Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

The Ultimate Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form is a document that allows businesses to charge a customer's credit card for goods or services. This form acts as a digital handshake between the merchant and the customer, ensuring that the customer consents to the transaction while providing critical payment information. Without this authorization, businesses risk potential disputes concerning chargebacks, which may negatively affect their financial standing.

The importance of credit card authorization forms cannot be overstated. They serve as a protective barrier for businesses against fraudulent claims, while simultaneously safeguarding sensitive customer information. Moreover, these forms facilitate a clear understanding between both parties involved in the transaction, reducing ambiguity and enhancing trust.

Benefits of using credit card authorization forms

Utilizing credit card authorization forms offers numerous benefits that enhance both security and operational efficiency. One major advantage is protection against chargeback abuse. Chargebacks occur when a customer disputes a charge on their credit card statement, often due to fraud or dissatisfaction with the service. Authorization forms substantially mitigate this risk.

By collecting a customer's explicit consent through an authorization form, businesses can strengthen their position in defending against chargebacks. For instance, a business that encounters a chargeback after obtaining a signed authorization form has rectifiable evidence to present to the credit card company. This documentation can be invaluable in ensuring that the chargeback is reversed or not upheld.

When and why to use credit card authorization forms

Certain scenarios make credit card authorization forms particularly beneficial. Remote transactions, where the customer isn’t physically present, require a robust mechanism for authorization to prevent fraud. Additionally, recurring payments, such as subscription services, need clear authorization to facilitate automatic billing with customer consent.

High-value transactions also significantly benefit from authorization forms. Given that larger amounts represent greater financial risk, obtaining customer consent becomes crucial. For platforms like Square, which cater to small businesses and services, implementing a clear authorization process can not only minimize risk but also project a professional business image.

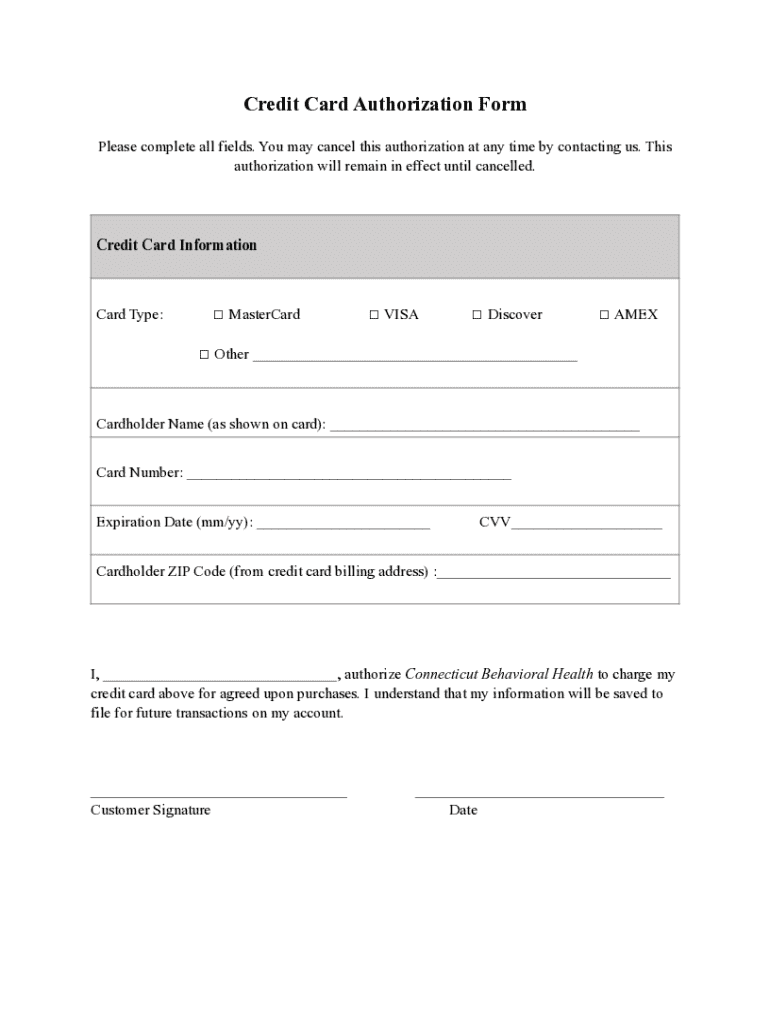

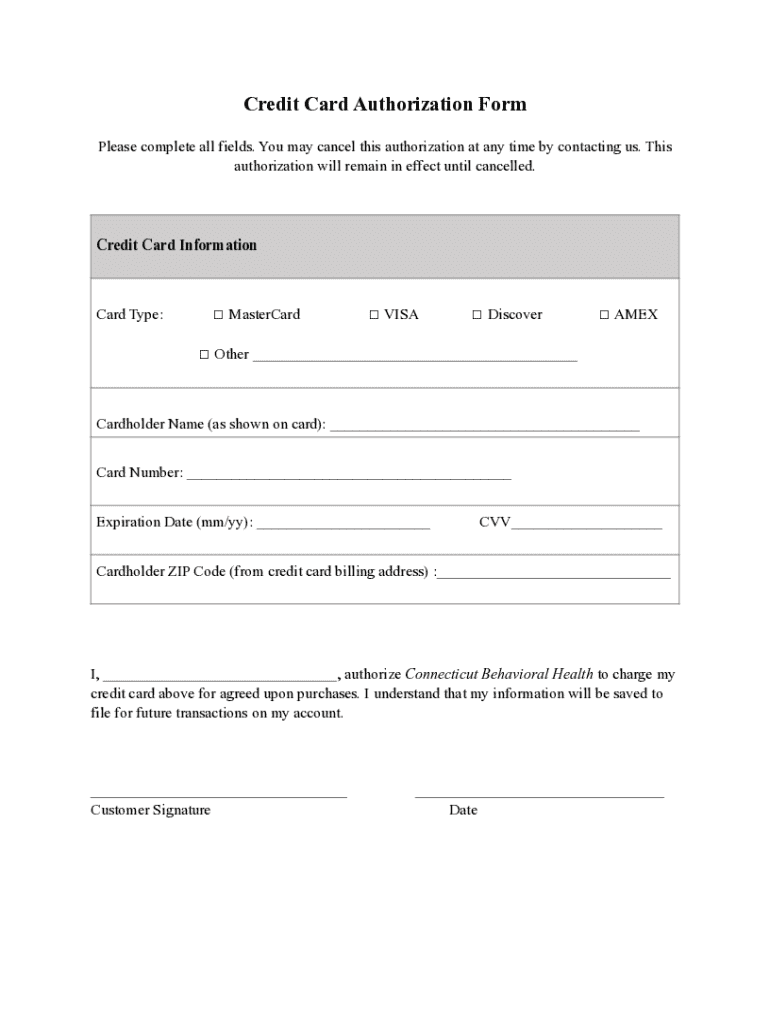

Essential elements included in a credit card authorization form

A well-structured credit card authorization form consists of several key elements. Firstly, it must capture the full name and contact information of the customer. This includes their phone number and email, which become vital for communication regarding the transaction.

Secondly, thorough credit card information is essential but should be handled with utmost care. It typically includes the card number, expiration date, and the cardholder's name. An authorization statement makes up the third component wherein the customer agrees to the transaction terms. Finally, a signature field legitimizes the agreement, and a terms and conditions section informs the customer of their rights and obligations regarding the transaction.

Filling out a credit card authorization form

Completing a credit card authorization form involves several straightforward steps. Initially, gather all necessary information, such as the customer’s name, contact details, and credit card specifics. Attention to detail during this stage is crucial to prevent future transactional disputes.

Next, fill in the credit card information accurately. Ensure there are no typos in the credit card number or expiration date. After entering the details, it is essential for the customer to provide their consent through a signature. This action signifies their agreement to the charges incurred. However, it’s also important to be mindful of common mistakes, such as not updating expiration dates or failing to clarify the transaction amount, as these errors could lead to complications.

Storing and managing credit card authorization forms

Proper storage and management of credit card authorization forms are paramount due to the sensitivity of the data involved. Legally, businesses must adhere to regulations regarding customer data protection, such as GDPR or CCPA. This also involves determining how long to retain these forms, generally recommended to be maintained for as long as any related transaction disputes could arise.

Adopting recommended practices for storage, such as using secure servers or cloud-based management systems, ensures that customer information remains safe from breaches. For example, pdfFiller's platform offers comprehensive features for securely storing and managing these documents while maintaining compliance with legal guidelines. Implementing strong access controls can further safeguard sensitive information.

Frequently asked questions (FAQs)

Many businesses wonder about the necessity of credit card authorization forms. Legally, while not universally mandated, they serve as crucial evidence of a customer's consent to charge their card, which can protect your business in case of disputes. Additionally, you may notice that CVV numbers are often not included in authorization forms. This omission occurs because the focus is on obtaining approval for the transaction rather than processing it immediately.

Another key point involves the concept of 'Card on File,' where businesses store a customer’s credit card details securely for future transactions. This arrangement can streamline repeat purchases, but it also increases the importance of safeguarding customer information to maintain trust. Overall, failure to use an authorization form can leave businesses exposed to vulnerabilities, making it imperative to adopt this practice.

Tools and technology for managing credit card authorization forms

Leveraging technology can significantly simplify the creation and management of credit card authorization forms. Platforms like pdfFiller provide user-friendly tools to customize authorization forms, ensuring all necessary fields are included and user-friendly. This approach streamlines the process for both the merchant and the customer, reducing onboarding friction.

Cloud-based solutions enhance the ability to store and access authorization forms from anywhere, catering to teams needing document flexibility. Beyond secure storage, these solutions integrate with other business tools to enhance overall payment processing efficiency. For example, integrating pdfFiller with your CRM can automatically populate customer data into authorization forms, improving the workflow and decreasing the risk of error.

Best practices for utilizing credit card authorization forms

Employing best practices when using credit card authorization forms will enhance their efficacy and improve security. Periodic reviews of your processes can ensure compliance with legal requirements and help identify any vulnerabilities in your authorization scheme. Keeping customers informed about your authorization policies builds trust and maintains transparency—an essential aspect of customer relations.

Monitoring for fraudulent activities regularly is another best practice. Utilizing tools that alert you to unusual patterns, such as spikes in chargebacks, will allow you to act promptly and investigate issues. Furthermore, continuously educating your staff on payment process security will equip them with the knowledge necessary to safeguard both the business and the customers.

Advancing your understanding of payment processes

Deepening your knowledge about payment processing is essential for optimizing how you handle credit card transactions. For instance, understanding payment gateways can clarify how transactions are authorized, settled, and ultimately processed through banks. By familiarizing yourself with card-not-present transactions, you can better grasp the risks involved in online sales where customers aren't physically present.

Furthermore, recognizing the role of secure authorizations in business operations can create a more stable and reputable environment. Taking these elements into account will not only safeguard your business but also improve customer satisfaction through seamless transactions, ensuring your operations thrive in a competitive marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card authorization form from Google Drive?

How can I get credit card authorization form?

How can I edit credit card authorization form on a smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.