Get the free Cfa-4 Report of Receipts and Expenditures of a Political Committee

Get, Create, Make and Sign cfa-4 report of receipts

Editing cfa-4 report of receipts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cfa-4 report of receipts

How to fill out cfa-4 report of receipts

Who needs cfa-4 report of receipts?

Understanding the CFA-4 Report of Receipts Form: A Comprehensive Guide

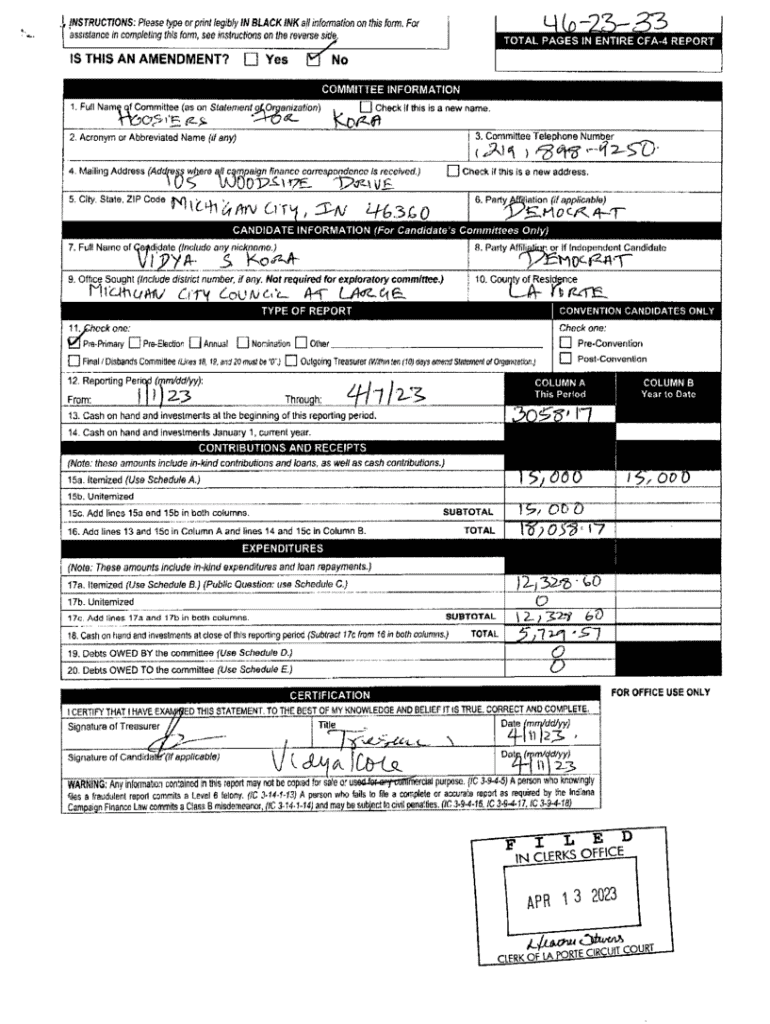

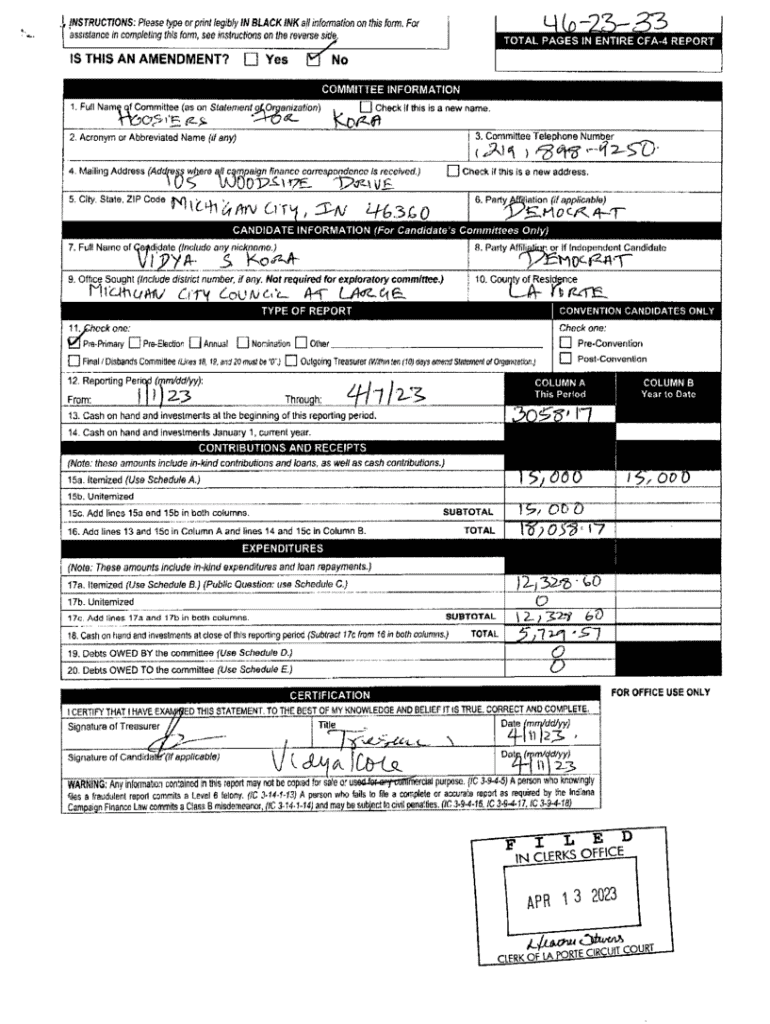

Overview of the CFA-4 Report of Receipts Form

The CFA-4 Report of Receipts Form is a crucial document in the realm of campaign finance. This form is designed to capture and report all financial contributions received by political candidates and campaigns during an election cycle. Its primary purpose is to ensure transparency in political fundraising and spending, providing a clear account of financial activities to election offices and the public.

Accurate reporting is not just a recommendation but a legal requirement. Misreporting or failing to file the CFA-4 can lead to serious consequences, including fines and damage to a candidate's credibility. Thus, understanding the details and requirements of this form is essential for anyone involved in political campaigns.

Who should use the CFA-4 Report of Receipts Form

The CFA-4 Report of Receipts Form is primarily used by campaign managers, political candidates, and fundraising teams. If you are actively involved in raising funds or managing a campaign, you are likely responsible for completing this form accurately and on time.

Key stakeholders also include election offices that review these submissions to ensure compliance with campaign finance laws. Additionally, donors and contributors are impacted by how these forms are filled out, as they have the right to know how their contributions are being utilized.

Document features and format

The CFA-4 Form is meticulously structured to ensure all necessary financial information is captured effectively. The primary sections include the total receipts, which summarize overall contributions, and various categories for itemized contributions, allowing for more detailed reporting.

In terms of file formats, the CFA-4 form is typically available in PDF format for easy printing and sharing. Editable formats might also be offered, facilitating real-time updates and modifications, particularly useful for collaborative teams who need to fill out the form together.

Step-by-step instructions for completing the CFA-4 form

Before you begin filling out the CFA-4 Form, it is essential to gather all necessary documentation, including receipts, invoices, and any records that detail financial contributions received. This preparation will streamline the process and reduce the likelihood of errors.

1. **Total Receipts Section:** Begin by summing up all contributions and listing the total amount received. Accuracy is crucial here, as this figure sets the tone for the rest of the form.

2. **Itemized Contributions Section:** Provide detailed information for each contribution over a certain threshold, including donor names, amounts, and dates received. This transparency is vital for compliance.

3. **Other Receipts Category:** This section allows for listing miscellaneous income that doesn't fit under standard donations, such as fundraisers or merchandise sales.

Common mistakes to avoid include overlooking small contributions that may seem insignificant but can add up. Additionally, be cautious about misreporting dates or amounts, as these can lead to complications in compliance checks.

Tips for editing and managing the CFA-4 form

Using a platform like pdfFiller can greatly simplify the editing process for the CFA-4 Form. The tool offers real-time editing features that allow users to make changes quickly, even on a collaborative basis. This capability is particularly advantageous when multiple team members are involved in the reporting process.

Collaboration features enable users to share forms easily, allowing for collective review and input. With tracking changes and commenting capabilities, teams can communicate effectively about necessary adjustments and ensure that the final submission is accurate and comprehensive.

Ensuring compliance with regulations

Each state may have specific requirements regarding the CFA-4 Report of Receipts Form, including variations in filing deadlines and contribution limits. It's important for campaign teams to familiarize themselves with their state’s regulations to avoid potential pitfalls.

Resources, including state election boards and compliance guides, can prove invaluable for addressing more complex situations. Keeping track of key reporting deadlines is equally vital, as late submissions can result in penalties that impact campaign integrity.

Troubleshooting common issues

When submitting the CFA-4 Report of Receipts Form, users may encounter error messages. Understanding what these messages mean is crucial for efficient problem-solving. For instance, a common error may indicate missing required fields or incorrect formatting.

If submission failures occur, revisiting the form to ensure all information is complete and correctly formatted will help. Should technical issues persist, users should not hesitate to reach out to support teams dedicated to resolving these issues promptly.

Advanced tools and resources in pdfFiller

In addition to basic editing capabilities, pdfFiller offers advanced tools for document review and storage. The platform's cloud storage benefits allow users to access their forms from anywhere at any time, ensuring convenience during the busy campaign periods.

Document organization features make it easy to categorize and retrieve the CFA-4 Form alongside other important campaign documents. Furthermore, integrating other document types with the CFA-4 can create comprehensive reports needed for strategic decision-making.

User testimonials and case studies

Many users have shared success stories about how pdfFiller has streamlined their process for handling the CFA-4 Report of Receipts Form. By utilizing the platform, campaigns have reported significant improvements in compliance, reduced errors, and overall enhanced document management.

The impact of efficient document management cannot be understated, as it fosters increased trust with donors and a more organized approach to fundraising. When teams can effectively manage their resources, they can focus on what truly matters—running an effective campaign.

FAQs about the CFA-4 Report of Receipts Form

As users become familiar with the CFA-4 Report of Receipts Form, several common inquiries tend to arise. One frequently asked question is, 'How do I file if I have no receipts?' In this case, a campaign should maintain a record of all contributions even if not documented with receipts, as they still need to be reported.

Another common question is, 'What to do if I made a mistake after submission?' The best course of action is to promptly file an amended form to correct any discrepancies. Transparency and proactive communication with election offices can help mitigate potential issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cfa-4 report of receipts to be eSigned by others?

How do I edit cfa-4 report of receipts in Chrome?

How do I fill out the cfa-4 report of receipts form on my smartphone?

What is cfa-4 report of receipts?

Who is required to file cfa-4 report of receipts?

How to fill out cfa-4 report of receipts?

What is the purpose of cfa-4 report of receipts?

What information must be reported on cfa-4 report of receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.