Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

A comprehensive guide to the credit card authorization form

What is a credit card authorization form?

A credit card authorization form is a document that allows a business to securely charge a customer's credit card for a specific transaction or series of transactions. The purpose of such forms is to obtain explicit permission from the cardholder, safeguarding both the merchant's and the customer's interests.

This form plays a critical role in payment processing as it ensures that the cardholder acknowledges and agrees to the payment. Legal considerations surrounding credit card transactions necessitate clear documentation, especially in cases of disputes or chargebacks.

Benefits of using a credit card authorization form

Utilizing a credit card authorization form offers several key advantages for businesses and customers alike. Firstly, it significantly reduces chargeback risks. Since the form requires explicit consent from customers, it provides evidence that they approved the transaction, making it harder for them to dispute the charge.

Additionally, these forms establish trust between parties. Customers feel more secure knowing their payment information is being handled appropriately. Another benefit is the simplification of payment processes; a well-structured form can streamline transactions, allowing for quick processing.

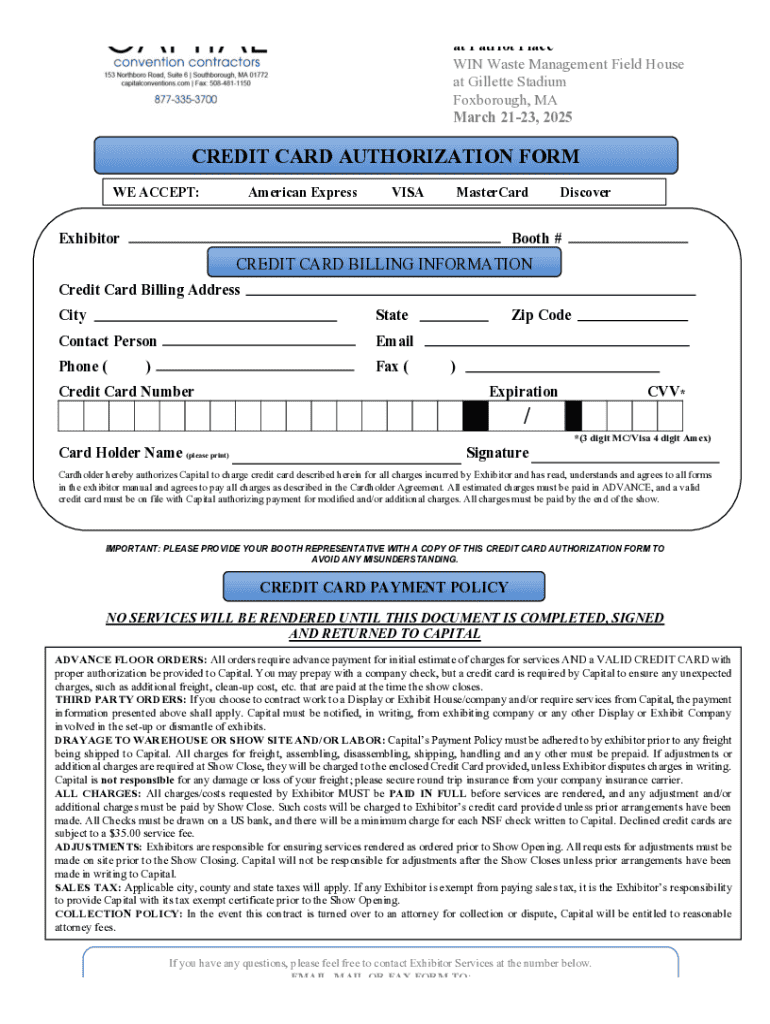

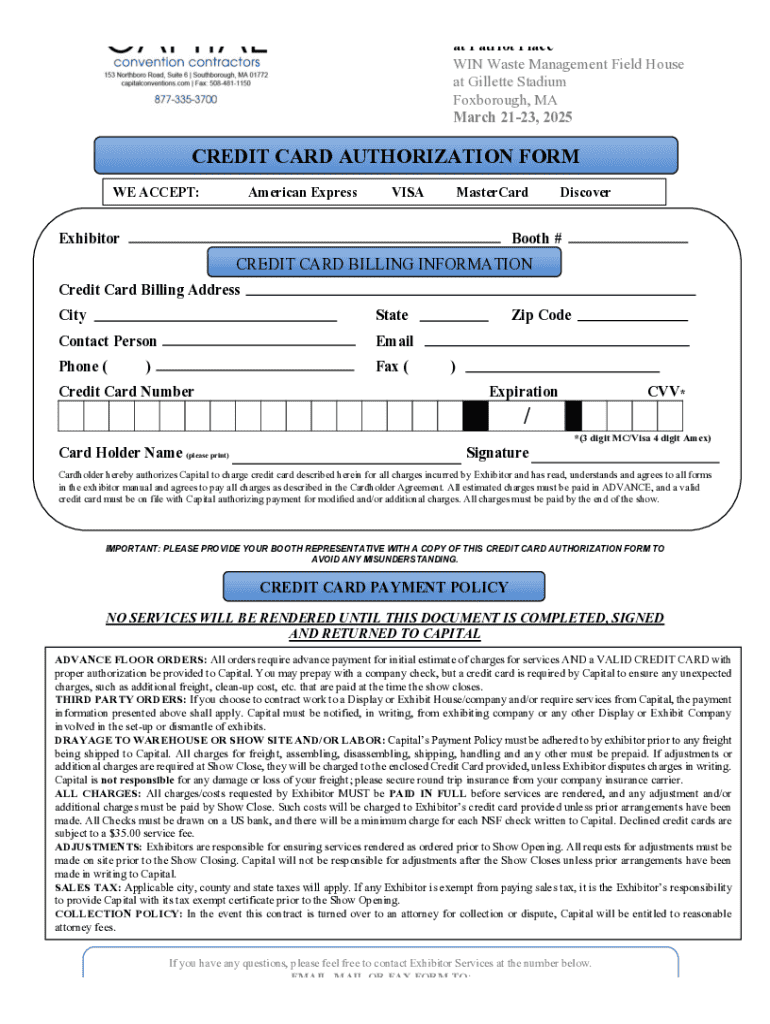

Key components of a credit card authorization form

An effective credit card authorization form must include several key components to be valid. Firstly, customer information is essential. This includes the full name, contact number, and email address, which help in identifying the customer and reaching out to them if necessary.

Next, the payment details must be clearly outlined. This includes the credit card number, expiration date, and billing address. Additionally, a clear authorization statement needs to be present, along with a section for the customer's signature, confirming their consent. It should also incorporate terms and conditions to inform customers about the transaction details and payment policies.

When to use a credit card authorization form

There are specific scenarios when using a credit card authorization form is advisable. For recurring payments, this form helps set up an automated transaction cycle while ensuring the customer's ongoing consent. In the case of high-value transactions, having a signed form provides an additional layer of protection for both parties.

E-commerce platforms often require this documentation, especially when the customer is not physically present. Furthermore, this form is essential for processing over-the-phone payments, where verbal consent alone may not suffice.

How to complete a credit card authorization form

Completing a credit card authorization form may seem daunting at first; however, it can be straightforward with a step-by-step approach. Firstly, customers should provide all necessary personal information, ensuring that it is accurate. Next, they should enter their payment information, including their credit card details.

Understanding and accepting the terms outlined in the form is crucial. Before signing, customers should ensure they have read and agree to all conditions. Lastly, they must sign the form, giving their explicit consent to the charges.

Common errors to avoid include entering incorrect card details, failing to read the terms, and neglecting to sign the form, which can result in payment processing issues or disputes.

Electronic vs. paper forms: which is better?

Choosing between electronic and paper forms for credit card authorization can significantly impact efficiency and security. Digital forms offer the convenience of accessibility and easy storage—documents can be quickly retrieved and shared with team members. Moreover, electronic forms often come equipped with enhanced security features, ensuring sensitive customer data is well-protected.

Conversely, paper forms can be more cumbersome, requiring physical storage space. Furthermore, they generally lack the security measures inherent in digital formats, making them more susceptible to fraud. Therefore, opting for electronic forms, particularly through platforms like pdfFiller, is often the preferred choice.

Using pdfFiller to manage your credit card authorization forms

pdfFiller streamlines the management of credit card authorization forms by offering a user-friendly interface and powerful editing features. Users can upload their existing forms or create new ones from scratch. Editing tools allow businesses to customize forms to meet specific needs. Additionally, pdfFiller supports the integration of eSignatures, making it easy for customers to approve documents securely.

The platform also facilitates team collaboration by enabling shared access to documents. Users can comment and suggest edits, enhancing workflow efficiency. Finally, with cloud storage, completed forms are securely stored and easily accessible, eliminating the risk of data loss or misplacement.

FAQs about credit card authorization forms

Many questions surround credit card authorization forms due to their importance in financial transactions. One common query is about the legal obligation to use such forms. While not a legal requirement for all transactions, businesses benefit significantly from having clear authorization in place.

Security is another primary concern. Businesses should store signed forms securely to protect customer information, implementing measures like encryption and limited access protocols. If a form is filled out incorrectly, the best course of action is to address the errors immediately, clarifying with the customer before proceeding with the transaction. Lastly, businesses can use these forms for international transactions, but they must ensure compliance with different countries' regulations.

Strategies for protecting against fraud

Fraud prevention is critical when handling sensitive credit card information. Implementing best practices for data protection is essential. This includes ensuring PCI compliance, which mandates stringent security measures for businesses processing card transactions. Regularly monitoring transactions for any unusual activity can help identify potential fraud early.

Businesses should also train employees on recognizing phishing attempts and secure data handling practices. Awareness can significantly reduce the risk of fraud. Moreover, establishing robust protocols for customer verification during transactions ensures that the person authorizing the charge is indeed the cardholder.

Future trends in credit card authorization

As technology advances, the landscape of credit card authorization is changing. The shift towards contactless payments is revolutionizing how transactions occur, providing faster and more secure options for customers. Integration with mobile wallets and e-wallets is also becoming more prevalent, allowing customers to store and manage payment information more conveniently.

Furthermore, advancements in data security technologies, such as biometric verification, are emerging. These innovations aim to enhance the security of transactions, making it increasingly challenging for fraudsters to exploit weaknesses. Businesses should stay informed about these trends to adapt their processing strategies accordingly.

Popular templates and resources

For businesses looking to implement credit card authorization forms, pdfFiller provides a range of downloadable templates. These templates can be fully customized to fit individual business needs. Users can access examples of completed forms for reference to avoid common pitfalls when creating their forms.

Customization options further enhance usability, allowing businesses to incorporate their branding and specific terms. This adaptability can lead to a professional appearance and improved customer satisfaction, as customers receive clear and concise information about their transactions.

Additional insights

Real-life applications of credit card authorization forms provide invaluable insights into their effectiveness. Various sectors have successfully integrated these forms into their payment strategies, demonstrating an increase in customer trust and overall transaction efficiency. Industry experts often emphasize the importance of maintaining clear, concise communication in payment processes to prevent misunderstandings.

Case studies from different businesses reveal success stories attributed to effective credit card transaction management. These insights underline how crucial it is for organizations to adapt and foster secure payment environments to meet rising customer expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form for eSignature?

How can I get credit card authorization form?

How do I fill out credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.