Get the free Required Minimum Distribution Form

Get, Create, Make and Sign required minimum distribution form

Editing required minimum distribution form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out required minimum distribution form

How to fill out required minimum distribution form

Who needs required minimum distribution form?

Understanding the Required Minimum Distribution Form

Understanding required minimum distributions (RMDs)

A required minimum distribution (RMD) is the minimum amount that a retirement plan account owner must withdraw annually, starting at a specified age. The purpose of RMDs is to ensure that individuals do not just accumulate tax-deferred savings indefinitely without eventually paying taxes on that money. The IRS mandates RMDs to fund government spending through tax revenue, making them a critical element of retirement planning.

RMDs play a significant role in retirement planning as they contribute to tax implications and influences on retirement savings. For annual taxation purposes, failing to withdraw the required amount can lead to severe penalties, resulting in 50% taxation on the missed distribution amount. RMDs also affect the timing of withdrawals, potentially reducing the availability of funds in later years if not managed correctly.

Who needs to file an RMD form?

Typically, anyone who owns a traditional IRA or similar retirement plans, like a 401(k), must file an RMD form once they reach a certain age. The current threshold is age 72, although those who turn 70½ before January 1, 2020, may be required to take their first RMD by that age. It’s essential to keep track of these requirements, especially for those with multiple retirement accounts.

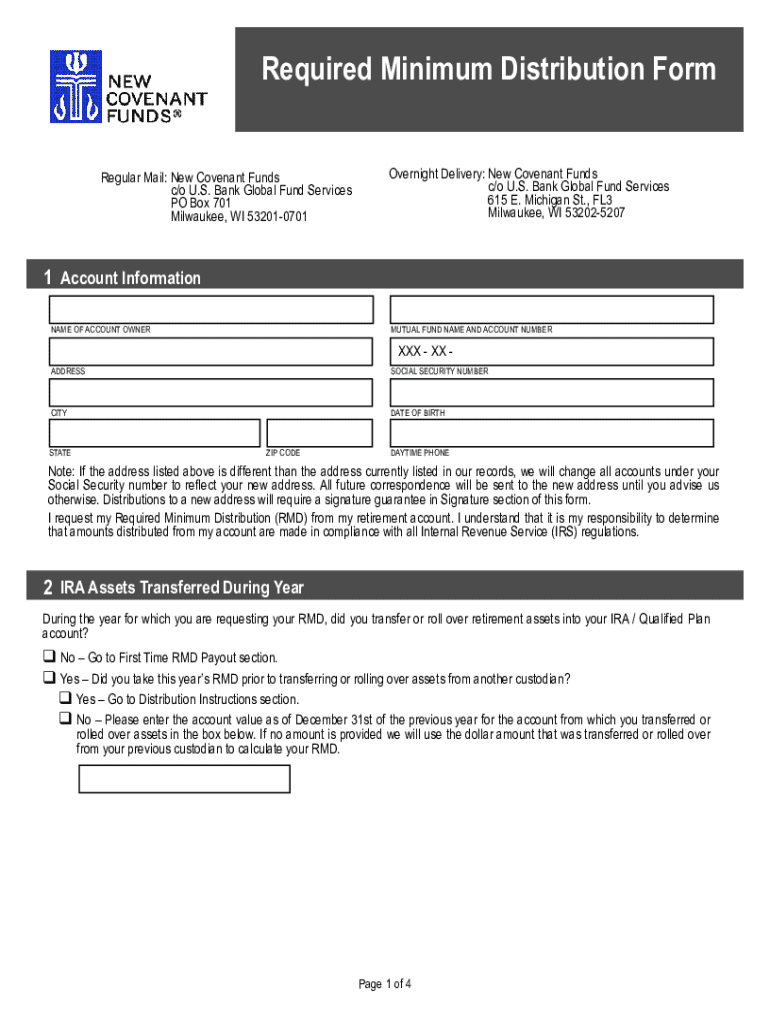

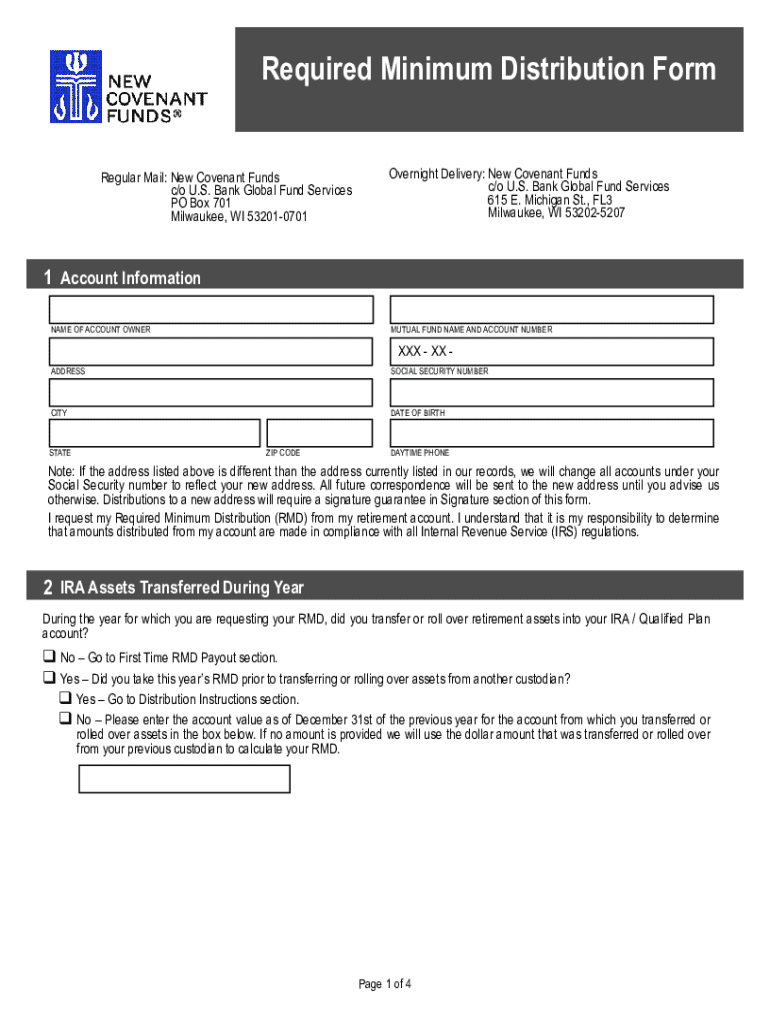

The required minimum distribution form explained

The Required Minimum Distribution form, most notably IRS Form 5329, serves several essential purposes. It provides a structured way to report the amount of your RMD, enabling the IRS to track whether tax obligations are met. This form also assists in calculating any potential penalties for missed distributions and verifies compliance with RMD regulations.

Key information contained in the RMD form includes your personal identification details, the account type, the amount to be distributed, and the age of the account owner. By documenting these elements, taxpayers can clearly understand their obligations and avoid costly mistakes.

Different versions of the RMD form

While IRS Form 5329 is the primary form used to report RMDs, there are also other relevant documents to consider. For example, taxpayers may find the IRS Form 1040 necessary when filing their income taxes, which includes reporting distributions as part of their taxable income. Understanding these forms will help individuals ensure they are completely fulfilling all requirements.

Steps to complete the required minimum distribution form

Completing the required minimum distribution form can initially seem daunting, but following specific steps can simplify the process. Start by gathering all necessary information, including personal identification details such as your Social Security number and account-specific information that includes the type of retirement account and balance amounts.

Next, fill out the personal information section thoroughly, ensuring all details are accurate to avoid complications. Calculate the required distribution amount based on IRS formulas or online calculators to ensure compliance. Once the distribution amount is determined, report it on the form as outlined in IRS instructions. Don’t forget to include your signature and the date to validate the form.

Interactive tools for RMD calculation

Utilizing online calculators for RMD calculations has become an essential resource for many retirees. These tools often feature intuitive interfaces that guide users through entering their account and personal details. The primary goal is to arrive at an accurate RMD amount swiftly, which can be a daunting task without proper resources.

To use these calculators effectively, individuals should have their most current account balances and age on hand. Inputting this information will yield an accurate estimate of your RMD, leading to a more robust retirement plan. Determining the correct RMD is crucial; errors may lead to financial penalties and tax implications, emphasizing the need for accuracy.

Importance of accuracy in RMD calculation

Understanding the accuracy needed for RMD calculations cannot be overstated. The IRS imposes a considerable penalty for failing to take the correct amount; anyone who misses the required distribution faces a 50% penalty on any shortfall. Moreover, if mistakes are repeated, the IRS may scrutinize your accounts deeply, leading to further complications in your financial planning.

Editing and managing the required minimum distribution form

Editing the required minimum distribution form is often necessary, particularly as circumstances change or when errors occur. Tools like pdfFiller provide seamless editing capabilities, allowing users to make adjustments quickly and accurately. Whether you need to correct personal information or update distribution amounts, pdfFiller ensures easy modifications that save time.

One significant advantage of using pdfFiller is their collaborative features, which allow multiple users to access and edit the document simultaneously. This collaborative approach streamlines the process for individuals managing joint accounts or consulting with financial advisors, enhancing the overall document management experience.

Electronically signing the RMD form

The benefits of eSignature technology cannot be overlooked when submitting the required minimum distribution form. Electronically signing documents enhances security, allowing for quick and safe submissions without the need for physical copies. Moreover, eSignatures provide a timestamp, confirming when the document was signed, which can be valuable in any future inquiries.

Using pdfFiller, eSigning your RMD Form is a straightforward process. Users can sign directly on the platform, which further simplifies document management and enhances accessibility. This capability is particularly advantageous for those who may be in remote locations or working with advisors who are not physically nearby.

Common pitfalls and FAQs related to RMDs

Completing the RMD form can be straightforward, but common errors often arise. Many individuals misuse calculations, whether due to misunderstanding the rules or not accounting for the right variables. Additionally, missing deadlines for submissions can result in hefty penalties that can significantly impact financial health.

Therefore, forecasting deadlines and staying organized is paramount. It is also prudent to consult frequently asked questions to clarify doubts and strengthen understanding around RMDs and their associated obligations.

What to do if miss my RMD deadline?

Missing your RMD deadline is complicated but not insurmountable. The IRS usually allows individuals to resolve accidental missed distributions by taking the required amount as soon as possible. However, it's prudent to file IRS Form 5329, which indicates the late withdrawal and explains the situation to mitigate penalties.

Options if am still working past the required age

For those who continue working beyond the age for RMDs, certain exemptions apply, particularly regarding employer-sponsored plans. Individuals may not be required to take distributions from their current employer's plan if they are still working. However, understanding the specifics and securing proper documentation is essential for compliance.

Managing RMDs with pdfFiller

pdfFiller offers a comprehensive document management system which makes managing RMDs more efficient and organized. Users can securely store critical documents, such as the required minimum distribution forms and related paperwork, ensuring easy access from any device. This feature greatly enhances user experience and mitigates the stress of managing sensitive financial information.

Collaboration features for teams

Another powerful element of using pdfFiller is its collaborative features. Teams can share forms and documents easily, enabling team members, families, or advisors to work together efficiently. This real-time editing capability ensures all necessary parties are informed, allowing for prompt updates and changes to be made when necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in required minimum distribution form?

How do I edit required minimum distribution form on an iOS device?

Can I edit required minimum distribution form on an Android device?

What is required minimum distribution form?

Who is required to file required minimum distribution form?

How to fill out required minimum distribution form?

What is the purpose of required minimum distribution form?

What information must be reported on required minimum distribution form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.