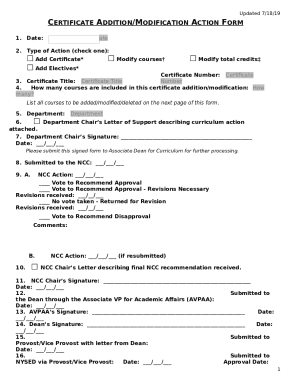

UK Bupa BHF 00049 2025-2026 free printable template

Show details

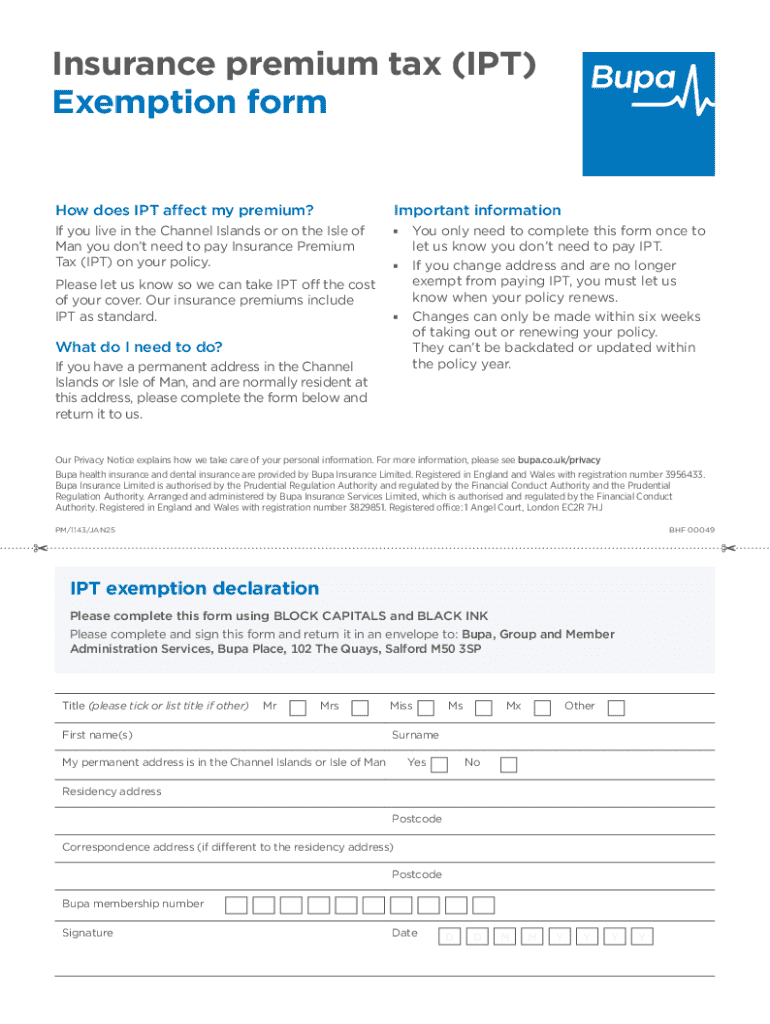

This form is used by residents of the Channel Islands or the Isle of Man to declare their exemption from Insurance Premium Tax on their insurance policies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Bupa BHF 00049

Edit your UK Bupa BHF 00049 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Bupa BHF 00049 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK Bupa BHF 00049 online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK Bupa BHF 00049. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Bupa BHF 00049 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Bupa BHF 00049

How to fill out insurance premium tax exemption

01

Collect all necessary documents that pertain to your insurance premiums.

02

Verify your eligibility for the tax exemption by reviewing the guidelines provided by your local tax authority.

03

Fill out the required forms accurately, ensuring you provide all necessary personal information and details about your insurance premiums.

04

Attach any supporting documentation, such as receipts or proof of payment for your insurance premiums.

05

Submit the completed forms to your tax authority before the specified deadline.

Who needs insurance premium tax exemption?

01

Individuals who are required to pay insurance premiums and meet specific eligibility criteria for tax exemption.

02

Businesses that incur insurance costs and seek to reduce their tax liabilities.

03

Policyholders in certain categories, such as low-income earners or those with disabilities, who may qualify for specific exemptions.

Fill

form

: Try Risk Free

People Also Ask about

Is the Isle of Man exempt from IPT?

Insurance Premium Tax (IPT) is a tax imposed by HM Government on insurance contracts but IPT does not apply to risks that are situated in the Channel Islands or the Isle of Man.

What is IPT in Portugal?

Find out more about IPT. There is no IPT regime in Portugal. Instead, Stamp Duty applies. Stamp Duty Portugal Law.

What is the IPT in the UK?

Insurance Premium Tax (IPT) is a tax on insurers, like VAT, that applies to most general UK insurance premiums. After your insurance provider collects the premium from you, the tax is paid directly to the Government.

What is the meaning of IPT in Bupa?

Insurance premium tax (IPT).

Is IPT different from VAT?

Insurance Premium Tax ( IPT ) is usually included in the price you pay for insurance. You do not pay VAT on insurance. The rate of IPT depends on the type of insurance and who supplies it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in UK Bupa BHF 00049?

The editing procedure is simple with pdfFiller. Open your UK Bupa BHF 00049 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the UK Bupa BHF 00049 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your UK Bupa BHF 00049 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete UK Bupa BHF 00049 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UK Bupa BHF 00049 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is insurance premium tax ipt?

Insurance premium tax (IPT) is a tax levied on the premiums paid for certain insurance policies. It is typically a percentage of the premium amount and is collected by insurance providers, who then remit it to the government.

Who is required to file insurance premium tax ipt?

Insurance providers and brokers who collect premiums from policyholders are required to file and remit insurance premium tax (IPT) to the relevant tax authority.

How to fill out insurance premium tax ipt?

To fill out insurance premium tax (IPT) forms, one must provide information such as the total premiums collected, applicable tax rate, and details of the insurance policies. Specific forms and filling instructions can vary by jurisdiction.

What is the purpose of insurance premium tax ipt?

The purpose of insurance premium tax (IPT) is to raise revenue for the government and to regulate the insurance industry by ensuring that insurance providers are compliant with tax obligations.

What information must be reported on insurance premium tax ipt?

Information that must be reported on insurance premium tax (IPT) includes the total premiums received, the applicable IPT rate, policy details, and the total tax amount due.

Fill out your UK Bupa BHF 00049 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Bupa BHF 00049 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.