Get the free Certificate of Exemption – Agar 2024/25 Form 2

Get, Create, Make and Sign certificate of exemption agar

How to edit certificate of exemption agar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption agar

How to fill out certificate of exemption agar

Who needs certificate of exemption agar?

Navigating the Certificate of Exemption AGAR Form

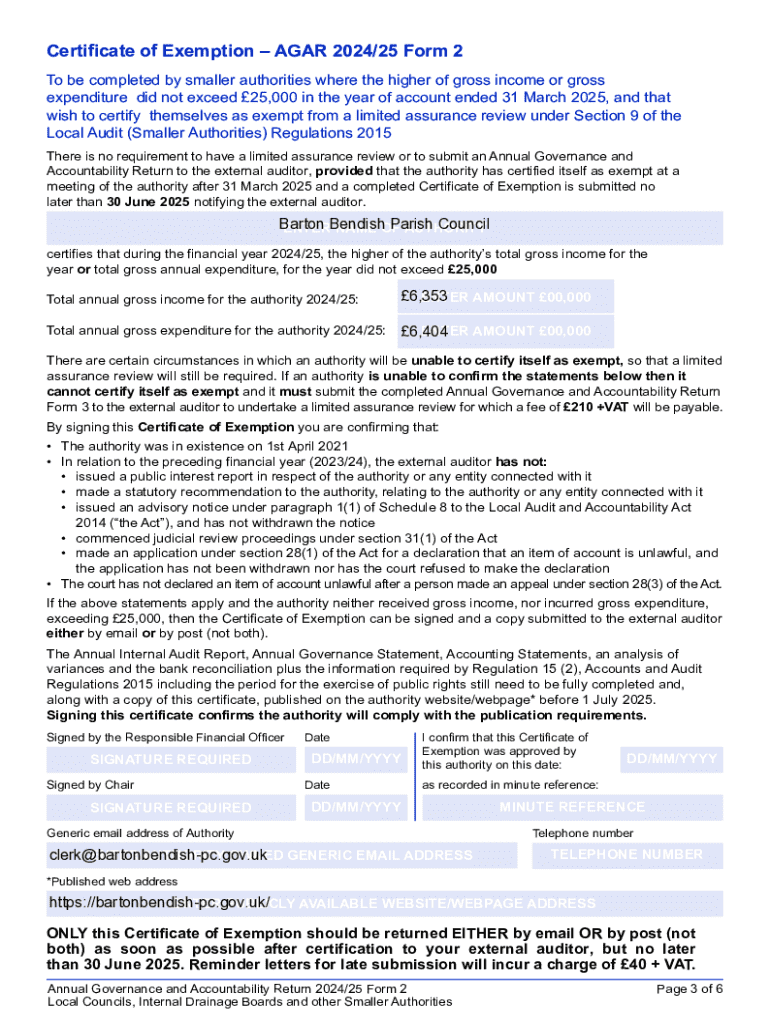

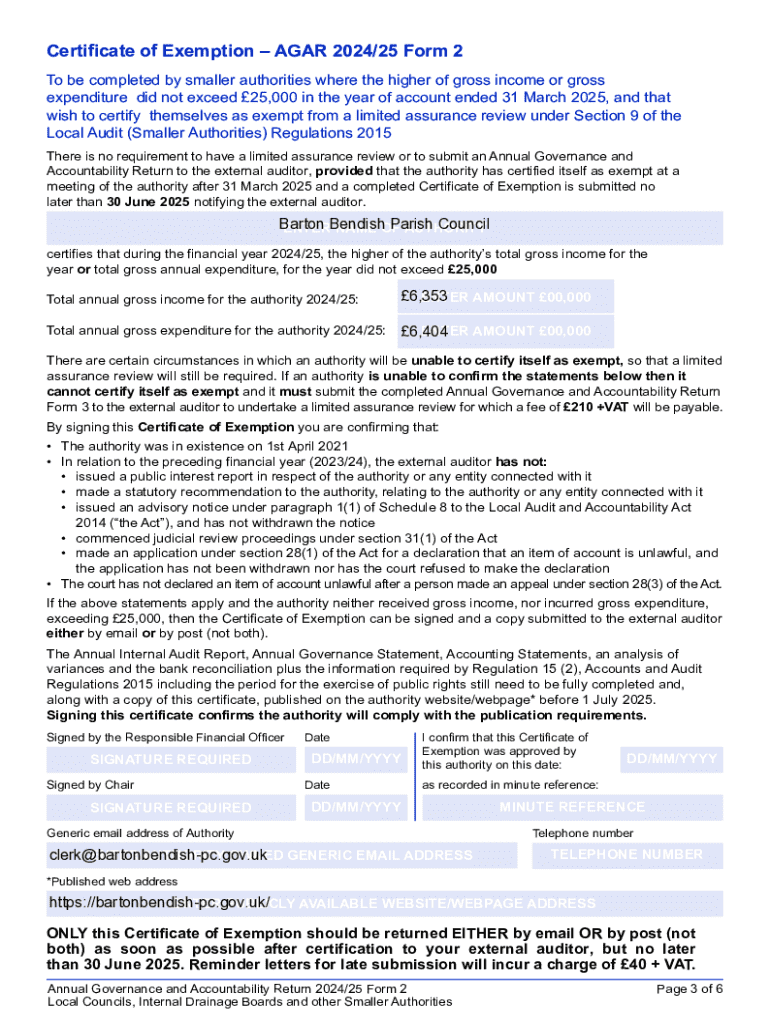

Understanding the Certificate of Exemption

The Certificate of Exemption serves as a vital document for local authorities, confirming that certain entities are shielded from specific reporting obligations under the Annual Governance and Accountability Return (AGAR). Its primary purpose is to simplify financial reporting for organizations that fall below certain financial thresholds, ensuring efficient governance without undue burden.

The AGAR form is integral to local governance, playing a significant role in how local councils demonstrate accountability and transparency in financial management. For many lesser-funded organizations, the inclusion of the Certificate of Exemption can streamline the audit process, allowing them to focus on community service rather than exhaustive paperwork.

Typically, any small local council or community organization may require a Certificate of Exemption when their annual income or expenditures do not exceed specific limits. Understanding who needs one and the implications of ineligibility is crucial for effective financial planning.

Key components of the AGAR and Certificate of Exemption

The structure of the AGAR form is multifaceted, crafted to capture comprehensive data about an organization's financial activities over the fiscal year. The Certificate of Exemption is embedded within this framework, clarifying that qualifying organizations operate within specific thresholds.

Each section of the AGAR form addresses different components of financial accountability, including income statements, expenditure reports, and a statement of governance. Crucially, the Certificate of Exemption indicates whether a full audit is necessary, simplifying oversight for smaller entities. Users must ensure that they cross-reference this form with other documentation, such as financial statements, to ensure completeness.

Eligibility criteria for the Certificate of Exemption

To qualify for a Certificate of Exemption, organizations must meet financial thresholds typically set by local governance bodies. As of the latest guidelines, organizations with an annual income not exceeding a specified limit—often around £25,000—are eligible for exemption. Knowing the exact figure is crucial, as local policies may vary.

In addition to income criteria, organizations may need to confirm compliance with other conditions, such as adhering to local governance mandates or ensuring proper expenditure documentation. Some specific organizations, such as charities, may face additional scrutiny or alternate requirements, so recognizing these distinctions is essential for applicants.

Step-by-step instructions for filing the Certificate of Exemption

Filing the Certificate of Exemption involves a systematic approach that begins with preparing the necessary documentation. Entities must gather foundational documents, including financial statements, meeting minutes that outline governance practices, and accurate totals relating to income and expenditures.

Filling out the form itself requires attention to detail. Each section needs to be completed accurately to avoid issues later in the process. Common mistakes often include omissions in financial reporting or failing to properly authenticate the document with required signatures.

Electronic submission of the Certificate of Exemption

In today's digitized environment, submitting the Certificate of Exemption electronically offers numerous benefits. Notably, users can utilize platforms like pdfFiller to submit forms seamlessly. The ease of access provided by cloud-based solutions means organizations can submit their certificates from anywhere, removing geographic barriers.

When it comes to submission methods, options such as filling out forms directly on pdfFiller or uploading completed PDFs are available. This versatility allows for quick revisions and hassle-free tracking.

Managing and tracking your certification process

Once your submission is complete, the next step is proactive management of your certificate's processing. Follow-up communication with local authorities ensures that any delays or additional requirements are swiftly addressed.

Accessing and reviewing submitted documents is also crucial. Platforms like pdfFiller offer tracking mechanisms that allow users to monitor the status of their applications easily. Should any queries arise, understanding how to respond effectively can help clarify matters with authorities.

FAQs about the Certificate of Exemption AGAR form

Frequently asked questions often revolve around what to do following a rejection of the Certificate of Exemption. The first step is to carefully review the provided feedback to understand the reasons behind the rejection. Making the necessary corrections before resubmission is essential for increased chances of approval.

Another common concern is how to amend a submitted form. If changes are required, a straightforward process typically involves completing an amendment form and resubmitting it to the appropriate local authority. Having clear guidelines can streamline these procedures.

Date reminders and key deadlines for 2024/25 AGAR filing

Awareness of critical deadlines is essential for successful submission of the Certificate of Exemption AGAR form. Various deadlines must be met, including those for submissions and reviews by local councils. For the fiscal year 2024/25, organizations should prepare for submission due dates that fall within the early months of the financial year.

Establishing a timeline can greatly facilitate organizational readiness. Highlighting important dates for document reviews ensures that teams stay on track and meet all necessary governance standards.

Resources for additional support and information

Engaging with official guidance and policy documents empowers organizations to gain clarity on their responsibilities concerning the Certificate of Exemption. Local councils often provide extensive resources outlining procedural requirements for filing the AGAR form.

Utilizing online tools such as templates available through pdfFiller can further enhance the filing process. These resources offer streamlined formats that ensure compliance with necessary standards.

Real-world examples and case studies

Examining successful uses of the Certificate of Exemption can provide insight into best practices. Numerous organizations have effectively utilized this certificate to facilitate their operations without the burden of an audit, allowing them to concentrate resources on community impact.

Case studies reveal that community groups have successfully navigated the AGAR filing processes by adhering strictly to guidelines and leveraging tools such as pdfFiller for accurate submissions. Testimonials from users validate this approach, highlighting time savings and improved accuracy.

Stay compliant: Policies and best practices

Understanding the policies that govern the Certificate of Exemption and AGAR filings is fundamental for compliance. Local councils often have specific regulations in place that outline the requirements for financial reporting and accountability.

Instituting best practices in governance, such as regular financial reviews and maintaining transparent documentation, ensures that organizations uphold their obligations while fostering trust within the community.

Community support and further engagement

Getting involved with local governance groups can significantly enhance understanding and compliance related to the Certificate of Exemption. Networks of community-focused organizations often share insights and resources that improve knowledge and best practices within the sector.

Staying updated with AGAR changes is essential for all stakeholders. Engaging in networking opportunities fosters connections that can aid in sharing challenges and solutions among peers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit certificate of exemption agar online?

How do I fill out the certificate of exemption agar form on my smartphone?

How do I fill out certificate of exemption agar on an Android device?

What is certificate of exemption agar?

Who is required to file certificate of exemption agar?

How to fill out certificate of exemption agar?

What is the purpose of certificate of exemption agar?

What information must be reported on certificate of exemption agar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.