Get the free Investment Application Form

Get, Create, Make and Sign investment application form

Editing investment application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out investment application form

How to fill out investment application form

Who needs investment application form?

Investment application form: How-to guide

Understanding the investment application form

An investment application form serves as a crucial document for individuals and institutions looking to invest in various financial products, including stocks, bonds, mutual funds, or managed accounts. This form collects necessary details to identify potential investors and assess their suitability for specific investment options.

The importance of providing accurate information on this application cannot be overstated. Inaccurate data can lead to unsuitable investment recommendations or even legal complications. The form helps assess the investor's financial standing, enabling investment professionals to tailor investment advice based on individual risk tolerance and investment preferences.

Typical users of the investment application form range from individual investors looking to diversify their portfolios to institutional investors such as fund managers or corporations seeking to invest large sums.

Types of investment application forms

Investment applications come in several forms, tailored to the needs of diverse investors. Individual applications are designed for solitary investors, while joint applications cater to couples or partnerships wishing to invest together.

Institutional applications, on the other hand, target organizations such as pension funds or endowments that require different information due to larger capital and regulatory scrutiny. Furthermore, various investment vehicles like mutual funds, ETFs, and hedge funds often have their unique forms, emphasizing specific details pertinent to each investment type.

Understanding these types is crucial for ensuring that users select the appropriate application form based on their specific investing situations.

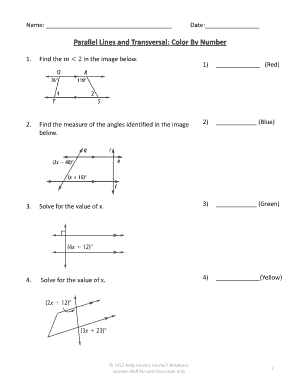

Key sections of the investment application form

A standard investment application form contains several key sections that gather essential information from the investor. The first section usually requests personal information, including full name and contact details. This information remains essential to establish a robust client profile, which, in turn, helps the adviser tailor appropriate recommendations.

Another critical section covers financial information. This is where applicants detail their sources of income, net worth, and previous investment history. Providing accurate financial data enables advisers to assess the potential for investment growth and advise appropriately.

Lastly, the investment objectives section is paramount, comprising questions regarding the applicant's risk tolerance and investment goals. Accurately disclosing this information can significantly influence investment strategies, ensuring better alignment with the investor’s financial aspirations.

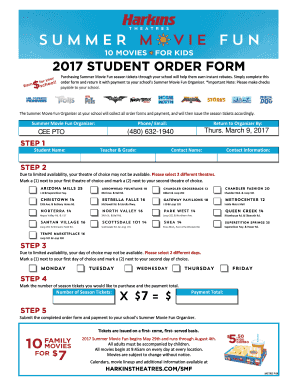

Step-by-step guide to filling out your investment application form

Filling out an investment application form can seem daunting, but breaking the process down into manageable steps can ease the complexity. The first step involves gathering required documents, such as identification proofs (like a driver's license or passport) and financial statements (like tax returns or bank statements).

Once this documentation is in hand, carefully completing the form is essential. Accuracy matters; hence, it’s helpful to take your time while filling out each section. Many people often make common mistakes, such as providing outdated contact information or misunderstanding questions about risk, which can have serious repercussions on their investment suitability.

After filling out the form, review it carefully. Utilize pdfFiller’s editing features to make necessary changes before submission. A final review checklist helps ensure that no critical information is left out, which can drastically improve the quality of the application.

eSigning your investment application form

In today's digital landscape, eSigning is an essential part of the investment application process. The importance of digital signatures cannot be overstated; they ensure the authenticity of electronic documents while saving time and resources. This method is widely accepted across the financial industry, making it easier to finalize your investments promptly.

To utilize pdfFiller’s eSigning features, navigate to your completed investment application form, select the eSign option, and integrate a secure digital signature. Step-by-step instructions guide you through this process, making it simple. Moreover, verifying signatures is critical to ensure that all parties have consented to the terms outlined in the form.

Submitting your investment application form

Once the form is complete and eSigned, the next step is submission. The submission options are varied, allowing investors to choose based on their convenience. Online submission through respective investment platforms is generally the most efficient method, enabling instant processing.

Alternatively, some investors might prefer sending the application via mail or delivering it in person. Tracking your submission is essential; ensuring you receive a confirmation of receipt can prevent unnecessary delays. Follow-ups may be necessary if you don’t hear back within the established review timeline.

Frequently asked questions (FAQs)

Investors often have questions regarding the investment application form, such as the procedure if a mistake occurs during form completion. Should you realize a mistake, it's crucial to contact the investment firm promptly to rectify the issue, as this will prevent complications later.

Many also wonder how long the review process takes — the timeline can vary, but typically, it ranges from a few days to several weeks, depending on the complexity of the application. Furthermore, it’s crucial to note that once submitted, most firms will not allow changes to the form, underlining the importance of accuracy before submission.

Troubleshooting common issues

When utilizing the pdfFiller platform, users may encounter technical glitches or issues while filling out the investment application form. Common complications include difficulties with document uploads or problems during the eSigning process. It's vital to troubleshoot these before submitting to ensure timely processing.

In case of persistent issues, accessing customer support becomes invaluable. pdfFiller’s customer service team is typically responsive and equipped to handle inquiries related to applications, ensuring a smooth user experience.

Exploring additional features of pdfFiller

Leveraging pdfFiller goes beyond filling out the investment application form. The platform offers collaborative tools that allow teams to work on documents in real-time, ensuring everyone is updated and on the same page. Furthermore, integrations with other platforms enhance operational efficiency, making document management a breeze.

Security features are also paramount; pdfFiller implements stringent measures to safeguard user data and documents, giving users peace of mind regarding the sensitive information often found in investment-related forms.

User testimonials and success stories

Users often share success stories highlighting their positive experiences with the investment application process facilitated by pdfFiller. Many have noted the transformation in their efficiency, thanks to the platform’s user-friendly interface and advanced features, which simplify document management.

Testimonials reveal how pdfFiller helped individuals navigate complex forms with ease and encouraged teams to collaborate effectively on investments. Highlighting these experiences can guide new users toward recognizing the value of utilizing this platform for their investment application forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the investment application form in Gmail?

How do I edit investment application form straight from my smartphone?

How do I edit investment application form on an iOS device?

What is investment application form?

Who is required to file investment application form?

How to fill out investment application form?

What is the purpose of investment application form?

What information must be reported on investment application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.