Get the free Credit Card Form

Get, Create, Make and Sign credit card form

How to edit credit card form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card form

How to fill out credit card form

Who needs credit card form?

A comprehensive guide to credit card forms

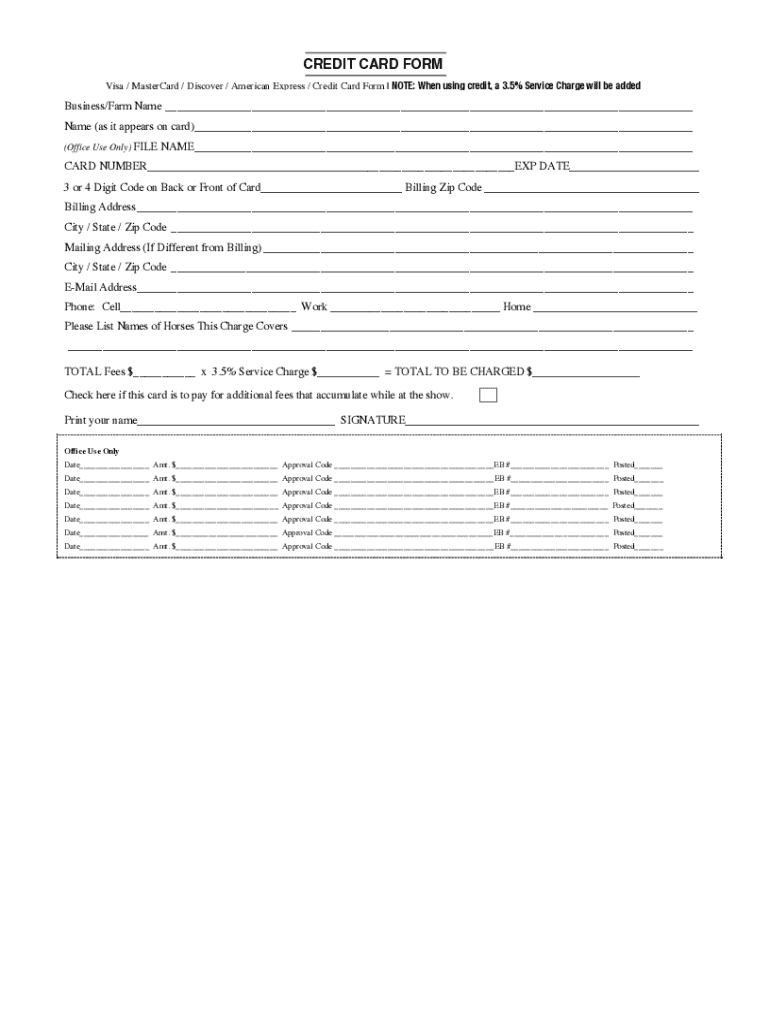

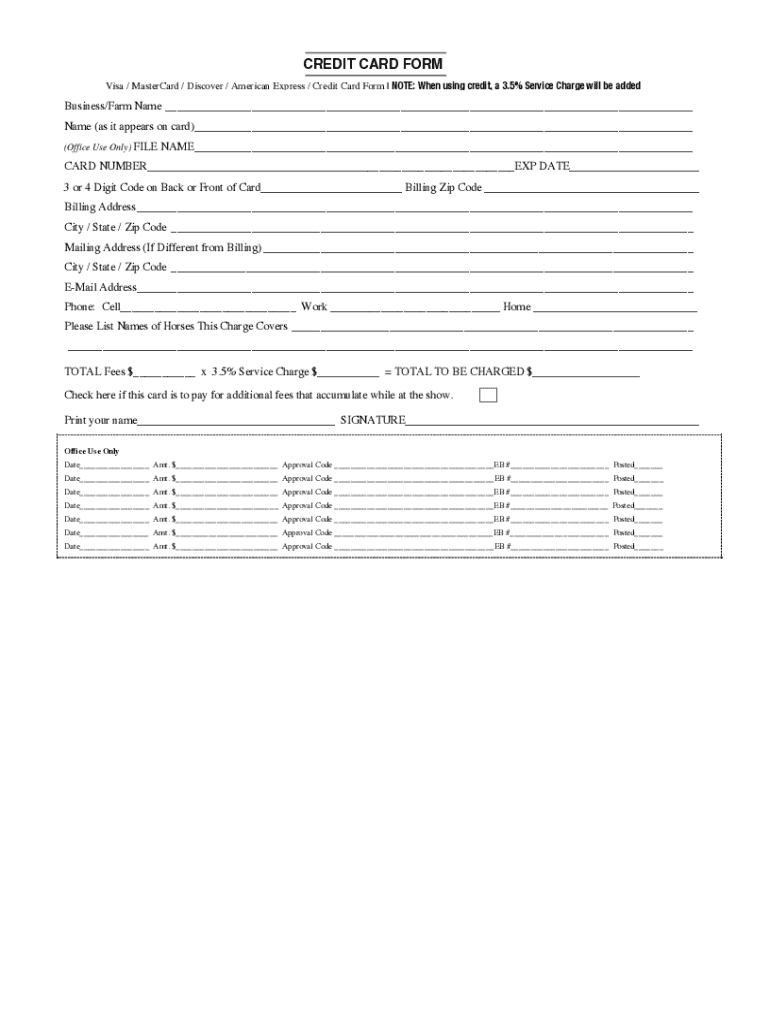

Understanding the credit card form

A credit card form serves as a fundamental instrument for processing payments in various transactions. It encapsulates essential information, ensuring that payments are conducted securely and efficiently. Credit card forms can differ significantly based on their specific uses and the type of transactions they support.

Among the various types of credit card forms, three prominent categories stand out: credit card authorization forms, one-time payment forms, and recurring payment authorization forms. Each type plays a crucial role in financial transactions, ensuring that businesses can manage payments according to their operational needs.

Understanding and utilizing the right credit card form is vital for both consumers and businesses since it enhances payment security, reduces the risk of fraud, and simplifies the overall transaction process.

Key components of a credit card form

A well-structured credit card form comprises several essential fields that gather critical information. Key components include:

Additionally, optional fields such as including the CVV (Card Verification Value) and specifying the transaction purpose can enhance the form's security and clarity.

Benefits of using credit card forms

Utilizing credit card forms reaps several benefits for both businesses and customers. Here are some advantages:

Steps to create a credit card form using pdfFiller

Creating a credit card form can be a straightforward process when using pdfFiller. Here’s how you can do it:

Filling out a credit card form: best practices

Whether you’re a customer or a business, filling out a credit card form should be approached with care. Adhere to these best practices:

Signing and submitting your credit card form

After filling out the credit card form, the next step is signing and submitting it. Consider these aspects:

Managing and storing credit card forms

Once your credit card forms are completed, effective management and secure storage become essential. Consider the following:

FAQs about credit card forms

Several common questions arise regarding credit card forms, particularly about their usage and security. Here’s a look at some of them:

Templates and resources available on pdfFiller

pdfFiller provides a range of templates and resources that facilitate quick setup of credit card forms. Users can:

Relevant topics and next steps

To further enhance your transaction management, consider exploring related areas like:

Customer testimonials and case studies

Many businesses have successfully integrated credit card forms into their operations using pdfFiller. Here are a few success stories that highlight this:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card form?

How do I make changes in credit card form?

How do I fill out credit card form on an Android device?

What is credit card form?

Who is required to file credit card form?

How to fill out credit card form?

What is the purpose of credit card form?

What information must be reported on credit card form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.