A comprehensive guide to creating a financial guarantee template form

Understanding financial guarantees

A financial guarantee is a formal commitment made by a guarantor to pay a debt or fulfill an obligation, should the primary party default. This instrument is crucial in numerous financial transactions, ensuring that creditors have a safety net, thus facilitating trust and security in business dealings.

The importance of a financial guarantee cannot be overstated. It serves as a confidence booster for lenders and creditors, particularly when lending to individuals or entities with limited credit histories. In this way, financial guarantees play a vital role in enabling businesses to access loans and other credit facilities.

A clear definition of the obligations undertaken by the guarantor.

Details regarding the guarantee amount and duration.

Identification of all parties involved in the agreement.

Parties involved in a financial guarantee

Understanding the roles of the parties involved in a financial guarantee is essential. The guarantor is the individual or entity that agrees to be responsible for the debt if the principal debtor defaults. Their obligations include ensuring that the agreed-upon amount is paid to the beneficiary, usually the creditor, ensuring that the transaction is secured.

The beneficiary or the primary creditor in this scenario receives the guarantee, providing assurance that they will ultimately recover their loan or services despite the risk of default from the principal debtor. This layer of protection encourages creditors to extend credit judiciously, knowing their interests are protected.

The principal debtor is the primary party who owes the obligation in question. If they fail to meet their obligations, the guarantor steps in to fulfill the debt. Understanding these roles ensures that all parties are aware of their responsibilities, significantly reducing potential disputes.

Types of financial guarantees

Financial guarantees can be divided into various categories, each serving unique purposes. Personal guarantees typically involve individuals providing assurance for personal loans, commonly utilized by small business owners or when individuals need to secure loans in the absence of sufficient credit history.

On the other hand, corporate guarantees come into play when businesses back each other's obligations. This setup typically occurs in business partnerships where one corporation guarantees the debts of another, thus helping expand their capacity for credit.

Limited guarantees restrict the amount the guarantor may owe.

Unlimited guarantees entail total liability for the guarantor.

Payment and collection guarantees assure the lender of fully covering the outstanding payments should the debtor default.

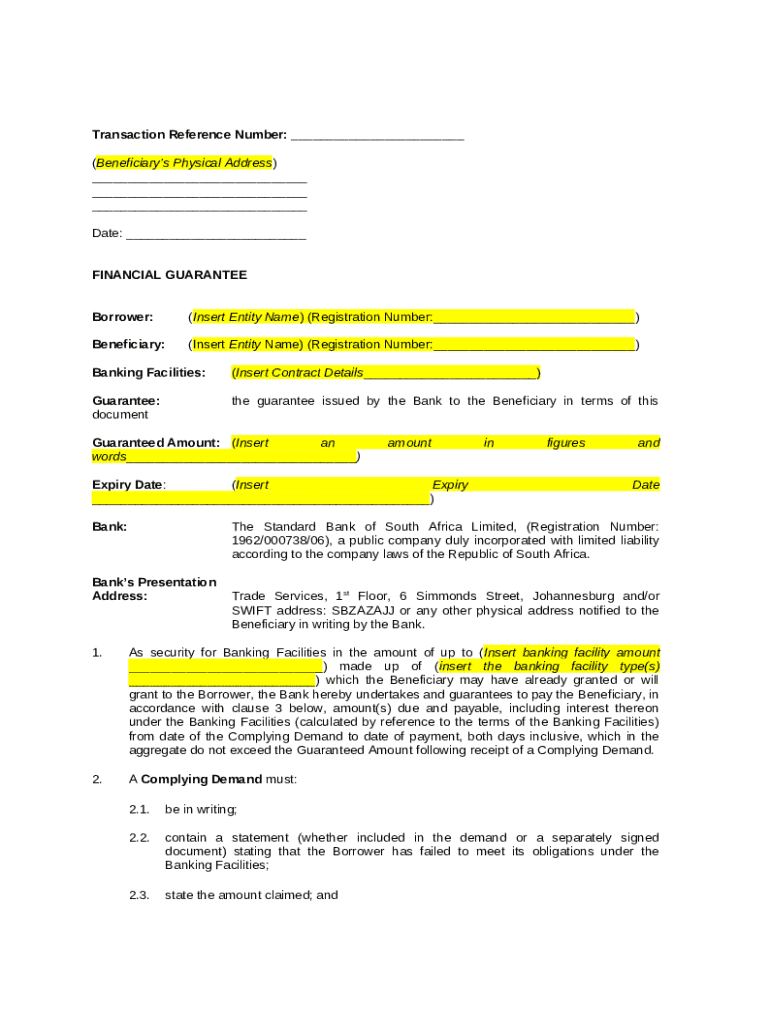

Creating your financial guarantee template form

Creating a robust financial guarantee template form requires a systematic approach. Start by determining your specific needs based on the transaction and the parties involved. Use this context to decide the extent and type of guarantee required.

Next, gather all necessary information, including personal and financial details of the guarantor, the principal debtor, and the beneficiary. You must also consider any legal requirements specific to your jurisdiction that may influence the structure of the guarantee.

Choosing the right template

Using a platform like pdfFiller can significantly streamline this process. With its collection of interactive templates, you can easily select a financial guarantee template that fits your needs.

Fill out the template carefully, ensuring that you include all required information clearly and concisely. Common pitfalls include omitting essential details or mislabeling parties, which can cause confusion and potential legal disputes.

Editing and customizing your financial guarantee

Once you have your financial guarantee template form filled out, leverage pdfFiller's editing tools to enhance accessibility. These features include drag-and-drop capabilities and customizable form fields, allowing you to tailor the document to fit your needs.

Additionally, incorporating signature fields is crucial for proper execution of your guarantee. Ensure that all parties involved have the opportunity to review and sign the document, fostering transparency and compliance with legal standards.

Collaborative features on pdfFiller allow for real-time sharing and editing. This capability is particularly beneficial for teams, enabling multiple stakeholders to provide input simultaneously and ensure swift completion of the documentation.

Managing your financial guarantee

Post-creation, managing your financial guarantee is crucial. Secure cloud storage options provided by pdfFiller safeguard your documents, ensuring that they remain accessible yet protected from unauthorized access.

Monitoring changes and versions of your document is vital. Document integrity can be compromised if revisions aren’t correctly tracked. Knowing who made which changes can help mitigate misunderstandings among the involved parties.

If circumstances change, being aware of the processes to revoke or replace guarantees is essential. Legal considerations around replacements need to be understood to maintain document validity.

Common questions about financial guarantees

Several questions often arise concerning financial guarantees. One critical question is what happens if the guarantor defaults. If the guarantor fails to fulfill their obligations, the creditor may pursue the principal debtor directly or look for alternative means to cover the default.

Enforcement mechanisms are also a frequent point of inquiry. This usually involves formal communication with the guarantor and, if unresolved, legal proceedings that may vary based on jurisdiction.

Can guarantees be transferred? Yes, although conditions apply.

Legal implications of signing a guarantee often involve full awareness of potential liabilities.

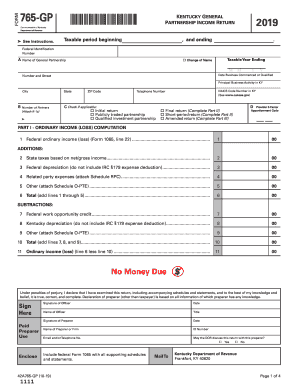

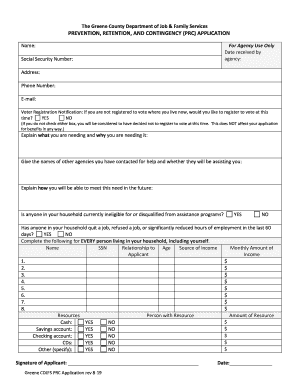

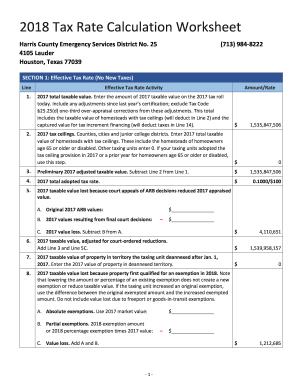

Related forms and resources

If you are working with financial guarantees, several standard forms can aid in your efforts. Financial guarantee forms, bond quantity worksheets, and monitoring reports may streamline your processes.

Posting a financial guarantee involves important steps that must be followed. Understanding how to navigate these resources ensures you are well-prepared and equipped to handle various financial obligations.

Features of pdfFiller relevant to financial guarantees

pdfFiller offers seamless document management capabilities, which are invaluable when dealing with financial guarantees. Its cloud-based solution enables easy access and collaboration, ensuring you never miss a crucial update.

The eSignature functionality enhances the security of your documents, allowing for lawful sign-offs without the need for physical presence. The platform’s user-friendly interface tailors the experience to individuals and teams, facilitating an efficient path to managing all document-related needs.

Industry applications of financial guarantees

Financial guarantees have widespread applications across various industries. In real estate transactions, they often serve to secure lease agreements or mortgage loans, ensuring property ownership is maintained through the guarantee of payments.

In the realm of business, financial guarantees facilitate loans and credit facilities that enable growth and operational expansion. They are also staple components in construction and performance bonds, ensuring that projects are completed as outlined in contracts, safeguarding financial interests.

Financial guarantee case studies

Analyzing successful applications of financial guarantees reveals a great deal of insight into their importance. For instance, businesses that have utilized personal guarantees when seeking loans have often secured the funds needed for expansion, leading to increased revenue and job creation.

Conversely, studying defaults on guarantees provides essential lessons. Businesses that approached financial guarantees with insufficient understanding often faced legal issues, damaging their reputations. Understanding these case studies fosters a more profound appreciation of the strategic use of financial guarantees.