Get the free Confirmation of Gifted Deposit

Get, Create, Make and Sign confirmation of gifted deposit

How to edit confirmation of gifted deposit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation of gifted deposit

How to fill out confirmation of gifted deposit

Who needs confirmation of gifted deposit?

Understanding the Confirmation of Gifted Deposit Form

Understanding the confirmation of gifted deposit form

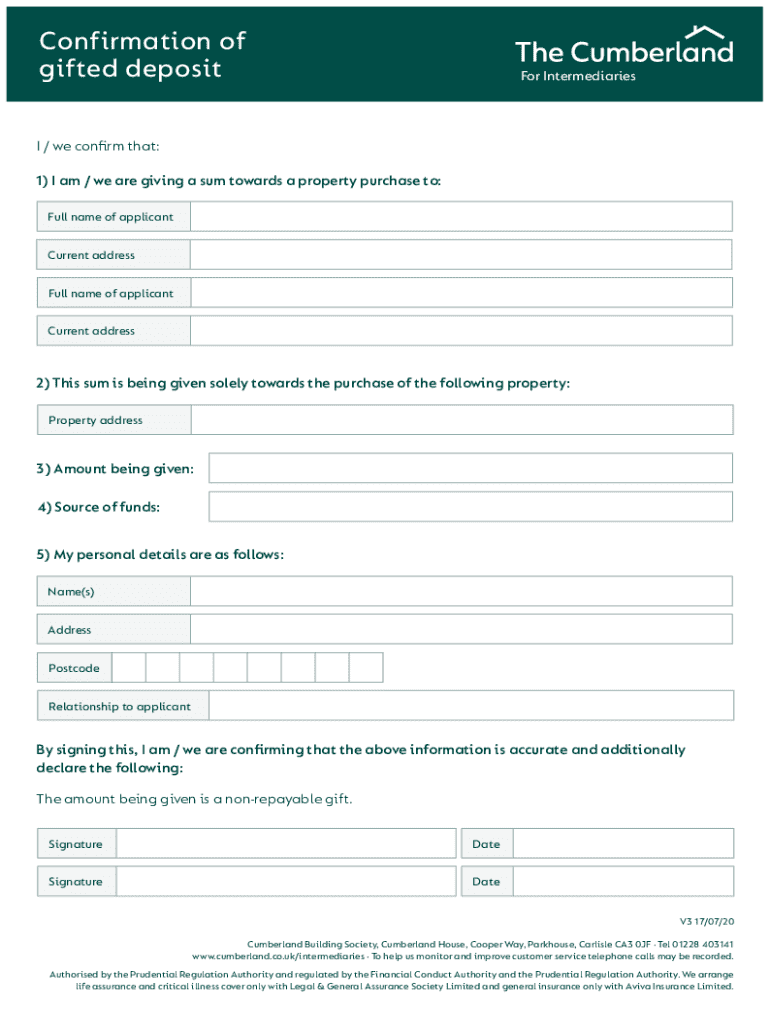

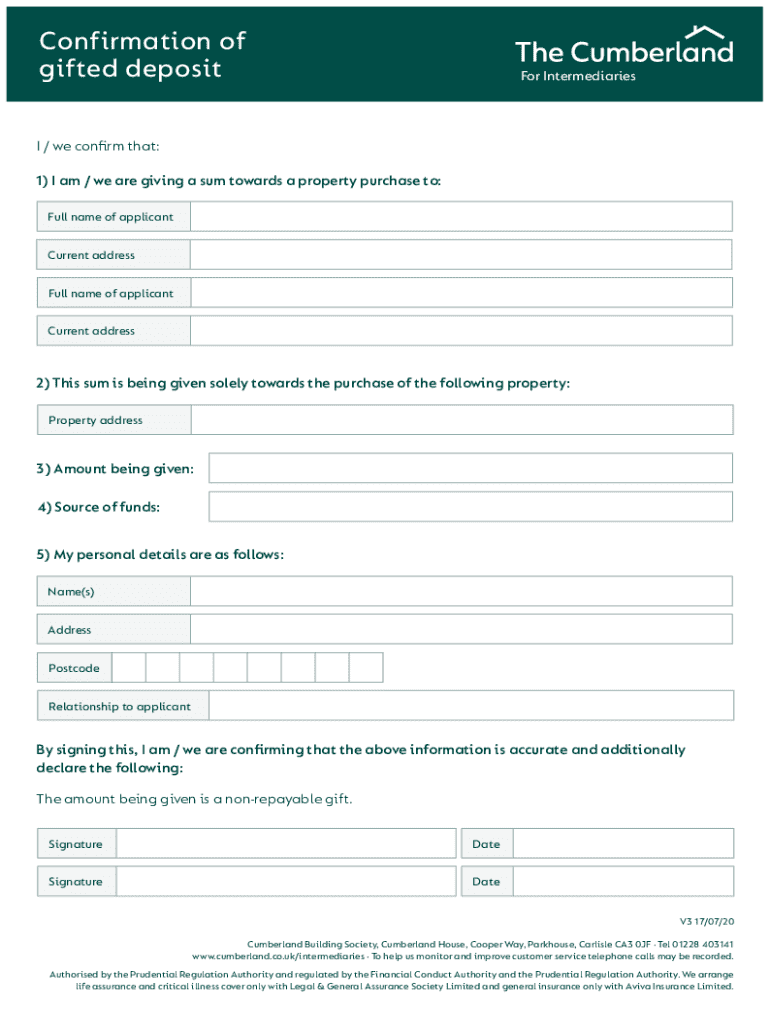

A confirmation of gifted deposit form is a crucial document for individuals who receive funds from family or friends to assist with a property purchase. This form outlines the details around the gifted funds, including amounts, relationships, and donor information. Its primary purpose is to ensure that mortgage lenders acknowledge these funds as gifts rather than loans, thus relieving the recipient from additional debt obligations.

Accurate documentation is vital in real estate transactions, as it helps maintain transparency and compliance with lender requirements. Each detail within the form must be precise and correctly filled out to avoid potential complications during the mortgage process.

Key components of a gifted deposit form

When filling out a confirmation of gifted deposit form, several key components must be included to ensure its validity. First and foremost, the form should contain clear and accurate donor and recipient information, including full names and contact details. This establishes a reliable record of the transaction.

In addition to these essential elements, the form should also include required signatures and dates from both parties, ensuring it is legally binding. If there are gifts of equity involved, additional notes pertaining to those aspects may also be necessary.

Step-by-step guide to completing the form

Completing a confirmation of gifted deposit form can seem daunting, but following a structured process can simplify it. Here’s a step-by-step guide to help navigate through the form.

How lenders use the confirmation of gifted deposit form

Lenders play a significant role in determining how gift funds can affect mortgage applications. The confirmation of gifted deposit form is essential in helping lenders distinguish between gifts and loans, impacting the borrower’s debt-to-income ratio and overall loan approval.

When a borrower submits a mortgage application, lenders will review the gifted deposit amount to ascertain that it complies with their criteria. Gifted funds can positively influence one’s eligibility by increasing down payment amounts, thereby reducing the loan-to-value ratio.

Importantly, lenders are interested in the source and legitimacy of these funds, necessitating the completion of the form. Proper documentation enhances the chances of loan approval, as it explicitly states that the recipient is not liable for repayment.

Common mistakes to avoid when completing the form

Completing a confirmation of gifted deposit form requires attention to detail to prevent issues down the line. Here are common pitfalls to avoid:

Best practices for submitting the gifted deposit form

After completing the confirmation of gifted deposit form, following best practices for submission can streamline the process. First, consider the submission method; some lenders accept electronic submissions while others may require physical copies.

Real-life examples and scenarios

The implications of gifting deposits can vary significantly based on each situation. For instance, a successful case study might involve a young couple who received a $50,000 gift from parents for their first home. This amount allowed them to secure a favorable mortgage and make a stronger offer on the property.

In contrast, lessons learned from common pitfalls can serve as cautionary tales. For instance, failing to correctly state the relationship may lead to increased scrutiny from lenders and potential delays in the mortgage approval process.

There are scenarios where additional documentation is essential. If the gift originates as a portion from a family trust, lenders may require trust documents to verify the legitimacy of the transaction.

Resources for managing your gifted deposits

Managing gifted deposits can be made easier with the right tools. Interactive platforms, like pdfFiller, provide users with intuitive document preparation tools that simplify the completion of forms like the confirmation of gifted deposit form.

Using features such as eSigning and collaboration, pdfFiller enables users to fill out, edit, and manage documents seamlessly. Additionally, a dedicated FAQ section can help address specific questions related to gifted deposits, alleviating some of the confusion often surrounding this topic.

Legal considerations surrounding gifted deposits

Always be aware of the legal implications surrounding gifted deposits, particularly regarding tax liabilities. Donors should consider potential gift tax implications when providing significant amounts. The IRS has regulations that specify limits for gift exclusions, so consulting a tax professional can help in understanding these nuances.

Moreover, state-specific regulations may affect how gifted deposits are treated, requiring an understanding of local laws. To ensure compliance and avoid problems in the transaction process, it's imperative to seek guidance from legal experts who specialize in real estate transactions.

Tips for ensuring a smooth transaction

Open communication is key to ensuring a smooth transaction when dealing with gifted deposits. The donor and recipient should have conversations about the expectations surrounding the gift, documentation, and any necessary disclosures needed by lenders.

Furthermore, maintaining thorough documentation is essential for future reference, not only for the current transaction but also for any potential future financial considerations. Using tools like pdfFiller aids in easy edits and secure storage, ensuring that both parties have quick access to the necessary documents when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit confirmation of gifted deposit from Google Drive?

How do I edit confirmation of gifted deposit online?

How do I edit confirmation of gifted deposit on an Android device?

What is confirmation of gifted deposit?

Who is required to file confirmation of gifted deposit?

How to fill out confirmation of gifted deposit?

What is the purpose of confirmation of gifted deposit?

What information must be reported on confirmation of gifted deposit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.