification agreement

Creating an effective indemnification agreement requires careful consideration and clarity. A step-by-step guide can help you navigate the key elements necessary for a comprehensive document.

Start by determining the purpose and scope of the agreement. It’s essential to define what risks are being mitigated and what scenarios warrant indemnification. Next, clarify the responsibilities and liabilities of both parties to avoid misunderstandings.

Lastly, consider state-specific variations that might influence the drafting process, as different jurisdictions can have specific rules regarding indemnification agreements.

Legality and enforceability of indemnification agreements

An indemnification agreement is legally binding, provided it meets specific criteria. To enhance enforceability, parties must ensure that the agreement is written clearly, adequately defines rights and responsibilities, and includes all necessary legal jargon.

Common legal challenges in indemnification agreements often arise from ambiguities or unreasonable terms. To avoid these issues, clarity in how indemnity is defined and the scope of liability is essential. Additionally, notarizing the agreement can bolster its legal standing, serving as evidence of the parties' intent.

Management of your indemnification agreement

Once drafted, proper management of your indemnification agreement is critical. Best practices include ensuring that documents are stored securely and can be easily accessed for review or update. As circumstances change — such as modifications in the law or changes in business operations — regularly revisit and edit the agreement to maintain its relevance.

Utilizing tools from pdfFiller can significantly enhance your document management process. With features for editing PDFs, eSigning capabilities, and collaboration features, you can streamline workflows and maintain the integrity of your agreements with ease.

Templates and resources

Accessing a free indemnification agreement template can save time and help ensure that all necessary elements are included. Customizing your template in pdfFiller allows for seamless modifications tailored to your specific situation.

Related document examples such as hold-harmless agreements and waivers of liability often go hand in hand with indemnification agreements, enabling comprehensive risk management in various fields.

Frequently asked questions (FAQ)

Understanding commonly asked questions about indemnification agreements can demystify this essential aspect of legal contracts. For instance, what constitutes an agreement of indemnity? Simply put, it is an arrangement wherein one party agrees to protect another from specified losses.

Additionally, knowing the three main types of indemnity can be beneficial: express indemnity, implied indemnity, and special indemnity. The most common form of indemnification agreement is typically found in contractual relationships where parties seek to manage liability risks proactively.

Legal considerations and exceptions

While indemnification agreements provide substantial protections, it’s essential to understand common exceptions to indemnification clauses. Some circumstances may invalidate or limit the enforceability of indemnification provisions, including cases of gross negligence or willful misconduct.

Furthermore, cross-referencing other relevant contracts is crucial in ensuring that the indemnification agreement aligns with the overall intent of the transactions involved.

Additional insights

As industries evolve, future trends in indemnification agreements may include increased use of technology to streamline drafting and management processes. Digital solutions facilitate efficiency and accuracy, ensuring agreements remain relevant and enforceable in the face of changing standards and expectations.

The role of digital solutions in document management extends beyond mere storage; they enhance collaboration, allow for real-time edits, and provide centralized access to essential agreements, making tools like pdfFiller indispensable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my indemnification agreement in Gmail?

How can I modify indemnification agreement without leaving Google Drive?

How do I complete indemnification agreement on an iOS device?

What is indemnification agreement?

Who is required to file indemnification agreement?

How to fill out indemnification agreement?

What is the purpose of indemnification agreement?

What information must be reported on indemnification agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.