Get the free Credit Card Dispute Form

Get, Create, Make and Sign credit card dispute form

How to edit credit card dispute form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card dispute form

How to fill out credit card dispute form

Who needs credit card dispute form?

Credit card dispute form: A comprehensive how-to guide

Understanding credit card disputes

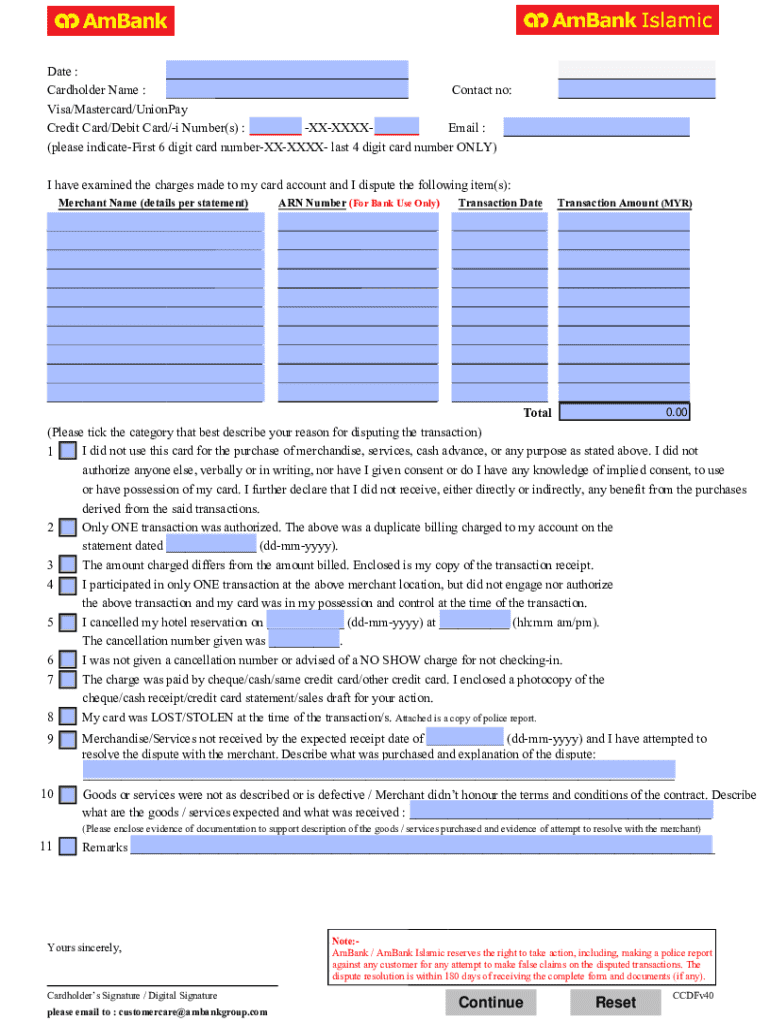

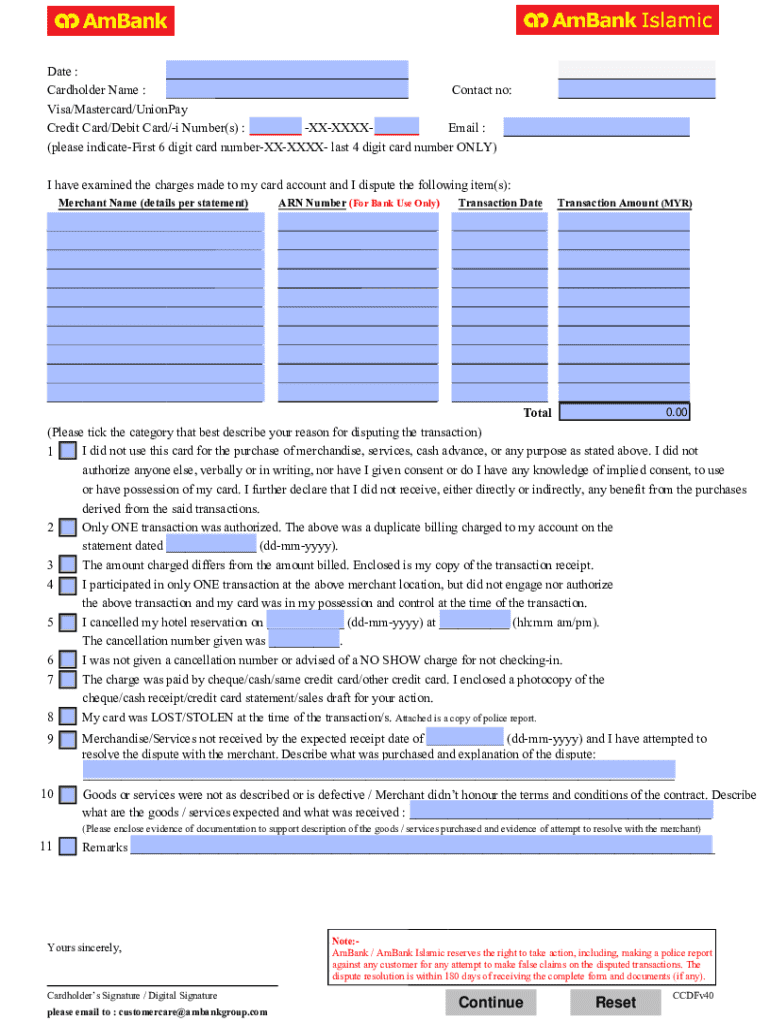

A credit card dispute arises when a cardholder challenges a transaction on their account. This process allows consumers to report unauthorized charges, billing errors, or dissatisfaction with goods/services received. Understanding the nuances of credit card disputes emphasizes the rights consumers have against errors and fraud.

Common reasons for filing a dispute include fraudulent charges, double billing, an incorrect transaction amount, or undelivered goods. Knowing these reasons helps users prepare their documentation and arguments effectively to represent their case.

Proper documentation is vital in the dispute process. It can affect not only the dispute's outcome but also your future credit score and credit report. When you dispute a charge, the credit card issuer must investigate before making a decision, and having a strong case backed by documentation increases your chances of success.

Preparing to file a credit card dispute

Before initiating a dispute, gather essential information to support your claim. Start with collecting relevant transaction details such as the transaction amount, date, and merchant name. This data is critical when specifying the disputed charge in your credit card dispute form.

Supporting documentation enhances your case significantly. This includes receipts, statements, any correspondence with the merchant, or visual evidence like screenshots or pictures. The more concise and compelling your evidence, the stronger your case becomes.

Additionally, familiarize yourself with common terms related to credit card disputes. Knowing definitions for terms like chargeback, fraud, and billing errors will make filling out the dispute form easier.

Step-by-step guide to completing the credit card dispute form

To initiate a credit card dispute, you need the official credit card dispute form. You can easily access this form through pdfFiller. It offers options for both online access and downloading in PDF format, ensuring you can fill it out at your convenience.

Filling out the form can seem daunting, but by breaking it down into steps, it becomes manageable.

Using pdfFiller tools simplifies the process significantly, allowing for a seamless upload of necessary evidence and ensuring everything is in order for review.

Submitting your credit card dispute

Once you complete the credit card dispute form, it’s time to review your submission carefully. Checking for completeness is crucial, so ensure every section has been filled out accurately, and that all supporting evidence is included.

Next, you need to submit the form. Typically, this can occur via mail, email, or through an online portal provided by your credit card issuer. It's best practice to contact your credit card issuer to understand the preferred submission method and any specific instructions they may have.

Tracking your dispute is essential. Keep a detailed log of all communications with your issuer regarding the dispute. This record can be beneficial if any issues arise during the review process.

What to expect after filing

After submitting your credit card dispute, expect some time for the investigation. Typically, credit card companies have to resolve disputes within 30 days to two billing cycles. They will review provided evidence, the merchant's response, and any additional information.

Outcomes of disputes can vary. A successful dispute may result in a refund or credit to your account, while an unsuccessful one may lead to the charge remaining. Understanding the result can help plan your next steps, such as disputing again or managing your finances accordingly.

Real stories: Experiences of credit card disputes

Hearing real-life experiences can provide insight into the dispute process. Many individuals have successfully navigated credit card disputes and shared their strategies. For instance, one user successfully disputed unauthorized charges by documenting all correspondence with their card issuer and providing comprehensive evidence of the fraudulent transaction.

Conversely, others have encountered challenges, resulting in unsuccessful disputes. Common lessons include the importance of clear evidence and the necessity to follow up regularly with their credit card issuer. By analyzing both successes and failures, consumers can refine their approach to the dispute process.

Resources for managing credit card issues

Understanding your credit report and score is essential, especially when navigating the dispute process. Disputes can affect your credit score depending on the outcome, so keeping tabs on your credit report will help you stay informed. You can request a free copy of your report from major bureaus to monitor any changes or inaccuracies.

In addition, consumer protection agencies offer resources for those seeking assistance with credit card issues. These organizations can provide guidance on filing disputes and complaints against card issuers, ensuring consumers know their rights.

Legal considerations in credit card disputes

Consumers are protected under the Fair Credit Billing Act (FCBA), which allows them to dispute charges and withhold payment on disputed amounts. The FCBA sets regulations that credit card issuers must follow during the dispute resolution process, ensuring fairness and transparency.

Sometimes a dispute can escalate beyond the form. If you find that your attempts to resolve an issue with your credit card issuer are unsuccessful, legal assistance might become necessary. Signs to seek legal help include continued billing errors for the same charge or lack of communication from your issuer.

Enhancing document management with pdfFiller

Using pdfFiller can transform how you handle document creation and management. Its features simplify the filling, editing, and signing processes for various forms, including the credit card dispute form. With cloud capabilities, you can access necessary documents from anywhere, ensuring you always have your materials at hand.

Users report that pdfFiller's interface enhances their document workflows, allowing them to finalize forms quickly without confusion. The ability to edit, fill, and store all documents in one location streamlines the often-tedious process of filing disputes and managing billing issues.

Additional tips for successful credit card management

Preventing disputes before they occur is key. Regularly tracking your spending can enable you to spot unauthorized charges promptly. Additionally, understanding your credit card’s terms and conditions can help you avoid service-related disputes.

Maintaining a healthy credit score is vital for long-term financial health. Consistent on-time payments, low credit utilization, and monitoring your credit report can all contribute to building a robust credit profile. Taking proactive steps to manage your credit can minimize future issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card dispute form to be eSigned by others?

How do I make changes in credit card dispute form?

Can I edit credit card dispute form on an Android device?

What is credit card dispute form?

Who is required to file credit card dispute form?

How to fill out credit card dispute form?

What is the purpose of credit card dispute form?

What information must be reported on credit card dispute form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.