Get the free Corporation Declaration of Estimated Income Tax

Get, Create, Make and Sign corporation declaration of estimated

Editing corporation declaration of estimated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporation declaration of estimated

How to fill out corporation declaration of estimated

Who needs corporation declaration of estimated?

Understanding the Corporation Declaration of Estimated Form: A Comprehensive Guide

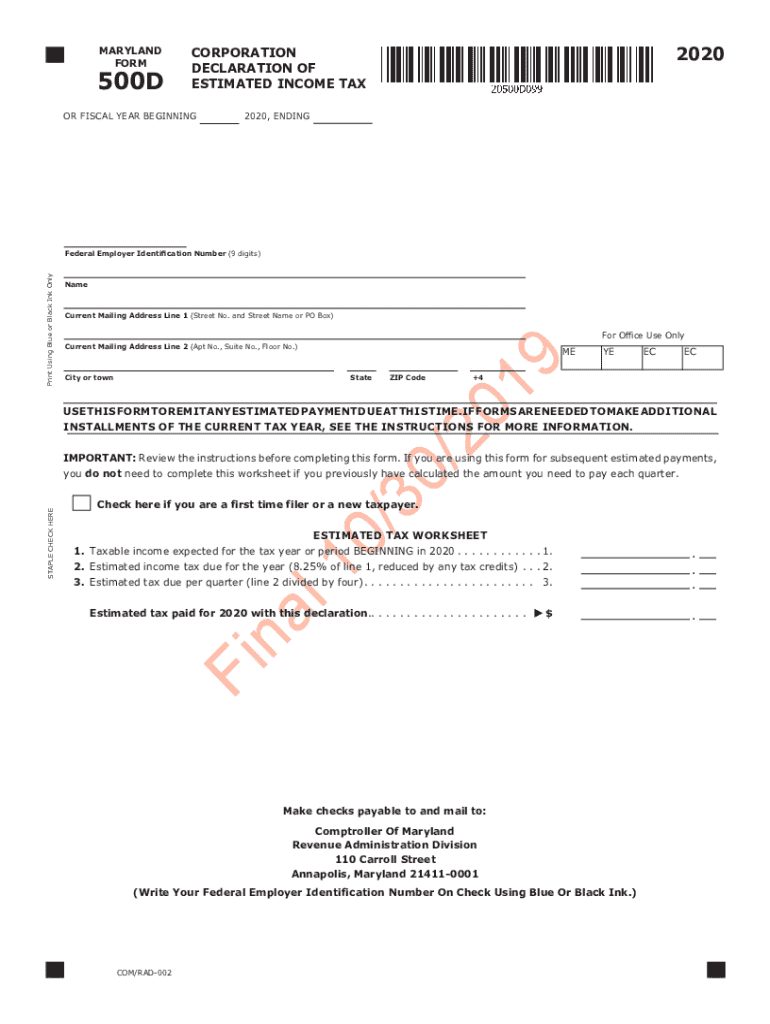

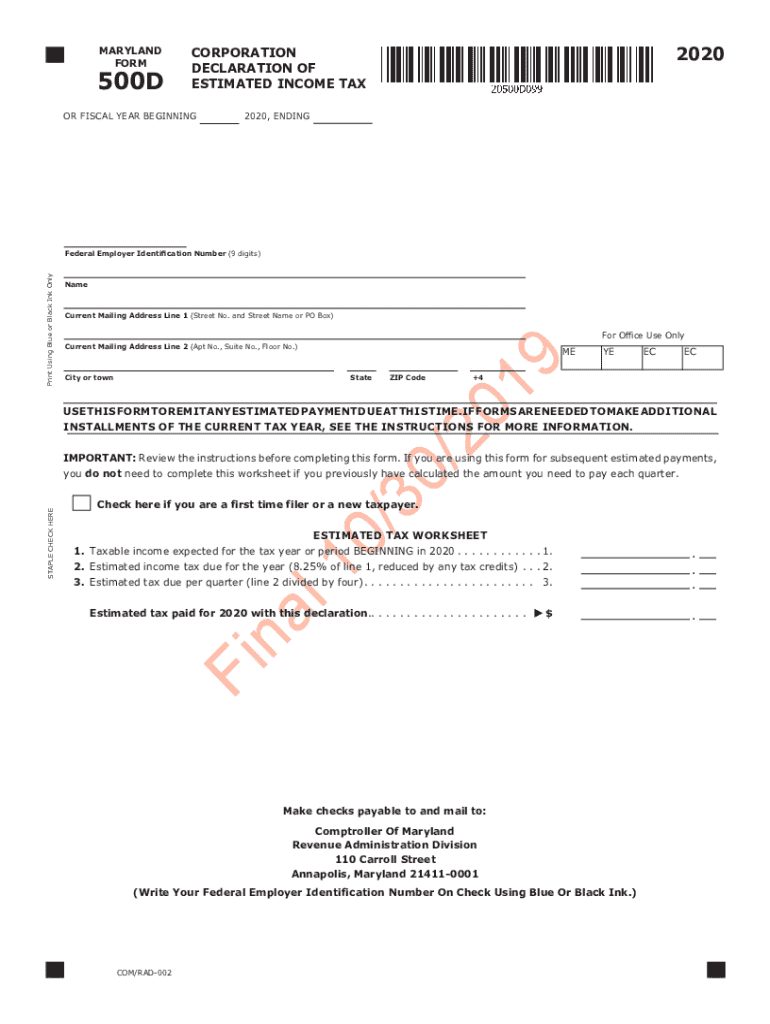

Overview of corporation declaration of estimated form

The Corporation Declaration of Estimated Form is a crucial document that corporations use to report their anticipated tax obligations to the IRS. This form is essential for tax compliance, as it allows corporations to estimate and pay their tax liabilities throughout the year rather than waiting until the end of the financial year. This proactive approach helps corporations manage their financial responsibilities more effectively.

Filing this form is especially important, as failure to do so can lead to penalties and interest charges. Corporations must be aware of key deadlines for submission and payment, which vary based on their fiscal year-end. Typically, estimated payments are due quarterly, and missing these deadlines can result in significant financial repercussions.

Who needs to file the corporation declaration of estimated form?

Generally, all corporations, regardless of their size or type, are required to file the Corporation Declaration of Estimated Form. This includes C-corporations and S-corporations that expect their taxes owed to be above a certain threshold. However, some entities, such as limited liability companies (LLCs) treated as partnerships, may not be required to file this form.

Certain exemptions and special cases exist within the tax code. Corporations that project a tax liability of $500 or less typically don’t need to file estimated payments. Additionally, newly established corporations may also be exempt from this requirement during their first year of operation if they anticipate losses. Understanding these nuances helps corporations accurately assess their filing obligations.

Understanding the key components of the form

Filling out the Corporation Declaration of Estimated Form requires understanding its key components. The form typically contains essential sections that capture critical corporate data and estimated financial obligations. First and foremost is the entity information section, which requires basic details like the corporation’s name, address, and tax identification number. Accuracy here is fundamental, as errors can delay processing and lead to compliance issues.

Next is the estimated tax calculation section, where corporations must calculate their expected tax liabilities based on projected income, deductions, and credits. Many corporations may overlook the importance of accurately projecting income and expenses, leading to potential shortfalls in payment amounts. Lastly, corporations must choose their payment method. They can pay electronically or by mail, and understanding these options can facilitate timely payments.

Step-by-step guide to filling out the corporation declaration of estimated form

Filling out the Corporation Declaration of Estimated Form can seem daunting, but breaking it down into manageable steps can simplify the process. The initial step is to gather necessary information, including financial records and previous tax returns. This data will provide a foundation for accurate calculations and projections.

The second step involves completing the form accurately; attention to detail is critical. Corporations should take their time to ensure that each section is filled in carefully, as even small mistakes can lead to delays and additional scrutiny from tax authorities. After completing the form, it's vital to review and verify all details. A checklist can be helpful for cross-referencing all required information before submission.

Finally, corporations must choose their submission method—either electronic or paper filing. Electronic submissions often allow for instant confirmation, whereas paper submissions can take longer to process. Select an option that best suits your operational needs for tracking and confirming submission.

Editing and managing your corporation declaration of estimated form online

Utilizing online tools like pdfFiller makes the process of editing and managing your Corporation Declaration of Estimated Form more efficient. Accessing and editing the form online enables real-time modifications, crucial for ensuring accuracy and up-to-date information. The ability to collaborate with team members within pdfFiller promotes enhanced productivity, as multiple users can annotate and provide input directly on the document.

Storing documents securely within the cloud is another advantage of using pdfFiller. Implementing best practices for document management, such as organizing files by fiscal year or project, ensures that important documents are easily retrievable. Being able to access your forms wherever you are facilitates a smoother workflow and provides peace of mind when it comes to corporate compliance.

eSigning the corporation declaration of estimated form

In the digital age, eSigning the Corporation Declaration of Estimated Form has become essential for timely submissions. Electronic signatures not only expedite the filing process but also track submissions for compliance audits. Utilizing pdfFiller, corporations can electronically sign their documents quickly and securely, ensuring they meet all deadlines without hassle.

The process of electronically signing is straightforward. Users can quickly utilize pdfFiller’s eSignature features, allowing for seamless integration into the document workflow. It is important to note that eSignatures hold the same legal weight as traditional signatures in corporate filings, adding a layer of validity that ensures the integrity of the submitted document.

Frequently asked questions

As corporations navigate the complex landscape of tax compliance, several common questions arise regarding the Corporation Declaration of Estimated Form. For instance, if a corporation misses the filing deadline, it may face penalties that can compound quickly with interest charges. In such cases, prompt action to rectify the situation is essential. Corporations can amend their submissions by filing an amended return or a specific form designated for corrections.

Additionally, keeping accurate records post-filing is vital for IRS audits and to provide a clear financial picture for future filings. Retaining documentation, including previous estimates and payments made, can safeguard against disputes and inquiries from tax authorities. Being proactive in these areas can alleviate many common concerns that corporations face when it comes time to file their taxes.

Related forms and extensions

In addition to the Corporation Declaration of Estimated Form, corporations must be aware of other relevant tax forms that may apply to their specific situations. Forms like SC1120-CDP and D-20ES are often used alongside the estimated form to capture corporate tax information comprehensively. Understanding the interplay between these forms is crucial for accurate reporting and compliance.

Filing extensions may also be necessary for corporations that need extra time to prepare accurate submissions. Knowing when and how to file for extensions can provide crucial relief, ensuring that corporations can manage their logistics without facing penalties for late submissions. Consulting with a tax professional is advisable to navigate these complexities effectively.

Interactive tools and resources

Interactive tools, such as online calculators, can greatly assist corporations in estimating their fiscal obligations more accurately. These resources allow users to input pertinent information and receive instant feedback on tax liabilities, enhancing the preparation process for filing the Corporation Declaration of Estimated Form. Integrating these tools increases accuracy and helps avoid potential pitfalls by providing real-time analyses.

Additionally, video tutorials offered on platforms like pdfFiller provide visual walk-throughs that can simplify the filing process. These resources cater to different learning styles and help clarify complicated steps involved in filling out tax forms, providing an added layer of support for corporations.

Troubleshooting common issues

Throughout the filing process, corporations often face various common issues when completing the Corporation Declaration of Estimated Form. Miscalculations in estimated payments or incorrect entity information can lead to unnecessary delays and compliance issues. By being aware of these potential pitfalls, corporations can proactively implement checks within their filing process.

In case of technical difficulties, users on pdfFiller can reach out to customer support for assistance. Technical help is available for navigating the platform, ensuring that users can access the full range of features designed to simplify form management and submission. Preparedness in troubleshooting can save time and frustration during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporation declaration of estimated to be eSigned by others?

How do I edit corporation declaration of estimated in Chrome?

Can I create an electronic signature for signing my corporation declaration of estimated in Gmail?

What is corporation declaration of estimated?

Who is required to file corporation declaration of estimated?

How to fill out corporation declaration of estimated?

What is the purpose of corporation declaration of estimated?

What information must be reported on corporation declaration of estimated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.