Get the free Credit Card Application

Get, Create, Make and Sign credit card application

Editing credit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card application

How to fill out credit card application

Who needs credit card application?

A Comprehensive Guide to the Credit Card Application Form

Understanding the credit card application form

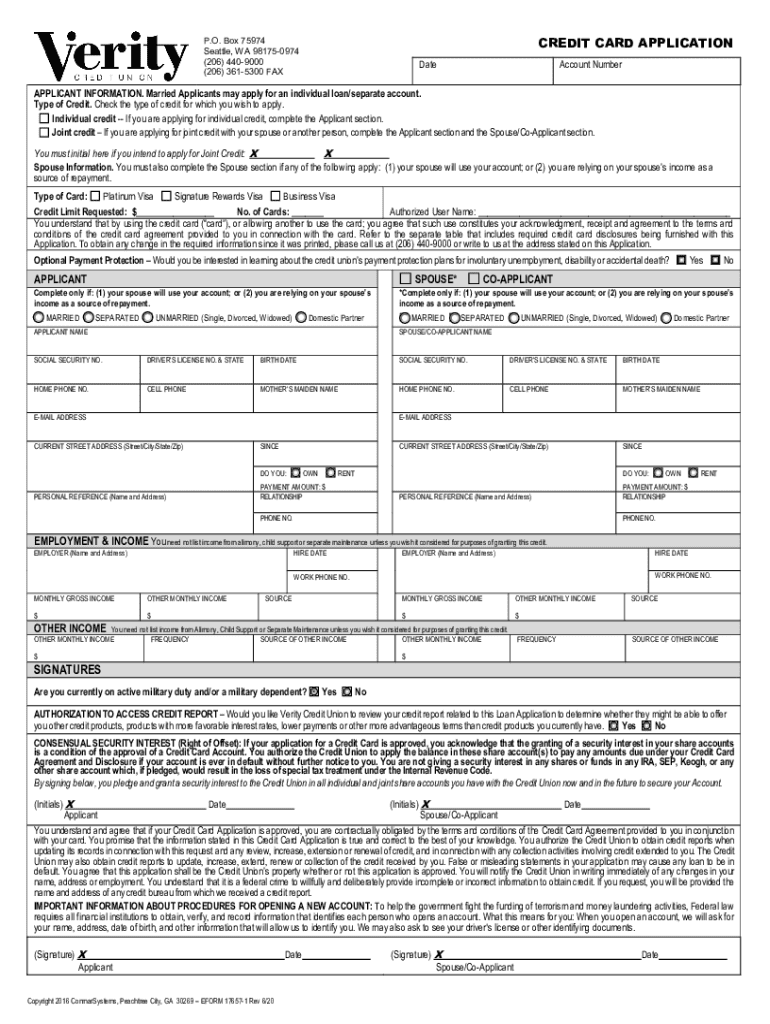

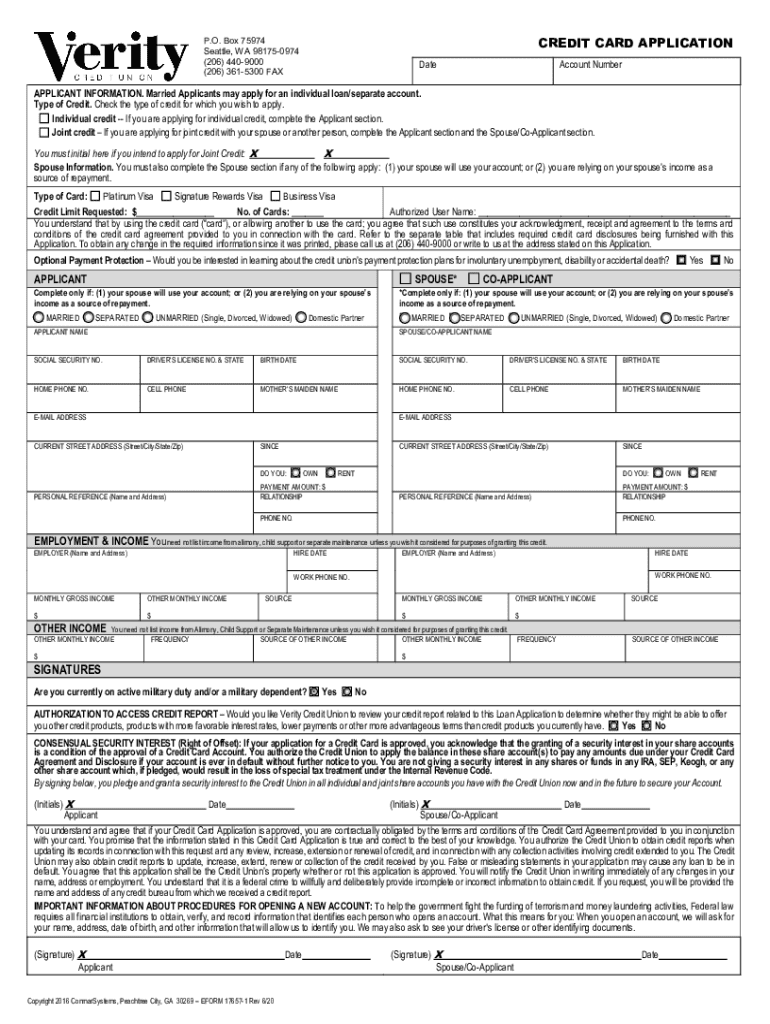

The credit card application form serves as the pivotal document in securing a credit card. It collects essential information that credit issuers use to evaluate applicants' creditworthiness and make informed decisions on approval. Understanding this form can considerably smooth the path toward obtaining a credit card, which can help manage personal finances and build credit history.

Potential applicants include individuals looking for personal credit cards, families needing joint accounts, or even businesses seeking corporate credit options. Specific scenarios necessitating a credit card application might involve making a significant purchase, consolidating debts, or enhancing one's purchasing power.

Key components of a credit card application form

A well-structured credit card application form typically consists of several critical sections, primarily designed to garner personal and financial data from the applicant. The personal information section requires details such as full name, address, date of birth, and social security number. These data points help lenders ascertain identity and calculate potential credit risks.

The financial information segment requires applicants to disclose their sources of income, employment history, and existing debts. Lenders use this data to evaluate the applicant's financial stability. Additionally, applicants are often required to provide insight into their credit history, including current credit scores. Understanding credit scores is essential, as they play a significant role in determining approval rates and interest rates on credit cards.

Types of credit card application forms

Credit card applications are available in various formats. The two primary methods are online applications and traditional paper applications. Online submissions are generally quicker and more efficient, allowing users to fill out forms at their convenience and receive instant feedback. Conversely, paper applications provide a tangible document but can delay the process due to mailing times.

Conditional application forms are also prevalent. These forms are useful for scenarios involving co-applicants or joint applications, where multiple individuals seek credit under a single account. Furthermore, each financial institution may impose specific requirements particular to their credit card offerings, so applicants must be aware of these discrepancies when filling out their forms.

Step-by-step instructions for completing the credit card application form

Completing a credit card application form can be straightforward if approached systematically. The first step involves gathering all necessary documents, such as identification, proof of income, and current debt information. Having these ready can expedite the process significantly.

Next, applicants should fill out the form meticulously. Accuracy is crucial—any discrepancies or errors can lead to application delays or even denials. Common pitfalls include incorrect social security numbers or missing income details, which can undermine the applicant's credibility.

After completing the form, taking time to review and verify the details is essential. Ensure all sections are complete and there are no typos. Finally, applicants can submit their applications either online or via mail. Knowing what to expect after submission, including typical timelines for processing and credit reviews, can provide additional peace of mind.

Interactive tools for simplifying the application process

Utilizing interactive tools like pdfFiller can greatly enhance the credit card application process. pdfFiller features allow users to fill out PDF forms online seamlessly, eliminating the need for printing or manual penmanship. This digital format not only expedites the application process but also ensures that all information is legible and accurately presented.

Moreover, cloud-based solutions empower teams to collaborate effectively while managing multiple applications. For instance, applicants can share their forms for input or review, making group submissions simpler and more organized.

E-signing your credit card application form

E-signatures have become an integral part of the digital application process, offering a secure and legally valid method of signing documents. Understanding the implications of e-signatures, including their security measures, can help applicants feel more comfortable with this technology.

Using pdfFiller to e-sign a credit card application form is straightforward. The platform allows users to integrate a digital signature effectively, ensuring that the document remains legally binding. By following a simple step-by-step guide, users can add their e-signature confidently, thereby completing the application process quickly.

Managing and tracking your application

Once the credit card application has been submitted, understanding the subsequent steps is vital. Following submission, applicants should expect a review period where the credit issuer evaluates the application. This process can take anywhere from a few days to several weeks, depending on the institution.

To ensure that applicants stay informed, they should consider how to effectively follow up on their application. Maintaining communication with the credit issuer through phone calls or online accounts can provide insights on the status of the application and any additional requirements needed.

Common issues and how to resolve them

Potential applicants may experience denial of their credit card applications for various reasons, such as low credit scores or incomplete applications. Understanding the reasons for such outcomes helps applicants address these issues more effectively. If an application is denied, reviewing the detailed denial letter and addressing the cited concerns is vital for future attempts.

Additionally, applicants should regularly check their credit reports for errors. Mistakes in the credit report can adversely affect scores and lead to application denials. Proactively correcting any inaccuracies can enhance applicants' chances during subsequent applications.

Best practices for a successful credit card application

Preparing finances before applying for a credit card is crucial. Applicants should assess their credit score and take steps to improve it if necessary, such as paying down existing debts or correcting credit report errors. Additionally, applicants should be mindful of the timing of their application. Submitting applications at times when one's financial situation is stable can lead to greater approval odds.

Credits and recognition

In the age of technology, tools like pdfFiller stand out as invaluable resources for completing and managing credit card application forms. Their features streamline the processes, allowing users to edit, sign, and organize documents with ease. Recognizing these innovative solutions equips applicants with the means to navigate these forms confidently, enhancing their overall experience during the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card application directly from Gmail?

How do I edit credit card application on an iOS device?

How can I fill out credit card application on an iOS device?

What is credit card application?

Who is required to file credit card application?

How to fill out credit card application?

What is the purpose of credit card application?

What information must be reported on credit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.