Get the free Corporate Tax Credit Submission Form Fy 2024-2025

Get, Create, Make and Sign corporate tax credit submission

Editing corporate tax credit submission online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate tax credit submission

How to fill out corporate tax credit submission

Who needs corporate tax credit submission?

Navigating the Corporate Tax Credit Submission Form: A Comprehensive Guide

Understanding corporate tax credits

Corporate tax credits are incentives provided by government entities that allow businesses to reduce their tax liabilities. By implementing these credits, governments aim to stimulate economic growth, encourage specific investments, or promote particular activities such as research and development, sustainability initiatives, or job creation. Corporations that qualify for these credits can significantly reduce their overall tax burden, thus retaining more capital for reinvestment or distribution to shareholders.

There are various types of corporate tax credits available, such as investment credits, employment credits, and research and development tax credits. Each of these serves a unique purpose and is designed to reward businesses for certain activities. For instance, R&D tax credits incentivize companies to innovate and develop new products, while employment credits may provide tax relief for companies that create new jobs within specific communities.

Importance of the corporate tax credit submission form

The corporate tax credit submission form is crucial for claiming the benefits associated with tax credits. Without proper submission, businesses may miss out on potential savings, which can impact their financial health. Among the primary reasons for submitting this form are maximizing tax benefits and ensuring compliance with tax laws.

Effective use of the submission form allows corporations to document their eligibility and the expenditures used to earn these credits. Compliance with tax regulations is essential as it can prevent costly audits and penalties. Therefore, thorough submission helps in avoiding unnecessary complications with tax authorities and ensures a smoother path to financial efficiency.

Overview of the corporate tax credit submission process

Submitting a corporate tax credit form involves a systematic approach which begins with identifying eligible credits and gathering necessary documentation. The process typically begins with assessing eligibility criteria based on the specific tax credit type, followed by collecting data about qualifying expenses. Once adequate information is gathered, the submission form can be filled out.

Corporations need to be mindful of key deadlines for submission, as these can vary by credit type and jurisdiction. Failing to meet such deadlines can result in forfeiting the opportunity to claim the credit, potentially leaving thousands of dollars in tax savings on the table. As a rule of thumb, familiarize yourself with the tax authority's calendar for specific dates related to credit submissions.

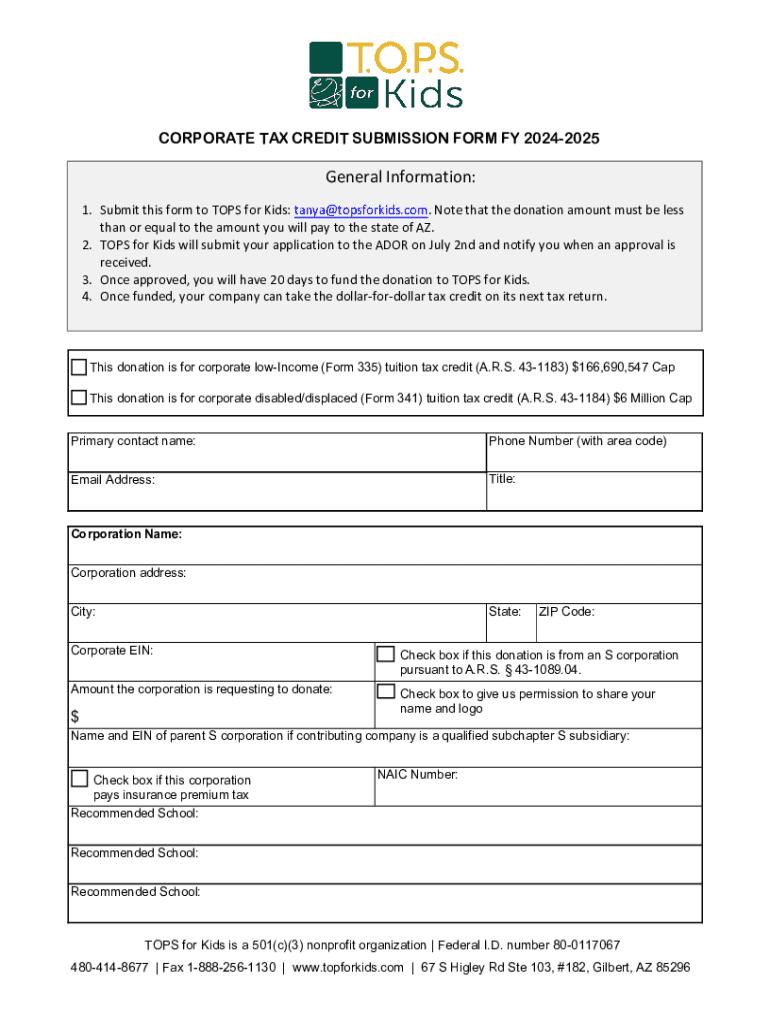

Detailed exploration of the corporate tax credit submission form

The corporate tax credit submission form comprises several components that need to be accurately filled out to increase the likelihood of approval. Key required fields typically include the business's identification information, the specific tax credit type being applied for, and detailed financial data reflecting the eligible expenses. Depending on the jurisdiction and credit, there may also be optional sections for additional claims.

Understanding the form's codes and terminology is equally fundamental in ensuring proper completion. Utilizing tax-specific language and abbreviations correctly helps in conveying the information precisely as intended. Make certain you are familiar with any specific terms used in the context of your targeted tax credit, which will enhance both your submission accuracy and the form's approval chances.

How to prepare for submission

Preparation for submitting a corporate tax credit form involves meticulous organization of necessary documentation. Corporations must gather all supporting documents, such as receipts, invoices, and financial reports that validate the claimed expenses. Apart from proper documentation, being aware of common pitfalls is crucial to avoid mistakes that could delay approval or result in denial.

For effective organization, consider categorizing documents based on the type of credit and the expenses claimed. This approach promotes clarity and eases the review process. Having all required documents readily available can also help speed up the completion process, minimizing potential back-and-forth communication with tax authorities.

Interactive tools for completing the submission form

Leveraging online resources can considerably enhance the experience of filling out the corporate tax credit submission form. Platforms like pdfFiller offer various tools, including templates and guides designed to streamline the completion process. By utilizing an interactive platform, teams can easily collaborate and edit documents, ensuring that all necessary information is accurately included before submission.

The editing and signing process can be further simplified through pdfFiller's user-friendly interface. With cloud-based access, team members can work simultaneously on the form from anywhere, making it easier to compile data quickly and efficiently. Such collaborative capabilities are especially advantageous for larger organizations where multiple departments may contribute to the completion of the submission.

Filling out the corporate tax credit submission form

Filling out the corporate tax credit submission form requires careful attention to detail. Each section should be completed diligently, ensuring that all required fields are filled with accurate information. Begin with basic company details, followed by the specific credit information, and conclude with supporting financial data representing the eligible expenses. The precision in data entry plays a vital role in successful claim approval.

Best practices for filling out the form include double-checking all entries and ensuring consistency across submitted documents. Using examples of completed forms for reference can also guide you effectively through the process. Each section's completion should reflect a clear understanding of the criteria, ultimately strengthening your submission's validity.

Submitting your corporate tax credit form

Once the form is fully completed, the next step is determining the method of submission. Typically, corporations can choose between electronic submissions or paper submissions. Electronic submissions are often preferred due to their efficiency and ease of tracking status, whereas paper submissions may take longer and can lead to delays in processing.

Ensuring that the delivery of the submission is accurate is critical. If opting for paper forms, use certified mail or a reliable courier to provide proof of submission. Companies should also monitor the status of their submission to verify that it has been processed, which helps in addressing any potential issues promptly.

Managing post-submission activities

After submitting the corporate tax credit form, it is essential to engage in proactive post-submission activities. Start by monitoring for confirmation from the tax authority regarding the receipt of the submission. This confirmation serves as an assurance that your application is in process and can help prevent any potential issues with tracking.

Furthermore, be prepared to address any follow-up questions or requests for additional information from the tax authority. Having documentation well-organized and readily accessible will facilitate faster responses and maintain clear communication, mitigating delays in the processing of your claim.

Common errors to avoid when submitting

Errors during the submission process can hinder a corporation's ability to benefit from tax credits. Common mistakes include incomplete information, missing required signatures, and failure to meet submission deadlines. Inadequate documentation or lack of clarity can also lead to claim denials or require re-submission, which can be time-consuming.

To avoid these pitfalls, it is vital to thoroughly review the submission before sending it off. Establish a checklist of required information and documentation, ensuring every item is accounted for. Double-checking all entries can mitigate the risk of careless mistakes that could jeopardize the submission.

Resources for ongoing support

Access to ongoing support and resources is critical for corporations navigating corporate tax credits. The pdfFiller platform offers a wealth of information, including FAQs, guides, and instructional videos tailored to various tax credit forms. Utilizing these resources can significantly improve understanding and compliance with tax requirements.

If you encounter unique challenges or need specific clarification, pdfFiller's customer support team is available to provide assistance. Their expertise can help craft more efficient submitted forms and guide teams in maximizing their tax credit claims.

Key considerations and best practices

Regular review of tax credit eligibility is a proactive measure corporations should adopt. Changes in tax legislation can impact the tax benefits available, and staying informed can lead to significant savings. Consider implementing a routine review of tax credit policies and local regulations involving corporate tax incentives.

Additionally, always keep abreast of any upcoming updates or modifications in the tax law that may influence your submissions. Invest time in educating internal teams about these best practices to ensure a collective awareness of tax compliance and benefits.

FAQs about the corporate tax credit submission

Understanding the nuances of corporate tax credit submissions can lead to common concerns and queries. For example, what steps should you take if your submission is denied? In this case, reviewing the feedback from the tax authority is essential. Addressing the reason for denial and providing any additional information required can rectify the situation.

Another common query involves how to amend a submitted form. If a mistake is detected after submission, contact the tax authority promptly to understand the correct procedures for amending your form, ensuring compliance with necessary protocols.

Related tax forms and resources on pdfFiller

Utilizing pdfFiller offers access to a variety of related tax forms and resources that can support your corporate tax credit submission process. Links to other relevant forms can help streamline your preparation and compliance efforts. Additionally, understanding other available tax incentives and credits can further enhance your organization's financial strategy, enabling a more robust approach to tax management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate tax credit submission to be eSigned by others?

How do I execute corporate tax credit submission online?

Can I edit corporate tax credit submission on an iOS device?

What is corporate tax credit submission?

Who is required to file corporate tax credit submission?

How to fill out corporate tax credit submission?

What is the purpose of corporate tax credit submission?

What information must be reported on corporate tax credit submission?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.