Get the free Consumer Use Tax Return

Get, Create, Make and Sign consumer use tax return

How to edit consumer use tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer use tax return

How to fill out consumer use tax return

Who needs consumer use tax return?

Consumer Use Tax Return Form: A Comprehensive Guide

Understanding consumer use tax

Consumer use tax is a tax imposed on the use, storage, or consumption of tangible personal property in a given state when sales tax has not been collected at the time of purchase. This tax ensures that consumers contribute their fair share to state revenue, compensating for the goods purchased out of state or online that were not subject to the local sales tax.

The importance of consumer use tax cannot be overstated, as it plays a crucial role in tax compliance and economic equality among businesses and consumers. With the rise of e-commerce, various consumers are purchasing goods from suppliers without sales tax collection, creating a growing liability for state governments.

Who needs to pay consumer use tax? Both individuals and businesses may be responsible. Individuals typically incur this liability when they shop from out-of-state retailers who do not charge local sales tax. Businesses might face consumer use tax when they purchase items not meant for resale, such as office supplies.

The basics of filing a consumer use tax return

Filing a consumer use tax return requires understanding specific criteria set by tax authorities. Generally, eligibility to file arises when you have purchased taxable goods or services for which sales tax was not remitted. Required documentation may vary by state, but commonly includes purchase receipts, records of transactions, and potentially invoices from out-of-state retailers.

When it comes to tax rates, these are typically determined by state guidelines, and they can vary significantly. For instance, California could have a different rate than Texas, making it essential to consult your state's Department of Revenue for accurate figures.

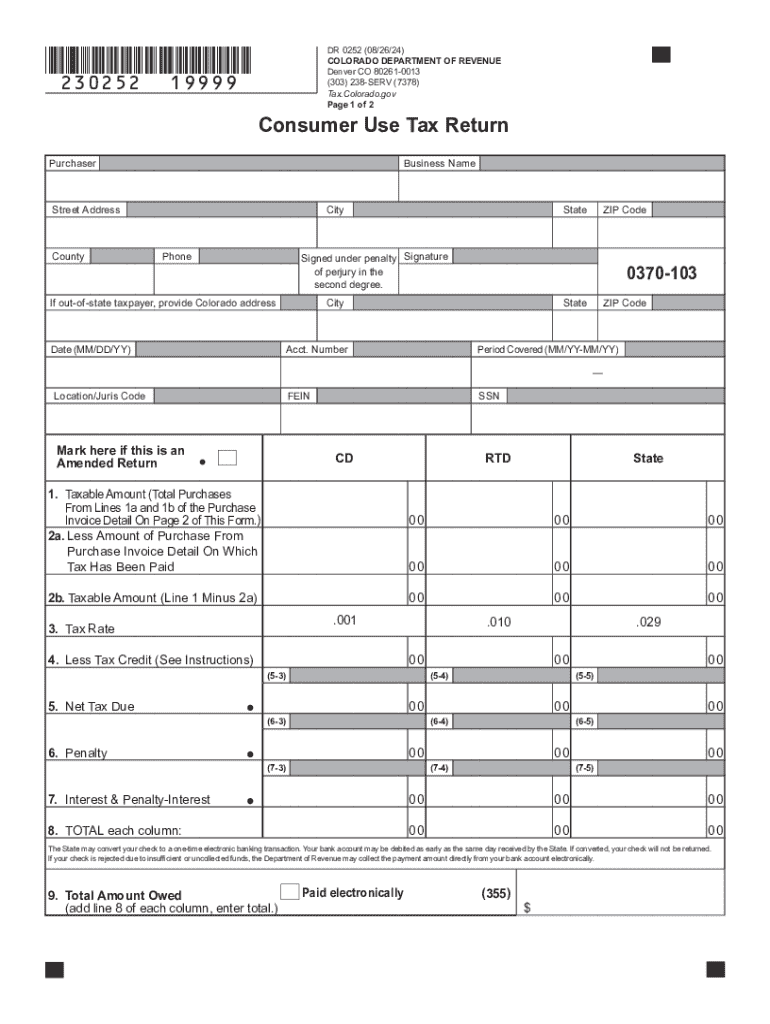

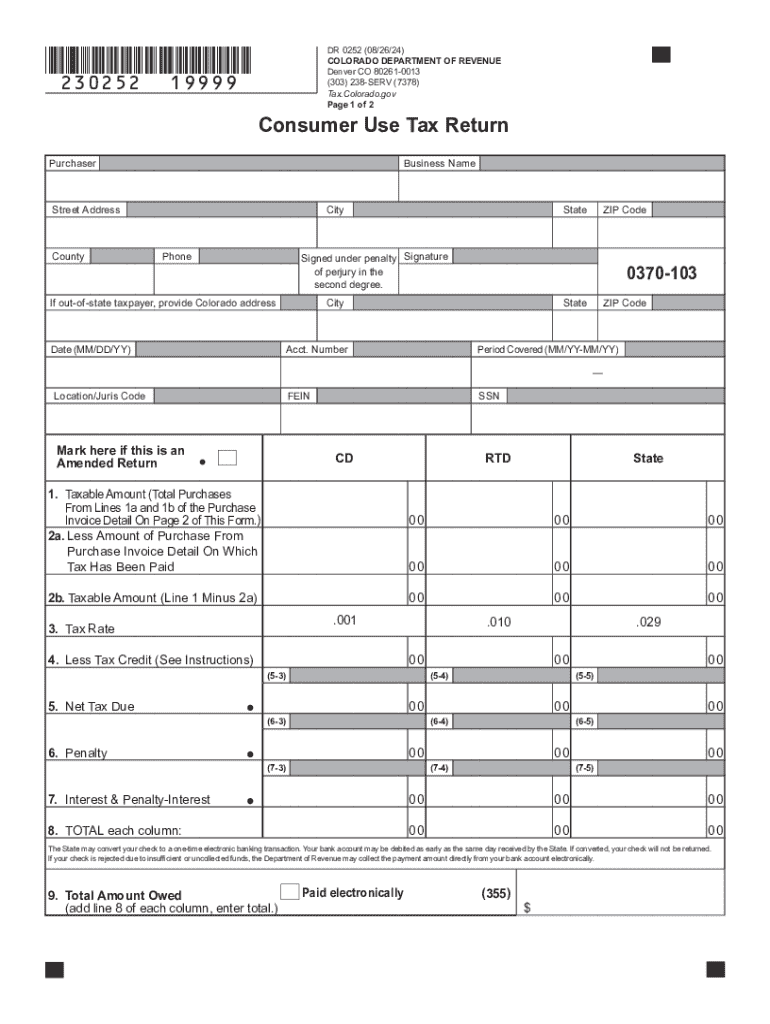

Completing the consumer use tax return form

The consumer use tax return form typically comprises key sections that request specific information related to your purchases. Common fields include personal identification information, details about the purchases subject to tax, and a section for claiming exemptions.

Filling out the form involves several steps. First, provide your personal information, including name and address. Next, detail the purchases made, indicating their taxable nature. Calculating your tax owed requires multiplying the purchase amount by the applicable tax rate. If any exemptions apply, such as purchases for resale, ensure to claim them accurately.

To ensure accuracy, it's vital to review the completed form carefully before submission. Common mistakes include miscalculating the tax owed, omitting required information, or failing to claim eligible deductions.

Filing options for consumer use tax return

When it comes to submitting your consumer use tax return, you have the choice between electronic filing and traditional paper filing. E-filing is often recommended for its convenience, speed, and reduced likelihood of errors compared to paper forms.

If you choose to file electronically, consider using platforms like pdfFiller, which provides step-by-step guidance for e-filing your consumer use tax return form. One major benefit of using pdfFiller is access to cloud-based tools that allow document creation, editing, and e-signing from anywhere, making the tax filing process more efficient.

For those opting to mail their return, be sure to verify the correct mailing address provided by your state’s tax authority. Also, consider using certified mail for guaranteed proof of delivery, reducing the chances of lost documents.

Amending your consumer use tax return

There are several instances where amending a consumer use tax return might be necessary, such as discovering errors in reported purchases or tax calculations after submission. Other common reasons for amendments include changes in exemptions or new taxable purchases that came to your attention post-filing.

To amend your return, you will typically need to complete a specific amendment form mandated by your state. This process may also require you to submit the original return along with any additional documentation justifying the changes. Be aware that any modifications could potentially impact your overall tax obligations, particularly if the changes result in additional taxes owed.

Understanding and calculating your tax burden

Understanding how to accurately calculate your consumer use tax liability is vital. Practical examples can illustrate this process effectively. For example, if you purchase a computer out of state for $1,000, and your state's use tax rate is 6%, the tax owed would be $60, bringing your total obligation to $1,060.

Failure to report consumer use tax accurately may lead to penalties or interest charges imposed by tax authorities. For instance, if that same computer purchase is reported incorrectly, you may owe not only the back taxes but also additional fees, which could significantly increase your tax burden if not addressed promptly.

Resources and tools for consumer use tax management

For those looking to streamline their consumer use tax filing process, pdfFiller offers various interactive tools that simplify document creation, editing, and collaborative work. Their platform features functionalities for eSigning, ensuring you can manage your consumer use tax return efficiently without needing extensive paperwork.

Additionally, addressing common queries about consumer use tax through a Frequently Asked Questions section can be incredibly helpful. Here, users can find answers tailored to their specific concerns, from determining eligibility for use tax to understanding how tax rates vary by state.

Educating yourself on consumer use tax

To navigate the complexities of consumer use tax effectively, engaging in workshops and online courses can enhance your understanding significantly. These educational opportunities often cover essential topics, from tax liability frameworks to best practices in filing returns.

Furthermore, knowing when to consult tax professionals is crucial, especially if your circumstances change significantly. Whether you're managing a new business or dealing with significant purchases, experts can offer insights that may save money and ensure compliance with all necessary regulations.

Keeping yourself informed

The landscape of consumer use tax is continually evolving, making it crucial to stay informed about changes in laws and regulations. Subscribing to updates from your state's tax authority or reliable tax news outlets can keep you current on developments that could affect your tax obligations.

Understanding and embracing the dynamic nature of tax law can empower you to make informed decisions and ensure compliance, minimizing the risk of incurring penalties from outdated practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer use tax return to be eSigned by others?

How can I get consumer use tax return?

Can I sign the consumer use tax return electronically in Chrome?

What is consumer use tax return?

Who is required to file consumer use tax return?

How to fill out consumer use tax return?

What is the purpose of consumer use tax return?

What information must be reported on consumer use tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.