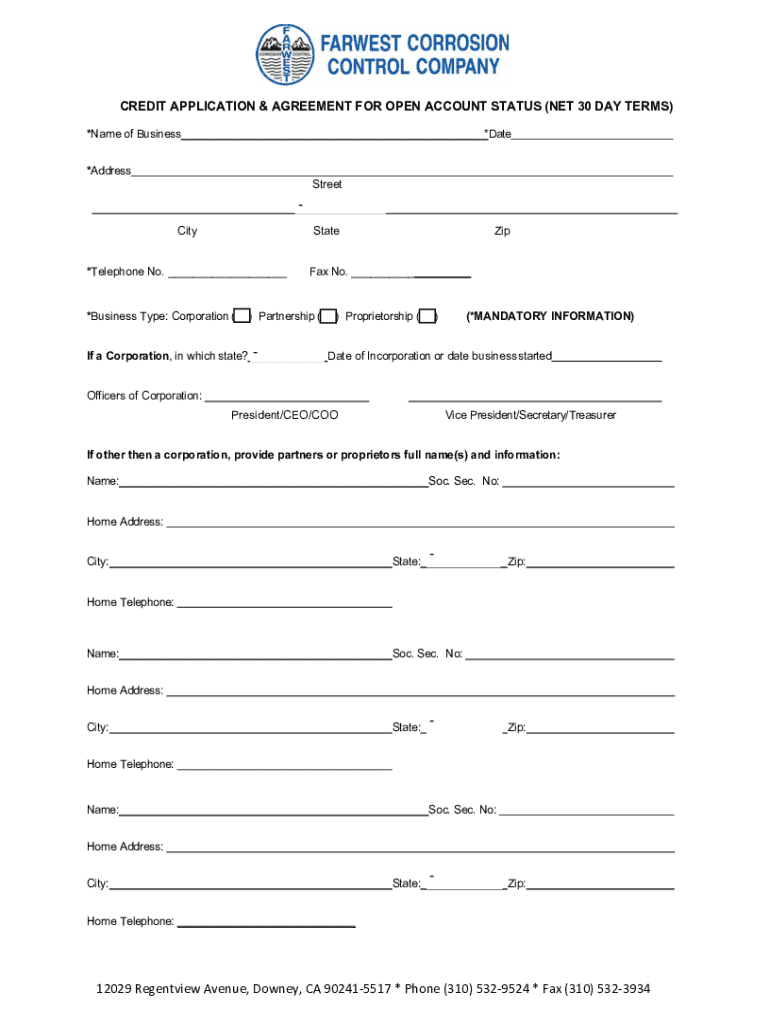

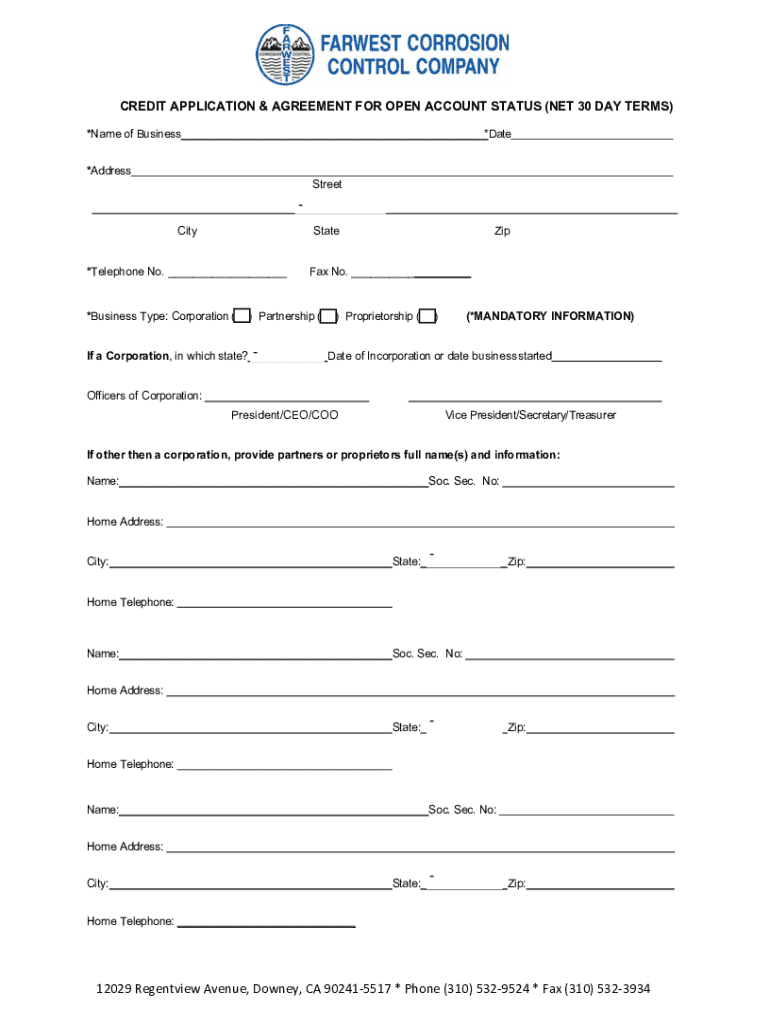

Get the free Credit Application & Agreement for Open Account Status (net 30 Day Terms)

Get, Create, Make and Sign credit application agreement for

Editing credit application agreement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application agreement for

How to fill out credit application agreement for

Who needs credit application agreement for?

Comprehensive Guide to Credit Application Agreement for Form

Understanding the credit application agreement

A credit application agreement is a formal document that individuals or businesses fill out when applying for credit or loans. This agreement outlines the terms, conditions, and obligations that borrowers must adhere to while seeking financial assistance. It plays a crucial role in financial transactions, as it sets the groundwork for assessing creditworthiness and determining loan eligibility.

The importance of a credit application agreement cannot be overstated. It not only helps lenders assess risk but also protects both parties involved by providing clarity on expectations. Key components typically include personal identification details, employment information, and a detailed financial history to evaluate the applicant's ability to repay borrowed funds.

Types of credit application agreements

Credit application agreements can largely be categorized into personal and business forms. Personal credit application agreements are used by individuals seeking personal loans, credit cards, or mortgages. Typical use cases include home purchases, vehicle financing, or credit for personal expenses. When filling out this form, individuals should provide information such as details of their income, employment status, and existing debts.

On the other hand, business credit application agreements differ significantly from personal ones. Businesses may need to supply financial statements, business plans, and credit history of their company. Essential details often include the legal structure of the business, length of time in operation, and projected cash flows. Providing this comprehensive information is vital for lenders to gauge the potential risk of lending to a business.

Preparing to fill out a credit application agreement

Prior to filling out a credit application agreement, applicants should gather all pertinent information. This includes personal identification details such as name, address, and Social Security number. Additionally, compiling a complete financial history is crucial. This background should encompass any current obligations, such as mortgages, car loans, or credit card debt, to give a clear picture of one's financial health.

Understanding your credit score and report is also imperative. Credit scores—numerical values representing creditworthiness—directly impact credit application outcomes. Applicants are encouraged to access and review their credit reports from agencies like Experian, TransUnion, or Equifax. This proactive measure allows potential borrowers to identify any discrepancies that may hinder their application.

Step-by-step instructions for filling out a credit application agreement

Filling out a credit application agreement can be straightforward if approached methodically. The first section typically asks for personal information, including names, addresses, and contact details. Following this, the financial information section requires applicants to disclose their income, debts, and assets. Providing accurate figures is paramount to enhance the credibility of your application.

Next, there is usually an employment verification section that may require details about your employer, position, and duration of employment. Finally, the authorization and signature section allows lenders to run credit checks and validates the information provided. Be cautious to avoid common mistakes, such as submitting incomplete forms or misunderstanding terms and conditions that could lead to application delays.

Editing and customizing your credit application agreement

Once the form is filled in, you may find it beneficial to edit or customize the credit application agreement. Utilizing tools like pdfFiller enables easy modifications to your document. With pdfFiller, you can edit text and fields to correct errors or update information without needing to start from scratch. For instance, if you need to add additional assets or adjust your income, you can easily do so.

In addition to editing, ensuring compliance with legal standards is crucial. Understanding local laws and regulations related to credit applications will help avoid issues later on. Proper legal terminology must be used to maintain the agreement's validity, thereby providing the necessary protections for both the applicant and the lender.

eSigning and finalizing the credit application agreement

The final step in completing your credit application agreement involves eSigning it. eSignatures are legal and secure, allowing you to finalize the agreement quickly without the need for physical documents. pdfFiller provides a straightforward eSigning process, guiding users through the steps required to sign electronically.

Once you’ve completed the form and added your eSignature, you can easily send the finalized agreement directly to the lender. Ensure that all parties involved understand the implications of the terms before submitting, as this helps prevent potential misunderstandings in the future.

Managing your credit application agreement in the cloud

Once you've completed and submitted your credit application agreement, managing the document effectively is vital. pdfFiller’s cloud storage solution allows you to access your document from anywhere, making it easy to retrieve information as needed. This is particularly useful if you need to review your application for upcoming meetings or discussions with lenders.

Moreover, pdfFiller enhances collaboration capabilities by allowing you to invite team members or financial advisors to view or edit the application. Tracking changes and versions is simplified, as you can utilize version history to monitor edits and understand who made specific changes. This element of document management ensures transparency and accountability in your financial dealings.

Frequently asked questions (FAQs)

After navigating the credit application process, applicants often have several questions. For instance, it's common to wonder what steps to take if your credit application is denied. In such cases, reviewing the lender's reason for denial can provide insights into necessary improvements for future applications.

Additionally, applicants may ask how long the credit application process typically takes. This duration can vary depending on financial institutions; however, understanding their timelines can help manage expectations. It's also vital to know whether you can withdraw your application after submission, especially if circumstances change.

The benefits of using pdfFiller for your credit application agreements

Utilizing pdfFiller for your credit application agreement offers a multitude of advantages. The platform provides comprehensive document tools that allow for the seamless creation and management of forms. Users benefit from a user-friendly interface that simplifies the entire process, making it easier for both novices and seasoned professionals to manage their documents efficiently.

Furthermore, pdfFiller’s enhanced security features ensure that your sensitive information remains protected throughout the application process. With robust encryption and secure access controls, you can feel confident in submitting your credit application agreement safely.

Tips for a successful credit application

To ensure a successful credit application, preparation is key. Start by preparing your financial statements, which provide a thorough overview of your financial health. Building a strong credit profile will also bolster your chances of approval; consider paying down existing debts and ensuring bills are paid on time.

Understanding financial terms and conditions is equally important. Familiarizing yourself with interest rates, fees, and repayment terms can help you make informed decisions. When you approach your loan request armed with accurate information, you position yourself as a responsible and serious applicant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute credit application agreement for online?

How can I edit credit application agreement for on a smartphone?

How do I edit credit application agreement for on an iOS device?

What is credit application agreement for?

Who is required to file credit application agreement for?

How to fill out credit application agreement for?

What is the purpose of credit application agreement for?

What information must be reported on credit application agreement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.