Get the free Cdtfa-230-m Rev. 4 (9-21) - comptroller usc

Get, Create, Make and Sign cdtfa-230-m rev 4 9-21

Editing cdtfa-230-m rev 4 9-21 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-230-m rev 4 9-21

How to fill out cdtfa-230-m rev 4 9-21

Who needs cdtfa-230-m rev 4 9-21?

A Comprehensive Guide to the CDTFA-230- Rev 4 9-21 Form

Overview of CDTFA-230- Rev 4 9-21 Form

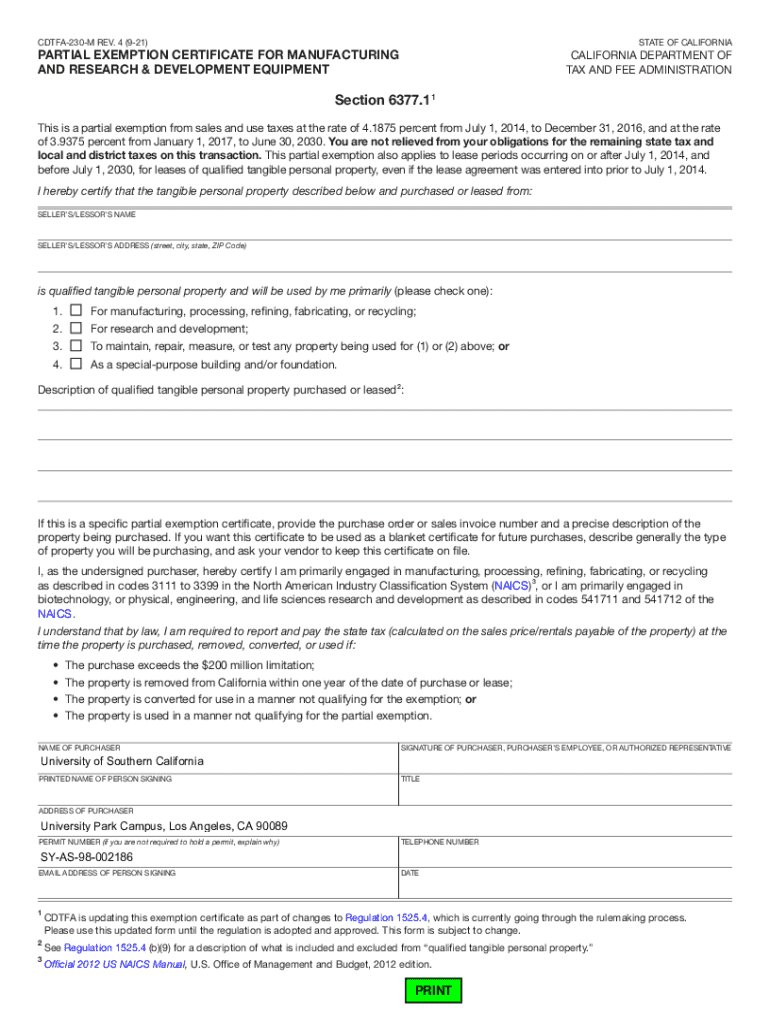

The CDTFA-230-M Rev 4 9-21 Form is an essential document utilized for reporting specific tax-related information within California. Issued by the California Department of Tax and Fee Administration (CDTFA), this form primarily aids businesses and individuals in complying with California tax laws. Understanding the nuances of this form is critical, especially for those managing sales tax, use tax, or related liabilities.

This form holds importance as it ensures taxpayers accurately report their tax obligations, contributing to transparency in financial dealings. By using the CDTFA-230-M, individuals and businesses can systematically detail their tax liabilities and deductions, ultimately reinforcing their compliance and avoiding potential penalties from erroneous filings.

Accessing the CDTFA-230- Rev 4 9-21 Form

For those looking to access the CDTFA-230-M Rev 4 9-21 Form, it is conveniently available online. The California Department of Tax and Fee Administration’s official website hosts the latest version of this form, ensuring taxpayers can obtain the necessary document without delay. Users can also find the form on platforms like pdfFiller, which streamlines the process of downloading and editing tax documents.

To download the form from pdfFiller, follow these straightforward steps: visit the pdfFiller website, navigate to the search bar, and input ‘CDTFA-230-M Rev 4 9-21.’ Once located, click on the form, and a download option will appear. Utilizing pdfFiller’s platform provides additional benefits, such as easy document management and collaboration features.

Understanding the components of the CDTFA-230- Rev 4 9-21 Form

The CDTFA-230-M Rev 4 9-21 Form comprises several sections, each designed to capture essential tax information. Here’s a breakdown of its critical components:

Section A includes General Information, where you will enter basic details such as your business name and address. In Section B, the Taxpayer Details, the form requires taxpayer identification numbers, which are crucial for processing your tax obligations. Finally, Section C, the Tax Liability Summary, allows you to summarize your tax liabilities, making it essential for calculating totals owed.

Step-by-step instructions for completing the CDTFA-230- Rev 4 9-21 Form

Completing the CDTFA-230-M Rev 4 9-21 Form requires careful preparation and organization. Below are detailed steps to guide you through the process.

1. Gathering required information

Before filling out the form, gather all necessary documents, including previous tax returns, receipts, and any other relevant financial statements. Having these materials organized will ensure a smooth filling process. Keep in mind that accuracy is paramount when reporting income and deductions.

2. Filling out the general information section

In Section A, accurately enter your business name, address, and contact details. Be cautious to avoid common mistakes, such as transposing numbers in your address or leaving out critical contact information, which can lead to processing delays.

3. Completing the taxpayer details section

In Section B, input your taxpayer identification number correctly. Misreporting this can lead to issues down the road. Additionally, report income accurately, providing all necessary deductions to ensure compliance.

4. Calculating tax liability

Once you have all the necessary figures, proceed to Section C to calculate your tax liability summary. Use clear formulas to arrive at total amounts owed. For example, if your total sales tax collected is $10,000 and your exemptions are $1,000, then your tax liability would be $9,000.

Editing and signing the CDTFA-230- Rev 4 9-21 Form in pdfFiller

After completing the form, you may need to make edits or add certain details. pdfFiller offers intuitive editing tools that allow users to modify the document easily, ensuring accuracy before submission. The platform also supports eSign functionality, enabling secure digital signing without the need for physical paper.

To eSign the document, click on the ‘eSign’ option within pdfFiller. You can choose to draw your signature, type it, or upload a scanned copy. This feature is especially useful for those who require remote collaboration or work within a team, enhancing efficiency and document security.

Submitting the CDTFA-230- Rev 4 9-21 Form

After you've completed and signed the form, the next step is to submit it. You have the option to submit the CDTFA-230-M form online directly through the CDTFA’s website or via traditional mail. Each method has its own set of requirements and preparation steps, so familiarize yourself with them beforehand.

Be aware of submission deadlines, as late submissions can incur penalties. It's advisable to submit your form as early as possible to avoid unexpected issues. Additionally, keep a copy of your submission for your records and confirmation of compliance.

FAQs about the CDTFA-230- Rev 4 9-21 Form

Many individuals have questions regarding the CDTFA-230-M Rev 4 9-21 Form. Addressing these queries can alleviate concerns and enhance understanding of the form's purpose.

In the event of discrepancies on the form, promptly contact the CDTFA for guidance. Keeping records of all communications and having a clear understanding of your responsibilities can aid in resolving any issues that arise.

Advanced tips for managing your CDTFA-230- Rev 4 9-21 Form and tax documents

Managing your CDTFA-230-M Rev 4 9-21 Form and other tax documents extends beyond just filling them out. Implementing effective document retention strategies ensures that you have quick access to vital records when needed.

Utilizing pdfFiller, you can create a cloud-based document management system, making it easier to organize your paperwork and collaborate with your team. Leverage the version history feature to track changes over time, allowing for seamless updates and management of recurrent submissions.

Resources related to the CDTFA-230- Rev 4 9-21 Form

Accessing additional resources can facilitate a deeper understanding of the CDTFA-230-M Rev 4 9-21 Form. Various guides, articles, and tools can be found on the pdfFiller site to assist you further. Furthermore, it’s prudent to be aware of related forms that may be required based on your specific tax scenario.

When in doubt, the CDTFA also provides contact information for support options, available for clarifying your queries or guiding you through the form completion process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cdtfa-230-m rev 4 9-21 directly from Gmail?

How do I make edits in cdtfa-230-m rev 4 9-21 without leaving Chrome?

How can I fill out cdtfa-230-m rev 4 9-21 on an iOS device?

What is cdtfa-230-m rev 4 9-21?

Who is required to file cdtfa-230-m rev 4 9-21?

How to fill out cdtfa-230-m rev 4 9-21?

What is the purpose of cdtfa-230-m rev 4 9-21?

What information must be reported on cdtfa-230-m rev 4 9-21?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.