Get the free Direct Debit Instruction Form

Get, Create, Make and Sign direct debit instruction form

Editing direct debit instruction form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct debit instruction form

How to fill out direct debit instruction form

Who needs direct debit instruction form?

A comprehensive guide to direct debit instruction forms

Overview of direct debit instructions

A Direct Debit Instruction (DDI) is a written request that authorizes a bank or financial institution to withdraw funds directly from an individual's account for payment of services or bills at specified intervals. DDIs are essential tools in financial management for both individuals and businesses, offering a convenient way to automate payments and avoid late fees.

The importance of DDIs lies in their ability to streamline payment processes, ensuring that obligations are met on time without requiring manual intervention each month. Key features of utilizing a DDI effectively include the flexibility of payment options, clarity in transaction records, and peace of mind for users, knowing their funds will be managed responsibly.

Understanding the direct debit process

The Direct Debit process encompasses several stages. It typically begins with the payer providing their bank with the signed Direct Debit Instruction. Once set up, the payee submits the payment request to the payer's bank, which processes this request according to the agreed schedule.

There are two main types of Direct Debit Instructions: one-off payments for singular transactions and recurring payments for regular, ongoing commitments. Automated payments simplify budgeting and ensure that users do not miss any deadlines, promoting better financial health.

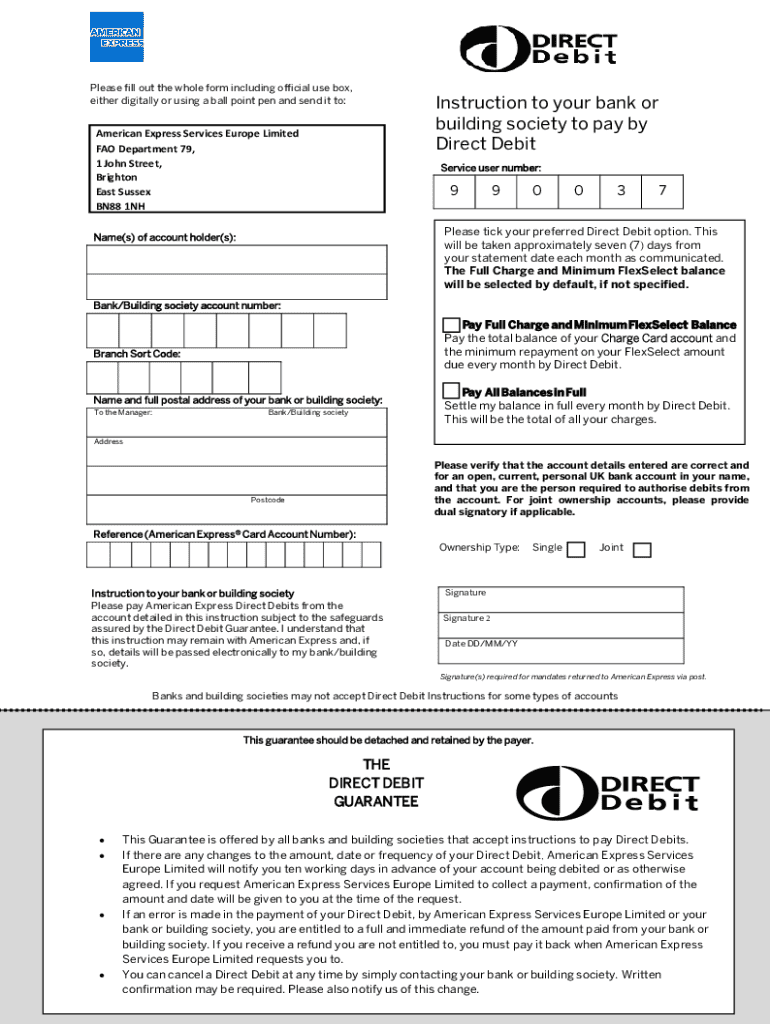

Components of an effective direct debit instruction form

An effective Direct Debit Instruction form should include several essential components to facilitate smooth transactions. These include the payer's personal information—such as name, address, and bank account number—as well as the details of the payee, including their name and organization.

Understanding the significance of each component can prevent errors. Personal details and payee information ensure correct processing, while payment amounts and frequency keep billing aligned with user expectations. It's crucial to distinguish between optional and mandatory fields, emphasizing the necessity of completing required information to avoid payment delays.

Step-by-step guide to filling out a direct debit instruction form

Completing a Direct Debit Instruction form correctly is vital for smooth transactions. Follow these steps to ensure accuracy:

To avoid common mistakes, double-check the spelling of names and ensure that account numbers are entered without any discrepancies, as inaccuracies can lead to payment failures or misrouted funds.

Submitting your direct debit instruction

Once the Direct Debit Instruction form is completed, it's time to submit it. There are multiple submission methods available, each providing varying degrees of convenience.

After submitting, expect a processing time which may vary from one bank to another, along with a confirmation of the successful setup. Keeping an eye on your bank statements during the initial payments can help ensure everything is functioning as intended.

Managing your direct debit instructions

Managing your Direct Debit Instructions efficiently is essential, as circumstances or preferences can change. To amend payment details or terminate a Direct Debit, specific steps need to be followed.

Keeping records of Direct Debit instructions is crucial for tracking payments and ensuring accountability. Document all transactions and changes to maintain accurate financial records.

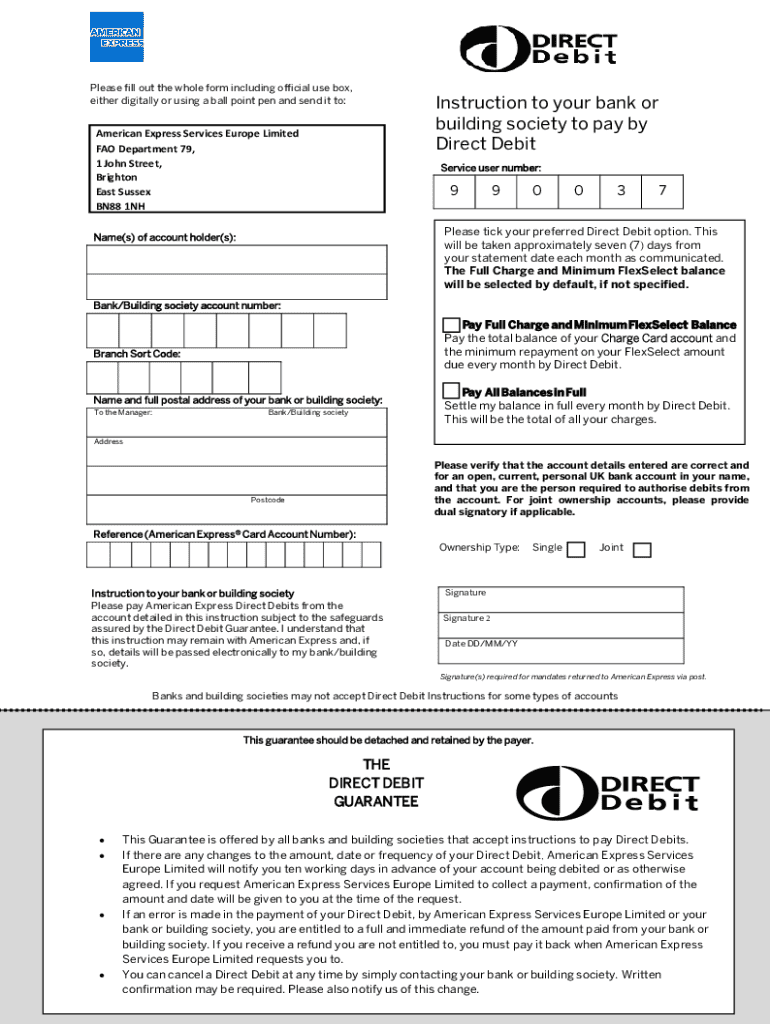

Understanding direct debit guarantees

The Direct Debit Guarantee provides comprehensive protection for payers, assuring them that their payments will only be taken with their consent. This guarantee means that in cases of error, such as incorrect amounts or unauthorized transactions, the payer has the right to a full refund from their bank.

Understanding the guarantees can empower users to feel secure in setting up Direct Debits, knowing that their financial transactions are upheld by strong protections.

Troubleshooting common issues with direct debit instructions

While Direct Debit systems are generally reliable, issues can arise from time to time. Common problems include payment failures, delays in processing, or disputes regarding charged amounts.

In situations that are unclear, contacting customer service should provide assistance and help resolve the issue promptly.

Best practices for using direct debit instructions

Staying organized with Direct Debit Instructions ensures that users do not encounter unexpected issues. Maintaining a calendar to track payment due dates can help manage finances effectively.

Understanding these practices can aid in preventing financial errors while also reinforcing users' confidence in automated payment systems.

Frequently asked questions about direct debit instructions

Several common queries often arise concerning Direct Debit Instructions. For instance, what is a Direct Debit reference number? This number serves as a unique identifier for each Direct Debit and aids both the payer and payee in monitoring transactions.

These FAQs encompass concerns that users may have, reinforcing the importance of understanding and practicing effective Direct Debit management.

Advanced features for managing direct debits on pdfFiller

pdfFiller offers advanced functionalities designed to optimize the management of Direct Debit Instructions. Interactive tools allow for easy editing and signing of documents online, reducing the need for paper forms.

Leveraging these tools can greatly enhance the experience of managing Direct Debit Instructions, making payments seamless and ensuring proper oversight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send direct debit instruction form for eSignature?

How do I make edits in direct debit instruction form without leaving Chrome?

Can I create an eSignature for the direct debit instruction form in Gmail?

What is direct debit instruction form?

Who is required to file direct debit instruction form?

How to fill out direct debit instruction form?

What is the purpose of direct debit instruction form?

What information must be reported on direct debit instruction form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.