Get the free Consolidated Report After Result Processing

Get, Create, Make and Sign consolidated report after result

Editing consolidated report after result online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consolidated report after result

How to fill out consolidated report after result

Who needs consolidated report after result?

Consolidated Report After Result Form: A Comprehensive Guide

Understanding the consolidated report after result form

A consolidated report after result form aggregates financial data from multiple entities, providing a unified view of performance metrics and financial positions. This document is essential for organizations with subsidiaries or divisions, facilitating a holistic understanding of overall financial health. Its primary purpose is to synthesize individual accounts into a consolidated figure, streamlining the evaluation process and making strategic insights accessible.

Consolidated reporting plays a crucial role in financial management. Stakeholders, including investors and management, rely on this clarity to gauge organizational performance accurately. It emphasizes compliance with financial reporting standards, ensuring transparency and accuracy. By centralizing financial data, organizations enhance their decision-making capabilities and align their operational strategies effectively.

Key components of a consolidated report

A well-structured consolidated report is built on several key components that ensure completeness and accuracy. Essential elements typically include financial statements, which comprise balance sheets, income statements, and cash flow statements. These documents provide insight into the financial performance and stability of the organization as a whole.

Data collection and analysis form the backbone of the consolidation process. Accurate financial figures from all entities must be collected before they can be integrated. It is equally important to identify intercompany transactions, which are transactions between different subsidiaries. Eliminating these transactions is vital to avoid double counting and to reflect an accurate view of financial performance. Additionally, companies must harmonize their accounting policies to ensure uniformity across reports, facilitating easier comparisons and clearer insights.

Why create a consolidated report after result form?

Creating a consolidated report after result form is essential for enhancing financial transparency within an organization. This type of reporting allows stakeholders to perceive the business's financial position as a single entity rather than a fragmented collection of independent segments. This clearer view can improve trust and confidence among investors and other external stakeholders.

Furthermore, it significantly boosts stakeholder communication by presenting complex data in a comprehensible manner. A consolidated report acts as a bridge, translating intricate financial information into actionable insights, thus facilitating informed decision-making. This form not only aids in compliance with regulatory standards but also empowers management to develop strategic initiatives effectively.

Steps to create a comprehensive consolidated report

Creating a consolidated report requires a meticulous approach, beginning with the collection of financial statements from all involved entities. In this initial step, templates and resources can streamline data collection. It's advisable to use uniform templates across divisions to minimize discrepancies.

The second step involves standardizing reporting periods and accounting policies. Ensuring that all entities report within the same time frame helps in maintaining consistency. Following this, it's vital to eliminate intercompany transactions. Identification can involve reviewing transaction logs and matching entries across accounts to adjust for any duplications. Beginning with consolidation worksheets allows for organized compiling of the financial data.

Practical example walkthrough

When creating a sample consolidated report, consider a company with three subsidiaries: A, B, and C. Subsidiary A generated revenue of $500,000, B $300,000, and C $200,000. To consolidate these figures, the process accumulates revenue, equating to a total of $1,000,000. However, if there are intercompany sales of $100,000 from A to B, this transaction must be eliminated from the final report to avoid inflating revenue.

Visual aids, such as sample report layouts, enhance understanding. Incorporating charts can illustrate revenue growth or depict expenses as a percentage of total revenue, enabling a clearer analysis of financial health. This illustrative representation is not only helpful for internal stakeholders but also beneficial for external parties evaluating the company’s performance.

Common challenges in consolidated reporting

Consolidated reporting can be fraught with challenges, especially during mergers and acquisitions. The merging of different accounting cultures and systems complicates integration. Different entities may employ varied accounting principles, potentially leading to discrepancies in financial reporting. Additionally, regulatory compliance presents another layer of complexity as each jurisdiction may have unique requirements.

Addressing these challenges necessitates a proactive approach, including establishing clear communication between finance teams from different subsidiaries and ensuring that all parties are aligned in terms of accounting policies. Solutions such as centralized documentation, training sessions on compliance, and employing experienced financial professionals can enhance operational efficiency, ensuring timely and accurate reports.

Interactive tools for managing your consolidated report

The right tools can significantly enhance the efficiency of creating and managing consolidated reports. Platforms like pdfFiller provide robust features for document creation and management, allowing teams to collaborate on reports in real-time. This kind of functionality enables multiple users to edit, comment, and finalize documents without the inefficiencies of back-and-forth emailing.

Moreover, collaborative tools can facilitate teamwork, helping teams to distribute tasks effectively. eSigning solutions ensure that final reports can be quickly approved without delays related to physical signatures. Utilizing these technologies streamlines the document lifecycle from creation to approval, ensuring that consolidated reports are not only comprehensive but also timely and accurate.

The role of technology in consolidated reporting

Cloud-based platforms are becoming essential for effective consolidated reporting. Such technology allows for easy access to financial data from anywhere, enabling teams to collaborate seamlessly, regardless of location. This flexibility is crucial, particularly for organizations operating across multiple geographies.

Recent innovations in document management solutions further enhance the reporting process. For example, AI-powered analytics can sift through vast amounts of data, identifying patterns and anomalies that may otherwise be overlooked. Implementing such technological solutions not only speeds up the reporting process but also improves the overall accuracy of financial reports.

FAQs about consolidated reporting

Diving into frequently asked questions about consolidated reporting illuminates common queries and concerns regarding this vital financial process. For instance, many wonder about the differences between consolidated and unconsolidated reports; essentially, consolidated reports combine financials from multiple entities, whereas unconsolidated reports focus solely on individual entities.

Responsibility for creating and overseeing a consolidated report typically lies with the finance team, specifically the Chief Financial Officer (CFO) or designated accountants experienced in consolidation processes. Regulatory requirements can significantly impact how these reports are prepared; organizations must stay compliant with standards such as GAAP or IFRS, depending on their operational jurisdiction. Tools like pdfFiller streamline the creation of these reports, offering templates and editing features that are invaluable.

Explore more topics related to consolidated reporting

Addressing topics around tax compliance and regulatory requirements further enhances understanding of the full landscape of consolidated reporting. Insights into transparent financial reporting practices show how best to communicate findings to stakeholders, thus fostering trust and credibility. Moreover, exploring techniques to enhance financial visibility and operational efficiency provides actionable strategies for companies seeking to improve their reporting frameworks.

For instance, developing clear communication channels among finance departments can streamline processes and increase accuracy. Embracing advanced analytics can lead to smarter, data-driven decisions that benefit long-term growth. Each of these components plays a critical role in ensuring that consolidated reports do not only meet regulatory compliance but also serve as strategic tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify consolidated report after result without leaving Google Drive?

Can I sign the consolidated report after result electronically in Chrome?

How do I fill out consolidated report after result on an Android device?

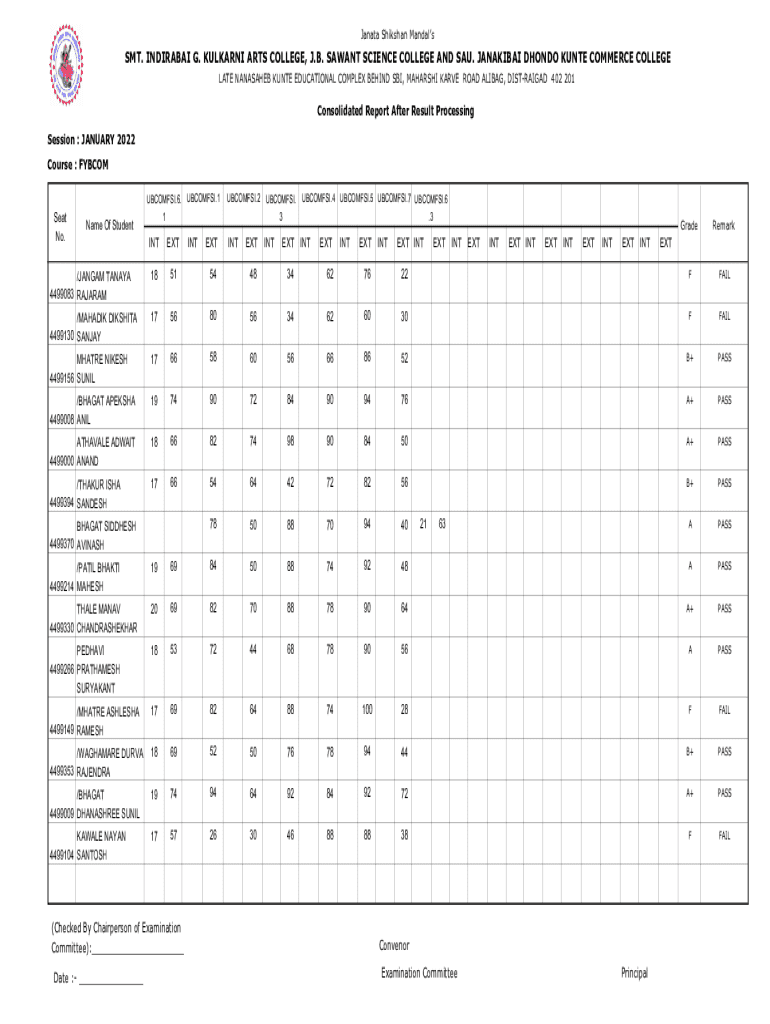

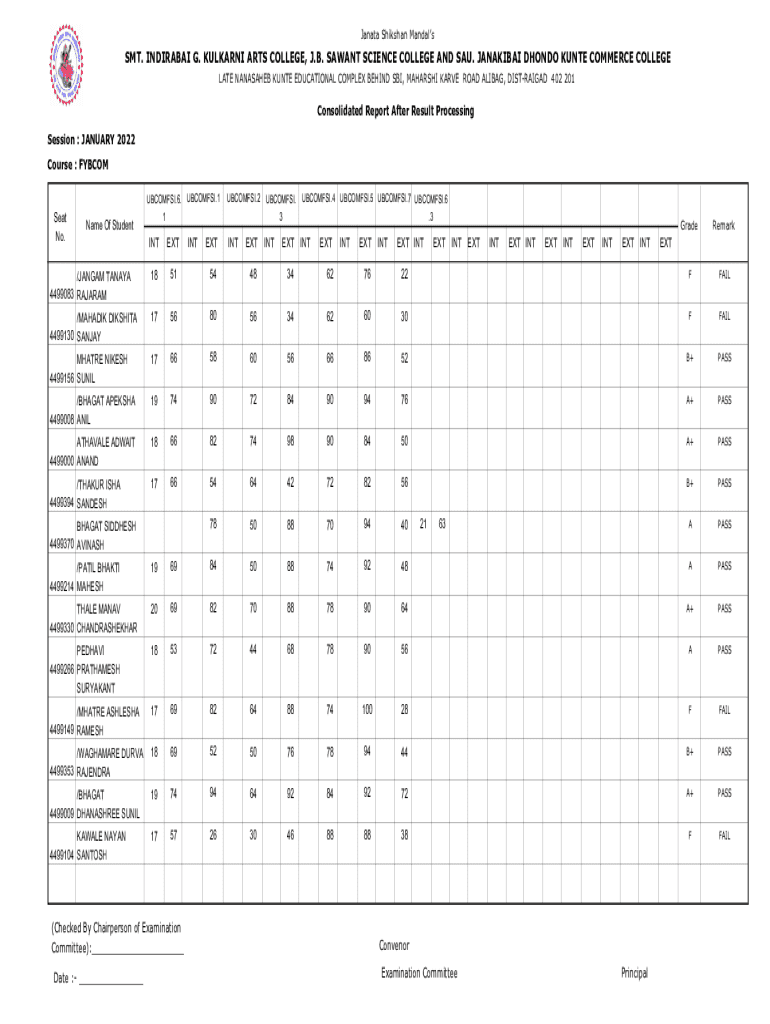

What is consolidated report after result?

Who is required to file consolidated report after result?

How to fill out consolidated report after result?

What is the purpose of consolidated report after result?

What information must be reported on consolidated report after result?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.