Get the free Credit Card Authorization Form for in Store Purchases

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How to Guide Long-Read

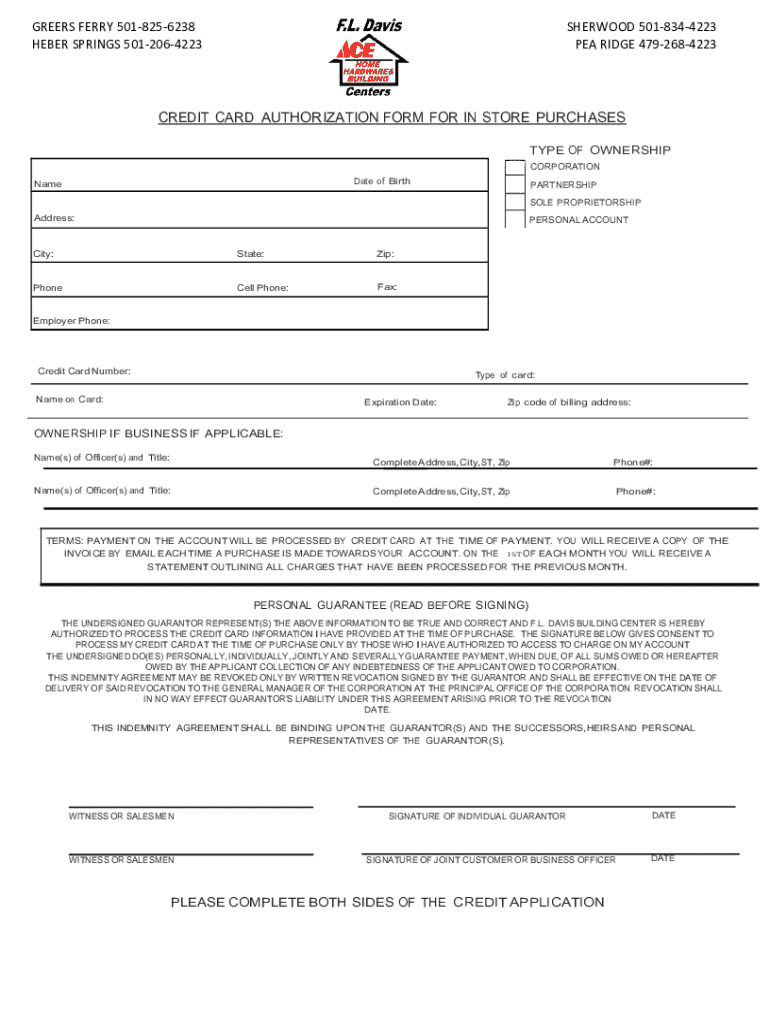

Understanding the credit card authorization form

A credit card authorization form is a document used by merchants to obtain permission from a cardholder to charge their credit card. It is essential in ensuring that transactions are legitimate and can help mitigate the risk of fraud. When a customer signs this form, they essentially agree to allow the seller to charge their card for specified amounts, ensuring both parties are safeguarded in the transaction.

The legal implications of using a credit card authorization form are significant. It acts as a legal contract, binding both parties to the terms agreed upon. This can become crucial in disputes, such as chargebacks or fraud claims, illustrating the importance of thorough and accurate submissions.

In today’s digital transaction environment, credit card authorization forms are invaluable. They play a pivotal role in preventing fraud and chargeback abuse by providing tangible proof of consent from the cardholder. Moreover, these forms bolster security for both businesses and consumers, establishing clear expectations for financial engagements.

Key components of a credit card authorization form

Every credit card authorization form should include essential elements to ensure effectiveness. Personal information fields, such as the cardholder's name, address, and contact details, are critical for verification. Additionally, payment information, which includes the credit card number and expiration date, is essential for completing any transaction.

Optional fields can also be included to enhance security and improve the transaction process. For instance, capturing the CVV (Card Verification Value) is important for security, as it adds an extra layer of protection during online and phone transactions. Moreover, fields for signature and date provide clear authorization from the cardholder, which is crucial for legal enforcement.

Understanding the difference between one-time payment and recurring authorization forms is key for proper usage. One-time payment forms are ideal for singular transactions, while recurring authorization forms are used for services with regular billing cycles, such as subscriptions or membership fees.

When to use a credit card authorization form

Credit card authorization forms serve various use cases for sellers and service providers. They are crucial for e-commerce transactions, where online merchants need proof of consent to charge the customer's card. The forms are equally important for subscription services that require recurring payments, such as gym memberships or streaming platforms. Additionally, industries that require deposits for bookings or services, such as hotels or event spaces, rely on these forms to secure initial payments.

Guidelines for timing and conditions of use rely heavily on transparency and customer awareness. Businesses should ensure that customers fully understand what they are authorizing. Clear communication about the terms of the transaction and obtaining explicit consent prior to charging is paramount.

How to create and implement a credit card authorization form

Creating an effective credit card authorization form requires attention to detail. Customers filling out the form should follow clear instructions to ensure accuracy. Key areas to focus on include entering the cardholder’s name exactly as it appears on the card, double-checking numbers, and signing where required. Accurate information reduces the risk of processing errors and enhances overall transaction security.

Digitizing your credit card authorization process can streamline the process for both businesses and customers. Tools like pdfFiller can help in creating and managing these forms seamlessly. Integrating with existing payment systems can create a frictionless experience, allowing businesses to quickly process payments while maintaining compliance and security.

Managing and storing credit card authorization forms

The secure storage of signed credit card authorization forms is paramount in safeguarding customer information. Organizations can choose between digital and physical storage methods, with digital storage offering solutions that are less prone to physical deterioration and easier to manage. However, it is vital to comply with data protection regulations, including GDPR and PCI DSS, to protect sensitive customer data.

Guidelines for retaining forms come down to legal requirements and best practices. Generally, forms should be retained for a period that aligns with the length of the transaction cycle. For recurring transactions, storing authorization forms for a minimum of 12 months after the last charge is recommended. For one-time charges, retaining them for a few months can suffice, unless required longer by specific regulations.

Addressing common FAQs about credit card authorization forms

One common question is whether businesses are legally obligated to use credit card authorization forms. While not required by law, they are highly recommended to protect against fraud and disputes. Another frequently asked question involves the absence of a CVV space on a form, which may occur based on business needs or compliance regulations but can raise security concerns.

The term 'Card on File' refers to storing a customer's card information for future charges, which often necessitates explicit authorization. In response to chargebacks related to authorization forms, it's critical to maintain comprehensive documentation and provide clear evidence of the cardholder's consent. Additionally, credit card authorization forms can indeed help reduce chargeback rates by ensuring that the merchant has the necessary proof of authorization.

Enhancing security and efficiency in payment processes

Leveraging advanced features of platforms like pdfFiller can significantly bolster the security of credit card authorization forms. Utilizing eSignature capabilities ensures that signed documents are legally binding and verified, while audit trails provide a detailed record of who signed a form and when. Integration with fraud prevention tools can further secure the payment process, ensuring that both consumers and businesses are protected.

Educating teams and customers about payment security not only fosters trust but also creates a culture of awareness. Businesses should provide details on how to recognize secure transactions and what to look for in terms of digital payments. Maintaining reliability in payment systems is crucial, as it reflects on the overall brand integrity.

Can credit card authorization forms be customized?

Customization options available within pdfFiller allow businesses to tailor credit card authorization forms to their specific needs. Branding and styling options enable businesses to present a professional image reflective of their brand identity. Furthermore, field customization to capture additional relevant information can enhance the overall effectiveness of the form.

For instance, a travel agency might customize their forms to include sections about travel dates or destination-specific details, ensuring they capture vital information that pertains to their services. Customized forms can also provide a better user experience, guiding customers more intuitively through the authorization process.

Exploring additional resources for credit card authorization

pdfFiller offers a variety of related forms and templates that cater to different business needs. From payment agreements to service contracts, businesses can find a suite of solutions that enhance their document management capabilities. Quick links to similar document solutions streamline form creation and editing, allowing users to easily navigate between necessary documents and resources.

Recommendations based on user needs can further guide customers in selecting the most suitable forms for their operations, tailoring solutions to distinct business models or industries.

Getting started with pdfFiller

Opening an account with pdfFiller is straightforward and provides access to a vast array of templates for credit card authorization forms and beyond. New users can quickly take advantage of the document management tools offered, which includes form editing, signing, and secure storage options, all within a cloud-based platform that promotes efficiency.

The key benefits of using pdfFiller include seamless collaboration features that allow multiple users to work on forms simultaneously. Additionally, the platform provides quick and efficient form editing options, ensuring that businesses can adapt their authorization processes to ever-changing needs. This positions pdfFiller as a vital tool for organizations striving for operational excellence.

Supporting tools and solutions for your business

pdfFiller's capabilities extend beyond document management; it integrates seamlessly with various software solutions, including CRMs, invoicing systems, and payment processors. This ensures that businesses can maintain a cohesive workflow that enhances efficiency across departments. Looking ahead, future trends in payment authorization and document management are expected to emphasize automation and artificial intelligence, allowing businesses to further streamline their processes.

As the digital landscape continues to evolve, organizations that embrace these innovations will likely find themselves at a competitive advantage, ensuring enhanced efficiency, security, and customer satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card authorization form in Chrome?

Can I sign the credit card authorization form electronically in Chrome?

Can I create an eSignature for the credit card authorization form in Gmail?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.