Get the free Check Deposit Guarantee Letter

Get, Create, Make and Sign check deposit guarantee letter

Editing check deposit guarantee letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check deposit guarantee letter

How to fill out check deposit guarantee letter

Who needs check deposit guarantee letter?

Check Deposit Guarantee Letter Form: A Comprehensive How-to Guide

Understanding the check deposit guarantee letter

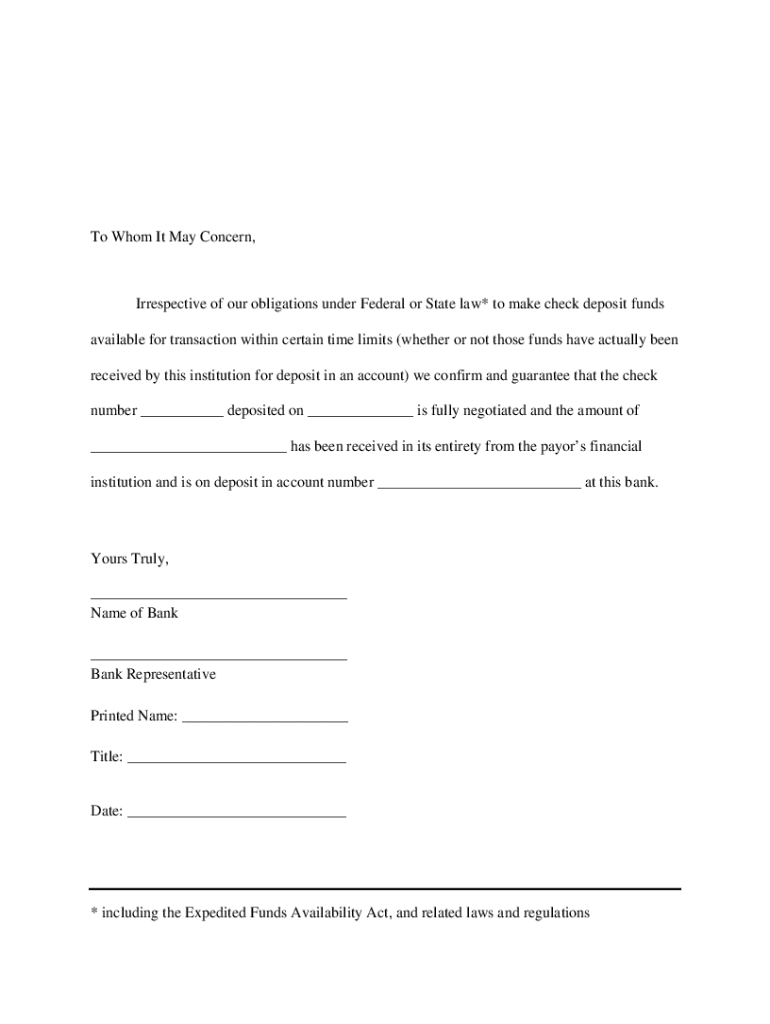

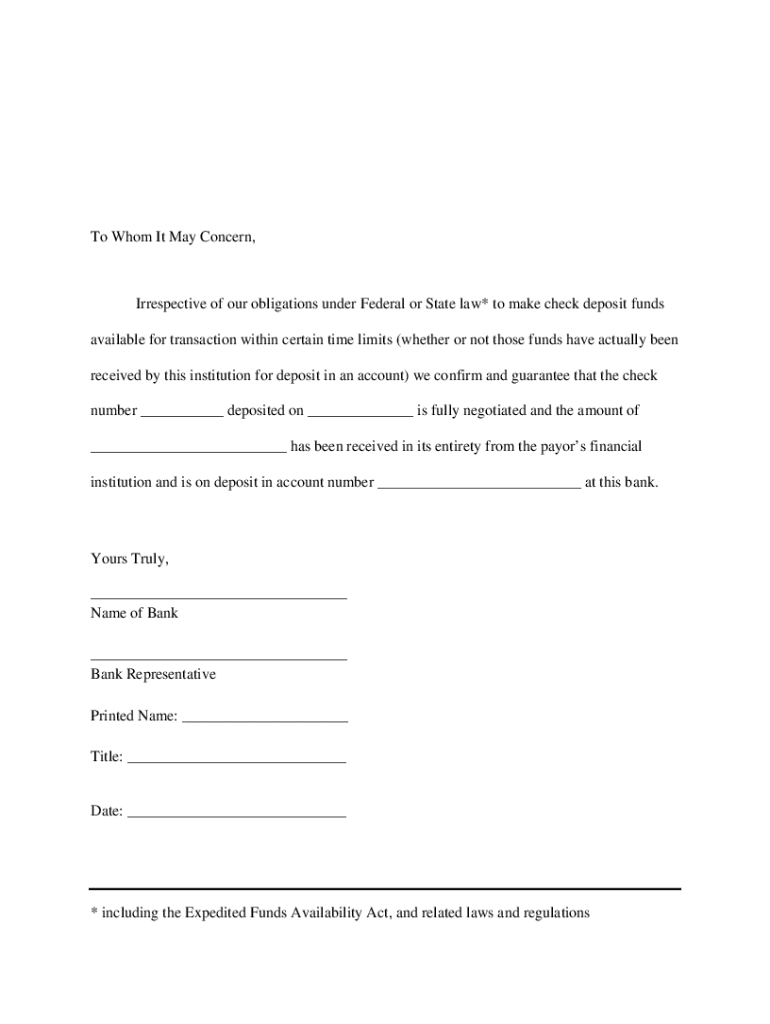

A check deposit guarantee letter is a formal document utilized to assure the receiving party that a specific amount of money will be deposited into their account. This letter not only serves as a promise of funds but also provides documented proof that can facilitate smoother transactions between individuals or businesses. The importance of such a letter can’t be overstated; it acts as a safety net during potentially risky financial dealings, ensuring that both parties feel secure in the transaction.

Individuals and entities may find themselves in situations where a check deposit guarantee letter is essential, such as real estate transactions, substantial purchases, or service agreements where upfront payments are common. Having this letter helps build trust and guarantees that financial obligations will be met.

Components of a check deposit guarantee letter

A well-structured check deposit guarantee letter contains several essential elements that convey its intent clearly. First, the date and recipient details should be present at the top; these details help in identifying when and to whom the letter was issued. Next, the amount being guaranteed must be explicitly stated. This is crucial as it defines the limits of what is being promised and provides clarity to the recipient.

Beyond the essential components, there are optional details that can further enhance the credibility of the letter. Incorporating your company letterhead adds a professional touch, while including transaction identification numbers can assist in tracking and referencing the specific transaction in future communications.

Preparing to fill out the form

Before diving into filling out the check deposit guarantee letter, gathering necessary information is crucial. You will need personal identification details such as your name, address, phone number, and email, as well as the bank's information where the deposit will be made. This organized approach helps prevent any confusion during the writing process.

Moreover, it’s essential to understand your bank's requirements. Different banks might have specific regulations regarding such letters, and it’s wise to verify these criteria before proceeding. Common mistakes include miscalculating deposit amounts or failing to obtain the proper signatures, which can delay or complicate your transaction.

Step-by-step instructions for filling out the check deposit guarantee letter form

Filling out the check deposit guarantee letter form requires attention to detail. Begin by inputting your personal information and the bank details in the designated sections. Clearly outline the guarantee amount in bold to emphasize this element, as it is the crux of the letter. Don't forget to provide adequate space for signatures, which should include your name, title (if applicable), and the date.

To ensure clarity and accuracy, use straightforward language. Avoid jargon or ambiguous terms that may confuse the reader. It's also crucial to ensure that your handwriting is legible, particularly if you're filling out the letter by hand, to prevent any misunderstandings.

Editing and customizing your document

Utilizing pdfFiller tools can significantly simplify the editing process for your check deposit guarantee letter. By accessing online editing tools, you can make adjustments easily, add notes or additional clauses if needed, and ensure the document is precisely tailored to your situation.

Legal language can be tricky, but certain guidelines can help ensure compliance with legal requirements. If the transaction is substantial, it may be beneficial to have the document reviewed by a legal team to confirm that the terms are enforceable and in line with regulations.

Signing the check deposit guarantee letter

When it comes to signing the check deposit guarantee letter, you have several options. One of the most convenient is to opt for an electronic signature. If you're using pdfFiller, the platform provides functionality for eSigning documents directly, streamlining the process without needing to print or scan physical copies.

It's also important to understand the differences between traditional and digital signing. While digital signatures are becoming increasingly accepted and can expedite transactions, there are instances — especially with large organizations or legal matters — where traditional signatures may be necessary. Always weigh the options against the specific requirements of the transaction.

Submitting the check deposit guarantee letter

Once you've completed and signed the check deposit guarantee letter, you need to submit it properly. One common method is to deliver the letter directly to your bank, ensuring it goes to the correct department for processing. Alternatively, you might choose to send it via email or through a secure portal if directed by the bank.

After submission, tracking the letter and confirming its receipt can prevent potential delays or issues. It's best to establish a timeline for checking in after submission to verify that the letter has been processed correctly.

Managing your check deposit guarantee letters

Storage and organization are key when it comes to managing check deposit guarantee letters. Using cloud storage solutions like pdfFiller enables you to keep all your documents in one accessible location. By creating specific folders for different transactions, you’ll find it easier to retrieve important letters when needed.

Moreover, accessing your documents from anywhere is not only convenient but essential for efficient management. pdfFiller offers a mobile app that allows you to manage your documents on the go, which is particularly helpful in today’s fast-paced environment.

Common scenarios and FAQs

Various scenarios may arise where a check deposit guarantee letter is necessary. For instance, someone purchasing a home might need to provide a guarantee letter as part of the earnest money deposit, ensuring that funds are secured during negotiations. Additionally, service agreements that involve significant payments upfront often require similar documentation to protect all involved parties.

Addressing frequently asked questions can clarify common concerns about these letters. Such questions might include inquiries about how long a guarantee lasts, what happens if funds are not available when expected, or whether the letter can be revoked. Providing clear answers to these queries can help demystify the process for users.

Ensuring security and confidentiality

The confidentiality and security of your check deposit guarantee letter must be prioritized. Utilizing pdfFiller's features such as password protection can safeguard sensitive information from unauthorized access, ensuring that your documents remain secure.

Additionally, understanding privacy policies within pdfFiller can provide peace of mind regarding data handling practices. Being informed about how your data is used and what protections are in place is vital, especially when dealing with financial documents.

Conclusion on the use of check deposit guarantee letter forms

Effectively managing and utilizing check deposit guarantee letters can significantly enhance your financial transactions. These letters not only safeguard interests but also foster trust and transparency between parties. As you navigate through various transactions requiring such documents, following the steps outlined in this guide ensures that you are well-prepared to issue, receive, and manage check deposit guarantee letters with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit check deposit guarantee letter online?

Can I sign the check deposit guarantee letter electronically in Chrome?

How do I fill out the check deposit guarantee letter form on my smartphone?

What is check deposit guarantee letter?

Who is required to file check deposit guarantee letter?

How to fill out check deposit guarantee letter?

What is the purpose of check deposit guarantee letter?

What information must be reported on check deposit guarantee letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.