Get the free Coverdell Education Savings Account Distribution Request Form

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Coverdell Education Savings Account Form - How-to Guide

Understanding Coverdell Education Savings Accounts (ESAs)

A Coverdell Education Savings Account (ESA) is a tax-advantaged investment vehicle designed to help families save for education expenses. Contributions to a Coverdell ESA grow tax-free, allowing you to maximize the savings over time until the funds are used for qualified educational expenses. In addition to this, when withdrawals are made for eligible education costs, the money is tax-free. This dual benefit makes Coverdell ESAs an appealing choice for parents and guardians planning for their children's educational future.

Tax advantages offered by Coverdell ESAs are significant; funds can grow without being subject to income tax or capital gains tax, as long as withdrawals are utilized for qualifying education expenses such as tuition, fees, books, and other associated costs. Understanding these benefits can aid families in making informed financial decisions.

Eligibility criteria for contributions

Eligibility for making contributions to a Coverdell ESA hinges on certain income limits set by the IRS. Individual contributors must have a modified adjusted gross income (MAGI) below certain thresholds to fully contribute to the account. For married couples filing jointly, the income limit is generally higher compared to single filers. Additionally, the eligibility of beneficiaries includes anyone under 18 years of age, allowing families to plan for both K-12 education and college expenses.

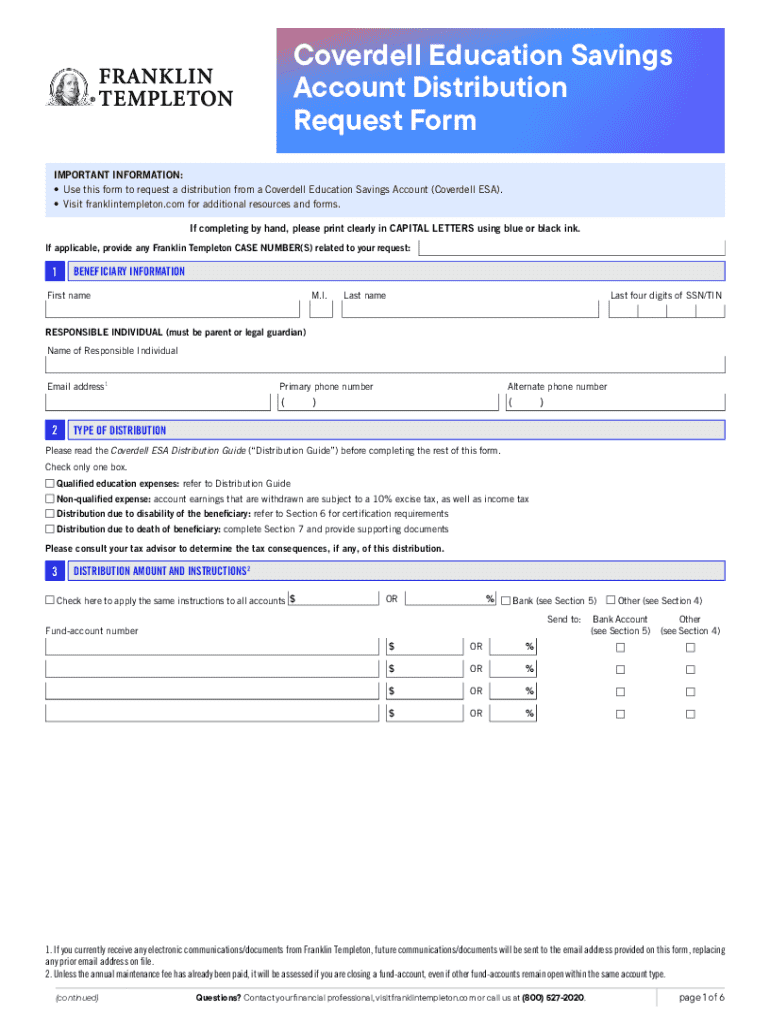

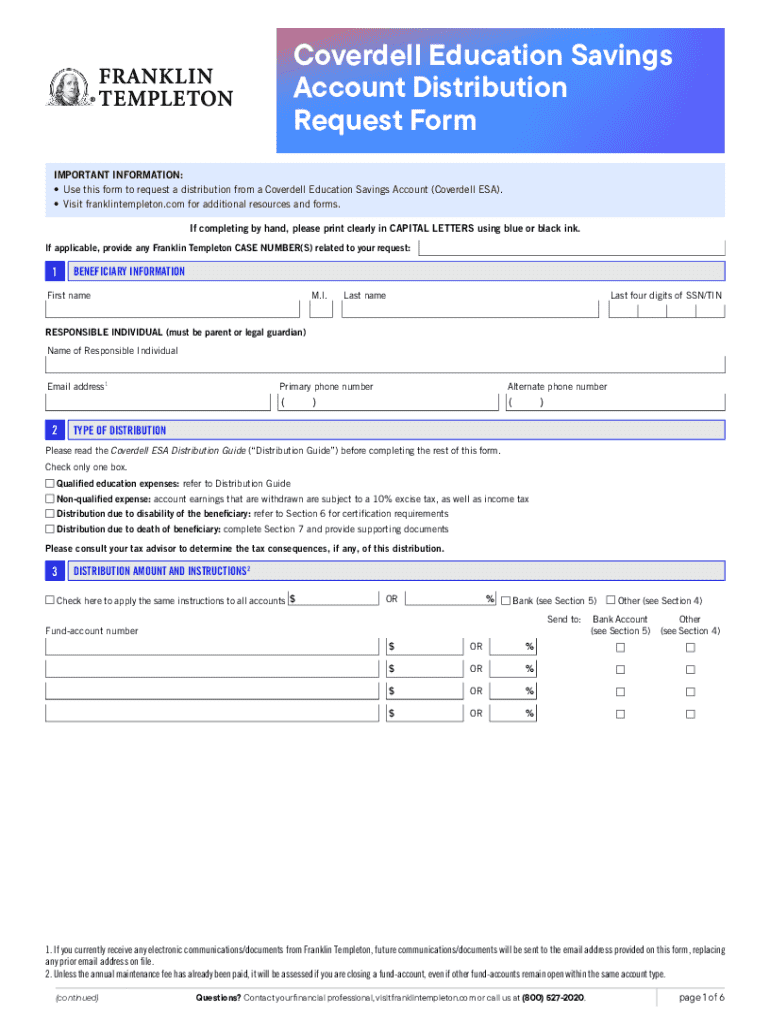

The importance of the Coverdell ESA form

The Coverdell ESA form is a critical document that serves as the foundation for establishing and managing the account. Properly completing this form is essential to ensure that contributions are reported correctly, and that the funds can be accessed without complications. Not submitting the form accurately or failing to provide required information could lead to delays in processing or even the rejection of the account setup.

The consequences of not completing the Coverdell ESA form correctly can range from tax penalties to the inability to utilize the funds for education expenses. Therefore, a thorough understanding of the form's structure is vital for anyone looking to take advantage of this educational savings tool.

Key components of the Coverdell ESA form

The Coverdell ESA form typically comprises several essential sections that need to be filled out accurately to establish and manage the account properly. Common components include personal information of both the contributor and the beneficiary, account identification details, and specifics surrounding the contributions made to the account.

Step-by-step guide for completing the Coverdell ESA form

Gathering necessary information

To begin the process of filling out the Coverdell ESA form, you will need to gather various pieces of personal information. This includes the social security numbers of both the beneficiary and contributor, details about the institution handling the ESA, along with the financial specifics that lay the foundation for your contributions.

Filling out the form

Detailed instruction on filling out the form begins with identifying the account. You should start by completing Section 1 with your account information, which will include the name of the financial institution and the account number. For Section 2, you’ll need to provide information about the beneficiary, including their full name, date of birth, and social security number to ensure compliance with IRS rules.

Section 3 focuses on contribution details; here, you specify the amount you wish to contribute and the frequency of these contributions—whether they will be one-time deposits or recurring contributions. Once completed, it’s important to review all entries to confirm accuracy before submission.

Common mistakes to avoid

Despite the straightforward nature of the form, people often make mistakes that can complicate the submission process. Common errors include incorrect social security numbers, skipping required sections, or not double-checking contribution amounts. It’s recommended to perform a thorough review of all entries and ensure that each part of the form is filled out completely.

Editing and customizing your Coverdell ESA form

How to edit your form using pdfFiller

Once you have the Coverdell ESA form, using pdfFiller allows you to easily edit and customize your document. The platform provides you with a user-friendly interface for making necessary adjustments, accommodating any unique requirements you may have. pdfFiller enables users to create a tailored form that fits their specific circumstances, ensuring precision in every entry.

Adding eSignatures and collaborating

An essential feature of pdfFiller is the ability to electronically sign the form, which enhances its legitimacy and expedites the process. Follow these steps to add your eSignature: start by placing your cursor where the signature is required, then choose the eSignature option and follow prompts to create or import your signature. Once signed, the document can be saved or shared directly via the pdfFiller platform.

Submitting the Coverdell ESA form

Where and how to submit your form

After thoroughly completing and reviewing your Coverdell ESA form, the next step involves submission. Depending on your financial institution’s policies, this can be done by mail or electronically. Each institution has specific submission guidelines, so it's important to follow these directions. If submitting by mail, ensure that all pages are included and signed, with adequate postage. If submitting electronically, confirm that the digital submission is via a secure platform.

Tracking your submission status

Once your Coverdell ESA form has been submitted, monitoring its status can provide peace of mind. Most institutions offer confirmation of receipt or a tracking system to monitor the processing stage of your submission. Be sure to keep records of your submission, including confirmation numbers or mail tracking numbers, if applicable. Generally, processing times can vary, so allow for a period before following up.

Managing your Coverdell ESA

Keeping track of contributions and withdrawals

Managing a Coverdell ESA includes keeping accurate records of contributions and withdrawals. Utilizing tools available within pdfFiller, such as spreadsheets or tracking documents, can streamline this process. Regularly updating these records ensures that you remain compliant with IRS rules while keeping an eye on future contributions and ensuring you do not exceed limits.

Understanding tax implications

Being aware of the tax implications surrounding your Coverdell ESA is crucial for effective management. While contributions grow tax-free, improper withdrawals can result in penalties and taxes. Familiarize yourself with what qualifies as an educational expense to avoid tax repercussions. It's advisable to consult a tax professional for personalized guidance on navigating tax implications effectively.

Frequently asked questions about Coverdell ESAs

What happens if exceed contribution limits?

If you exceed the contribution limits set for a Coverdell ESA, you may face tax penalties on the excess amount. It's essential to consult IRS guidelines or a tax professional to understand the repercussions and find strategies to remedy the situation by either withdrawing the excess contributions or properly documenting eligible education expenses.

Can change the beneficiary of my Coverdell ESA?

Yes, you can change the beneficiary of your Coverdell ESA. However, the new beneficiary must also meet the eligibility criteria for the ESA to avoid any tax implications. Generally, changing beneficiaries can be a straightforward process; check with your financial institution for specific requirements.

What educational expenses can use Coverdell ESA funds for?

Funds from a Coverdell ESA can be used for a wide range of educational expenses, including tuition, fees, books, supplies, and even certain room and board costs if the beneficiary is enrolled at least half-time. However, ensure that any expenses comply with IRS guidelines to maintain tax advantages.

Additional tools and resources

Interactive tools for calculating contributions

pdfFiller offers interactive calculators that help you estimate educational savings contributions based on your goals and time frame. Utilizing these tools can help you create a more strategic plan for your Coverdell ESA, ensuring that you are on track to achieve the desired funding for your beneficiary's education.

Template library for related educational saving forms

Alongside the Coverdell ESA form, pdfFiller provides a comprehensive library of templates related to education savings accounts. These resources allow you to efficiently manage all educational savings documents in a centralized location, streamlining your administrative efforts and making document management seamless.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute coverdell education savings account online?

How do I make edits in coverdell education savings account without leaving Chrome?

How do I complete coverdell education savings account on an iOS device?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.