Get the free Confirmation of Gifted Deposit

Get, Create, Make and Sign confirmation of gifted deposit

Editing confirmation of gifted deposit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation of gifted deposit

How to fill out confirmation of gifted deposit

Who needs confirmation of gifted deposit?

Confirmation of gifted deposit form: A comprehensive guide

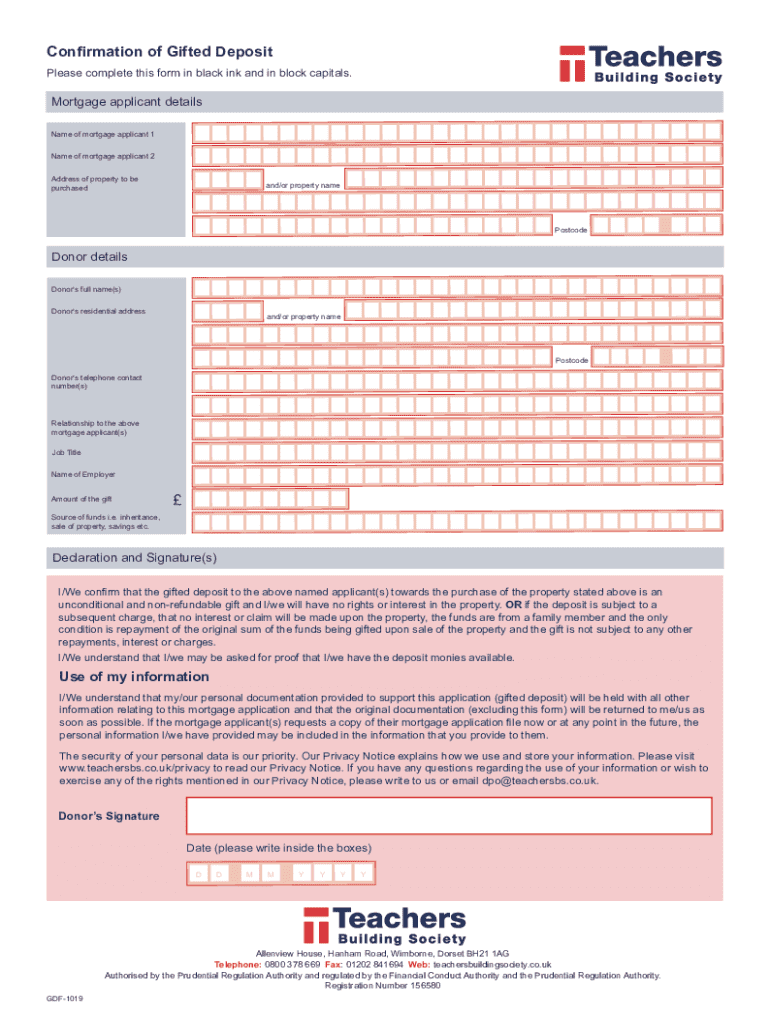

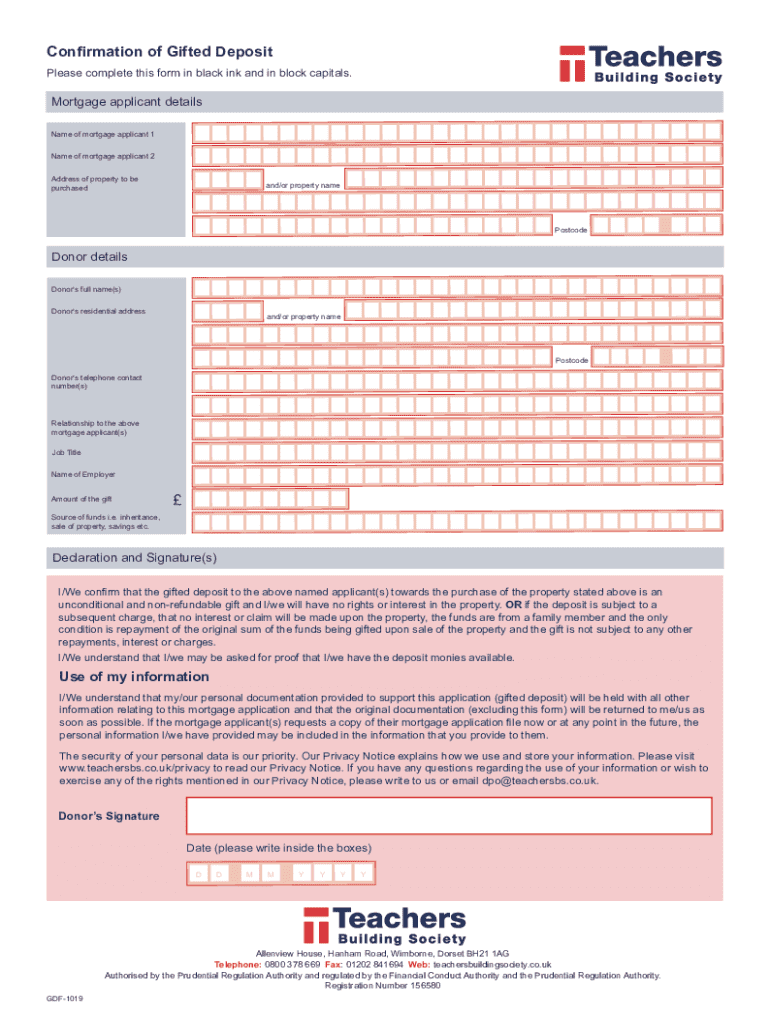

Understanding the gifted deposit form

A confirmation of gifted deposit form is a critical document in the mortgage process that certifies a financial gift given to help with a home purchase. Its primary purpose is to assure lenders that the funds provided as a deposit do not need to be repaid, thereby reducing the financial burden on potential homeowners. This form serves as a vital safeguard for lenders, ensuring that all deposits are legitimate and freely given.

The importance of gifting in home financing cannot be overstated. Many first-time buyers or those looking to upgrade may struggle to gather enough capital for a down payment. Cash gifts, often from family members, can significantly enhance purchasing power, opening doors to homes that might otherwise be unaffordable. With rising property prices, understanding the process around gifted deposits is crucial for anyone navigating the housing market.

Key components of a confirmation of gifted deposit form

A confirmation of gifted deposit form must include several essential components to ensure its validity and compliance with lender requirements. First and foremost is the exact dollar amount of the gift, which should be clearly stated. Additionally, a donor’s statement is required, assuring the lender that the funds are a gift with no expectation of repayment.

In addition to the gift amount and donor statement, the form requires complete details of the donor, which include their full name, address, and phone number, as well as pertinent information from the borrower. The signer’s verification through notarized signatures is also vital to validate the transfer of funds.

How to fill out the confirmation of gifted deposit form

Filling out the confirmation of gifted deposit form can be straightforward if you follow a systematic approach. To start, you need to gather all necessary information before you begin the process.

For seamless form filling, consider utilizing digital tools available through pdfFiller. These tools can guide you through the process, ensuring proper format and prompt completion.

Reasons why lenders require confirmation of gifted deposits

Lenders require a confirmation of gifted deposits primarily to ensure the legitimacy of the funds being used for the down payment. Given the substantial sums involved in home purchases, it is crucial for lenders to verify that money is not a loan hidden under the guise of a gift. This safeguarding measure helps prevent mortgage fraud and ensures that borrowers are not taking on more financial liability than they can handle.

Gifted funds can also impact a borrower's creditworthiness. Lenders assess these funds as part of the overall financial profile of the borrower. A legitimate gift can enhance the borrower’s financial stability and credibility, influencing the lending decision and potentially resulting in better loan terms and interest rates.

Important rules and guidelines regarding gifted funds

Understanding the eligibility criteria for gifted deposits is critical for both donors and recipients. Generally, close relatives such as parents, grandparents, and siblings can legally provide these funds. However, even non-family members can offer gifts, though lenders may scrutinize such transactions more closely due to the potential of hidden loans.

Tax implications also play a significant role, as both the donor and the recipient may have liabilities depending on the amount gifted. It’s advisable to consult a tax professional to navigate these guidelines effectively. Additionally, restrictions on the amounts and conditions under which gifts can be provided vary by lender, necessitating a thorough understanding of these rules to ensure compliance.

Template for confirmation of gifted deposit form

To facilitate the process of completing your confirmation of gifted deposit form, utilizing a template can simplify matters considerably. A downloadable PDF format of the template can be conveniently accessed via pdfFiller.

Using the template ensures that all requisite information is captured, minimizing errors that could complicate the mortgage process. Always review the completed form carefully before submission to ensure accuracy and completeness.

Common mistakes to avoid when submitting gifted deposit forms

There are several common pitfalls to be aware of when submitting a confirmation of gifted deposit form. Missing signatures or incomplete donor statements can lead to delays or rejections from lenders.

To help prevent errors, consider maintaining a checklist of required documents and signatures throughout your submission process. This practice can streamline the preparation significantly.

Frequently asked questions (FAQs)

Clarifying doubts about the confirmation of gifted deposit form often involves addressing pertinent questions. One common inquiry concerns the difference between a gift letter and a gifted deposit form. While both serve similar purposes, the gift letter typically outlines the financial gift's nature, while the gifted deposit form is more formal and often required by lenders.

Another question pertains to the proof of receiving gifted funds. Usually, providing bank statements that show the deposit is sufficient. If a donor changes their mind after the form is submitted, it’s crucial to communicate that with the lender immediately, as this may impact loan approval.

Practical tips for a smooth gifting process

Effective communication with lenders about gifted deposits is essential for a smooth mortgage process. Familiarize yourself with the lender's specific requirements regarding gifted funds, including any documentation they may need upfront. This proactive measure can save significant time and potential complications later in the process.

Strategic timing for gift transfers is also vital. Ideally, funds should be transferred shortly before the mortgage application to ensure there are no delays in documentation of the gift. An aligned timeline supports a smoother experience and increases the chances for quick lender approval.

Leveraging pdfFiller for document management

Utilizing pdfFiller can significantly enhance your experience with the confirmation of gifted deposit form. This powerful tool offers a range of features tailored for document management in an easy-to-use, cloud-based environment.

The benefits of a cloud-based document solution like pdfFiller extend beyond document creation. You can access your filled documents from anywhere, collaborate with needed parties, and maintain an organized filing system, making your mortgage process more straightforward and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get confirmation of gifted deposit?

Can I sign the confirmation of gifted deposit electronically in Chrome?

How do I fill out the confirmation of gifted deposit form on my smartphone?

What is confirmation of gifted deposit?

Who is required to file confirmation of gifted deposit?

How to fill out confirmation of gifted deposit?

What is the purpose of confirmation of gifted deposit?

What information must be reported on confirmation of gifted deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.