Get the free 2024 Ri-1041 - tax ri

Get, Create, Make and Sign 2024 ri-1041 - tax

Editing 2024 ri-1041 - tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 ri-1041 - tax

How to fill out 2024 ri-1041

Who needs 2024 ri-1041?

2024 RI-1041 - Tax Form: Your Comprehensive Guide

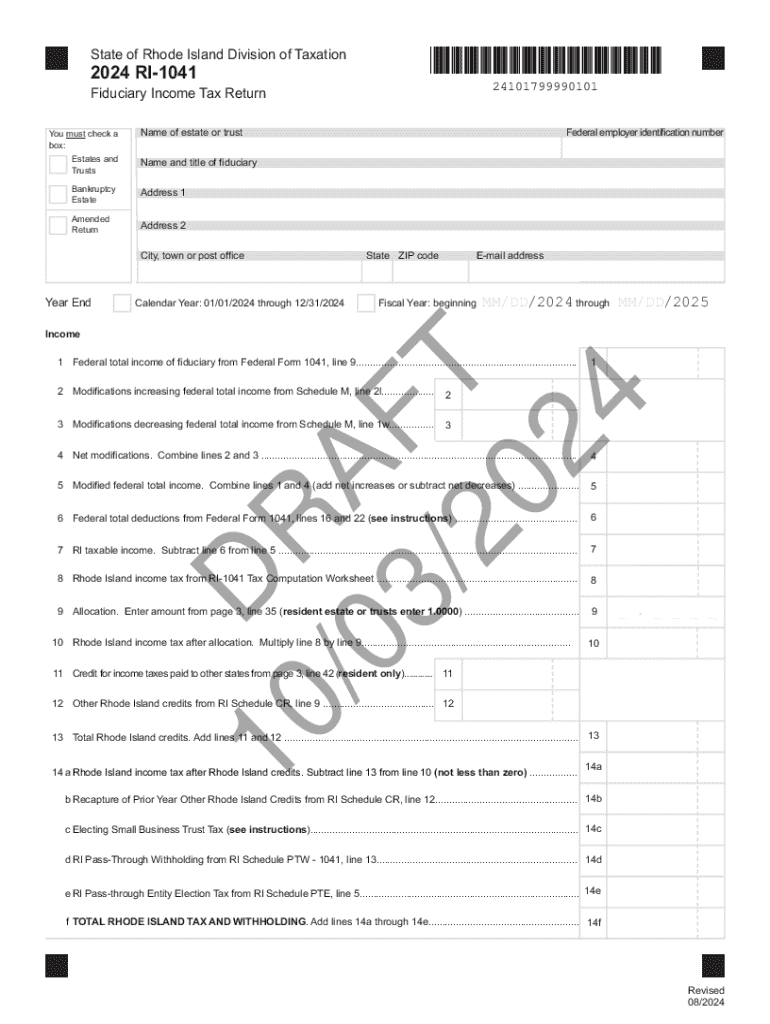

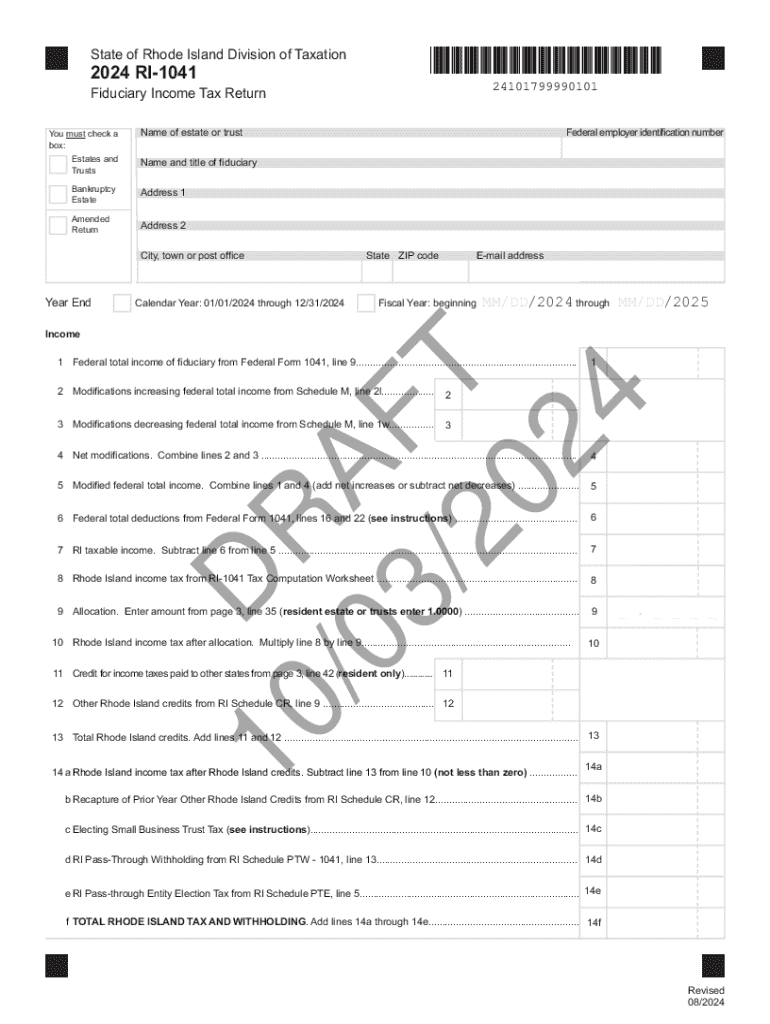

Overview of the 2024 RI-1041 tax form

The 2024 RI-1041 tax form is a crucial document for Hawaiian-based trusts and estates needing to report taxable income to the state. Understanding this form is vital as it ensures compliance with state tax laws, facilitates accurate tax payments, and helps avoid potential penalties. For fiduciaries and trustees, completing the form correctly is essential for proper estate management and benefiting beneficiaries.

Individuals or entities required to file the 2024 RI-1041 typically include those managing estates with gross income exceeding $1,000, or trusts that meet similar income thresholds. This form applies to various entity types, ensuring they meet state tax requirements. 2024 brings new updates, including enhanced deductions and clarified instructions about reporting, making it necessary to review changes to remain compliant.

Understanding the structure of the 2024 RI-1041

The 2024 RI-1041 tax form is organized into distinct sections, each requiring specific information for accurate completion. Understanding these sections is key to minimizing errors and streamlining the filing process. From the header to the income section and deductions, each part plays a significant role in reporting.

In the header information, ensure to provide taxpayer identification and select the appropriate entity type, whether it's a trust, estate, or other fiduciary account. The income section requires detailing all sources of income, including interest, dividends, and gains. Lastly, the deduction and credit sections allow for maximizations, given that understanding which apply to your situation can significantly alter tax liabilities.

Step-by-step instructions for filling out the 2024 RI-1041

Before diving into the form, preparation is essential. Gather necessary documents including EIN for the trust or estate, IRS Form 1041 information, any previous years' tax forms, and details about all income sources. Access the form through pdfFiller for seamless editing and completion that can be saved in real-time. This cloud-based solution simplifies the entire process.

To fill out the form accurately, begin by inputting the header information with your unique taxpayer identification. Proceed to the income section, utilizing any calculations to ensure total income is correctly represented. Deductions should be categorized based on eligibility hence reviewing previous documentation helps to ensure maximization. After completing the sections, review for any discrepancies before submission.

Interactive tools for filling the 2024 RI-1041

When choosing to fill the 2024 RI-1041, utilizing interactive tools such as those provided by pdfFiller can significantly enhance your filing experience. Features like easy editing and signing capabilities allow users to upload and modify documents seamlessly, catering specifically to the individual needs of fiduciaries and teams.

Real-time collaboration options further facilitate teamwork, ensuring compliance among members involved in the filing process. Saving forms in the cloud means easy retrieval and extension capabilities for filing any necessary amendments later in the year. Taking full advantage of these features can ease the complexity of tax preparation.

Common mistakes to avoid when filing the 2024 RI-1041

Filing the 2024 RI-1041 can be intricate; thus, common mistakes can lead to penalties or unwanted audits. One common error involves failing to report all sources of income, which could inadvertently lead to underreporting tax liabilities. Another frequent mistake is neglecting to include necessary schedules or documentation that support claims or deductions.

It is crucial to double-check all entries, especially numbers and identification information, to ensure they match across documents. Utilizing tools like pdfFiller provides options to verify data entry, thereby minimizing pitfalls. Using available resources for troubleshooting common filing issues and understanding penalties for late filing can also help mitigate risks.

FAQs about the 2024 RI-1041 tax form

Several questions frequently arise regarding the 2024 RI-1041. Some common concerns cover filing deadlines, penalties for late submissions, and the process for amending a previously submitted form. The state has specific due dates for when the 2024 RI-1041 must be filed, and understanding these is vital to avoid unnecessary penalties or interest on overdue taxes.

In the event of errors after submission, initiating an amendment is straightforward; however, following the proper procedure is vital to ensure issues are rectified swiftly. Understanding state-specific tax implications, especially for differing entity types, is also paramount for accurate guidance on how to approach potential pitfalls.

Additional considerations for filing the 2024 RI-1041

Filing the 2024 RI-1041 also involves understanding the implications of recent tax law adjustments that may affect your return. New deductions, potential tax relief measures, and adjusted thresholds can all influence the amount of tax owed and the resulting liability for fiduciaries. Being informed on recent changes ensures that your filing reflects the most beneficial outcomes.

Incorporating strategic tax planning can allow for efficiency within filings, ensuring you maximize any available credits and deductions for the trust or estate under management. Staying apprised of future changes and engaging professionals when needed will help in navigating the complexities that might arise due to evolving regulations and tax standards.

Preparing for future tax years

Finally, taking steps to prepare for upcoming tax years can ease the filing under the 2025 RI-1041 and beyond. Engaging with resources that track tax law changes ensures you remain informed. Utilizing document management platforms like pdfFiller allows you to streamline efforts over multiple years with respect to compliance and accurate reporting.

Maintaining organized records and engaging in proactive planning for tax efficiency can significantly reduce stress in future filings. Creating a filing schedule that anticipates due dates and requirements will also assist in managing the overall tax preparation process conveniently and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 ri-1041 - tax in Chrome?

How do I fill out the 2024 ri-1041 - tax form on my smartphone?

How do I edit 2024 ri-1041 - tax on an iOS device?

What is 2024 ri-1041?

Who is required to file 2024 ri-1041?

How to fill out 2024 ri-1041?

What is the purpose of 2024 ri-1041?

What information must be reported on 2024 ri-1041?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.