Get the free Minnesota Last Will and Testament

Get, Create, Make and Sign minnesota last will and

Editing minnesota last will and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota last will and

How to fill out minnesota last will and

Who needs minnesota last will and?

Minnesota Last Will and Form: Your Comprehensive Guide

Understanding the Minnesota Last Will and Testament

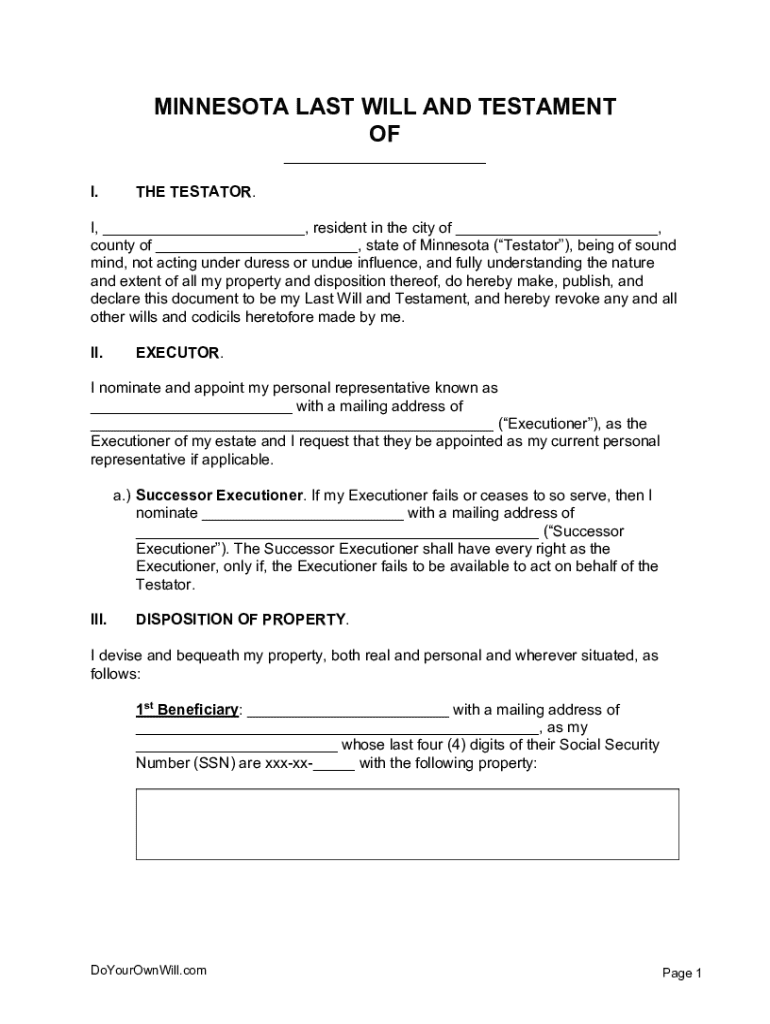

A Last Will and Testament is a legal document that outlines how your assets will be managed and distributed after your death. In Minnesota, having a well-drafted will is vital; it ensures your wishes are honored and can simplify the probate process for your loved ones. Without a will, your estate will be subject to Minnesota intestacy laws, which may result in a distribution that does not align with your preferences.

The legal requirements for a valid will in Minnesota include being at least 18 years old, being of sound mind, and signing the will in the presence of two witnesses, who must also sign the document. These requirements are crucial to ensure the will is enforceable and recognized by the court.

Types of wills in Minnesota

In Minnesota, there are several types of wills, each serving different purposes: Holographic wills are handwritten and signed by the testator, which do not require witnesses in most cases. While they can be valid, they may lack clarity. Self-proved wills include an affidavit signed before a notary, simplifying the probate process by avoiding the need for witness testimony. Formal wills are typically typed, signed, and witnessed according to state laws, providing a clearer format and greater assurance of validity.

It's essential to distinguish between living wills, which address healthcare decisions and end-of-life care, and last wills, which govern the distribution of your estate. Understanding these differences ensures that your wishes for both your assets and health decisions are clearly articulated.

Components of a Minnesota last will

Essential elements of a Minnesota last will include the appointment of a personal representative, who manages the estate through the probate process; the designation of beneficiaries, specifying who will receive your assets; and detailed instructions for the distribution of those assets. Additionally, if you have minor children, your will should designate a guardian to care for them.

Beyond these essential components, consider including specific bequests, which detail particular gifts to certain individuals, and a residuary clause, explaining how any remaining assets not specifically mentioned in your will should be divided. These provisions can clarify your intentions and prevent disputes among heirs.

Who needs a will in Minnesota?

Creating a will is not just for the wealthy; it benefits a wide range of individuals. One key reason for drafting a will is to provide for families with minor children, ensuring guardianship and financial support for their upbringing. Individuals holding significant assets, regardless of their age, should draft a will to ensure their wealth is passed down according to their wishes.

Blended families present another demographic where wills are particularly critical. A carefully crafted will can designate inheritances and guardianships that acknowledge family dynamics, reducing potential conflict among relatives.

Essential steps to create a Minnesota last will

Creating a last will involves several essential steps, beginning with gathering necessary information. Compile an inventory of your assets, including real estate, bank accounts, personal belongings, and make a list of your beneficiaries. This foundational work ensures a well-structured distribution plan.

Choosing the right format for your will is crucial. You can opt for a handwritten will, a self-proved will, or a formal typed will depending on your circumstances and comfort level. After selecting the format, draft the document, possibly utilizing pdfFiller's interactive template, which offers a structured outline for your intentions.

Following the creation of your will, ensure it meets signing and witnessing requirements. Two witnesses must sign the will in your presence, adhering to Minnesota state law. Finally, store your will safely, in a place where your loved ones can access it when needed.

Updating and changing your Minnesota will

Your will is not a static document; significant life events often necessitate updates. Major changes such as marriage, divorce, or the birth of a child are critical junctures to amend your will. Failing to update your will may lead to your estate being distributed contrary to your current wishes.

You can amend a will by creating a codicil, which is an addition or change to the original document, or by revoking the old will and drafting a new one. It is essential to follow proper legal procedures during these amendments to maintain validity.

Frequently asked questions about Minnesota wills

Many individuals have questions regarding the creation and enforcement of wills in Minnesota. A common inquiry is whether a lawyer is required to make a will; while legal assistance can be beneficial, it is not mandatory if you create your will using valid templates, such as those offered through pdfFiller.

Another frequent question is the implications of dying without a will in Minnesota. Your estate would be subjected to state intestacy laws where assets are distributed based on established hierarchies of heirs, potentially ignoring your preferences. Other questions often revolve around notarization requirements, the proper storage of a will, and the legality of disinheriting someone, all of which are critical for a well-executed estate plan.

The probate process in Minnesota

Upon death, the probate process in Minnesota oversees the division of your estate. Initially, the will must be filed with the local probate court. The court will then notify all heirs and interested parties, ensuring transparency in asset distribution.

A step-by-step guide to Minnesota probate includes handling debts and taxes owed by the estate, a process that the personal representative manages. After settling liabilities, the remaining assets can be distributed to beneficiaries as per the directions outlined in the will. However, potential pitfalls include disputes among heirs or failure to comply with legal procedures, which can delay the process.

The cost of creating a will in Minnesota

The cost of creating a will in Minnesota can vary significantly depending on whether you choose to engage a lawyer, use online services, or draft one yourself. Factors influencing cost include the complexity of your estate, legal fees, and the type of will being created.

On average, hiring an attorney can range from $300 to over $1,000, while using services like pdfFiller often proves more cost-effective. Utilizing pdfFiller's templates allows you to create a valid will quickly and affordably, streamlining the estate planning process without breaking the bank.

Legal services and resources

Working with legal professionals can ensure your will complies with Minnesota laws and reflects your wishes accurately. For those who prefer a DIY approach, accessing trusted forms and templates via pdfFiller can streamline the process, offering a user-friendly platform for document creation.

In addition, numerous online resources are available for estate planning in Minnesota. Local legal aid organizations can also provide assistance to individuals needing guidance, ensuring you have access to the necessary support while drafting your last will.

Interactive tools and features offered by pdfFiller

pdfFiller provides an array of tools that can streamline the process of creating a Minnesota last will. Their interactive template system allows users to personalize their documents easily, ensuring all critical components are included.

Additionally, pdfFiller offers secure document storage and sharing capabilities, making it easy to store your will safely. The platform also includes eSigning functionalities and collaboration tools, enabling family members or advisors to review and sign the document seamlessly.

Related documentation and support

Beyond wills, other estate planning documents may be necessary, such as powers of attorney and healthcare directives. For further reading, various resources outline related documentation, ensuring you are fully informed about your estate planning options.

Connecting with local legal aid resources can provide additional support, guiding you in drafting and managing your estate planning needs effectively. Regular updates on Minnesota estate laws are crucial for keeping your documents aligned with current regulations.

Conclusion and next steps

Creating a last will is crucial for securing your estate and ensuring your wishes are upheld. By leveraging the tools and resources available on pdfFiller, you can simplify the process and guarantee your last will is comprehensive and valid.

Take the next step in your estate planning journey by utilizing pdfFiller’s resources. Whether creating a new document or updating an existing will, the platform empowers users to manage their last will and form efficiently from anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit minnesota last will and from Google Drive?

Where do I find minnesota last will and?

How do I fill out minnesota last will and on an Android device?

What is Minnesota last will and?

Who is required to file Minnesota last will and?

How to fill out Minnesota last will and?

What is the purpose of Minnesota last will and?

What information must be reported on Minnesota last will and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.