Get the free Foreign Trade Regulations

Get, Create, Make and Sign foreign trade regulations

Editing foreign trade regulations online

Uncompromising security for your PDF editing and eSignature needs

How to fill out foreign trade regulations

How to fill out foreign trade regulations

Who needs foreign trade regulations?

Navigating the Foreign Trade Regulations Form: A Comprehensive Guide

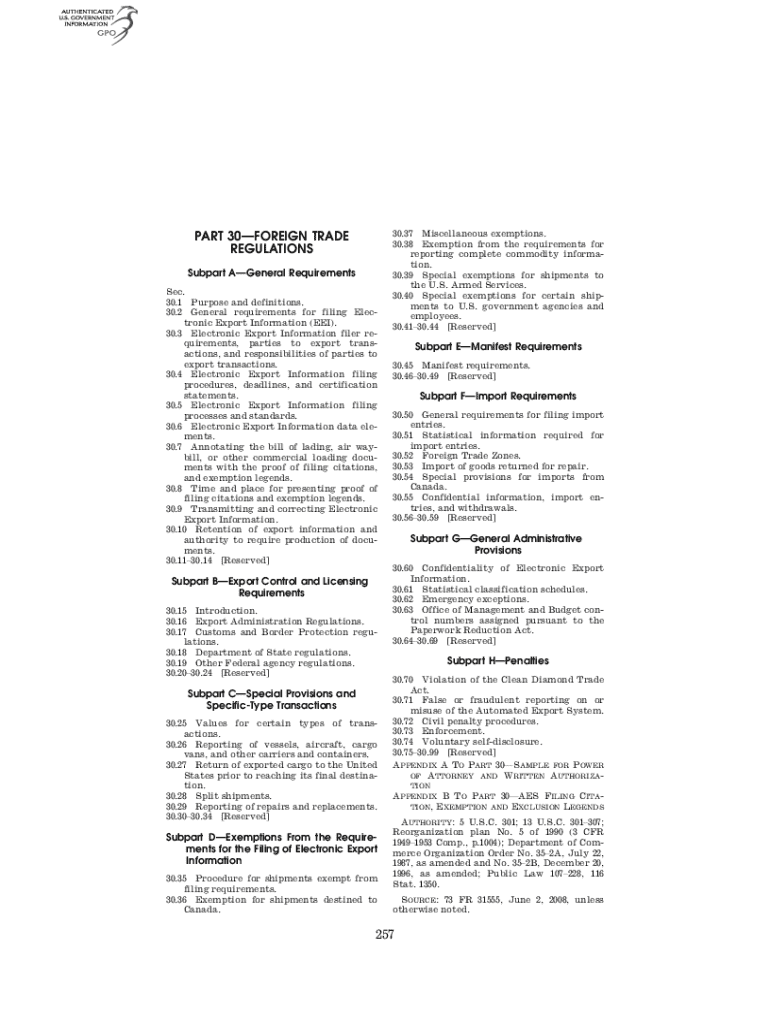

Understanding foreign trade regulations

Foreign Trade Regulations (FTR) govern the export and import of goods in the United States, providing a framework that facilitates international trade while ensuring compliance with U.S. export laws. The FTR is crucial for maintaining national security, complying with international agreements, and enforcing trade policies. Within these regulations lies the inescapable requirement for businesses involved in exporting goods to fill out the Foreign Trade Regulations Form, ensuring detailed documentation of each transaction.

Compliance with the FTR is not merely a suggestion—it is mandatory. Non-compliance can result in penalties, including fines and the potential seizure of goods, making it imperative for exporters to understand and navigate these regulations effectively. The Foreign Trade Regulations Form plays a pivotal role as it encompasses essential details that validate each export shipment, ensuring that businesses maintain adherence to federal laws.

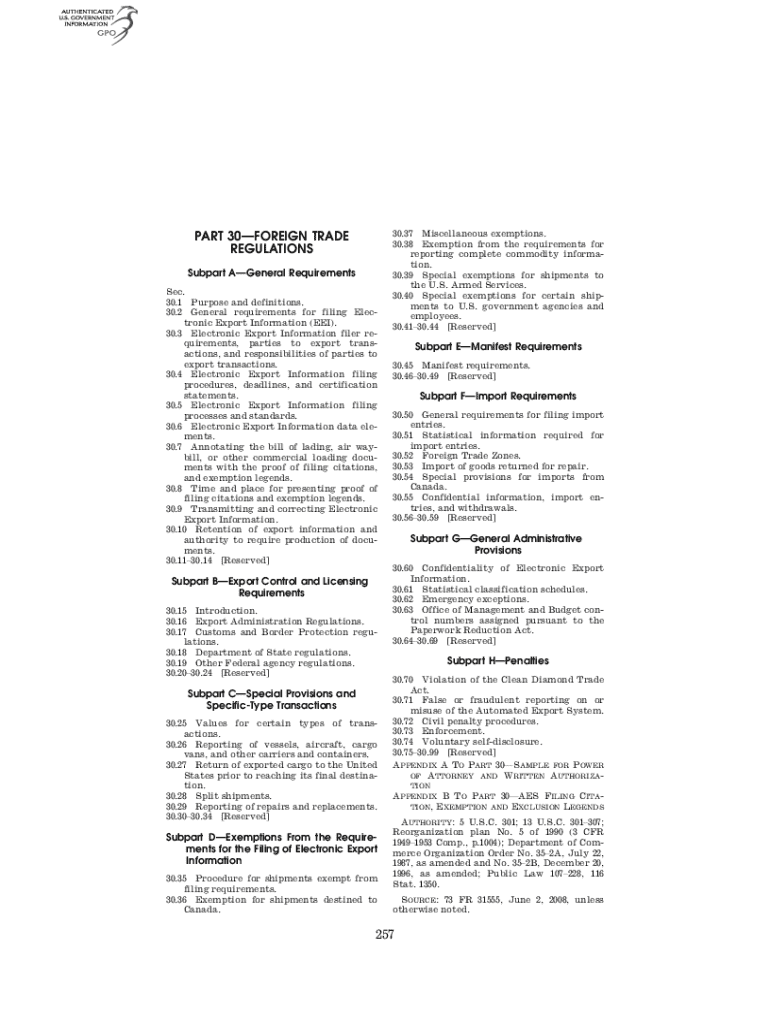

Key components of the foreign trade regulations form

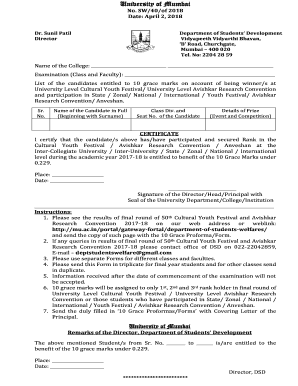

The Foreign Trade Regulations Form consists of several essential sections that exporters must complete accurately for legal compliance. Each part of the form captures crucial information necessary for the proper processing and documentation of export shipments. Key sections of the form include the following:

In addition to the main sections of the form, there is also a requirement for supporting documents to accompany the FTR Form. These include invoices that specify the pricing agreements between exporters and buyers, export licenses that may be required based on the nature of the goods, and packing lists that detail how the goods are packaged and shipped.

When is the foreign trade regulations form required?

The submission of the Foreign Trade Regulations Form is mandated under specific circumstances. Understanding these situations is crucial for compliance and operational efficiency. The main situations that require the form submission include:

It's essential to recognize that there are exceptions to the requirement for the Foreign Trade Regulations Form. Instances that might exempt exporters from submitting this form include certain types of commercial documents, re-exports of foreign goods, and transactions falling under specific trade agreement exemptions.

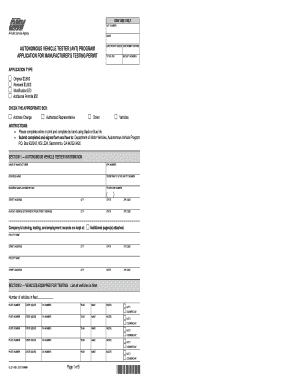

How to fill out the foreign trade regulations form

Filling out the Foreign Trade Regulations Form requires attention to detail and accuracy to avoid errors that can lead to non-compliance. Here’s a step-by-step guide to assist you:

Common mistakes to avoid include leaving sections incomplete, using inaccurate descriptions, and failing to include required supporting documents. To ensure compliance, it can be beneficial to verify the definitions of terminology used in the form against industry standards.

Submission process for the foreign trade regulations form

Once the Foreign Trade Regulations Form is completed accurately, the next step is to submit it for processing. Several filing options are available for exporters:

Key considerations during the submission process include understanding the timelines and deadlines for submitting forms based on the expected departure of goods. Late submissions can lead to unnecessary delays in shipment and fines.

Managing and tracking your submission

Effective management of submissions is a crucial aspect of exporting. After submitting the Foreign Trade Regulations Form, exporters often wish to track the status of their submission. Here are options available for tracking status:

It is vital to keep thorough records of all submissions, as this will facilitate future exports and help establish patterns that may require attention or adjustment.

Tools and resources available on pdfFiller

pdfFiller offers extensive features that streamline the process of filling out the Foreign Trade Regulations Form. Users can benefit from an array of tools designed for efficiency and accuracy in document management:

Additional document management tools, such as tracking, collaboration features, and communication channels with legal advisors or other stakeholders, make pdfFiller an invaluable ally for teams managing foreign trade regulations documentation.

FAQs about the foreign trade regulations form

When engaging with the Foreign Trade Regulations Form, many users encounter common questions and concerns that require clarification. Here are some frequently asked questions:

Addressing these concerns ensures that individuals and teams are well-equipped to navigate the complexities of trade regulations with ease and confidence.

Conclusion on the importance of adhering to foreign trade regulations

Navigating the Foreign Trade Regulations Form is an essential duty for exporters committed to compliance and operational integrity in international trade. By understanding key components, necessary procedures, and common pitfalls, businesses can ensure their shipping processes run smoothly while adhering to legal standards.

In conclusion, ongoing compliance with foreign trade regulations not only protects your business from legal repercussions but also builds trust with international partners. As global trade continues to evolve, being proactive in managing your documentation will set you ahead in the dynamic marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my foreign trade regulations in Gmail?

How can I fill out foreign trade regulations on an iOS device?

Can I edit foreign trade regulations on an Android device?

What is foreign trade regulations?

Who is required to file foreign trade regulations?

How to fill out foreign trade regulations?

What is the purpose of foreign trade regulations?

What information must be reported on foreign trade regulations?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.